If you’re running a crypto business and want to serve customers in New York, you’re not just dealing with another state’s rules. You’re facing one of the toughest, most detailed regulatory frameworks in the U.S.-the BitLicense. It’s not a suggestion. It’s a legal requirement. And if you skip it, you can’t legally operate in New York. Period.

What Exactly Is the BitLicense?

The BitLicense is a business license issued by the New York State Department of Financial Services (NYDFS). It’s not just for exchanges. It covers any company that does any of these five things with virtual currency involving New York residents:- Receiving or transmitting crypto

- Storing or holding crypto for others

- Buying or selling crypto as a business

- Providing exchange services

- Issuing or controlling a crypto asset

Core Requirements: Money, Security, and Compliance

Getting the BitLicense isn’t about filling out a form. It’s about proving you can handle serious financial risk. Here’s what you actually need:Capital Requirements

You need real money on the line. The minimum is $1 million in capital, but most businesses need $2 million to $5 million, depending on how much crypto they handle. This isn’t a one-time deposit-it’s ongoing. NYDFS checks your balance every quarter.Customer Protection Fund

You must protect your customers’ funds. That means either:- A surety bond of at least $500,000, or

- A segregated, fully funded account with the same value

Anti-Money Laundering (AML) and KYC

You need a full AML program that meets U.S. Bank Secrecy Act standards. That means:- Verifying every customer’s identity

- Monitoring transactions for suspicious activity

- Reporting red flags to FinCEN

- Keeping records for at least five years

Cybersecurity

NYDFS doesn’t want you using basic passwords and unencrypted wallets. You need “military-grade” security. That means:- Multi-factor authentication for all access points

- Regular penetration testing by third parties

- Encryption of all sensitive data

- Incident response plans tested quarterly

Financial Reporting

You must submit audited financial statements every year. Not just any audit-by a firm approved by NYDFS. You also report monthly on:- Total transaction volume

- Number of new customers

- Customer complaints

- Security incidents

What’s New in 2025? The Coin-Listing Rule

In November 2023, NYDFS dropped a bombshell: you can’t just list any crypto token. You need approval before adding a new coin or token to your platform. The new rule requires you to prove:- The token isn’t a security under U.S. law

- There’s no market manipulation risk

- The team behind it is transparent

- The code has been audited by a reputable firm

- The token has real liquidity and trading volume

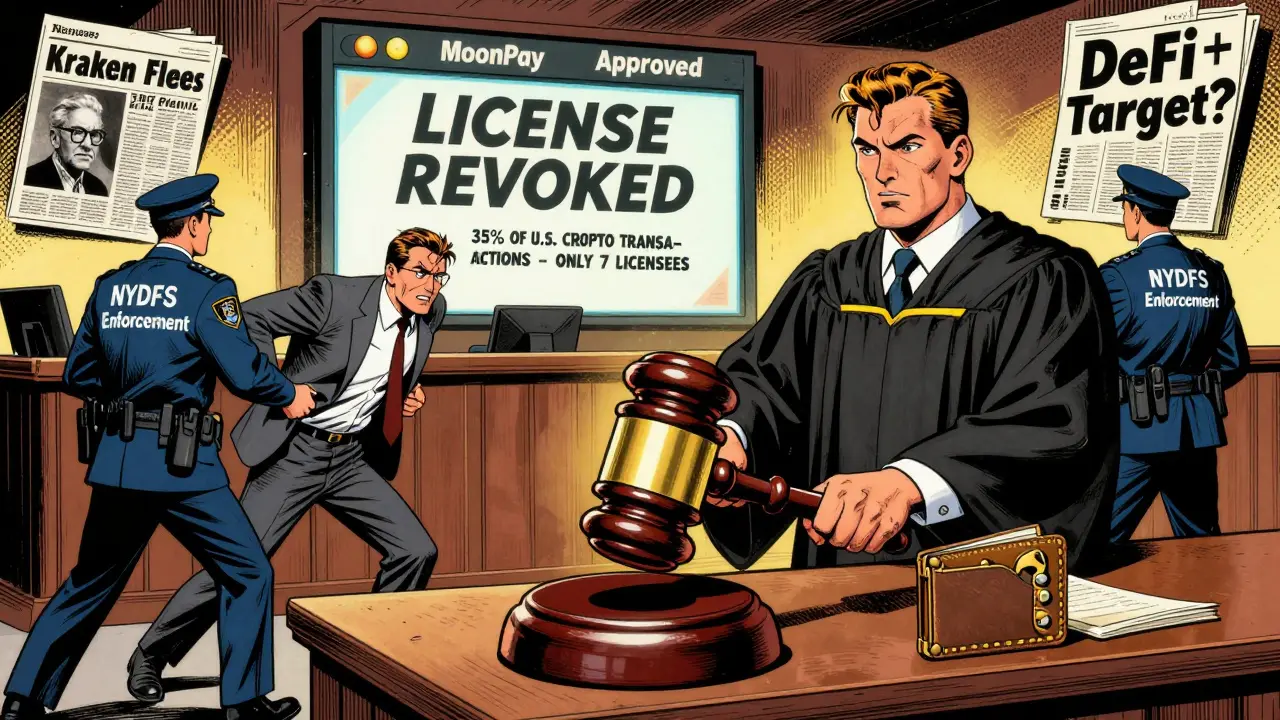

Who Has a BitLicense? (2025 List)

As of June 2025, only seven major crypto firms legally serve New York customers:- Coinbase - First to get a BitLicense in 2015, now has a full compliance team of 25 people

- Gemini - Holds both a BitLicense and a trust charter

- eToro - Entered New York in early 2025 after clearing all compliance hurdles

- Robinhood - Limited to buying/selling, no wallet services

- Uphold - Uses a trust charter instead of BitLicense

- Bitstamp - Approved in 2024 after a 16-month application

- MoonPay USA LLC - Got approved in June 2025 for crypto on-ramp services

Costs: It’s Not Just the Application Fee

The application fee is $5,000. That’s the cheapest part. Total upfront costs? $150,000 minimum. Most companies spend $300,000 to $500,000. Why?- Legal fees: $100,000-$200,000 for drafting compliance docs

- Consultants: $200-$500/hour for NYDFS specialists

- Technology: $50,000+ for AML and cybersecurity systems

- Surety bond: $500,000-$5 million (frozen capital)

- Capital reserve: $1 million-$5 million (your own money)

Why Do Companies Still Apply?

New York has 19.6 million people. It’s one of the richest financial markets in the world. Even with the costs, the payoff is huge. Coinbase and Gemini don’t just get access-they use the BitLicense as a trust signal. Their marketing says: “We’re the only ones approved by New York’s strictest regulator.” That builds confidence. And that means more customers. The 2025 Chainalysis report shows BitLicense holders process 35% of all U.S. crypto transactions-even though they make up only 1.2% of crypto businesses. That’s the power of being trusted.What About Other States?

New York isn’t alone. But it’s the strictest.- Wyoming offers a “Utility Token Exemption” with almost no reporting.

- California uses its Finance Lenders Law-lower capital, fewer controls.

- Louisiana has similar bond and reserve rules, but less oversight.

What Happens If You Don’t Get It?

If you operate without a BitLicense and serve New York customers, you risk:- Fines up to $1 million per violation

- Criminal charges for executives

- Asset freezes

- Being blocked from U.S. payment processors

Can Startups Ever Get a BitLicense?

It’s tough. But not impossible. The first BitLicense went to Circle in 2015. Since then, only 17 companies have received one. Most are well-funded. But MoonPay, a crypto on-ramp startup, got approved in June 2025. How? They focused on one narrow service: helping users buy crypto with credit cards. They didn’t try to be a full exchange. They kept their scope small, their documentation tight, and their compliance team expert. The lesson? Don’t try to do everything. Do one thing, really well, and prove you can do it safely.What’s Next for the BitLicense?

The framework isn’t going away. In fact, it’s expanding. NYDFS is now looking at:- Decentralized finance (DeFi) protocols

- Stablecoin issuers

- Central bank digital currencies (CBDCs)

Final Take: Is It Worth It?

The BitLicense is expensive. It’s slow. It’s complex. But if you want to operate legally in New York, there’s no alternative. For big players, it’s a competitive edge. For startups, it’s a mountain to climb. For regulators, it’s a shield for consumers. For users, it’s peace of mind-or limited choices. If you’re serious about crypto in New York, you don’t ask if you can afford the BitLicense. You ask if you can afford not to get it.Do I need a BitLicense if I’m not based in New York?

Yes. If your service is used by anyone in New York-even one customer-you’re required to have a BitLicense. Location doesn’t matter. Customer location does. NYDFS has gone after foreign exchanges that didn’t block New York users.

Can I use a trust charter instead of a BitLicense?

Yes. A New York State limited purpose trust charter or bank charter can also allow you to offer crypto services. The requirements are similar, but the process is even longer and more expensive. Only a few companies like Uphold and Gemini use this route. It’s not easier-it’s just another path.

How long does the BitLicense application take?

On average, 12 to 18 months. Some take over two years. The timeline depends on how complete your application is, how quickly you respond to NYDFS questions, and whether your business model triggers extra scrutiny. There’s no fast track.

What happens if I get denied a BitLicense?

You can reapply. But NYDFS will review your previous application and denial. If you made the same mistakes, you’ll be denied again. Most successful applicants fix the exact issues flagged in the denial letter before reapplying. Hiring a compliance lawyer experienced with NYDFS is critical.

Can I offer crypto services to New York residents without a license if I don’t charge fees?

No. Whether you charge fees or not doesn’t matter. If you’re transmitting, storing, buying, selling, or issuing crypto for New York residents, you need a BitLicense. The law focuses on activity, not revenue.

Are decentralized exchanges (DEXs) exempt from the BitLicense?

Technically, yes-if they’re truly decentralized with no central operator. But if your DEX has a company behind it that controls smart contracts, lists tokens, or collects fees, NYDFS considers you a virtual currency business. They’ve made it clear: no loopholes. If you’re running a DEX and serving New Yorkers, you’re at risk.

Can I apply for a BitLicense if I’m an individual, not a company?

No. The BitLicense is only for business entities-LLCs, corporations, partnerships. Individuals cannot apply. If you’re running a crypto service as a sole proprietor, you must incorporate first.

There are 15 Comments

Bianca Martins

Man, I remember when Bitcoin was just a weird internet thing and now we got this whole bureaucratic monster just to let a wallet app operate in NY. 😅 The BitLicense is like the financial equivalent of a TSA pat-down for crypto companies.

alvin mislang

Anyone who thinks this is 'regulation' is delusional. This is state-sponsored extortion disguised as consumer protection. They don't want you to succeed-they want you to pay them until you're broke. 💸

Monty Burn

It's funny how we call this 'innovation' while building regulatory fortresses around it. The BitLicense doesn't protect users-it protects the status quo. The real revolution isn't in blockchain it's in refusing to play by rules written by people who don't understand the technology

Kenneth Mclaren

They're using the BitLicense to kill competition before it even starts. CoinBase and Gemini? They're not winners-they're collaborators. The whole thing is a cartel setup. NYDFS is just the enforcer for the big boys. And don't even get me started on how they're quietly pushing DeFi under the same boot next. 🕵️♂️

Alexandra Wright

Oh sweetie you really think MoonPay got approved because they were 'small and focused'? Nah. They paid a $200k consulting firm to write the application in NYDFS's exact dialect. It's not about compliance-it's about fluency in bureaucratic legalese. 😏

Jack and Christine Smith

so like i was just reading this and wow the capital reqs are wild like i get why they want to keep things safe but also... why does a crypto wallet need 5 million in reserve?? i mean if i lose my keys its not like they owe me money right?? 😅

Jackson Storm

Biggest thing people miss-the BitLicense isn't about crypto it's about control. They're not trying to protect users they're trying to make sure no one can build a financial system outside the old banks. That's why they're targeting DEXs next. If you're building something decentralized you're already a target. Keep your head down and document everything

Raja Oleholeh

USA still think they own the world with rules. India has 500 million crypto users without any license. Why do you need permission to move money? 🇮🇳

Prateek Chitransh

Interesting how the same people who scream 'decentralize everything' are suddenly begging for government approval. The BitLicense is the ultimate irony-a crypto license from a centralized authority. You can't have it both ways. 🤷♂️

Michelle Slayden

While the regulatory burden is undeniably onerous, it is also a necessary bulwark against systemic financial instability. The absence of such oversight in other jurisdictions has led to catastrophic investor losses. The BitLicense, however rigid, represents a responsible fiduciary standard. One cannot equate innovation with irresponsibility.

christopher charles

Okay so I applied for a BitLicense last year and let me tell you-this ain't no joke. We spent 8 months just getting the AML software to pass their checklist. Then they asked for a flowchart of how our customer support ticket system integrates with KYC. I swear I cried. But now we're approved and honestly? Worth it. We got 3x the NY clients since launch. 🙌

Vernon Hughes

They block Kraken and Binance but let Robinhood in with a limited license. That's not regulation. That's favoritism. The system is rigged. No one talks about it but it's obvious. The big players write the rules. The rest of us just clean up the mess

Alison Hall

Just wanna say-this is actually super helpful. I'm a dev trying to build a small wallet tool and I had no idea how deep this went. Thanks for laying it out like this. 🙏

Amy Garrett

so moonpay got approved?? omg i thought they were gonna get rejected for sure like they only do buy/sell right?? but wow that's so cool that a startup actually made it through 😍

Johnny Delirious

As a licensed financial services executive with over two decades of regulatory experience, I must emphasize that the BitLicense represents the most rigorous, transparent, and ethically grounded framework for virtual currency operations in the United States. Its structure is not punitive-it is prophylactic. The capital requirements, cybersecurity mandates, and AML protocols are not burdens; they are the foundational pillars of trust in a nascent and volatile industry. To suggest that this is overregulation is to misunderstand the magnitude of systemic risk inherent in unmonitored digital asset flows. The fact that only seven firms have successfully navigated this process speaks not to its exclusivity, but to the extraordinary diligence required to safeguard consumer capital in an environment rife with fraud, volatility, and opacity. This is not an obstacle to innovation-it is the very architecture upon which sustainable, legitimate innovation must be built. The alternative is chaos. And chaos, as history has repeatedly demonstrated, is the enemy of progress.

Write a comment

Your email address will not be published. Required fields are marked *