SMAK Airdrop Claim Checker

Check Your SMAK Airdrop Eligibility

Enter your Tezos-compatible wallet address below to verify if you received tokens from the CoinMarketCap airdrop (September 13–23, 2021). Note: This tool simulates verification and does not connect to live blockchain data.

Verification Results

When SMAK a decentralized escrow platform built on the Tezos blockchain teamed up with CoinMarketCap in September 2021, the result was a $20,000 promotional airdrop aimed at jump‑starting community interest. The campaign, officially called the SMAK airdrop, ran for ten days and promised free SMAK tokens to anyone who followed the required steps on the CoinMarketCap platform.

What Smartlink and SMAK Actually Do?

Smartlink (ticker SMAK) entered the crypto scene in early 2021 with a clear goal: provide a trust‑free escrow service for Web3.0 transactions. By leveraging Tezos’ low fees and on‑chain governance, Smartlink offers three core products:

- Smartlink Escrow Service - handles C2C, B2C, and B2B trades without a middleman.

- Smartlink Payment Processing - a decentralized payment portal that settles instantly in multiple digital currencies.

- Decentralized Marketplace - lets sellers list goods and services while the escrow engine protects both parties.

The native utility token, also called SMAK, gives holders fee exemptions, escrow rewards, and voting rights over platform upgrades.

Campaign Timeline and Mechanics

The airdrop was announced via a YouTube video on September72021, then officially opened on September132021. Participants had to:

- Register on CoinMarketCap and verify their email.

- Follow Smartlink’s official social channels (Twitter, Telegram).

- Complete a short survey confirming their interest in escrow services.

- Submit a wallet address compatible with the Tezos network.

Distribution concluded on September232021, with the $20,000 pool divided among roughly 3,800 eligible wallets. Each wallet received a proportional share based on the survey responses.

Hard Numbers: Allocation, Supply & Distribution

| Metric | Value |

|---|---|

| Total USD Value | $20,000 |

| Campaign Duration | 10 days (Sept13‑232021) |

| Eligible Participants | ≈3,800 wallets |

| Average Token Share | ≈5,260 SMAK per wallet |

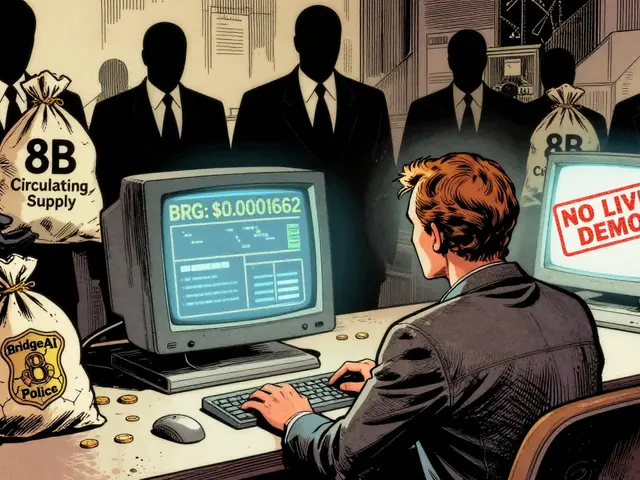

| Current Circulating Supply (as of Oct2025) | ≈305.5million SMAK (self‑reported) |

CoinMarketCap lists the circulating supply as 305.49million SMAK, yet several analytics sites show zero tokens in active circulation, hinting at reporting inconsistencies that may have confused traders.

Post‑Airdrop Price Performance

After the distribution, the token briefly hovered around $0.003-$0.004, spurred by the publicity surge. However, the price has been on a steep decline for the past four years:

- June2022: $0.0024 per SMAK

- June2023: $0.0011 per SMAK (‑54%)

- June2024: $0.00045 per SMAK (‑59%)

- Oct2025: $0.00012 per SMAK (‑94.6% from the 2022 peak)

The 24‑hour trading volume registered $0.00 on most exchanges, and the token now trades mainly on Gate.io with negligible liquidity. Daily price swings exceed 10% on average, reflecting a thin market and low investor confidence.

Why the Decline? Market Realities and Project Challenges

Several factors contributed to the erosion of SMAK’s value:

- Limited Exchange Listings - Apart from Gate.io, the token is absent from major venues like Binance or Coinbase, cutting off a huge pool of potential buyers.

- Supply Ambiguities - Conflicting reports on circulating supply created uncertainty, which scared off institutional traders.

- Adoption Gap - Despite a technically sound escrow engine, Smartlink’s user base has remained modest. Real‑world merchant onboarding has been slower than projected.

- DeFi Saturation - The 2021 airdrop boom flooded the market with low‑utility tokens, making it hard for SMAK to stand out after the hype faded.

Even though Tezos offers low fees and strong on‑chain governance, those advantages haven’t translated into higher demand for the escrow service itself.

How to Verify If You Received the Airdrop

If you think you might have been part of the 2021 campaign, follow these steps to check your wallet:

- Open a Tezos‑compatible block explorer (e.g., tzstats.com).

- Enter your wallet address in the search bar.

- Look for token transactions labeled “SMAK” with timestamps between September13‑232021.

- If you see a token receipt, it’s likely from the airdrop. Verify the amount matches the average share (~5,200SMAK).

Keep in mind that many wallets were never activated after the airdrop, so the tokens might sit idle with no trading value.

Risk Assessment for Potential Investors

Before considering any new purchase of SMAK, weigh these risk points:

- Liquidity Risk - With near‑zero daily volume, exiting a position could be costly.

- Regulatory Uncertainty - As a utility token tied to escrow services, future regulations could affect its legal status.

- Project Roadmap Uncertainty - The last major upgrade was announced in early 2023; no clear milestones have been posted since.

For risk‑averse traders, allocating a small, speculative portion of a portfolio (e.g., 1‑2%) is a prudent approach.

What’s Next for Smartlink?

Smartlink’s team hinted at two upcoming features:

- Cross‑Chain Escrow - Integrating Bitcoin and Ethereum assets to broaden appeal.

- Marketplace Incentive Program - Offering SMAK rewards for sellers who hit transaction volume thresholds.

If these roll out successfully, they could revive demand for SMAK. However, without broader exchange listings, any upside remains limited.

Frequently Asked Questions

Did I need to hold any tokens before the SMAK airdrop?

No. Participants only had to complete the CoinMarketCap sign‑up, follow Smartlink’s social accounts, and provide a Tezos‑compatible wallet address.

Can I claim the airdrop now?

The distribution window closed in 2021, so new claims are not possible. You can only verify a past allocation if you already received tokens.

Why does CoinMarketCap list a circulating supply of 305million SMAK?

Smartlink self‑reported that figure after the airdrop, but several analytics services show a zero‑balance because many of those tokens are locked or held in inactive wallets. The discrepancy creates uncertainty for traders.

Is SMAK listed on any major exchanges?

Currently only Gate.io offers an SMAK trading pair. Absence from larger platforms limits liquidity and price discovery.

Should I buy SMAK as a long‑term investment?

Given the steep price decline, thin market, and unclear roadmap, SMAK is a high‑risk speculative asset. Allocate only a small portion of your portfolio if you decide to buy.

There are 16 Comments

Mark Bosky

Thanks for putting together the full picture of the SMA SMAK airdrop; the numbers really help put the hype in context. The $20,000 pool was split among roughly 3,800 wallets, which works out to about 5,260 SMAK per address on average. While the token’s price peaked at $0.004 shortly after the distribution, it has steadily declined to $0.00012 as of October 2025, reflecting thin liquidity and limited exchange listings. The discrepancy between the reported circulating supply of 305 million and the near‑zero on‑chain balances is a red flag for anyone considering a re‑entry. Overall, the airdrop was a classic 2021 promotional flash that failed to sustain long‑term value.

Michael Phillips

The decline makes sense when you consider that escrow services are a niche market. Without major exchanges listing SMAK, the token never gained the network effect needed for price stability. It’s a reminder that airdrops alone don’t build ecosystems.

Jason Duke

Wow!!! This airdrop was a wild ride!!! The community buzz was insane, and the $20K giveaway sounded like a crypto gold rush!!! Even though the price is now pennies, the sheer volume of participants proved that people love free tokens!!! Just remember, free money today can be junk tomorrow!!!

Franceska Willis

Yo, i think u guys miss the point, its not just about the price lol. thts why the airdrop was a cool try, but many dont even know how 2 use SMAK or what it d0. some ppl just grab n forget, so the market looks dead but the tech could be rad!!!

EDWARD SAKTI PUTRA

I get why many are frustrated; seeing a project flounder after an airdrop can feel like a betrayal. If you still hold SMAK, consider checking the escrow feature updates – they might still have utility even if the token price is low.

Bryan Alexander

Imagine a world where SMAK finally lands on a major exchange and the escrow platform becomes the backbone of countless NFT sales! The token could soar like a phoenix from the ashes of its current slump. Keep an eye on their roadmap – the cross‑chain escrow could be the game‑changer we all need.

Patrick Gullion

Honestly, the whole SMAK thing is a perfect example of hype over substance. A $20K giveaway sounds impressive, but if the product never gains traction, the token is just a marketing gimmick.

Jack Stiles

Looks like most people just left the token on the shelf.

Ritu Srivastava

We should call out projects that promise utility but deliver nothing. Encouraging investors to chase airdrops without solid fundamentals erodes trust in the entire crypto space.

Nicholas Kulick

To verify your allocation, use a Tezos block explorer like tzstats.com and look for SMAK token transfers dated between Sep 13‑23 2021. The transaction will show the exact amount, typically around 5,200 SMAK if you were part of the airdrop.

Caleb Shepherd

Did you know that some of those “zero‑balance” wallets are actually controlled by bots? It’s rumored that a hidden contract holds the majority of the supply, which could be released later to manipulate the market.

Richard Bocchinfuso

Promoting a token that barely trades is irresponsible. Creators should focus on delivering real services instead of throwing away money on cheap giveaways.

Monafo Janssen

It’s easy to dismiss SMAK as a failed experiment, but there are a few aspects worth acknowledging. First, the collaboration with CoinMarketCap succeeded in drawing attention to a novel escrow solution built on Tezos. Second, the airdrop’s distribution model was transparent – every eligible wallet could see the allocation on the blockchain. Third, the token’s utility, albeit limited, does provide fee exemptions within the Smartlink platform. Fourth, the team has continued to develop cross‑chain escrow features, which could broaden their market reach. Fifth, the marketplace incentive program they hinted at might attract merchants seeking decentralized payment options. Sixth, community members who remain active are often early adopters of future DeFi tools. Seventh, the low token price makes it accessible for experimentation without significant capital risk. Eighth, the token’s governance rights allow holders to influence platform upgrades. Ninth, the presence of a token can help bootstrap a user base for the escrow service itself. Tenth, the thin liquidity encourages patient holders rather than day‑traders. Eleventh, the token’s governance and open‑source contributions are particularly compelling. Twelfth, the project’s open‑source components contribute to the broader Tezos ecosystem. Thirteenth, the modest liquidity encourages patient holders rather than day‑traders. Fourteenth, the airdrop’s historical data provides a useful case study for other projects planning similar campaigns. Finally, while the market may be thin today, the underlying technology could experience a resurgence if cross‑chain escrow gains mainstream adoption.

Marcus Henderson

I appreciate the thorough breakdown; the points about governance and open‑source contributions are particularly compelling. Should the cross‑chain rollout succeed, SMAK’s utility could indeed increase, justifying a reevaluation of its market potential.

Andrew Lin

Let's be real – the only reason SMAK stays afloat is because some nationalist agenda pushes it as a “home‑grown” Tezos token. The whole thing is a staged propaganda piece to keep US investors inside the echo chamber.

Matthew Laird

Actually, the project’s alignment with local development teams provides a unique advantage in navigating regulatory landscapes, which foreign tokens often struggle with. Dismissing it outright ignores the strategic value of domestic ecosystems.

Write a comment

Your email address will not be published. Required fields are marked *