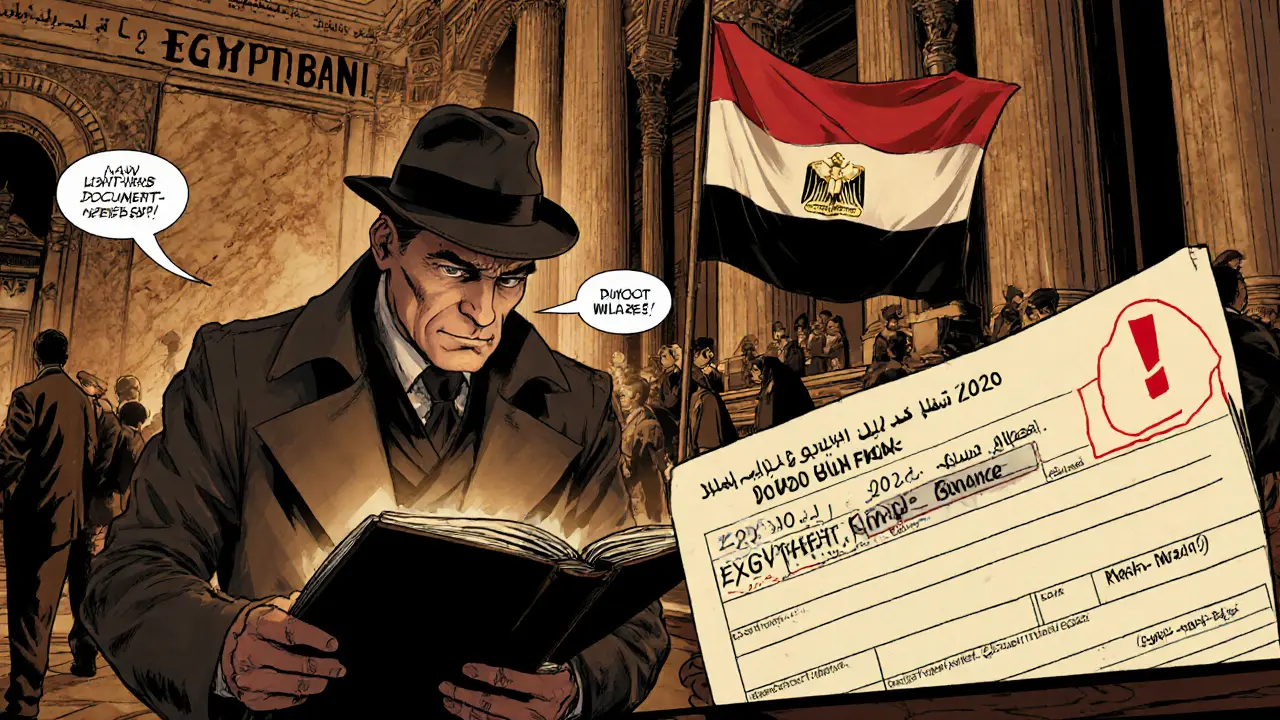

How Egyptian Banks Monitor Crypto Transactions in 2025

A clear guide on how Egyptian banks monitor cryptocurrency transactions, covering legal rules, detection methods, tech tools, customer impact, and future trends.

Read MoreWhen working with Crypto Monitoring, the practice of tracking price movements, network activity, and on‑chain metrics in real time. Also known as crypto tracking, it helps traders and developers spot trends before they become headlines. Blockchain Forks, splits in a blockchain’s protocol that create new chains or alter existing rules are a core signal for any monitoring setup because they can cause abrupt price shifts and liquidity reallocation. Understanding Funding Rates, periodic payments exchanged between long and short positions in perpetual futures is another must‑have; they directly affect trader sentiment and can forecast short‑term market direction. Finally, keeping an eye on Slashing Protection, mechanisms that safeguard proof‑of‑stake validators from penalties ensures network health and prevents sudden drops in stake‑related tokens. In short, crypto monitoring combines these elements to give a 360° view of market health.

Crypto monitoring encompasses blockchain forks analysis, funding rates evaluation, and slashing protection oversight, creating a feedback loop where each component influences the others. For example, a hard fork often resets validator sets, which can trigger slashing events if nodes aren’t updated—this, in turn, spikes funding rates as traders hedge against uncertainty. Likewise, funding rates influence trader behavior on both spot and derivatives markets, which can amplify the impact of a fork‑driven price swing. Wrapped assets, such as WBTC and WETH, add another layer: their volume spikes often mirror underlying network events, giving a quick proxy for fork or slashing risk. By linking these signals, you can anticipate market moves, adjust positions, and avoid costly surprises.

The collection below pulls together hands‑on guides, deep dives, and practical checklists that cover everything from modular blockchains and rollup data availability to Nigeria’s underground crypto economy and the mechanics of airdrops. You’ll find step‑by‑step tutorials on tracking funding rates, protecting validators, and monitoring wrapped asset volumes, plus real‑world case studies like North Korea’s massive crypto heist and the evolution of crypto bans across Africa. Whether you’re a beginner looking to grasp the basics or a seasoned trader seeking advanced analytics, these resources give you the tools to build a robust crypto monitoring workflow that reacts fast and stays resilient in a volatile market.

A clear guide on how Egyptian banks monitor cryptocurrency transactions, covering legal rules, detection methods, tech tools, customer impact, and future trends.

Read More