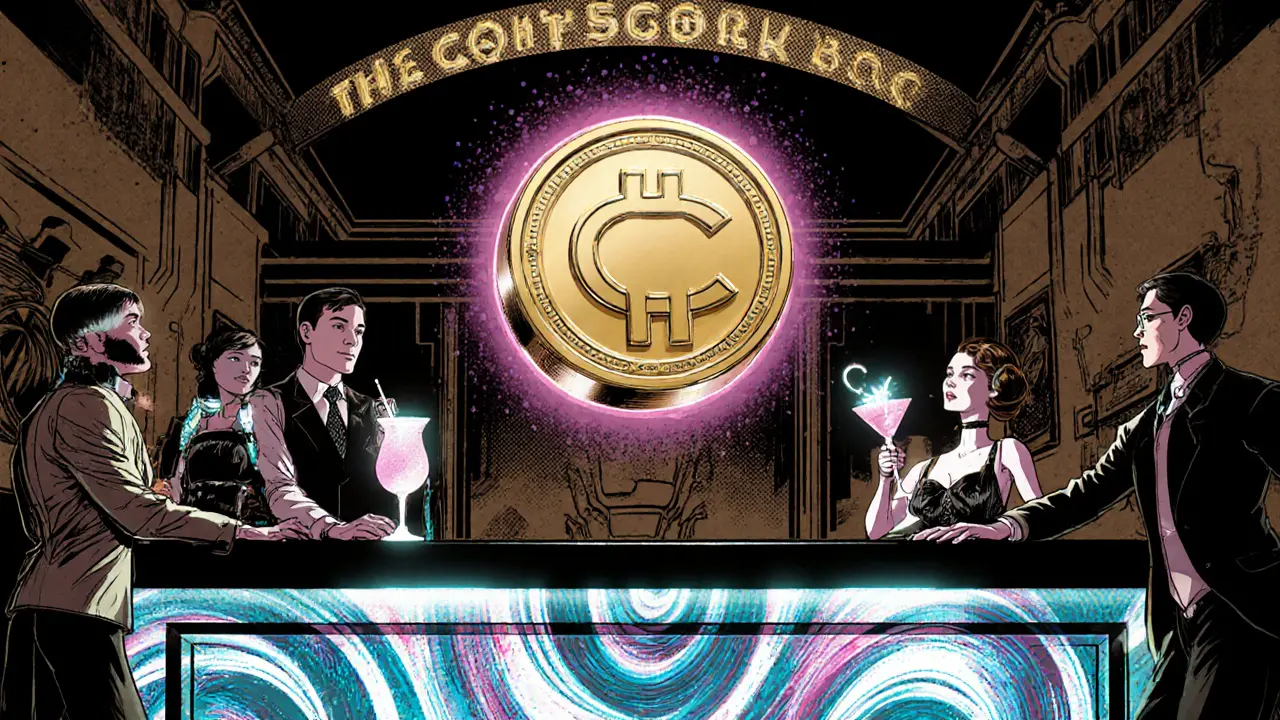

The CocktailBar (COC) Crypto Coin Explained - Token Details, Market Data & Risks

A plain‑English guide to The CocktailBar (COC) crypto coin: token basics, market data, utility, governance, risks and FAQs.

Read MoreWhen working with cryptocurrency market data, the collection of price, volume, on‑chain and derivatives metrics that let traders see what’s moving in the crypto world. Also known as crypto market stats, it fuels everything from a quick price check on a mobile app to a multi‑year research report on blockchain ecosystems.

One of the most actionable slices of market data is funding rates, the periodic payments exchanged between long and short positions in perpetual futures contracts. Funding rates act like a pulse check for market sentiment – when they’re high, longs are paying shorts, indicating bullish pressure; when they’re low or negative, the opposite is true. Understanding this helps you time entry and exit points without guessing.

Another pillar is hash rate, the total computational power miners contribute to secure a proof‑of‑work blockchain. A rising hash rate usually means stronger network security and often leads to higher mining difficulty, which in turn can affect supply dynamics and price stability. Traders who watch hash rate trends can anticipate shifts in miner behavior and adjust their positions accordingly.

Wrapped assets like WBTC and WETH add another layer to market data. Because they mirror the value of Bitcoin or Ether on other chains, they create cross‑chain liquidity bridges. Tracking the trading volume of these wrapped tokens reveals where capital is moving and can hint at emerging arbitrage opportunities. For example, a sudden spike in WBTC volume on a layer‑2 network may signal a pending congestion event on the main chain, prompting traders to shift assets pre‑emptively.

Volatility metrics round out the picture. By measuring price swings over different time frames, volatility tells you how risky a coin is at any moment. In bull markets, volatility often spikes as new money rushes in, while bear markets may show prolonged low volatility before a breakout. Knowing the current volatility pattern helps you size positions, set stop‑loss levels, and choose the right trading strategy, whether you’re day‑trading or holding for the long haul.

All these data points are intertwined: funding rates reflect trader sentiment, hash rate influences supply security, wrapped asset volume shows cross‑chain flow, and volatility ties them together in a risk profile. When you combine them, you get a multi‑dimensional view of the market that’s far richer than a single price chart.

Below you’ll find a curated set of articles that dig deeper into each of these topics. From practical guides on reading funding rates to deep dives on hash rate dynamics, wrapped token rankings, and volatility patterns, the collection equips you with the knowledge to turn raw market data into actionable insight. Ready to explore? Scroll down for the full lineup.

A plain‑English guide to The CocktailBar (COC) crypto coin: token basics, market data, utility, governance, risks and FAQs.

Read More