Untracked Crypto Exchange: What It Is and Why It’s Risky

When you hear untracked crypto exchange, a cryptocurrency trading platform that operates without regulatory oversight, public audits, or transparent ownership. Also known as unregulated crypto platform, it often hides behind vague jurisdictions, anonymous teams, and no customer support. These platforms don’t answer to any government or financial authority. They don’t publish license numbers. They don’t share where their money is held. And if you lose your funds, there’s no one to call.

Most untracked crypto exchanges, like FREE2EX and MaskEX, operate out of countries with weak or nonexistent crypto laws. Also known as offshore crypto platforms, they target users who want to avoid KYC—but that convenience comes at a steep cost. These sites often promise low fees and fast trades, but real users report frozen withdrawals, fake trading volumes, and disappearing websites. The crypto exchange risk, the chance of losing all your funds due to fraud, hacking, or operator abandonment isn’t just possible—it’s likely.

Some of these platforms pretend to be legitimate by copying the design of big names like Binance or Coinbase. They use fake testimonials, cloned logos, and misleading blog posts. But if you check their domain registration, you’ll often find it was created last month. If you search for reviews, you’ll find silence—or worse, hundreds of complaints on Reddit and Telegram groups. The unverified exchange, a platform with no third-party security audit, no insurance, and no public team doesn’t care if you win or lose. It only cares if you deposit.

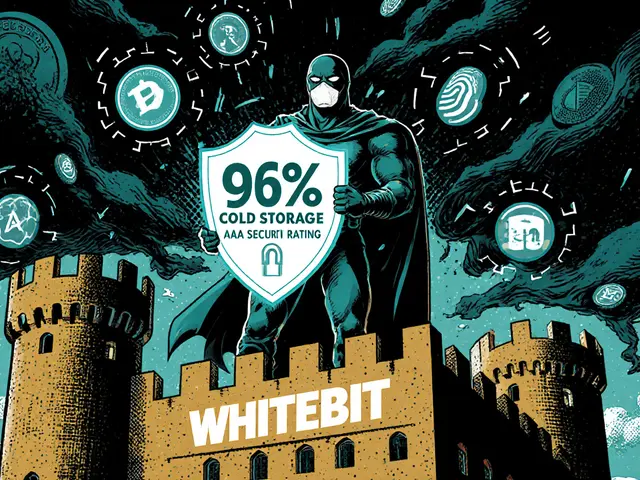

And it’s not just about scams. Even if a platform isn’t outright fraudulent, being untracked means zero protection. No chargebacks. No legal recourse. No FDIC-style insurance. If the operator runs off with your ETH, you’re out of luck. Compare that to regulated exchanges like WhiteBIT, which publish audit reports, have clear compliance teams, and operate under European law. The difference isn’t subtle—it’s life or death for your crypto.

There’s no magic trick to spotting an untracked crypto exchange. You don’t need a degree in blockchain. You just need to ask: Who runs this? Where are they based? Can I verify their license? Is there a real support team? If the answers are ‘I don’t know,’ ‘somewhere overseas,’ ‘no,’ or ‘we don’t talk about that,’ walk away. The posts below expose real cases—FREE2EX, MaskEX, and others—that fit this pattern. You’ll see exactly how they lure users in, what red flags to watch for, and why even the most tempting offers can end in total loss.