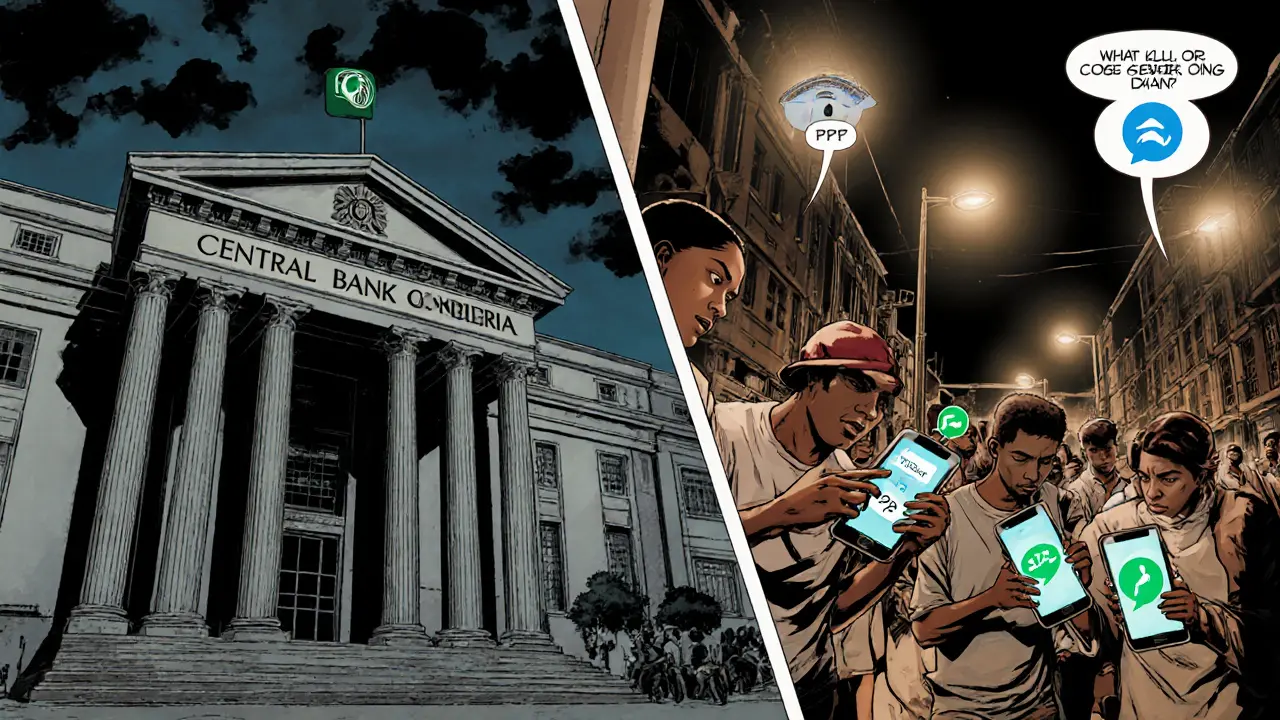

How Nigeria’s Underground Crypto Economy Thrived During the 2021‑2023 Ban

Explore how Nigeria's crypto ban sparked a billion‑dollar underground market, the P2P platforms that powered it, fraud risks, and its lasting impact on regulation.

Read MoreWhen exploring Underground Crypto Economy, the hidden side of digital assets where illicit activity, unconventional incentives, and niche tech intersect, also known as dark crypto market, you quickly see three forces shaping it. First, crypto airdrops, free token giveaways that can be legitimate bootstraps or bait for phishing attacks flood wallets daily, creating sudden spikes in on‑chain traffic. Second, modular blockchains, architectures that split consensus from data availability, enabling rollups to scale while keeping security layers distinct give developers tools to build faster apps, but also open new attack surfaces for smart‑contract exploits. Third, funding rates, periodic payments that keep perpetual futures in line with spot prices, often manipulated by large traders to squeeze smaller participants. These elements intersect with crypto hacking, state‑backed or criminal groups that steal billions through exchange breaches, ransomware, and DeFi exploits, forming a feedback loop where higher yields attract more attackers, and more attacks create volatile markets that fuel airdrop hype. In short, the underground crypto economy encompasses airdrops, modular blockchains, funding rates and hacking, each influencing the other and reshaping risk profiles for everyday users.

Understanding the Underground Crypto Economy helps you spot risk and opportunity before they hit your wallet. Airdrop hunters need to verify token legitimacy, check contract audit reports, and watch for sudden token dumps that can crash prices. Developers building on modular blockchains should monitor data‑availability proofs and layer‑2 security updates, because a compromised rollup can expose millions of dollars in assets. Traders dealing with funding rates must track open‑interest charts and parity indexes to avoid being caught in negative‑rate spirals that erode capital fast. Meanwhile, staying aware of hacking trends—like the North Korean groups that siphoned $3 billion via exchange exploits—means you’ll double‑check exchange security, enable hardware wallets, and diversify holdings across custodial and non‑custodial solutions. By linking these themes, you get a practical roadmap: audit airdrop contracts, test modular‑chain integrations, manage funding‑rate exposure, and reinforce security against hacking. The articles below dive deeper into each of these topics, offering step‑by‑step guides, real‑world case studies, and actionable strategies to navigate the shadowy side of crypto with confidence.

Explore how Nigeria's crypto ban sparked a billion‑dollar underground market, the P2P platforms that powered it, fraud risks, and its lasting impact on regulation.

Read More