Remittance Cost Calculator

Send Money from Nigeria

Calculate how much you save by using cNGN instead of traditional remittance services

Note: cNGN network fees are $0.50-$1.50 depending on blockchain used

Your Savings

Why This Matters

By using cNGN, you can save 0% compared to traditional remittance services. For example, sending $250 (N100,000) could cost you $20 with traditional services but only $1 with cNGN.

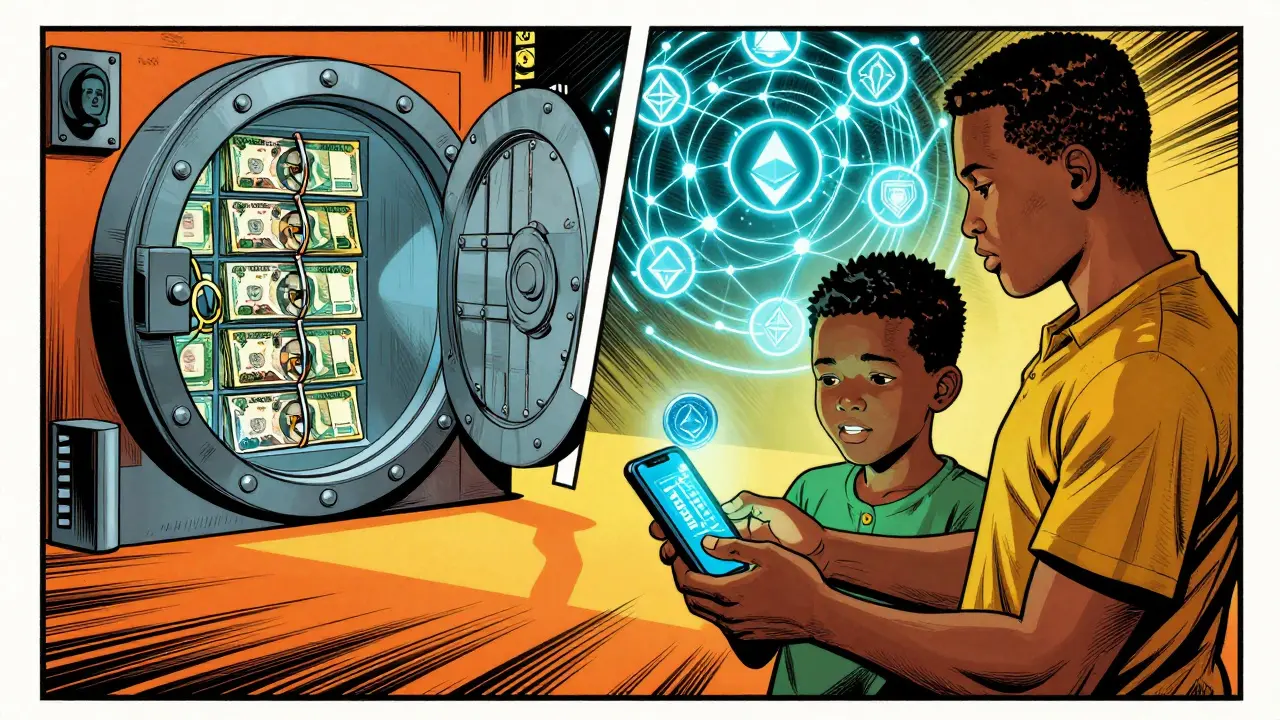

Most people think crypto means Bitcoin, Ethereum, or maybe Dogecoin - wild, unpredictable, and risky. But what if there was a digital coin that didn’t swing up and down like a rollercoaster? What if it was as stable as the naira in your wallet, but faster, cheaper, and works across the internet? That’s Compliant Naira (cNGN).

What Exactly Is cNGN?

cNGN is Nigeria’s first legally approved digital token that’s always worth exactly 1 Nigerian Naira. It’s not a gamble. It’s not speculation. It’s digital cash, built on blockchain, but backed by real money sitting in Nigerian banks. Every time someone creates one cNGN, a real Naira is locked up in a licensed bank. That’s it. No magic. No hype. Just 1:1 backing.

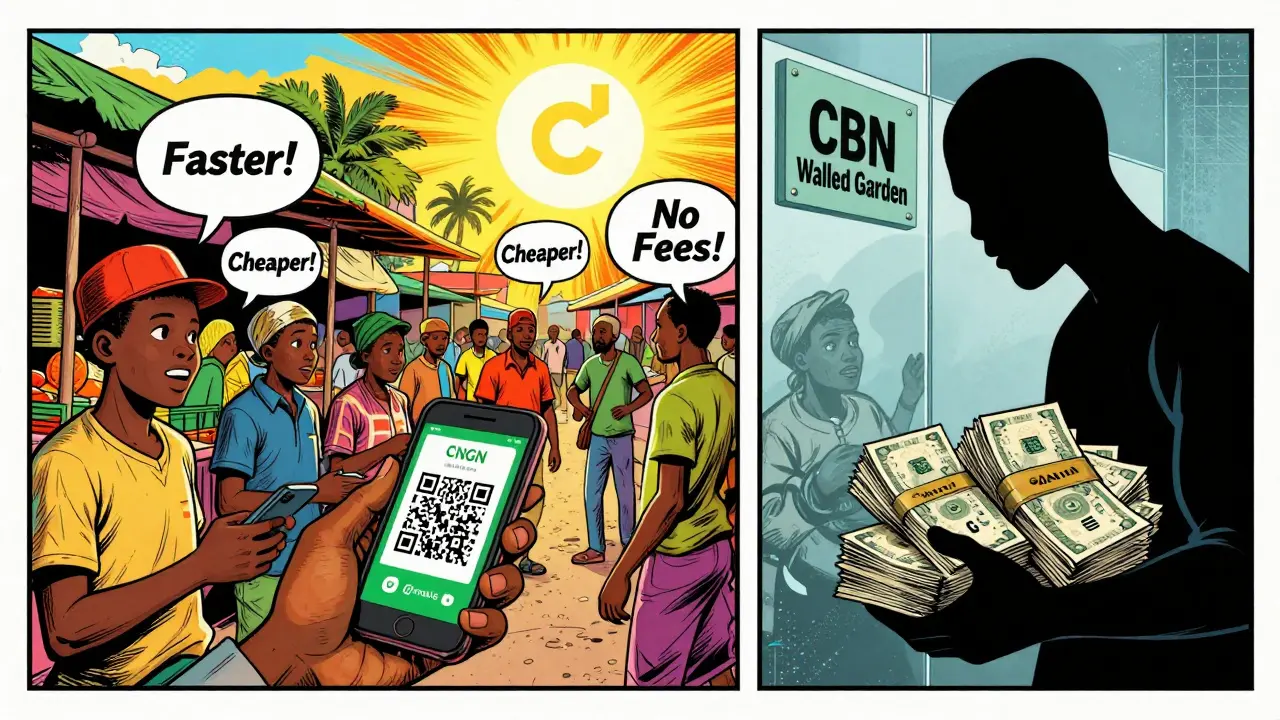

It was launched in early 2025 by the Africa Stablecoin Consortium - a group of banks, fintechs, and tech firms including Wrapped CBDC Limited. Their goal? Fix what went wrong with Nigeria’s own central bank digital currency, the eNaira. The eNaira never took off. People didn’t trust it. It was locked inside a government system, slow, and didn’t connect to anything outside the Central Bank’s walled garden. cNGN is the opposite. It’s open, public, and works on multiple blockchains like Ethereum, Polygon, Binance Smart Chain, and TRON. You can send it anywhere those networks reach.

How Is cNGN Different From Bitcoin or Ethereum?

Bitcoin and Ethereum are volatile. Their prices can jump 20% in a day. That’s fine if you’re trading. Terrible if you’re trying to pay your rent or send money home to your family. cNGN doesn’t do that. It’s designed to hold its value. If you have 100 cNGN today, you’ll still have the equivalent of 100 Naira tomorrow - no matter what’s happening in the crypto markets.

It’s more like USDT or USDC, but with one big difference: those are backed by U.S. dollars. cNGN is backed by Nigerian Naira. That matters. If you’re in Nigeria, you don’t want to be stuck with a stablecoin tied to the dollar. You want something that reflects your local economy. cNGN does that.

Why Was cNGN Created?

Nigeria sends and receives over $25 billion in remittances every year. That’s money sent by Nigerians living abroad to families back home. Traditional services like Western Union or MoneyGram charge 5% to 10% in fees. That’s $1.25 to $2.50 for every $25 sent. Over time, that adds up.

cNGN cuts that cost. You can send cNGN across borders in minutes for less than a dollar in network fees. Recipients can cash out to their local bank account or use it directly on apps that accept it. There’s no waiting days for a transfer to clear. No hidden charges. Just fast, transparent movement of value.

It also helps people who don’t have bank accounts. About 38 million Nigerians are unbanked, according to EFInA’s 2024 survey. With a smartphone and internet, they can now access digital money without needing a traditional bank. That’s huge for small traders, freelancers, and gig workers.

How Does cNGN Work?

Here’s the simple version:

- You deposit Naira into a partner bank account linked to an approved exchange like Quidax or Busha.

- That bank confirms the deposit to the Africa Stablecoin Consortium.

- The system creates an equal amount of cNGN and sends it to your digital wallet.

- To cash out, you send cNGN back to the exchange, they burn the tokens, and send you Naira to your bank.

It takes 2 to 4 hours during banking hours (8am-4pm WAT, Monday to Friday). Outside those hours, it waits until the next business day. That’s slower than sending crypto on Ethereum, but it’s still faster than traditional wire transfers, which can take 3 days.

Every day, the Africa Stablecoin Consortium publishes a public report showing exactly how many Naira are held in reserve. No guesswork. No opacity. You can check if every cNGN is truly backed. That’s what makes it “compliant.”

cNGN vs eNaira: Why One Works and the Other Doesn’t

Many people confuse cNGN with Nigeria’s eNaira. They’re both digital naira, but they’re worlds apart.

| Feature | cNGN | eNaira |

|---|---|---|

| Backing | 1:1 Naira in commercial banks | 1:1 Naira held by Central Bank of Nigeria |

| Blockchain | Multi-chain: Ethereum, Polygon, BSC, TRON, etc. | Single, private blockchain controlled by CBN |

| Accessibility | Works on any crypto exchange or wallet | Only usable through CBN-approved apps |

| Regulation | Approved by SEC Nigeria | Issued directly by Central Bank |

| Use Cases | Payments, remittances, DeFi, savings | Primarily government payments, limited merchant use |

| Adoption | Over 450 million cNGN in circulation by July 2025 | Low usage, minimal public trust |

cNGN is designed for real people doing real things - sending money to family, paying freelancers, buying goods online. eNaira feels like a government project that never asked users what they needed.

Where Can You Use cNGN?

You can use cNGN in several ways:

- Remittances: Nigerians abroad send cNGN to relatives who cash out locally. Fees drop from 8% to under 1%.

- Freelance Payments: International clients pay in cNGN instead of USD. No currency conversion. No PayPal fees.

- Yield Farming: Platforms like Xend Finance let you earn 15-20% annual interest by staking cNGN. That’s way higher than Nigerian savings accounts (5-7%).

- Merchant Payments: More Nigerian businesses are accepting cNGN for goods and services, especially online stores and service providers.

- DeFi: You can lend, borrow, or trade cNGN on decentralized finance apps built on Ethereum or Polygon.

It’s not everywhere yet. You still can’t walk into a local market and pay with cNGN. But it’s growing fast. By June 2025, over 300 Nigerian fintech companies were using it for cross-border payments. Reddit users report seeing it used for food delivery, airtime top-ups, and even school fees.

What Are the Downsides?

No system is perfect. Here are the real issues:

- Banking Hours: You can only mint or redeem cNGN during Nigerian bank hours. Weekends and holidays = no processing.

- Limited Merchant Acceptance: Most small shops still take cash. cNGN is mostly used for digital transactions right now.

- Learning Curve: If you’ve never used crypto before, setting up a wallet and doing KYC can be confusing. First-time users often take 3-5 days to feel comfortable.

- Regulatory Risk: It’s approved now, but what if the government changes its mind after the 2027 election? That’s a real concern.

- Gas Fees: On some blockchains like Ethereum, sending cNGN can cost a few dollars in network fees. On Polygon or TRON, it’s pennies.

But these aren’t dealbreakers. They’re growing pains. And they’re being solved. Payment processors like Muda, Noblocks, and Fincra are making it easier to connect bank accounts to cNGN. More exchanges are adding instant Naira deposits.

How to Get Started With cNGN

Here’s how to start using it in 5 steps:

- Choose an Exchange: Use Quidax, Busha, or another SEC-approved platform. Quidax has the best support (87% satisfaction on Trustpilot).

- Complete KYC: Upload your ID and proof of address. Takes about 24 hours.

- Deposit Naira: Transfer money from your bank account to the exchange’s designated bank account.

- Mint cNGN: Once the deposit is confirmed, click “Buy cNGN” and you’ll get tokens in your wallet.

- Use or Save: Send it, spend it, or stake it for yield.

Start small. Try sending 500 cNGN to a friend. See how fast it arrives. Then try cashing out. Once you’ve done it once, it becomes second nature.

What’s Next for cNGN?

The future looks promising. In July 2025, the Africa Stablecoin Consortium announced plans to integrate cNGN with Nigeria’s National Payment Gateway. That means it could soon be used for utility bills, taxes, and government services.

They’re also exploring expansion to other African currencies through PAPSS - the Pan-African Payments and Settlement System. Imagine sending cNGN to Ghana and having it automatically convert to Ghanaian Cedi. That’s the next step.

Experts say cNGN has a 65% chance of long-term success if Nigerians keep using it and regulators stay supportive. Right now, adoption is growing. Over 450 million cNGN were in circulation by July 2025 - up from just 66 million in February. That’s a 600% increase in five months.

It’s not just another crypto. It’s a financial upgrade for Nigeria. One that’s regulated, transparent, and built for real people - not just investors.

Is cNGN the same as eNaira?

No. eNaira is Nigeria’s central bank digital currency, controlled entirely by the Central Bank of Nigeria. It runs on a private blockchain and can only be used through CBN-approved apps. cNGN is a privately issued stablecoin, regulated by the SEC, and works across public blockchains like Ethereum and Polygon. cNGN is open, interoperable, and designed for everyday use - while eNaira remains limited and underused.

Can I earn interest on cNGN?

Yes. Platforms like Xend Finance allow you to stake cNGN and earn 15-20% annual returns. This is possible because the reserve assets backing cNGN generate yield (like interest from bank deposits), and a portion is shared with users. This is far higher than traditional Nigerian savings accounts, which typically pay 5-7%.

Is cNGN safe?

cNGN is one of the safest crypto assets in Nigeria because it’s fully backed 1:1 by Naira reserves held in licensed banks, and daily attestations are published publicly. Unlike unbacked tokens or volatile cryptos, cNGN’s value doesn’t fluctuate. However, like any digital asset, you’re responsible for securing your wallet. If you lose your private key or send it to the wrong address, there’s no way to recover it.

Can I use cNGN outside Nigeria?

Yes. cNGN works on global blockchains like Ethereum and Polygon, so you can send it to anyone worldwide. Recipients can hold it, trade it, or cash out through local exchanges that support cNGN. It’s especially useful for Nigerians abroad sending money home - it’s faster and cheaper than traditional remittance services.

How do I cash out cNGN to Naira?

Send your cNGN back to an approved exchange like Quidax or Busha. Request a redemption, and the platform will burn your tokens and send Naira to your linked bank account. This process takes 2-4 hours during Nigerian banking hours (8am-4pm, Mon-Fri). Outside those hours, it waits until the next business day.

Is cNGN legal in Nigeria?

Yes. cNGN is the first African stablecoin to receive formal regulatory approval from the Securities and Exchange Commission (SEC) Nigeria. It operates under the Investment and Securities Act, making it fully compliant with Nigerian financial laws. Unlike unregulated tokens, it’s not considered illegal or risky under current law.

Final Thoughts

cNGN isn’t trying to replace the naira. It’s trying to make it better. Faster. More accessible. More useful. It’s not about speculation. It’s about solving real problems: expensive remittances, slow payments, unbanked populations, and lack of trust in digital money.

If you’re a Nigerian with family abroad, a freelancer getting paid internationally, or even just someone tired of waiting days for a bank transfer - cNGN is worth trying. Start small. Learn the process. See how it works. Then decide if it fits your life.

It’s not perfect. But it’s real. And for the first time in Nigeria’s digital currency journey, it’s actually being used by real people - not just tested in labs.

There are 23 Comments

Patricia Amarante

cNGN is actually kinda genius-no drama, just stable digital cash that works like real money. Tried sending 500 to my cousin in Lagos, got there in 90 seconds. No fees, no BS.

Elvis Lam

For real, this is the first Nigerian digital currency that actually solves problems instead of creating them. The 1:1 backing with public attestations? That’s what every stablecoin should be. Most are just crypto ponzi with a spreadsheet. cNGN? It’s audited, regulated, and usable. No hype, just utility.

Emma Sherwood

As someone who’s helped set up crypto wallets for elderly relatives in Nigeria, I can tell you this is life-changing. My aunt used to wait 3 days for remittances from Chicago. Now she gets cNGN in under an hour, cashes out at the corner shop with a QR code. No more ‘where’s my money?’ calls at 2am. It’s simple, it’s fast, and it respects the person using it-not the tech.

Shruti Sinha

Interesting how this works better than eNaira. India’s UPI taught us that infrastructure matters more than tech. cNGN leverages existing blockchain networks instead of forcing users into a government sandbox. Smart move.

Kelsey Stephens

I was skeptical at first-another crypto thing? But the transparency here is rare. Daily reserve reports? Publicly verifiable? That’s not just compliance, that’s trust-building. And for people without banks, this is a bridge, not a barrier.

Dionne Wilkinson

It’s funny how we think tech has to be complicated to be good. cNGN is just… simple. Like a digital envelope with a stamp. No flashing lights, no whitepapers, no ‘decentralized future.’ Just money that moves. Maybe that’s the real innovation.

Kayla Murphy

If you’re still using Western Union, you’re paying a tax on love. cNGN cuts that cost by 90%. Imagine sending money to your mom without feeling guilty about the fee. That’s not finance-it’s dignity.

Sean Kerr

Y’all need to try staking cNGN on Xend Finance!! 18% APY is wild!! And it’s not some sketchy rug pull-backed by real naira!! My grandma’s savings are now earning more than her bank account!! 😍💰

Tom Joyner

How quaint. A stablecoin backed by a currency that loses 30% of its value annually. You call this innovation? It’s just arbitrage dressed in regulatory lipstick. The real story is how Nigeria’s monetary policy failed, and this is just a Band-Aid on a hemorrhage.

Amy Copeland

Oh wow, another ‘compliant’ crypto. Next they’ll tell us the SEC is your new fairy godmother. 🙄 Meanwhile, the Central Bank is still printing money like it’s confetti. This is just a Trojan horse for dollarization under a Nigerian flag.

Sue Bumgarner

Why are we even talking about this? The U.S. dollar is the only real stable asset. Nigeria can’t even control inflation, so why trust their digital naira? This is just a scam waiting to be regulated into oblivion.

Donna Goines

They say it’s backed by real naira… but what if the banks are lying? What if the reserves don’t exist? What if this is just a front for the CBN to track every transaction? I’ve seen too many ‘innovations’ turn into surveillance tools. This feels like Step 1 of the digital prison.

Chevy Guy

Compliant? Yeah right. Next thing you know they’ll require your face scan to send 100 cNGN to your cousin. They’re not building a currency they’re building a leash. And you’re all just happy to wear it

Florence Maail

15% yield on cNGN? Bro… that’s not interest, that’s a Ponzi. They’re using new users’ deposits to pay old ones. The ‘reserves’ are fake. I’ve seen this movie before. When the Fed cracks down, it all vanishes. You’ll be left holding digital trash.

😭Sally Valdez

Let’s be real-this is just crypto colonialism. Americans and Europeans get to profit off African labor while Nigerians get a ‘stable’ coin that’s still tied to their collapsing economy. Meanwhile, the real winners are the blockchain devs in Silicon Valley. Thanks for the crumbs.

Rebecca Kotnik

While the technical architecture of cNGN is commendable-particularly its multi-chain interoperability and adherence to SEC Nigeria’s regulatory framework-it is imperative to contextualize its emergence within the broader socio-economic landscape of Nigeria. The persistent volatility of the naira, coupled with systemic inefficiencies in traditional banking infrastructure, has created a vacuum that this instrument is designed to fill. However, one must not conflate regulatory approval with economic sustainability. The reliance on commercial bank reserves introduces counterparty risk that, while mitigated by daily attestations, remains non-trivial in a financial ecosystem marked by institutional fragility. Furthermore, the temporal constraints on minting and redemption, tied to banking hours, undermine the very notion of ‘digital immediacy’ that blockchain purports to deliver. This is not a revolution; it is a carefully curated compromise, one that prioritizes compliance over radical accessibility. Whether this constitutes progress or merely a rebranding of existing power structures remains an open question.

Heather Turnbow

I appreciate the transparency here, and the fact that people are actually using this to send money home. That’s more than I can say for most crypto projects. But I wonder-what happens when the banks holding the reserves face liquidity issues? Or if there’s a run on cNGN? It’s not just about regulation. It’s about trust in the system behind it. I hope they’re ready.

Jesse Messiah

Hey, I just tried cNGN for the first time last week. Took me 3 days to figure out KYC but now I’m sending cash to my sister in Abuja every week. It’s not perfect, but it’s way better than what we had. Thanks to the team for making this real. Keep it up!

George Cheetham

There’s something quietly profound about a currency that doesn’t try to be revolutionary, but simply… functional. cNGN doesn’t promise to change the world-it just wants to make paying your daughter’s school fees a little less painful. In a world obsessed with disruption, maybe the real disruption is doing something useful without fanfare.

SeTSUnA Kevin

Technically sound, but the regulatory dependency renders it non-decentralized by definition. A stablecoin governed by a national securities commission is not crypto-it’s digitized fiat with a blockchain veneer. The term ‘crypto’ is being diluted by such instruments. Precision matters.

Greg Knapp

They say it's backed by real money but what if the banks just print more naira to cover withdrawals? I've seen this before. They promise stability then the government prints more and your 'stable' coin becomes worthless. This is just a trap for the poor

Jack Daniels

Why do I even care? No one I know uses this. It’s just another thing to stress about. I’ll stick with cash and WhatsApp payments. At least I know where my money is.

Terrance Alan

My cousin in London sent me 10,000 cNGN last week. I cashed out to my bank in 2 hours. No fees. No delays. I cried. Not because of the money. Because for the first time, sending help home didn’t feel like a financial crime.

Write a comment

Your email address will not be published. Required fields are marked *