Russian Crypto Law: What You Need to Know

When navigating the crypto landscape in Russia, the first thing to understand is Russian crypto law, the set of statutes and regulations that govern cryptocurrency activities in the country, covering licensing, tax, anti‑money‑laundering (AML) obligations, and digital asset classification. Also known as Russian crypto regulations, it shapes how exchanges, DeFi projects, and individual traders operate within the legal framework. Russian crypto law encompasses AML compliance, the process of meeting anti‑money‑laundering standards set by the Federal Financial Monitoring Service, and requires exchange licensing, official permission from the Central Bank and the Ministry of Finance for platforms that facilitate crypto trading. Moreover, digital asset classification, the legal definition of tokens as securities, utilities, or property for tax purposes influences how income is reported and what taxes apply. These core elements are tightly linked: compliance with Russian crypto law requires exchange licensing, which in turn mandates AML compliance, while digital asset classification determines the tax regime.

Key Areas Covered by Russian Crypto Law

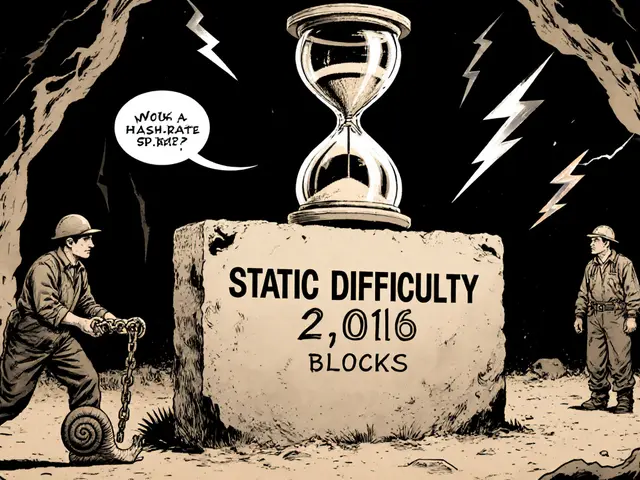

First, the licensing regime. Any crypto exchange that offers fiat‑to‑crypto or crypto‑to‑crypto services must register with the Central Bank, submit a detailed AML program, and undergo periodic audits. The law also mandates that exchanges implement strong KYC procedures, monitor transaction volumes, and report suspicious activities within 24 hours. Failure to obtain a license can lead to fines up to 5 % of annual turnover or suspension of operations.

Second, AML and counter‑terrorism financing (CTF) obligations. Russian law aligns with the FATF recommendations, requiring entities to keep records for at least five years, perform source‑of‑funds checks, and employ transaction‑monitoring software that flags large or irregular movements. Companies that ignore these rules face criminal charges, asset freezes, and up to ten years in prison for severe violations.

Third, tax treatment of digital assets. The law classifies crypto tokens as property for capital‑gain calculations, meaning profits from sales are subject to personal income tax at rates ranging from 13 % to 30 % depending on residency status. Mining rewards are treated as ordinary income, while staking yields fall under the same regime as interest income. Proper classification of tokens—whether a security, utility, or commodity—determines whether additional reporting to the securities regulator is required.

Fourth, the impact on DeFi and DApp developers. Although DeFi platforms are not directly licensed, the law extends responsibility to any entity providing custodial services or facilitating token swaps for Russian residents. Developers must ensure their smart contracts incorporate AML safeguards, such as on‑chain identity verification, or risk being deemed unlawful service providers.

Finally, cross‑border considerations. Russia’s approach to crypto is evolving alongside international pressure. Recent amendments tighten rules on crypto‑related advertising, require foreign exchanges to block Russian IPs unless they comply with local licensing, and introduce penalties for facilitating anonymized transfers. Staying updated on these changes is crucial for anyone operating in or dealing with Russian markets.

Understanding these pillars helps you assess risk, plan compliance strategies, and avoid costly penalties. Below you’ll find a curated collection of articles that dive deeper into each of these topics—ranging from practical guides on obtaining exchange licenses to analyses of how AML rules affect DeFi projects in Russia. Use them to build a solid compliance foundation and keep your crypto activities on the right side of the law.