When you’re looking for a crypto exchange that offers Bibox trading with up to 1:150 leverage, 500+ coins, and low fees tied to its BIX token, it sounds like a dream. But beneath the surface, Bibox has serious problems that most new traders don’t find out until it’s too late.

What Bibox Actually Offers

Bibox launched in 2017, making it one of the older crypto exchanges still operating today. It markets itself as an AI-powered platform with decentralized features, but don’t let the buzzwords fool you. What you get is a spot and derivatives trading platform with over 500 cryptocurrencies available, including major ones like Bitcoin, Ethereum, and Solana, plus hundreds of smaller altcoins you won’t find on Coinbase or Kraken.It supports futures, margin trading, perpetual contracts, options, and even NFT trading. If you’re into high-risk, high-reward strategies, Bibox gives you tools most retail exchanges don’t. Leverage goes up to 1:150 on futures - that’s higher than most regulated platforms allow. The minimum deposit? Just $1. That’s appealing if you’re starting small.

Its fee structure is unique. Instead of basing discounts on your verification level like Binance or KuCoin, Bibox cuts fees based on how many BIX tokens you hold. Spot trading starts at 0.1% and drops to 0.01% if you hold enough BIX. Futures fees are even lower: 0.04% to 0.06%. For heavy traders who already own BIX, this can save money. But if you don’t hold the token, you’re stuck paying the full rate.

The Big Problem: You Can’t Deposit Fiat

Here’s where Bibox falls apart for most people. Despite claiming to support fiat currencies like USD, JPY, and EUR, you cannot deposit fiat directly. You can only withdraw in fiat - but only after you’ve bought crypto on another exchange and sent it over.This means you need to use a different platform - like Coinbase, Kraken, or Binance - to buy crypto with your bank card or bank transfer. Then you send it to Bibox. That’s two steps, two sets of fees, and two points of failure. For beginners, this is confusing. For anyone who wants simplicity, it’s a dealbreaker.

Trust Scores Are Terrible

Bibox doesn’t just have minor complaints - it has systemic trust issues. On Trustpilot, it has a 1.1 out of 5 rating based on over 170 reviews. That’s not a glitch. That’s a pattern.Users consistently report:

- Withdrawals stuck for days or weeks

- Customer support that never replies to emails

- Accounts frozen during market swings

- Difficulty verifying identity despite uploading documents

ScamAdviser gives Bibox a 70/100 trust score - which sounds okay until you realize that means it’s flagged as “moderate risk.” Traders Union, which reviews over 3,800 financial services, rates Bibox at 3.37 out of 10 and explicitly warns users to “exercise caution.”

Compare that to Binance (4.7/5 on Trustpilot), Kraken (4.5/5), or Coinbase (4.6/5). Those platforms have regulatory licenses, dedicated support teams, and millions of active users. Bibox has none of that.

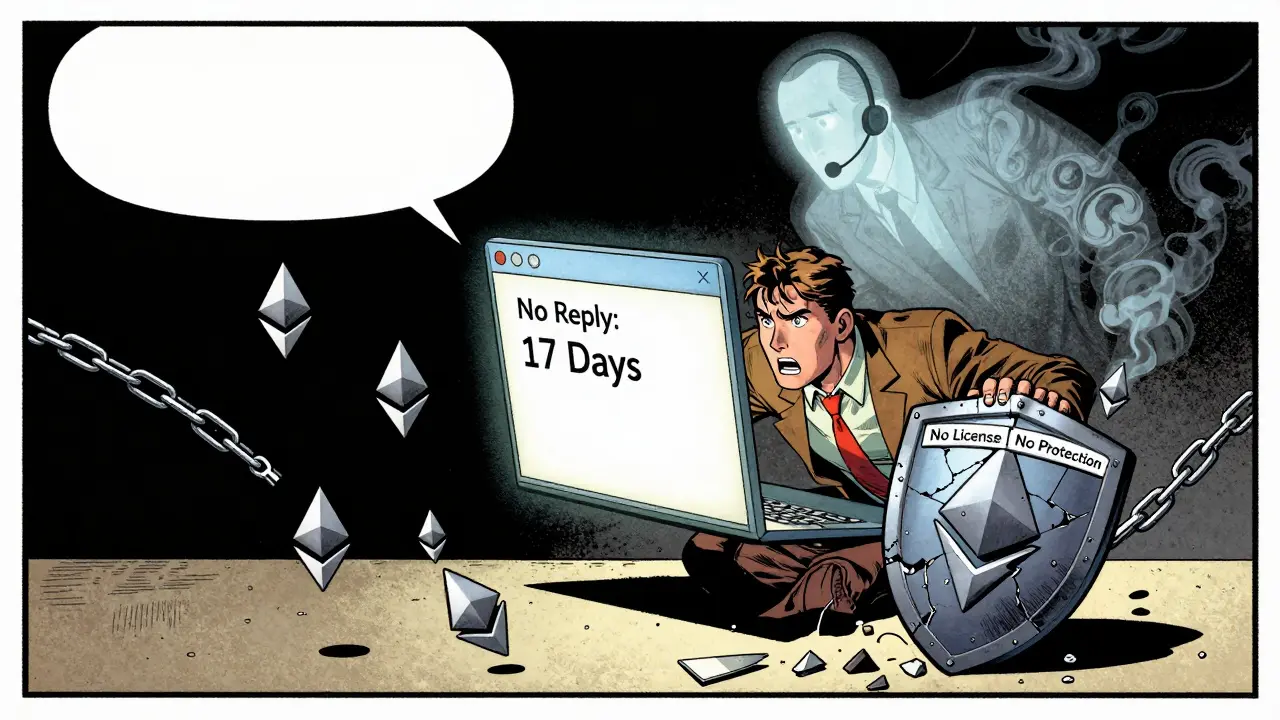

Customer Support Is Basically Nonexistent

Bibox offers email-only support. No live chat. No phone. No ticket system with status updates. If you have a problem - say, your withdrawal is stuck - you send an email and wait. And wait.Reddit threads from late 2025 are full of users saying they’ve emailed Bibox 10 times over three weeks with no reply. One user reported sending 17 ETH for withdrawal on December 1, 2025. It was still pending on January 10, 2026. No explanation. No apology. Just silence.

There’s no public roadmap, no update logs, and no transparency about why withdrawals get delayed. The platform doesn’t even acknowledge these issues publicly. That’s not poor service - it’s negligence.

Security and Regulatory Red Flags

Bibox doesn’t have a license from any major financial authority. No FinCEN registration. No MiFID II compliance. No FCA or ASIC oversight. That means if the platform gets hacked, freezes funds, or disappears - you have zero legal recourse.It’s not just retail traders who avoid Bibox. Institutional investors and hedge funds won’t touch it. Why? Because compliance teams flag it immediately. No license = no integration. No audit = no trust.

The platform claims to be “decentralized,” but it’s not. It’s a centralized exchange with a confusing label. You don’t control your private keys. You don’t hold your assets. You’re trusting Bibox’s servers - and their track record says that’s risky.

Who Should Use Bibox?

There’s one scenario where Bibox might make sense: experienced crypto traders who already hold a large amount of BIX tokens and are comfortable with high-risk, high-leverage trading. If you’re already deep into altcoins, know how to manage margin calls, and treat this like a speculative gambling tool - not a savings account - then Bibox’s 1:150 leverage and low fees could be tempting.But even then, you’re gambling with your funds. If you need to cash out during a market crash, and Bibox is slow or unresponsive, you could lose money you can’t afford to lose.

Alternatives That Actually Work

If you want high leverage, low fees, and 500+ coins - but also reliability - here are better options:- Binance: 500+ coins, 1:125 leverage, 0.02% spot fees, 24/7 support, licensed in multiple regions.

- Kraken: 200+ coins, 1:50 leverage, strong security, regulated in the U.S. and EU.

- Bybit: 1:100 leverage, 0.01% spot fees, fast withdrawals, transparent operations.

- OKX: 500+ assets, options trading, strong UI, and active customer service.

All of these have verified user reviews, public licenses, and real-time support. None of them have 1.1-star ratings.

Final Verdict: Avoid Unless You’re Willing to Lose Money

Bibox isn’t a scam - it’s still operating. But it’s a platform built on convenience for traders who don’t care about safety. It offers tools that look powerful, but it fails at the most basic thing a crypto exchange should do: let you get your money out when you need it.For beginners, it’s a trap. For experienced traders, it’s a gamble. And for anyone who values their funds over flashy leverage - it’s not worth the risk.

If you’re looking for a crypto exchange in 2026, choose one with a track record of reliability. Not one with 500 coins and a 1.1-star rating.

Can I deposit fiat money directly into Bibox?

No, you cannot deposit fiat currency directly into Bibox. While the platform claims to support USD, EUR, and JPY, users must first buy cryptocurrency on another exchange like Coinbase or Kraken and then transfer it to Bibox. This adds extra steps, fees, and risk.

Is Bibox safe to use?

Bibox is not considered safe by industry standards. It has no regulatory license from major jurisdictions like the U.S. or EU, and its Trustpilot rating is 1.1/5 based on over 170 reviews. Common complaints include frozen withdrawals, unresponsive support, and lack of transparency. Experts advise avoiding it unless you’re prepared to lose access to your funds.

How do Bibox trading fees work?

Bibox uses a tiered fee system based on your BIX token holdings. Spot trading starts at 0.1% and drops to 0.01% if you hold enough BIX. Futures fees range from 0.04% to 0.06%. If you don’t hold BIX, you pay the highest rate. This system rewards token holders but penalizes newcomers.

Does Bibox have a mobile app?

Yes, Bibox has mobile apps for iOS and Android. They offer full trading functionality, including charting via TradingView integration. However, users report the same reliability issues as the web platform - especially with withdrawals and login problems. The app doesn’t fix the underlying trust issues.

What’s the highest leverage available on Bibox?

Bibox offers up to 1:150 leverage on futures and perpetual contracts. This is among the highest available on any exchange. However, such high leverage increases the risk of liquidation dramatically. Most regulated exchanges cap leverage at 1:50 or lower to protect retail traders.

Why do people say Bibox has bad customer support?

Users report that Bibox only offers email support, with no live chat or phone line. Many have sent multiple emails over weeks without any reply. Withdrawal delays, account freezes, and verification issues often go unanswered. This lack of responsiveness is one of the top reasons users leave negative reviews.

Is Bibox regulated?

No, Bibox is not regulated by any major financial authority. It has no license from the SEC, FCA, ASIC, or any EU or U.S. regulator. This means users have no legal protection if funds are lost, stolen, or frozen. Most reputable exchanges operate under strict licensing - Bibox does not.

Should I use Bibox for long-term investing?

No. Bibox is not suitable for long-term holding. Its poor withdrawal reliability, lack of regulatory oversight, and history of user complaints make it dangerous for storing funds. Even if you’re buying Bitcoin or Ethereum for the long term, keep them on a hardware wallet or a trusted exchange like Kraken or Coinbase.

There are 24 Comments

Pramod Sharma

Bibox is like buying a sports car with no brakes. Looks cool, goes fast, but you’re one bad turn from a dumpster fire.

Don’t let the 1:150 leverage fool you - that’s not leverage, that’s a suicide pact.

Save yourself the headache.

Liza Tait-Bailey

i just tried to withdraw like 2 eth last month and still waiting. no reply. no update. nothing.

like... did they ghost me or did my funds get absorbed into the crypto multiverse?

im done. going back to binance. even if their fees are higher, at least i know where my money is.

also why do they even have a mobile app if it doesnt fix the core issues? just to make us feel better while we wait forever?

someone pls tell me im not the only one who got ignored for 3 weeks.

its not even about the fees anymore. its about basic human decency.

nathan yeung

look i get it - high leverage is tempting. i’ve been there.

but if your exchange can’t even answer an email, you’re not trading crypto - you’re playing russian roulette with your portfolio.

why not just use bybit? same leverage, way better support, and they actually respond.

also, holding bix tokens just to get lower fees? that’s like paying extra to join a club that locks your door from the inside.

not worth it.

Bharat Kunduri

they dont even have a phone line?? lmao

what kind of 2026 exchange is this??

my dog has better customer service than bibox

and my dog just barks and sleeps

imagine sending 17 eth and getting crickets for 40 days

theyre not a company - theyre a honeypot for suckers

and the 1.1 star rating? thats not a rating - thats a funeral notice for your money

Chris O'Carroll

okay but imagine this: you wake up one morning, your account is frozen, you’ve got a 100k position on 1:150 leverage, and you try to withdraw to cover a margin call…

and bibox just… doesn’t reply.

not ‘we’re processing’ - not ‘sorry for the delay’ - just silence.

that’s not a platform. that’s a trap door.

and the fact that they market themselves as ‘ai-powered’? please. their ai is just a bot that auto-replies ‘thank you for your patience’

and then ghosts you for 6 months.

if you’re not rich enough to lose this money - don’t even look at this site.

Kelly Post

my friend lost 3 months of savings on this platform because they froze his withdrawal during a dip.

he sent 14 emails. no reply.

he posted on reddit. got 3 likes and 10 people saying ‘lol same’.

he cried.

and now he’s working two jobs to rebuild.

you think leverage is sexy until you realize the exchange doesn’t care if you live or die.

please - if you’re reading this and thinking ‘maybe i’ll try it’ - stop.

go to kraken. go to bybit. go anywhere else.

your future self will thank you.

Andre Suico

While Bibox offers technically impressive features - high leverage, low fees for token holders, and a broad asset selection - the absence of regulatory oversight and the documented pattern of operational neglect render these advantages irrelevant.

Trust is not a feature; it is the foundation of any financial intermediary.

Without it, even the most sophisticated trading tools become instruments of risk amplification rather than wealth generation.

For users seeking exposure to crypto derivatives, the existence of regulated, transparent, and responsive alternatives makes the choice unambiguous.

One should not trade on an exchange that treats customer inquiries as noise.

Professionalism is not optional in finance - it is non-negotiable.

Chidimma Okafor

Let me be perfectly candid: Bibox is not merely unreliable - it is an affront to the very ethos of decentralized finance.

One does not build trust by offering 1:150 leverage while withholding withdrawal requests like a miser guarding his last coin.

It is not merely poor customer service - it is a betrayal of the trader’s fundamental right to access their own capital.

When an exchange cloaks its centralization in buzzwords like ‘AI-powered’ and ‘decentralized features,’ it is not innovating - it is deceiving.

Let us not mistake spectacle for substance, nor volume for validity.

The market rewards those who operate with integrity, not those who gamble with the livelihoods of the naive.

Choose wisely, for your assets are not mere numbers - they are your labor, your hope, your future.

And Bibox? Bibox is a mirage in the desert of crypto.

Bill Sloan

bro i used bibox for a week and i swear i saw a ghost in the withdrawal queue

like... literally. i refreshed 17 times and the status didn’t change.

then i checked their twitter - 3 posts in 6 months.

one was a meme.

the other two were ‘we’re working on improvements’

and it’s been 8 months.

the app is fine but the backend? it’s like a 2008 flash website with a crypto logo slapped on.

if you’re not rich and don’t mind losing it - go ahead.

if you want to sleep at night? don’t.

also i still have 12 bix tokens i bought for ‘discounts’ - they’re worth more as paperweights now.

ASHISH SINGH

you think this is a coincidence? 1.1 rating? no license? no support?

they’re not a crypto exchange - they’re a front for a money laundering ring disguised as a trading platform

think about it - why would a legit company not have phone support?

because they don’t want you to talk to a human

because if you did, you’d ask where your money went

and they’d have to lie

or worse - admit they stole it

the ‘bix token’? that’s just a way to pump and dump the weak

they’re not here to help traders

they’re here to harvest them

and the regulators? they’re all in on it

they’re just waiting for enough people to lose everything before they shut it down

and then they’ll say ‘oops’

and buy the dip on binance

Vinod Dalavai

been using bibox for a year now - honestly? i’m still here.

but i only use it for small altcoin trades. like under $500.

never put more than i’m willing to lose.

and i never, ever try to withdraw during a crash.

wait 2 weeks after the market calms down.

and pray.

they’re not evil - they’re just broken.

like a car with no brakes but a sweet stereo.

so yeah - i use it.

but i treat it like a casino.

and i cash out before the house wins.

Callan Burdett

1:150 leverage sounds like a superpower until you realize you’re the only one holding the cape.

everyone else has safety nets.

you? you’ve got a prayer and a hope.

but hey - if you wanna go full anime protagonist and bet your rent money on a meme coin with 100x leverage… go for it.

just don’t cry when the platform vanishes with your portfolio.

and if you do cry? send me a screenshot.

i’ll send you a virtual hug and a meme about how ‘crypto is hard’.

Anthony Ventresque

what’s wild is that bibox still exists.

how? because there are enough people who don’t know any better.

new traders see ‘1:150 leverage’ and think ‘this is the key to wealth’.

they don’t see the fine print: ‘we reserve the right to delay withdrawals indefinitely’.

they don’t see the 170 reviews saying ‘i haven’t seen my money since december’.

they just see the hype.

and that’s the real scam.

not the platform - the illusion that you can outsmart the system.

you can’t.

not here.

Nishakar Rath

you guys are being way too nice

bibox is a scam

no one cares about your 1.1 rating

they care about the 1000 people who lost everything

and no one even knows if they’re still alive

they’re not an exchange

they’re a digital black hole

and the bix token? that’s just the bait

you think you’re getting discounts?

no you’re just funding their next yacht

and the ‘ai-powered’ thing? their ai is just a script that says ‘we’re working on it’

over and over

for 12 months

and you still think this is legit?

you’re not trading crypto

you’re donating to a cult

Jason Zhang

the only reason bibox still runs is because people are too lazy to switch.

‘oh i’ve got 50 bix tokens’

‘oh i’ve got a position open’

‘oh i’ll just wait until next week’

next week becomes next month becomes never.

and then you’re stuck.

not because you lost money.

because you got emotionally attached to a platform that doesn’t care.

that’s the real trap.

not the leverage.

not the fees.

the silence.

Katherine Melgarejo

so bibox lets you trade 500 coins but won’t let you withdraw?

congrats - you’ve found the crypto version of a restaurant that serves you the meal but won’t let you leave with the leftovers.

and the ‘ai-powered’ tagline? that’s just their way of saying ‘we have no idea what’s going on but we sound fancy’.

also - 1.1 stars?

that’s not a rating.

that’s a eulogy written by 170 people who lost everything.

and still, people keep signing up.

human nature is the real crypto scam.

Patricia Chakeres

obviously this is all a setup by the fed to push people toward centralized exchanges.

they let bibox exist so people get burned and then flock to coinbase like sheep.

the 1:150 leverage? that’s the bait.

the lack of regulation? that’s the trap.

the silence? that’s the psychological warfare.

they want you to lose so you’ll beg for ‘safe’ platforms.

and then they’ll charge you 0.5% fees and call it ‘security’.

it’s all a game.

and bibox? they’re just the patsy.

or worse - the willing accomplice.

Alexis Dummar

my buddy used bibox for a year and finally pulled out his funds after 11 weeks.

he got 92% back.

the rest? ‘processing fees’ they said.

no receipt.

no explanation.

just a ‘thank you for your patience’ email.

he laughed.

then cried.

then switched to kraken.

and now he’s sleeping again.

the lesson? don’t trade where you can’t trust.

even if the numbers look good.

because the real number you care about? is the one in your wallet.

not the one on their chart.

kristina tina

i just want to say - if you’re reading this and thinking about trying bibox… please stop.

i’ve been where you are.

i thought i was smart.

i thought i could ‘manage the risk’.

but when your withdrawal sits at ‘pending’ for 47 days…

you realize you weren’t trading.

you were begging.

and no one was listening.

your money isn’t safe anywhere unless you control it.

and bibox? they don’t even care if you’re alive.

so please - go to bybit.

go to binance.

go anywhere else.

you deserve better than silence.

Anna Gringhuis

the fact that people still defend this place is insane.

1.1 stars. no phone support. no license.

and yet - ‘oh but the fees are low!’

so you’d rather lose $10k than pay $10 extra in fees?

that’s not smart trading.

that’s masochism.

and the ‘bix token discount’? that’s just a way to make you buy their garbage coin so they can pump it and leave you holding the bag.

they’re not a platform.

they’re a Ponzi with a trading interface.

and you’re the sucker who keeps feeding it.

Michael Jones

the data is clear: Bibox lacks regulatory compliance, exhibits systemic customer service failure, and has a documented history of withdrawal delays and account freezes.

These are not isolated incidents - they are structural flaws.

For any trader - novice or experienced - the risk-reward calculus is unequivocally negative.

Even with high leverage and low fees, the probability of losing access to capital exceeds any potential gain.

Therefore, the only rational decision is to avoid Bibox entirely.

There are numerous alternatives that offer superior reliability, transparency, and support.

Choose wisely. Your capital deserves better.

Lauren Bontje

you americans are so soft.

you want ‘trust’ and ‘support’ and ‘regulation’?

in my country we just use whatever works.

if you can’t handle 1:150 leverage then don’t trade.

if you can’t wait 2 weeks for your money then go back to your mom’s basement.

bibox is for real traders.

not for people who cry when their crypto dips.

and if you think binance is better?

they’re just a bigger version of the same thing.

they just have better PR.

and you’re too stupid to see it.

Pramod Sharma

that last comment? that’s why bibox still exists.

the people who get burned don’t come back.

the people who win? they don’t talk.

and the ones who still post? they’re either paid or delusional.

the real winners? the ones who never joined.

Andre Suico

Indeed - the psychological trap of ‘I’ll just wait a little longer’ is precisely what allows platforms like Bibox to persist.

It exploits the sunk cost fallacy and the human aversion to admitting loss.

Once capital is entrusted, the mind rationalizes delay as ‘temporary’ rather than ‘permanent’.

This cognitive dissonance is the true engine of the scam.

Not the lack of regulation.

Not the poor UI.

But the unwillingness of users to walk away.

And that is the most dangerous risk of all.

Write a comment

Your email address will not be published. Required fields are marked *