UTXO EVM Bridge: How Bitcoin and Ethereum Connect

When you send Bitcoin, it doesn’t just move—it gets broken into pieces called UTXOs, Unspent Transaction Outputs, the basic building blocks of Bitcoin’s ledger that track who owns what. This is different from how Ethereum works, where accounts hold balances in a single state. A UTXO EVM bridge, a technical system that lets assets move between Bitcoin’s UTXO model and Ethereum’s account-based EVM environment solves a huge problem: how do you bring Bitcoin’s security and liquidity into DeFi without trusting third parties? It’s not magic—it’s code, cryptography, and careful design.

These bridges matter because Bitcoin has $1 trillion in value locked in wallets, but almost none of it works in Ethereum-based apps like Uniswap or Aave. A UTXO EVM bridge changes that. It lets you lock Bitcoin on its chain and get a wrapped version—like wBTC or HBTC—on Ethereum, all while keeping the original Bitcoin safe. But it’s not just about wrapping. Some bridges now let you use Bitcoin as collateral in lending protocols, trade it directly on DEXs, or even earn yield without selling. Projects like Celestia, a modular blockchain focused on data availability that helps secure cross-chain communication and rollup infrastructure, layer-2 systems that bundle transactions to reduce costs and increase speed are making these bridges faster, cheaper, and more secure. That’s why you’re seeing more DeFi protocols build directly into UTXO-EVM pathways instead of relying on centralized custodians.

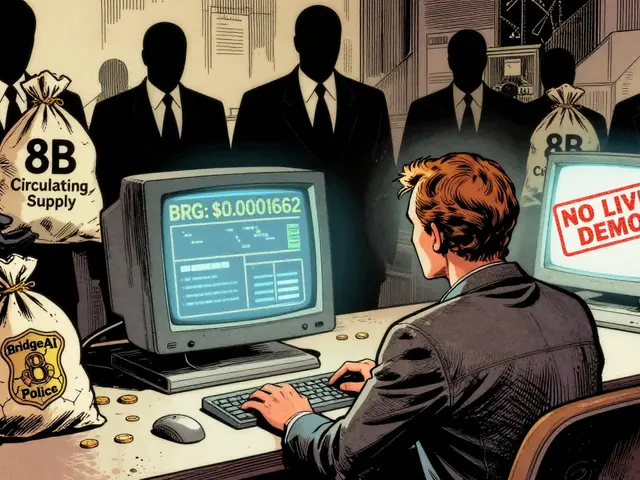

But it’s not all smooth sailing. These bridges face real risks: smart contract bugs, validator collusion, and delays when Bitcoin’s slow block times bottleneck Ethereum’s speed. That’s why the best ones use multi-sig or threshold signatures—no single party controls the keys. And if you’re thinking about using one, check who’s auditing it, how long it’s been live, and whether it’s been attacked before. The posts below cover real examples of these bridges in action, how they’re built, what went wrong in past failures, and which ones are actually safe to use today. You’ll find deep dives on wrapped assets, cross-chain liquidity, and how new tech like data availability sampling is fixing old problems. No fluff. Just what you need to know before you move your Bitcoin into DeFi.