Australian Crypto Regulations

When navigating the world of digital assets down under, you first need to know what the law actually says. Australian crypto regulations, the set of laws and guidelines that govern how digital assets are created, traded, and reported in Australia. Also known as crypto compliance in Australia, they shape everything from exchange licensing to tax reporting.

Australian crypto regulations affect every crypto user in the country, whether you’re a hobbyist buying a few tokens or a startup building a DeFi platform. Understanding the rules helps you avoid fines, keep your wallet safe, and stay on the right side of regulators.

Core entities that drive compliance

One of the main players is ASIC, the Australian Securities and Investments Commission, which supervises financial markets and enforces crypto rules. ASIC’s mandate includes granting licences to crypto exchanges, monitoring market abuse, and issuing guidance on investment‑product classification. Without ASIC approval, an exchange can’t legally offer services to Australian residents.

Next up are AML/KYC requirements, anti‑money‑laundering and know‑your‑customer rules that financial services must follow to prevent illicit activity. These standards force exchanges and wallet providers to verify user identities, keep transaction records, and report suspicious behavior to AUSTRAC. Failure to meet AML/KYC standards can lead to heavy penalties and shutdown orders.

Another critical piece is crypto exchange licensing, the formal approval process that lets a platform operate legally, offering trading, custody, and settlement services. A licensed exchange must adhere to capital‑adequacy rules, maintain robust cybersecurity, and publish transparent fee structures. Unlicensed platforms risk being blocked by payment processors and can be subject to civil action.

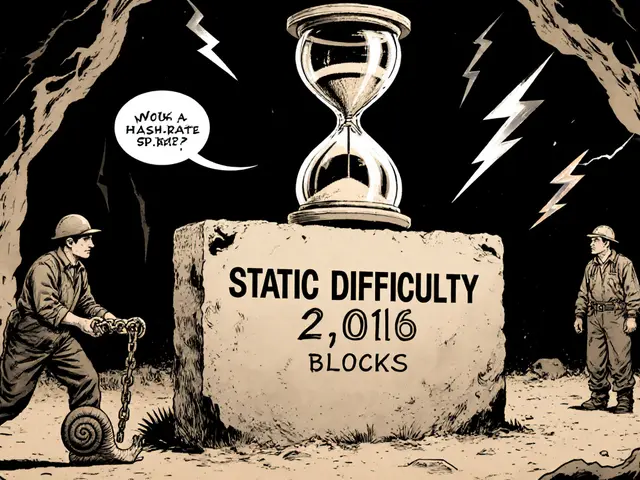

Finally, there’s crypto tax, the Australian Tax Office’s approach to treating digital assets as property for capital‑gains and income‑tax purposes. Every trade, swap, or reward triggers a tax event, and the ATO expects accurate record‑keeping and timely reporting. Ignoring crypto tax can result in audits, interest, and even criminal prosecution in severe cases.

These four entities—ASIC, AML/KYC, exchange licensing, and crypto tax—form the backbone of the regulatory landscape. They intersect in clear ways: ASIC enforces AML/KYC standards, licensing ensures compliance with both, and tax rules apply to every licensed activity.

Why the rules matter for you

If you’re planning to launch a token sale, you’ll need to check whether the offering qualifies as a managed investment scheme under ASIC guidelines. If you simply trade on a global exchange, you still need to register with AUSTRAC, keep detailed logs, and calculate your capital gains for the ATO. Even DeFi users aren’t exempt; the regulator is increasingly looking at decentralized protocols that attract Australian participants.

What this means in practice is that you’ll spend time gathering ID documents, setting up secure storage, and using tax‑software that can handle hundreds of transactions. The upside is a smoother relationship with banks and payment providers, lower risk of sudden service interruptions, and peace of mind that you won’t be caught off‑guard by a regulator’s audit.

What you’ll find in the article collection below

The posts linked on this page dive deep into each of these pillars. You’ll see a step‑by‑step guide to getting an ASIC licence, a breakdown of the latest AML/KYC checklist from AUSTRAC, real‑world examples of how crypto tax calculations are performed, and insights into how emerging DeFi projects are being treated under current law. Whether you’re a beginner who needs the basics or an experienced founder looking for compliance shortcuts, the collection covers the full spectrum.

In short, we’ve curated a toolbox that lets you move from “I hear there are rules” to “I can operate confidently under those rules.” Browse the articles, pick the topics that match your situation, and start building or trading with solid legal footing.

Ready to explore the specifics? The posts below break down each component, give you actionable tips, and keep you updated on any regulatory changes that could affect your crypto activities in Australia.