Crypto Arbitrage Opportunity Calculator

Arbitrage Results

Understanding trading pairs is the first step to spotting real profit gaps in crypto markets. When two assets are quoted against each other, their price ratio becomes a measurable signal. If that ratio drifts away from the market’s expectation on one exchange but stays tight on another, the gap is an arbitrage window. Below we break down the main ways the structure of a pair creates, hides, or amplifies those windows.

Key Takeaways

- Trading pairs create direct price relationships that can be compared across venues.

- Exchange arbitrage exploits the same pair on different platforms.

- Triangular arbitrage uses three inter‑linked pairs inside a single exchange.

- DeFi introduces AMM‑based pairs, enabling DEX‑CEX and flash‑loan arbitrage.

- Statistical tools like cointegration help you decide which pairs are worth monitoring.

Why Trading Pairs Matter

Trading pair is a quotation that expresses the value of one asset in terms of another, such as BTC/USDT or ETH/BTC. Because each pair defines a unique conversion rate, any deviation from the expected rate signals a mispricing. Those mispricings can be temporary-lasting seconds or minutes-yet they are enough for a trader who can move quickly.

Pairs also act as a filter. Instead of watching every coin’s absolute price, you watch the relative price between two assets. That reduces noise, highlights genuine inefficiencies, and makes automated monitoring feasible.

Exchange Arbitrage: Same Pair, Different Books

When the same trading pair appears on multiple exchanges, price differences often emerge due to liquidity imbalances, withdrawal fees, or latency. For example, Binance might quote BTC/USDT at $31,200 while Bybit lists it at $31,350. Buying on Binance and selling on Bybit locks in a $150 spread per BTC, minus transaction costs.

Successful execution requires:

- Accounts on each exchange with sufficient funding.

- Fast order routing-most traders use an arbitrage bot to scan order books and trigger trades instantly.

- Awareness of withdrawal limits and network congestion, especially on congested blockchains.

Even a small spread can become profitable if the trade volume is high and the bot repeats the cycle many times a day.

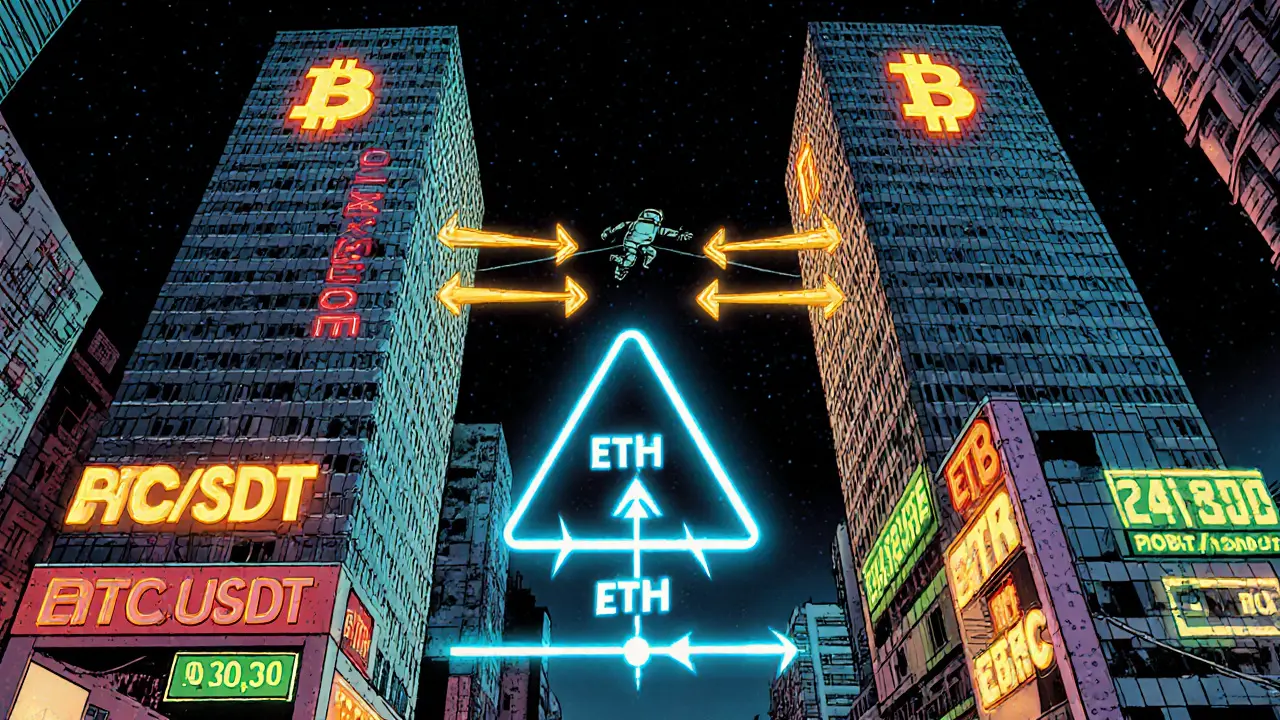

Triangular Arbitrage: The Three‑Step Dance

Inside one exchange, three inter‑linked pairs can create a loop: BTC/USDT → ETH/USDT → ETH/BTC. If the implied rate from BTC→USDT→ETH back to BTC differs from the direct BTC/ETH rate, a trader can execute a 3‑step trade that ends with more BTC than they started with.

Consider the following snapshot on a fictional exchange:

| Pair | Mid‑price | Implied BTC value |

|---|---|---|

| BTC/USDT | 31,200 | 1 BTC = 31,200 USDT |

| ETH/USDT | 2,000 | 1 ETH = 2,000 USDT |

| ETH/BTC | 0.065 | 1 ETH = 0.065 BTC (≈2,028 USDT) |

The implied BTC value from the ETH/USDT→ETH/BTC leg is 2,000USDT ÷ 0.065≈30,769USDT, lower than the direct BTC/USDT rate of 31,200USDT. Buying ETH with USDT, swapping ETH for BTC, then converting BTC back to USDT yields a net gain of about 0.44% before fees.

Key challenges:

- All three pairs must have sufficient depth; otherwise slippage wipes out the margin.

- Execution must be atomic-most traders use a single transaction or a smart contract that rolls back if any leg fails.

- Monitoring must be real‑time because the window typically collapses within seconds.

DeFi‑Driven Arbitrage: DEX vs. CEX

Decentralized exchanges (DEXs) use automated market makers (AMMs) to price pairs based on pool balances rather than order books. This creates systematic price gaps compared to centralized exchanges (CEXs) that rely on limit orders.

Typical workflow:

- Buy BTC/USDT on a DEX where the pool is under‑weighted, leading to a favorable price.

- Sell the same BTC/USDT on a CEX where the order book reflects a higher price.

- Return the borrowed assets (if using a flash loan) within the same transaction.

Flash loans let you borrow unlimited capital without collateral as long as the loan is repaid atomically. A typical flash‑loan arbitrage smart contract might look like this (pseudo‑code omitted for brevity): borrow → swap on DEX → sell on CEX → repay loan → pocket the spread.

Benefits include:

- No upfront capital required.

- Execution in a single block, eliminating settlement risk.

Risks include high gas fees, smart‑contract bugs, and rapid price updates that can make the spread evaporate before the transaction is mined.

Pairs Trading in Traditional Markets

Outside crypto, a similar concept called pairs trading pairs two securities with historically correlated movements. Researchers analyzing 1962‑2002 US equities found that the top 20 paired stocks earned an average annualized excess return of 11% when the spread reverted to its mean.

The statistical backbone is cointegration. A cointegrated pair maintains a stable long‑term relationship despite short‑term divergence. Traders run an Augmented‑Dickey Fuller test to confirm cointegration, then set entry/exit thresholds (e.g., 2‑standard‑deviation bands) to capture the mean‑reversion profit.

Why does this matter for crypto? Many tokens are intentionally linked-stablecoins, wrapped assets, or tokenized versions of the same underlying. Applying cointegration analysis to BTC/ETH, BNB/BNB‑B, or USDT/USDC can reveal statistically robust arbitrage opportunities that survive fee pressure.

Risk Management & Cost Considerations

Arbitrage isn’t free money. The main cost drivers are:

- Transaction fees (blockchain gas, exchange taker fees, withdrawal charges).

- Slippage-price movement caused by the size of your order.

- Latency-delays between price discovery and order execution.

To be profitable, the gross spread must exceed the sum of these costs. A rule of thumb for crypto traders is to target at least a 0.2% net spread after fees for exchange arbitrage, and 0.5% for triangular or flash‑loan setups where gas can be high.

Risk mitigation tactics include:

- Setting tight stop‑losses on each leg of a multi‑step trade.

- Using a “cold‑wallet” buffer to cover sudden withdrawal delays.

- Running back‑tests on historical data to estimate average drawdown and profit‑loss ratio.

Real‑World Example: BTC/USDT Flash‑Loan Arbitrage (2024)

In March2024, a trader observed a 1.2% spread between Binance (BTC/USDT=31,150) and the Uniswap V3 pool (effective price=31,000) after accounting for gas. By borrowing 50BTC via a flash loan, swapping on Uniswap, then selling on Binance, the trader earned roughly $180,000 before gas. The entire process completed in a single Ethereum block, illustrating how DEX‑CEX pair mismatches can be turned into sizable gains without any capital at risk.

Emerging Opportunities as Markets Evolve

New pair structures keep popping up: synthetic assets on platforms like Synthetix, cross‑chain bridges that create BTC/ETH pairs on multiple layers, and tokenized real‑world assets that trade against stablecoins. Each additional market layer adds a fresh arbitrage dimension.

Staying ahead means:

- Monitoring multi‑chain price feeds (e.g., using Chainlink aggregators).

- Integrating API data from both CEXs and DEXs into a single dashboard.

- Continuously refining statistical filters-cointegration, Kalman filters, or machine‑learning regressions-to avoid false signals.

Choosing the Right Arbitrage Strategy

| Strategy | Typical Capital Needed | Main Technical Skill | Liquidity Sensitivity | Typical Net Spread |

|---|---|---|---|---|

| Exchange arbitrage | Moderate (few thousand USD) | API integration & bot development | Medium - relies on order‑book depth | 0.2% - 0.5% |

| Triangular arbitrage | Low (hundreds of USD) | Atomic transaction design | High - needs depth on three pairs | 0.3% - 0.8% |

| DEX‑CEX flash‑loan | Zero (smart‑contract loan) | Solidity / smart‑contract security | Very high - pool size matters | 0.5% - 2% |

| Pairs trading (statistical) | Variable (depends on pair size) | Cointegration & time‑series analysis | Medium - correlated assets required | 0.1% - 0.4% (per trade) |

Pick the method that matches your technical comfort, capital availability, and risk tolerance. For beginners, exchange arbitrage on high‑volume pairs like BTC/USDT is a low‑complexity entry point. Advanced coders may gravitate toward flash‑loan loops that unlock massive leverage.

Next Steps & Troubleshooting Guide

If you’re ready to start, follow this checklist:

- Create verified accounts on at least two major exchanges (e.g., Binance, Kraken).

- Deposit a small amount of USDT to cover fees and test trades.

- Set up a price‑monitoring script that pulls the order‑book mid‑price for your target pair every second.

- Define a spread threshold (e.g., 0.25%) that triggers a trade.

- Run the script in “dry‑run” mode for 24hours to confirm signal reliability.

- Once confident, enable the live bot and monitor the first few executions closely.

Common hiccups and fixes:

- Spread disappears before execution: Reduce latency by locating your server nearer to the exchange’s matching engine (e.g., use a VPS in the same region).

- Fees eat profit: Compare taker fee tiers, enable fee discounts (e.g., using native exchange tokens), and factor gas price spikes into your threshold.

- Transaction revert on DEX: Ensure sufficient slippage tolerance and double‑check your smart‑contract’s gas estimation.

Frequently Asked Questions

What is the difference between exchange arbitrage and triangular arbitrage?

Exchange arbitrage exploits price gaps for the same trading pair across two or more venues. Triangular arbitrage, by contrast, uses three inter‑related pairs within a single exchange to create a loop that ends back at the original asset.

Do I need a lot of capital to start crypto arbitrage?

Not necessarily. Simple exchange arbitrage can begin with a few thousand dollars, while flash‑loan strategies require no upfront capital but do need technical skill to write secure contracts.

How does cointegration help in pairs trading?

Cointegration confirms that two assets share a long‑term equilibrium relationship. When the spread widens, statistical models predict a reversion, letting traders enter a long‑short position that profits when the spread narrows.

Are flash‑loan arbitrage opportunities still viable in 2025?

Yes, but competition has risen. Successful bots now scan dozens of DEXs and CEXs each block, so you need low‑latency infrastructure and careful gas‑price management to stay ahead.

What are the main risks of arbitrage trading?

Key risks include execution latency, slippage, sudden fee spikes, smart‑contract bugs, and regulatory changes that could freeze deposits on an exchange.

There are 13 Comments

Angela Yeager

Great overview! I especially appreciate the clear breakdown of how each arbitrage style ties back to the underlying pair dynamics. For newcomers, focusing on high‑volume pairs like BTC/USDT can keep the math simple and the spreads more reliable. Also, keeping an eye on fee tiers across exchanges saves a lot of hidden cost. Looking forward to more deep dives on the statistical filters you mentioned.

vipin kumar

While the guide is solid, it ignores how some major exchanges subtly coordinate order flow behind the scenes. There are whispers that liquidity providers share data feeds, smoothing out the very spreads arbitrage bots chase. If that’s true, the real edge might be hidden in the latency wars rather than pure price gaps. Still, staying on the radar for sudden shifts can help you catch the few genuine windows that slip through.

Lara Cocchetti

Arbitrage can feel like a harmless profit‑making hobby, but it also raises ethical questions about market fairness. Exploiting fleeting inefficiencies often means you’re profiting from other traders’ lack of speed or information. In a world where regulators are still catching up, such tactics can invite scrutiny or even bans. It’s worth asking whether the short‑term gains justify the long‑term reputational risk. A cautious approach, with transparent accounting, helps keep the practice on the right side of the line.

Mark Briggs

Yeah, because ethics matter more than profit.

mannu kumar rajpoot

Really, you’re missing the bigger picture. Most of the “ethical” complaints ignore how the ecosystem is engineered to benefit the insiders who design the fee structures. When you dig into the smart‑contract code, you’ll see hidden rebates that only certain bots can claim. It’s not just about moral high ground; it’s about who controls the data pipelines. If you’re not part of that inner circle, you’ll always be a step behind, no matter how clean your spreadsheets look. So before you preach about fairness, understand the layers of opacity baked into every exchange.

Tilly Fluf

Thank you for the thorough article. It is evident that diligent monitoring of pairs can unlock modest yet consistent returns. I would encourage beginners to start with small capital and gradually scale as they become comfortable with the operational nuances. Maintaining a disciplined record of each trade will also aid in refining one’s strategy over time. Best of luck to all who venture into this fascinating facet of the crypto market.

Darren R.

Wow!!! What a beautifully articulated piece-truly a masterpiece of insight!!! Your emphasis on disciplined tracking is spot on!!! Yet, one must also recognize the sheer thrill that comes with seizing those fleeting arbitrage moments-pure adrenaline!!! Remember, while the numbers count, the narrative of outsmarting the market adds a layer of excitement that invigorates the entire journey!!! Keep the brilliance flowing!!!

Hardik Kanzariya

Hey folks, love the detailed breakdown! If you’re just starting, I recommend setting up a sandbox environment where you can test your bot logic without risking real funds. Use minimal trade sizes and simulate fees to see if the spread covers everything. As you gain confidence, incrementally increase exposure while keeping a tight stop‑loss on each leg. Consistency beats occasional big wins, so stay patient and keep learning.

Shanthan Jogavajjala

To build on what Hardik mentioned, let’s delve into the technical scaffolding required for a robust arbitrage engine. First, you need a high‑frequency market data ingest pipeline that normalizes order‑book snapshots from each exchange into a unified ticker format; this often involves WebSocket streams with timestamp alignment down to the microsecond. Second, implement a latency‑aware arbitrage detector that computes the cross‑exchange spread while factoring in network round‑trip times; a simple moving average can filter out noise but a Kalman filter provides superior predictive capabilities. Third, your execution module must support atomic multi‑exchange orders-this usually means employing a two‑phase commit protocol or leveraging flash‑loan contracts that guarantee rollback if any leg fails. Fourth, incorporate a dynamic fee model that retrieves real‑time taker fee tiers and adjusts the profitability threshold accordingly; many exchanges expose this via REST endpoints. Fifth, consider gas optimization strategies on the EVM side: batch multiple swaps within a single transaction, reuse the same nonce, and pre‑sign transactions to reduce on‑chain latency. Sixth, for risk management, embed real‑time position monitoring that caps exposure per asset and enforces a maximum slippage limit; this can be achieved by simulating order‑book depth before execution. Seventh, logging and telemetry are vital-store every successful and failed arbitrage event with full context (prices, fees, gas costs, timestamps) to enable post‑mortem analysis. Eighth, incorporate a fallback system that switches to alternative liquidity sources if the primary pool depth falls below a threshold, thereby preserving the spread. Ninth, test your entire stack in a staging environment using historical replay data to validate the end‑to‑end latency and profitability under varying market conditions. Tenth, continuously update your statistical filters-cointegration tests, Pearson correlation, and VIF analysis-to ensure the pairs you monitor remain truly correlated and not just coincidentally moving together. Eleventh, secure your API keys with hardware security modules to prevent unauthorized withdrawals that could cripple your bot. Twelfth, monitor regulatory changes across jurisdictions, as certain arbitrage strategies may become restricted overnight. Thirteenth, keep an eye on cross‑chain bridges, as emerging DEXs on L2 solutions can present new arbitrage vectors with lower gas costs. Fourteenth, leverage decentralized oracle networks like Chainlink to obtain tamper‑proof price feeds for sanity checks. Finally, maintain an agile development culture-crypto markets evolve rapidly, and your arbitrage framework must adapt just as fast.

Jack Fans

Here’s a quick checklist for anyone looking to start: • Set up API keys on at least two major exchanges (Binance, Kraken, etc.). • Pull real‑time mid‑price data every second and store it in an in‑memory cache. • Define a spread threshold (e.g., 0.25%) that triggers a trade. • Simulate the trade in dry‑run mode for 24 hours to verify signal reliability. • Once confident, enable live execution with modest trade sizes and monitor the first few runs closely. This should get you up and running without overwhelming complexity.

Adetoyese Oluyomi-Deji Olugunna

While the checklist is serviceable, it lacks the nuanced appreciation for the subtle art of market micro‑structure that truly separates the elite from the dilettantes. One must cultivate a refined palate for order‑flow dynamics, lest one remain forever mired in mediocrity.

Krithika Natarajan

Thanks for the practical steps.

Rebecca Stowe

Glad you found it helpful! Keeping it simple and consistent really does make a difference.

Write a comment

Your email address will not be published. Required fields are marked *