Mining Difficulty Explained – What It Means for Crypto Miners

When working with mining difficulty, the metric that tells how hard it is to solve a proof‑of‑work puzzle and add a new block to a blockchain. Also known as difficulty target, it adjusts automatically to keep block times steady.

The difficulty is tightly linked to Proof of Work, the consensus algorithm that forces miners to find a hash below a certain threshold. As more computational power joins the network, the hash rate, the total number of hashes generated per second across all miners climbs, and the network responds by raising difficulty. This creates a feedback loop: mining difficulty ↔ hash rate ↔ block time.

Why Mining Difficulty Matters for Everyone

For a miner, difficulty is the bottom line of profitability. Higher difficulty means more hashes are needed to find a valid block, which directly raises electricity costs and wear on equipment. That’s why the type of hardware you run matters. An ASIC miner, a purpose‑built device that computes hashes at billions of attempts per second can stay competitive when difficulty spikes, while a CPU or GPU quickly becomes unprofitable.

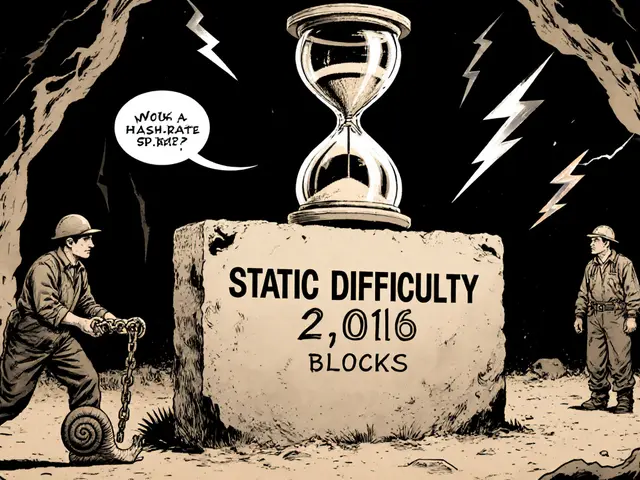

Difficulty also protects the network. By ensuring blocks appear roughly every ten minutes (in Bitcoin’s case), it prevents spam attacks and keeps transaction confirmation times predictable. If difficulty stayed static while hash rate surged, blocks would arrive too fast, leading to chain splits and security risks.

Adjustment algorithms are the unsung heroes here. Bitcoin’s difficulty‑adjustment algorithm (DAA) looks at the timestamps of the past 2016 blocks and rewrites the target so that the next 2016‑block period averages ten minutes per block. Other chains use more frequent adjustments—some every block—to react faster to hash‑rate swings. The choice of algorithm influences how quickly the network can absorb new miners or respond to sudden drops, such as when a large mining farm shuts down.

Market cycles amplify these effects. During bull runs, higher coin prices attract more miners, pushing up hash rate and difficulty. Conversely, a price crash can cause miners to switch off equipment, dropping hash rate and prompting the network to lower difficulty. Understanding this cycle helps traders predict short‑term price pressure caused by miner behavior.

Hardware trends also shape difficulty trends. The shift from GPU mining to ASICs for Bitcoin has driven difficulty upward for years. Emerging ASICs, like the hydro‑cooled models highlighted in our “Top Bitcoin Mining Hardware Picks for 2025” guide, squeeze more performance out of the same power envelope, nudging difficulty higher without a proportional rise in electricity costs.

Beyond Bitcoin, newer PoW chains experiment with alternative difficulty schemes. Some use a “difficulty bomb” that artificially raises difficulty over time to encourage a switch to proof‑of‑stake, as seen in Ethereum’s roadmap. Others tweak the formula to favor decentralization, limiting the advantage of massive ASIC farms.

So what should you watch if you’re a miner, investor, or just curious about the space? Keep an eye on:

- The current difficulty number (often displayed on block explorers).

- Network hash rate trends, which can be charted on analytics sites.

- Upcoming hardware releases—new ASICs typically precede difficulty jumps.

- Consensus‑layer upgrades that may alter adjustment algorithms.

These signals together paint a picture of where the network is heading and how profitable mining might be.

Our collection of articles below dives deeper into each of these angles. You’ll find practical guides on choosing mining hardware, explanations of how difficulty ties into blockchain forks, tips for protecting validators from slashing as network conditions shift, and even a look at how volatility patterns differ in bull versus bear markets. Whether you’re just starting to mine or you’re managing a large operation, the insights here will help you navigate the ever‑changing difficulty landscape.

Ready to explore? Scroll down to discover detailed analyses, step‑by‑step tutorials, and real‑world case studies that show mining difficulty in action across the crypto ecosystem.