Alice Weidel (AFD) Token Price Tracker

Track the performance of the three Alice Weidel crypto token variants. Prices update automatically based on current market data.

afd-alice-weidel

Ethereum (ERC-20)

$0.00001398

↓ 75.6%

Supply: Unlimited

$ALICE

Binance Smart Chain (BEP-20)

$0.00001398

↓ 75.6%

Supply: 500M

$AFD

Solana

$0.00001398

↓ 75.6%

Supply: 1B

| Variant | Blockchain | Total Supply | Primary Use | Notable Feature |

|---|---|---|---|---|

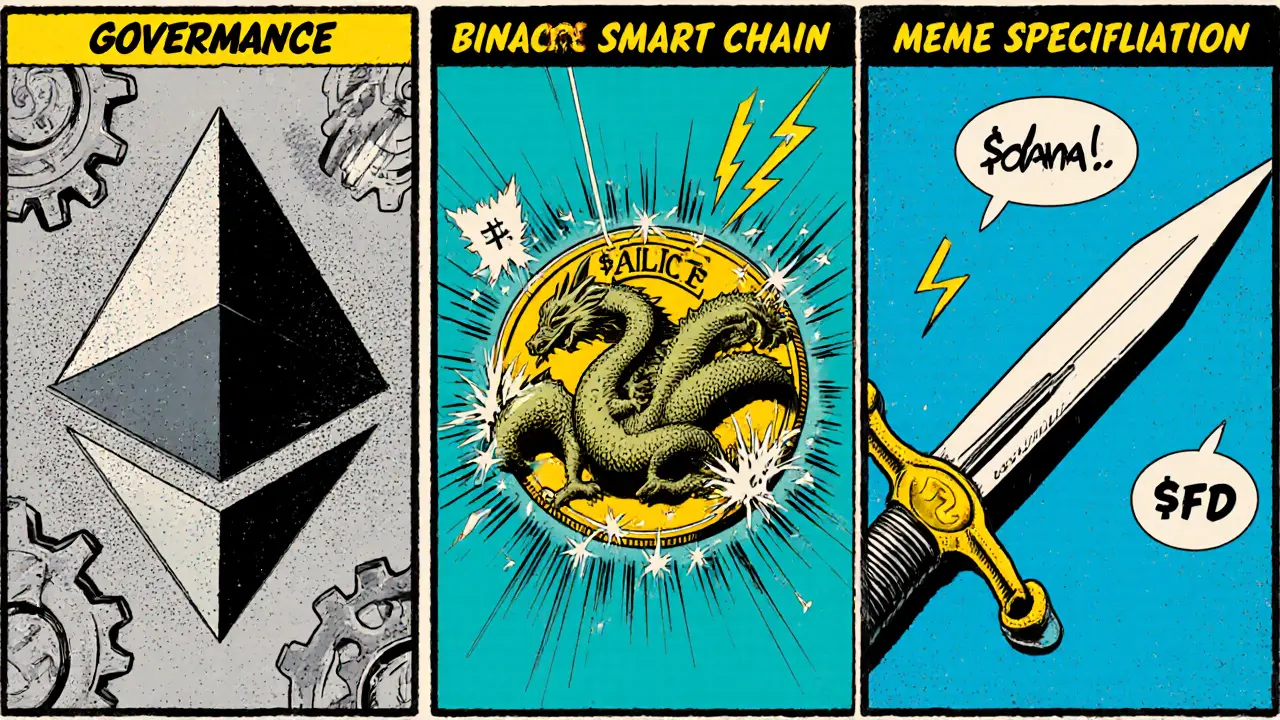

| afd-alice-weidel | Ethereum (ERC-20) | Unlimited | Governance & Donations | Staking for Voting Rights |

| $ALICE | Binance Smart Chain (BEP-20) | 500 million | Meme Speculation | Community Campaigns |

| $AFD | Solana | 1 billion | Fast Transactions | 0% Tax, Burned Liquidity |

Investment Simulation Result

Ever stumbled upon a crypto token named after a German politician and wondered what the fuss is about? The Alice Weidel crypto coin sits at the crossroads of politics, meme culture, and blockchain tech, promising everything from political donations to fast Solana trades. Below we break down what it actually is, how it functions, and why it’s a risky bet for most investors.

What Is the Alice Weidel (AFD) Crypto Coin?

Alice Weidel (AFD) token is a politically‑themed cryptocurrency that surfaced in early 2024, named after Alice Weidel, the chancellor candidate for Germany’s Alternative for Germany (AfD) party. The token was never officially endorsed by the party; instead, it’s an independent project that leverages her name and the party’s brand to attract a niche community of political enthusiasts and meme‑coin traders.

The ecosystem includes three main variants:

- the core afd‑alice‑weidel token, designed for governance and campaign‑funding tools;

- the $ALICE meme coin, which markets itself as a fun, viral asset;

- the $AFD token, a Solana‑based version with a fixed supply of 1billion tokens and a 0% tax structure.

All three run on public blockchains, meaning anyone can verify transactions, but they differ in purpose, technical stack, and community size.

Token Variants and Technical Specs

Understanding the differences helps you decide which (if any) aligns with your goals.

| Variant | Blockchain | Total Supply | Primary Use‑Case | Notable Feature |

|---|---|---|---|---|

| afd‑alice‑weidel | Ethereum (ERC‑20) | Unlimited (mintable) | Governance & political donations | Staking for voting rights |

| $ALICE | Binance Smart Chain (BEP‑20) | 500million | Meme‑driven speculation | Community‑run “viral” campaigns |

| $AFD | Solana | 1billion (fixed) | Fast, low‑fee transactions for supporters | 0% tax, burned liquidity pool |

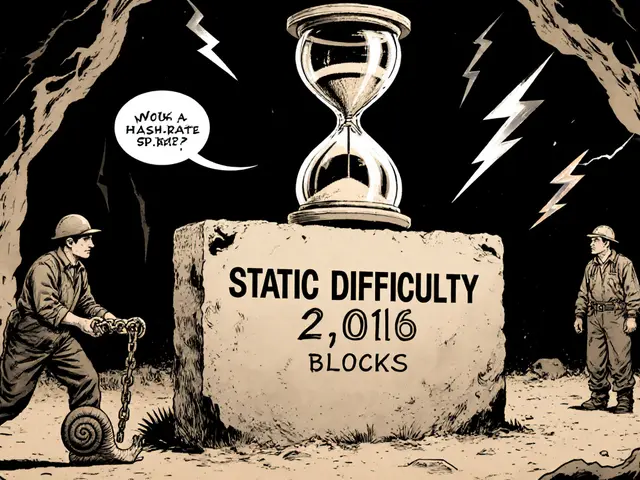

The Solana‑based $AFD leverages the network’s sub‑second finality and cheap fees, which appeals to users who want to move small amounts without burning cash on gas. By contrast, the Ethereum variant benefits from a mature DeFi ecosystem but suffers higher transaction costs.

How the Token Is Used

Each variant carries a slightly different utility profile:

- Governance: Holders of the afd‑alice‑weidel token can vote on community proposals, such as which political initiatives receive funding.

- Donations: The token can be sent directly to campaign wallets, allowing supporters to bypass traditional banking channels. Blockchain transparency makes it possible to trace each contribution.

- Staking: Some platforms let users lock up their tokens to earn modest rewards, which in turn grant more voting weight.

- Speculation: $ALICE and $AFD are mostly traded as meme assets, riding on social‑media hype-especially tweets from Elon Musk.

Because the tokens are not tied to any official party infrastructure, their real‑world impact remains limited. Most activity happens on decentralized exchanges (DEXs) and within niche Telegram or Discord groups.

Market Performance and Volatility

Politically‑linked meme coins are infamous for sudden price spikes followed by steep crashes. Here’s a snapshot of recent data (as of October2025):

- April42025 - price: $0.000055450 per token (peak after a Musk mention).

- Current (Oct2025) - price: $0.00001398 USD with essentially zero 24‑hour volume.

The dramatic drop illustrates a classic meme‑coin pattern: price moves are driven by news cycles, not fundamentals. With trading volume hovering near zero, liquidity is thin, meaning even a modest sell order can wipe out most of the market depth.

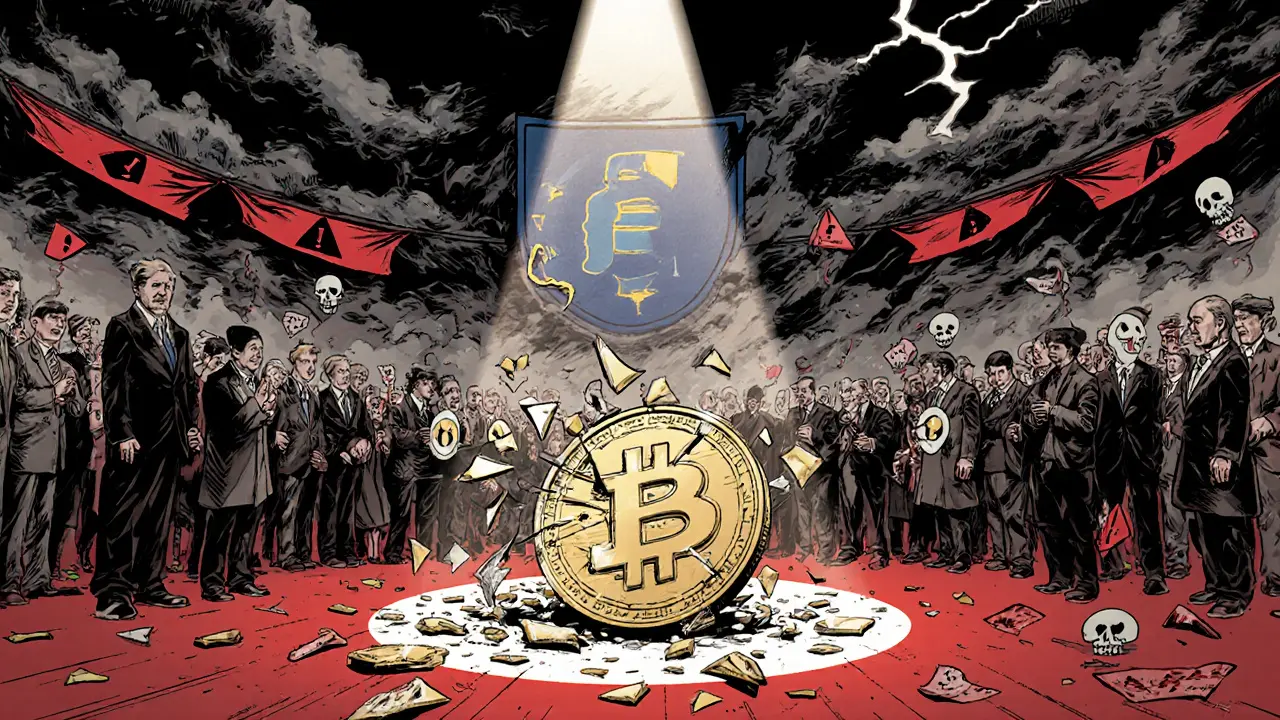

Risks and Regulatory Concerns

Investing in the Alice Weidel crypto coin comes with a stack of red flags:

- Political association: The AfD party is classified by German intelligence as an extremist organization. Any financial tie‑in could attract scrutiny from regulators in the EU and beyond.

- Trademark and impersonation risk: Since the token uses a public figure’s name without permission, courts could order a cease‑and‑desist, potentially freezing assets.

- Liquidity crunch: As noted, daily volume is negligible, making it hard to exit a position without severe price impact.

- Regulatory ambiguity: The EU is tightening rules around “political crypto assets,” which could label these tokens as securities or illegal fundraising tools.

- Reputation damage: Aligning with a far‑right party may alienate investors and partners, limiting future development or exchange listings.

In short, the token’s value hinges more on the political climate and meme hype than on any durable technology advantage.

How to Buy, Store, and Trade

If you still want to dip your toe in, follow these steps:

- Set up a wallet that supports the target blockchain:

- Ethereum: MetaMask or Trust Wallet.

- Binance Smart Chain: Trust Wallet.

- Solana: Phantom or Solflare.

- Acquire the native blockchain token for gas fees (ETH, BNB, or SOL) and transfer it to your wallet.

- Visit a reputable DEX that lists the token (e.g., Uniswap for Ethereum, PancakeSwap for BSC, or Raydium for Solana).

- Swap your native token for the desired variant (afd‑alice‑weidel, $ALICE, or $AFD). Pay close attention to slippage settings; low liquidity means high price impact.

- Store the received tokens in your wallet and, if you plan to hold long term, consider a hardware wallet for added security.

Never invest money you can’t afford to lose. Given the speculative nature, many users treat the token as a novelty rather than a serious portfolio component.

Community Sentiment and Future Outlook

The community is small but vocal. On X (formerly Twitter), hashtags like #WeidelCoin and #AFDToken trend sporadically, especially after any mention of Weidel in the media. However, the zero‑volume signal on CoinMarketCap suggests most holders are either long‑term believers or have moved the tokens off‑exchange into private wallets.

Future viability depends on three variables:

- Political success: If Weidel climbs higher in polls, the token could see a resurgence of interest.

- Endorsements: Additional tweets from Elon Musk or other influencers could trigger temporary spikes.

- Regulatory clarity: A clear EU stance could either legitimize the token (if allowed) or render it illegal (if banned).

At present, the token sits in a speculative gray zone-high‑risk, high‑potential upside only if you’re betting on political drama rather than blockchain tech.

Frequently Asked Questions

Is the Alice Weidel token officially linked to the AfD party?

No. The token is an independent project that uses the politician’s name for branding. The party has publicly denied any official involvement.

Which blockchain does the $AFD token run on?

$AFD is built on the Solana blockchain, offering sub‑second finality and low transaction fees.

How can I use the token for political donations?

Some community‑run wallets accept the token as a contribution method. You send the tokens to a public address linked to a campaign, and the blockchain record provides transparent proof of the donation.

What are the main risks of buying Alice Weidel coins?

Risks include extreme price volatility, thin liquidity, potential legal action over trademark misuse, and regulatory crackdowns because of the token’s political ties.

Where can I trade these tokens?

They are listed on a handful of decentralized exchanges: Uniswap for the Ethereum version, PancakeSwap for $ALICE, and Raydium or Serum for the Solana‑based $AFD.

There are 22 Comments

Marie-Pier Horth

Behold the latest political token parade, a dazzling spectacle where ideology meets blockchain hype. It feels like watching a circus where the clowns wear suits and promise governance rights for a fraction of a cent. The absurdity is almost poetic, as if the creators think the market will forgive any regulatory nightmare. Yet we, as observers, cannot help but marvel at the audacity of branding a meme with a parliamentarian's name. In the end, it's a reminder that crypto culture thrives on drama just as much as on technology.

Gregg Woodhouse

What a dumpster fire of a token.

F Yong

Oh sure, because handing out tokens named after a politician is the ultimate safeguard against surveillance. The whole thing reeks of a secret agenda to funnel money into undisclosed pockets while pretending to empower voters. If you ask me, this is the crypto equivalent of a breadcrumb trail leading straight to a hidden bunker.

Sara Jane Breault

Hey folks, just a heads up: these tokens are high‑risk. If you decide to play, make sure you only use money you can afford to lose. Consider diversifying and keep an eye on the news for any regulatory changes. Stay safe out there!

Mangal Chauhan

Dear community, I would like to emphasize the importance of conducting thorough due diligence before allocating capital to any emerging digital asset. The inherent volatility, coupled with potential legal implications, necessitates a prudent approach. Please feel free to reach out should you require further guidance. 😊

Iva Djukić

From a systemic perspective, the introduction of politically‑themed utility tokens raises a constellation of epistemic concerns that intersect governance theory, market microstructure, and regulatory jurisprudence. First, the nominal linkage to a public figure creates a symbolic conduit through which sentiment may be amplified, thereby distorting price discovery mechanisms in ways that defy traditional efficient‑market hypotheses. Second, the tokenomics-unlimited supply on Ethereum, capped supplies on BSC and Solana-impose divergent inflationary trajectories that complicate cross‑chain arbitrage strategies, especially when liquidity pools are shallow and susceptible to rug pulls. Third, the regulatory ambiguity surrounding political branding in decentralized finance may trigger supervisory interventions under securities law, anti‑money‑laundering statutes, or even electoral financing regulations, depending on jurisdictional nuances. Moreover, the speculative fervor engendered by meme culture can catalyze feedback loops wherein social media amplification fuels rapid capital inflows, only to precipitate abrupt corrections as market participants recalibrate risk assessments. Finally, the ethical dimension cannot be ignored: leveraging a political identity for profit may erode public trust and invite accusations of exploitation, thereby imposing reputational externalities on both the token issuers and the broader crypto ecosystem. In sum, while the novelty of these assets may capture imaginations, a rigorous analytical framework suggests that participants should approach with heightened vigilance, diversified exposure, and a clear exit strategy.

Darius Needham

I dug into the token contracts and noticed the lack of any anti‑whale mechanisms. That means early whales could dump huge amounts without penalty, crashing the price for the rest of us. Keep an eye on the holder distribution if you decide to dip your toe in.

WILMAR MURIEL

Reading through the whitepaper, I felt a mix of curiosity and caution. The idea of staking for voting rights sounds community‑focused, yet the governance model isn’t fleshed out. If you’re interested, I suggest joining the Discord to ask the developers directly.

Maggie Ruland

Sure, because nothing says “stable investment” like a token named after a controversial figure that dropped 75% already. Nice job, crypto.

jit salcedo

Imagine the clandestine cabal behind these tokens, orchestrating market moves while the world watches meme charts. It’s like a secret society meets digital alchemy, with each coin an elixir of power and peril.

Joyce Welu Johnson

Hey everyone, just wanted to share that I’ve been monitoring the $AFD token’s volume, and it’s surprisingly active for a niche project. If you decide to explore, consider setting a stop‑loss to protect against sudden swings.

Kristen Rws

Just a friendly reminder to keep your expectations realistic. These tokens can be fun, but they’re not a guaranteed way to get rich quick. Stay smart!

Fionnbharr Davies

From an analytical standpoint, the cross‑chain deployment adds an interesting layer of interoperability, but it also raises security considerations. Audits on each chain are essential before trusting the code.

Narender Kumar

Behold, the grand theater of tokenomics where drama meets fiscal irresponsibility. One might argue it is a masterpiece of conjecture, yet the ledger tells a different tale.

Lisa Strauss

Wishing everyone good luck if they decide to venture into these experimental tokens. Remember, the journey is just as important as the destination.

Darrin Budzak

Nice vibe on the $ALICE token, but please stay chill and don’t chase after every hype wave.

karsten wall

Considering the token’s supply dynamics, it’s prudent to assess how dilution might affect long‑term holders. A balanced approach helps mitigate risk.

C Brown

Oh great, another political meme coin promising the moon while the market is already in a black hole. Truly groundbreaking innovation.

Noel Lees

Just a heads‑up 🙂 – if you’re playing with $AFD, keep an eye on the Solana fees; they can get pricey during network spikes.

Raphael Tomasetti

Quick note: token swaps on BSC tend to be faster, but always double‑check the contract address.

bhavin thakkar

The saga of politically branded crypto tokens is a modern epic, where each new issuance writes another chapter of speculation, intrigue, and cautionary tales. As the narrative unfolds, the market watches with a mix of fascination and dread.

Janelle Hansford

Stay positive, stay informed, and enjoy the ride. The crypto world is full of possibilities!

Write a comment

Your email address will not be published. Required fields are marked *