South Korea Crypto Regulation: What It Means for Traders and Investors

When it comes to South Korea crypto regulation, a strict but evolving framework that controls how cryptocurrencies are traded, taxed, and used by individuals and institutions. Also known as Korean crypto laws, it’s one of the most detailed and enforced digital asset regimes in Asia. Unlike countries that take a hands-off approach, South Korea treats crypto like a financial instrument—subject to banking rules, tax audits, and exchange licensing. This isn’t just about blocking scams; it’s about controlling capital flow in a nation where over 10 million people own crypto.

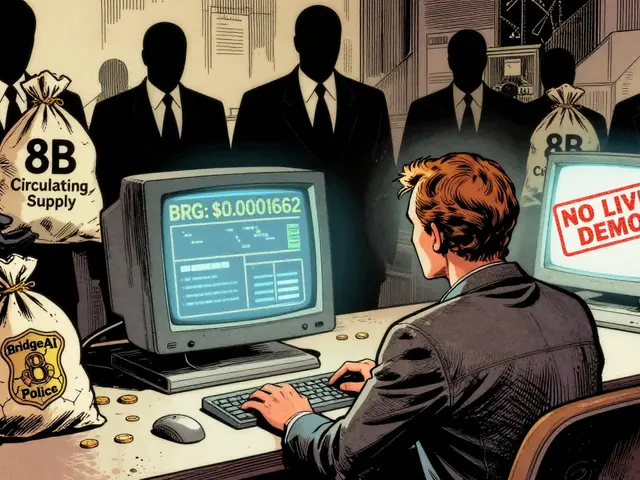

One of the biggest pieces of this puzzle is crypto exchange rules Korea, a system requiring all local exchanges to register with the Financial Services Commission and follow strict KYC and AML protocols. Also known as Korean exchange compliance, it means platforms like Binance and Upbit must verify every user’s identity, report large transactions, and keep funds in segregated accounts. If an exchange fails, it gets shut down—no warnings. This is why you won’t find shady tokens or unlicensed platforms operating openly in Seoul. At the same time, CBDC Korea, the central bank’s digital won project, is being tested as a potential replacement for physical cash and a tool to monitor crypto flows. Also known as Korea’s digital currency initiative, it’s not just about innovation—it’s about control. The Bank of Korea wants to know where money goes, and crypto transactions are a blind spot they’re determined to close. Then there’s crypto taxation Korea, a system where profits from crypto trades are taxed at up to 42% if you make over 2.5 million KRW in a year. Also known as Korean crypto capital gains tax, it applies to everyone—retail traders, day traders, even people who swap one token for another. There’s no exemption for hobbyists. The government tracks this through exchange data sharing and bank transaction monitoring.

What does this mean for you? If you’re trading from South Korea, you’re not just buying Bitcoin—you’re navigating a legal minefield. You need to keep records, report income, and avoid unlicensed platforms. Even if you’re outside Korea but trading with Korean exchanges, you’re still under their rules. The country doesn’t care where you live—if your money touches a Korean exchange, they want to know. This is why institutions hesitate to enter the market: the rules change fast, penalties are harsh, and transparency is limited. But for those who play by the rules, South Korea offers one of the most secure crypto environments in the world—with deep liquidity, strong infrastructure, and clear consequences for breaking them.

Below, you’ll find real-world examples of how these regulations affect trading, what exchanges comply, and which tokens are still allowed to trade under the radar. Whether you’re a Korean resident or just trading with Korean platforms, this collection gives you the facts—not the hype.