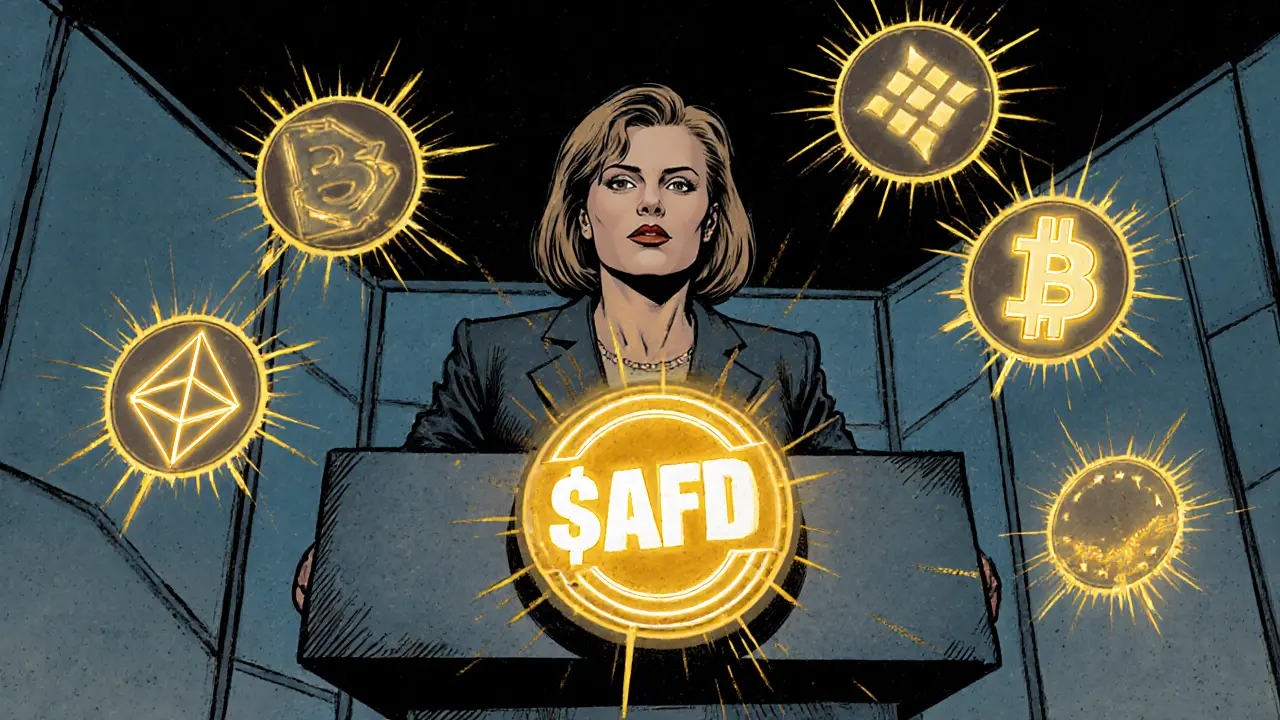

Alice Weidel (AFD) Crypto Coin Explained: How It Works, Risks & Market Data

A clear guide to the Alice Weidel (AFD) crypto coin, covering its variants, tech specs, market behavior, risks, and how to buy or trade it.

Read MoreWhen working with $AFD token, a blockchain‑based digital asset designed to unlock platform services and generate yield, also known as AFD, you’re stepping into a space where finance meets tech. $AFD token sits at the crossroads of several key concepts: it behaves like a utility token, a digital asset that grants holders rights to use a product or service on its native platform, yet regulators often examine it through the lens of a security token, a token classified as a financial security subject to compliance rules. This dual nature means investors need to understand both the functional benefits and the legal frameworks that could affect trading, custody, and tax treatment. The token’s architecture also supports crypto airdrop, a method of distributing free tokens to eligible wallets to spur adoption and community growth, making community incentives a core part of its ecosystem.

Beyond its token classification, $AFD token is a staple of the DeFi token, a class of assets that power decentralized finance protocols like lending, staking, and automated market making. In practice, holders can lock $AFD into smart contracts to earn yield, participate in governance votes, or unlock premium features within the platform. The token’s design leverages peer‑to‑peer (P2P) networking principles, which originated in early file‑sharing systems and now underpin blockchain’s distributed consensus. This P2P foundation enables faster settlement, lower fees, and greater resilience against centralized failure points. Meanwhile, the token’s airdrop mechanics have been fine‑tuned to reward early adopters without flooding the market—a balance that many newer projects struggle to achieve. By combining utility, security compliance, and community‑driven distribution, $AFD token illustrates how modern crypto assets can serve multiple roles simultaneously.

Below you’ll find a curated collection of articles that unpack these ideas from every angle. We cover everything from the nitty‑gritty of crypto ETFs and how they differ from straight coin investments, to deep dives on P2P evolution, utility versus security token distinctions, and practical airdrop guides. Whether you’re a beginner asking “what can I do with $AFD?” or a seasoned trader hunting the next yield‑generating strategy, the posts ahead give you actionable insights, real‑world examples, and risk‑aware tips. Dive in to see how $AFD token interacts with DeFi protocols, how its airdrop history shapes future distributions, and what regulatory trends mean for its classification as a security token.

A clear guide to the Alice Weidel (AFD) crypto coin, covering its variants, tech specs, market behavior, risks, and how to buy or trade it.

Read More