How Ethereum Moved from Mining to Staking - And Why It Matters

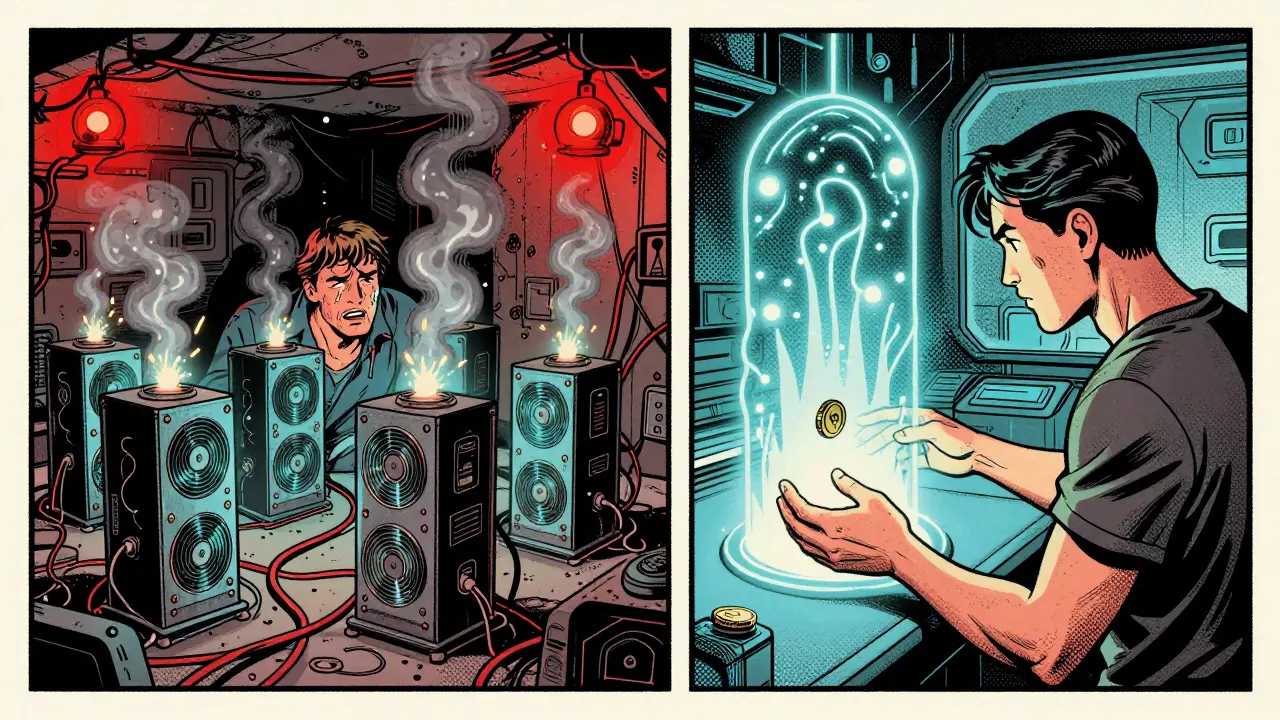

Ethereum switched from energy-heavy mining to eco-friendly staking in 2022. Learn how staking works, how much you need to start, and why it's better than mining for most users.

Read MoreWhen you stake Ethereum, the second-largest cryptocurrency network that switched from mining to energy-efficient validation. Also known as Ethereum 2.0, it now runs on a system called proof-of-stake, a method where users lock up ETH to validate transactions and earn rewards. This change cut Ethereum’s energy use by over 99% and turned holders into active participants, not just buyers.

Staking isn’t just about earning passive income—it’s how the network stays secure. Instead of powerful computers solving math problems (like Bitcoin mining), validators are chosen based on how much ETH they lock up. The more you stake, the higher your chance to propose new blocks and earn rewards. But there’s a catch: if you go offline or act dishonestly, part of your stake can be slashed. That’s why most people use staking pools, groups that combine smaller stakes to meet the 32 ETH requirement and share rewards. These pools handle the technical side, so you don’t need a server or constant uptime.

Validator rewards vary based on total ETH staked across the network. Right now, annual returns range between 3% and 5%, but they can drop if more people join or rise if fewer do. You also get rewards for helping the network stay synchronized and for reporting bad actors. Unlike mining, there’s no hardware cost—just your ETH and a reliable internet connection. And because Ethereum is now fully proof-of-stake, your stake directly supports the entire DeFi ecosystem, NFT marketplaces, and dApps built on it.

Not all staking is the same. You can stake directly through the Ethereum deposit contract, use a centralized exchange like Blockchain.com or Alterdice, or join a decentralized pool. Each has trade-offs: direct staking gives you full control but needs 32 ETH and technical setup; exchanges are easy but you don’t control your keys; pools strike a balance. If you’re new, start small. Even 0.1 ETH in a pool can earn you rewards while you learn.

Staking also ties into bigger trends. With global crypto regulations tightening—like the U.S. GENIUS Act and MiCA in Europe—staking services are being classified as financial activities. That means more oversight, clearer rules, and possibly fewer shady operators. The rise of institutional HSMs and decentralized identity tools shows the ecosystem is maturing. You’re not just earning interest—you’re helping build a more secure, transparent financial layer.

Below, you’ll find real-world breakdowns of validator economics, staking pool fees, and how Ethereum’s shift impacts everything from DeFi to regulatory compliance. Some posts warn about fake staking offers. Others explain why your rewards might dip. A few even show how staking connects to CBDCs and blockchain security. This isn’t theory—it’s what’s happening now, and what you need to know before you lock up your ETH.

Ethereum switched from energy-heavy mining to eco-friendly staking in 2022. Learn how staking works, how much you need to start, and why it's better than mining for most users.

Read More