Norway Crypto Mining Data Center Restrictions - 2025 Guide

Explore Norway's 2025 crypto mining data center restrictions, registration rules, temporary ban, compliance checklist, and how it stacks up against other Nordic countries.

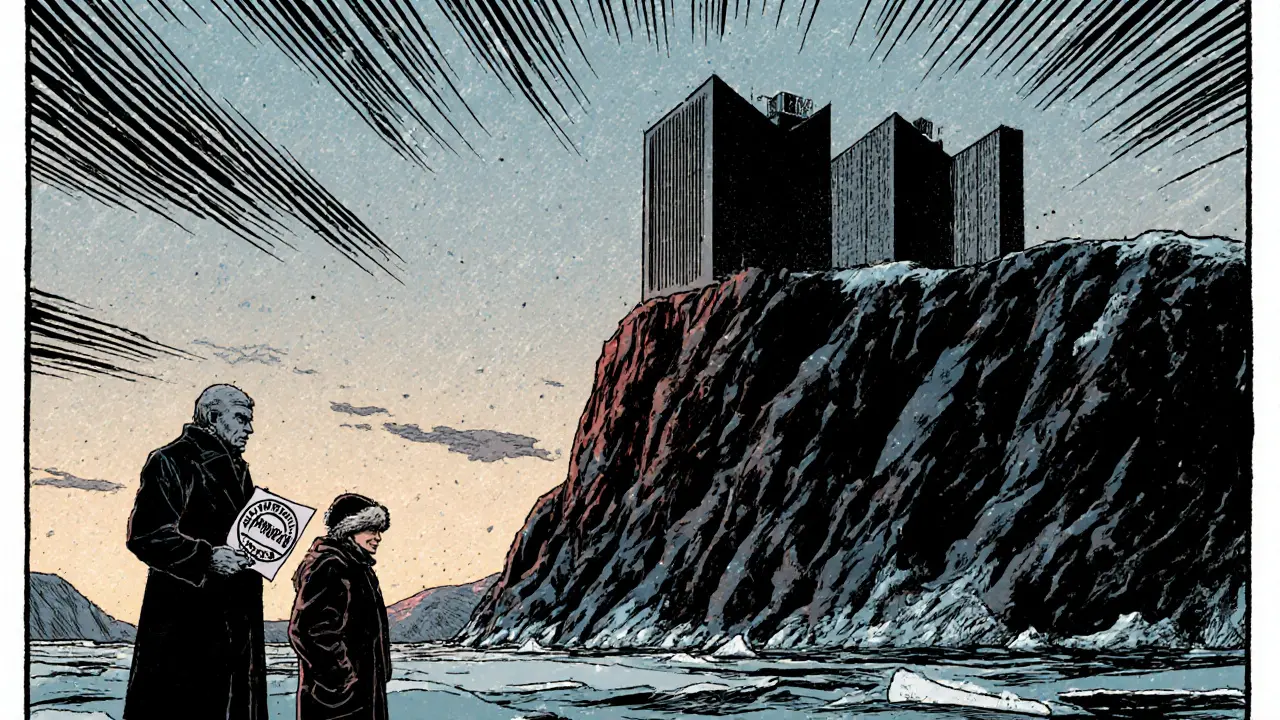

Read MoreWhen talking about Norway crypto mining, the practice of running cryptocurrency mining operations in Norway, leveraging its abundant hydroelectric power and favorable climate. Also known as Norwegian mining, it offers lower electricity costs and a greener footprint compared to many other jurisdictions. Bitcoin mining, the process of validating Bitcoin transactions and securing the network by solving cryptographic puzzles is the most common activity, and the local hash rate, the total computational power contributed by miners in the region directly shapes how competitive a Norwegian operation can be. The country’s energy policy requires renewable sources for large‑scale consumption, which means miners must align with strict sustainability rules. This creates a clear semantic link: Norway crypto mining encompasses high‑efficiency hardware, requires low‑cost power, and is influenced by regulatory frameworks.

The cold climate isn’t just a scenic backdrop—it’s a natural cooling system. When hydro‑cooled miners, mining rigs that use water to dissipate heat efficiently are paired with Norway’s near‑free water flow, operating costs drop dramatically. This equipment choice feeds back into the hash rate, because more efficient rigs can run longer at higher speeds without overheating. At the same time, the national energy regulator caps electricity prices for industrial users, so miners can predict expenses more accurately. The result is a virtuous cycle: lower energy costs enable larger deployments, which boost the regional hash rate, which in turn attracts more hardware investments. However, the same regulator also monitors carbon footprints, meaning operators must report emissions even if they rely on renewable sources. This regulatory feedback loop forces miners to balance profitability with compliance, shaping the overall market dynamics in Norway.

Beyond equipment and power, financing and risk management play a big role. Many Norwegian miners tap into local venture funds that specialize in green tech, leveraging the country’s reputation for sustainability. These investors often demand transparent reporting on energy usage, so miners adopt real‑time monitoring dashboards that track wattage per terahash. Such data feeds back into strategic decisions, like whether to expand a farm or upgrade to newer ASIC models. The interaction between Bitcoin mining profitability and the energy regulation, laws governing electricity pricing and renewable quotas creates a dynamic environment where miners must stay agile. When Bitcoin’s price spikes, hash rate increases quickly, pushing up competition; when prices dip, efficient energy use becomes the sole survival factor.

Below you’ll find a curated set of articles that break down each of these pieces in detail. From deep dives into the latest hydro‑cooled ASICs to step‑by‑step guides on navigating Norway’s licensing process, the collection covers everything a miner needs to know. Expect practical tips, real‑world case studies, and up‑to‑date analysis that will help you decide if Norway’s unique mix of cheap renewable power and strong regulatory oversight fits your crypto mining strategy.

Explore Norway's 2025 crypto mining data center restrictions, registration rules, temporary ban, compliance checklist, and how it stacks up against other Nordic countries.

Read More