When you look at the cryptocurrency market today, it’s not a wild gamble anymore-it’s a real financial system. As of early 2026, the total market value of all cryptocurrencies sits at just over $4.3 trillion. That’s more than the GDP of Germany. And yet, almost 80% of that value comes from just five coins. If you’re trying to understand where the real money is flowing in crypto, you don’t need to chase every new memecoin. You need to know who’s leading the pack.

Bitcoin Still Rules the Roost

Bitcoin (BTC) isn’t just the first cryptocurrency-it’s still the biggest by a huge margin. With a market cap of $2.48 trillion and a price around $124,000, it controls nearly 58% of the entire crypto market. That’s more than the next four coins combined.

What’s driving this? Not speculation anymore. It’s institutions. Spot Bitcoin ETFs have poured over $60 billion into the market since their launch, and that flow hasn’t stopped. Major banks, pension funds, and even sovereign wealth managers are now holding Bitcoin as part of their long-term reserves. The U.S. government’s move to establish a strategic Bitcoin reserve in late 2025 only added legitimacy. Bitcoin isn’t a fad. It’s digital gold, and the world is starting to treat it that way.

Its price has climbed steadily through 2025 and into 2026, up 18% year-to-date. That’s not explosive-but it’s steady. And in a market full of volatility, that’s the kind of performance that builds trust.

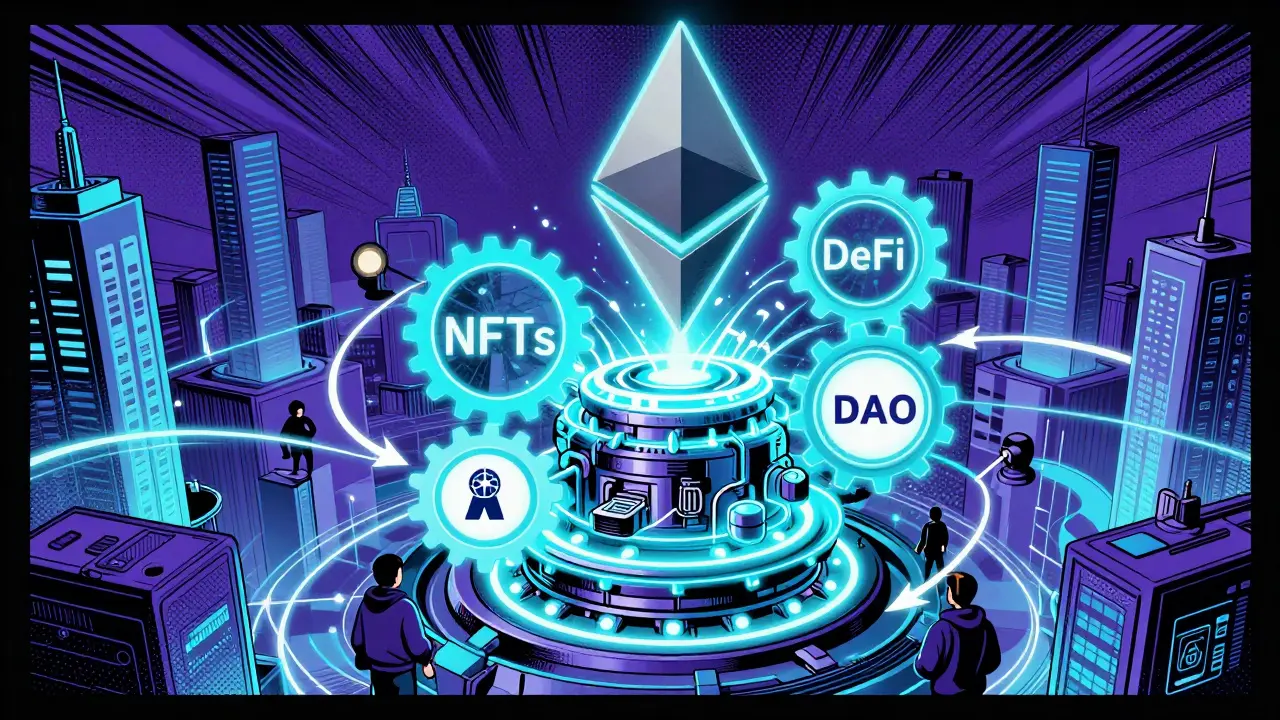

Ethereum: The Engine of Decentralized Finance

While Bitcoin stores value, Ethereum (ETH) builds things. It’s the backbone of DeFi, NFTs, DAOs, and thousands of dApps. Its market cap sits at $550 billion, making it the second-largest cryptocurrency by far.

Ethereum’s price is around $4,500, and it’s up over 31% in 2026. Why? Because it keeps getting better. The Merge in 2022 killed energy-hungry mining. Since then, upgrades like Dencun and Proto-Danksharding have slashed transaction fees and increased scalability. Developers are building faster. Users are transacting more. And institutions are starting to use Ethereum-based tokens for real-world settlements.

Over 70% of all DeFi activity runs on Ethereum. That’s not just a number-it’s a network effect. The more people use it, the more valuable it becomes. And with new layer-2 solutions like Arbitrum and Optimism handling millions of daily transactions, Ethereum isn’t slowing down. It’s accelerating.

XRP: The Payment Protocol That Won’t Go Away

XRP is the third-largest cryptocurrency with a market cap of $185 billion and a price near $3.05. It’s up 38% this year, making it one of the top performers in the top five.

Unlike Bitcoin or Ethereum, XRP doesn’t aim to be a store of value or a smart contract platform. It’s built for one thing: fast, cheap cross-border payments. RippleNet, the network powered by XRP, settles transactions in 3-5 seconds. Compare that to SWIFT, which takes days and costs hundreds of dollars per transfer.

Banks in Latin America, Southeast Asia, and Africa are testing it. Central banks are watching. The U.S. SEC’s long legal battle over whether XRP is a security ended in 2024 with a ruling that cleared the path for its use as a payment tool-not a security. That decision was a turning point. Now, financial institutions are integrating XRP into their liquidity solutions.

It’s not perfect. The XRP Ledger is centralized in some ways. But its speed and cost efficiency are hard to ignore.

Tether: The Invisible Backbone

You won’t hear much about Tether (USDT) in headlines, but you’ll see it everywhere. With a market cap of $122 billion, it’s the most traded asset in crypto. Every time someone buys Bitcoin on Binance or sells Ethereum on Coinbase, chances are they used USDT.

It trades at $1.0005, pegged to the U.S. dollar. That’s not an accident. It’s by design. Tether acts as the bridge between fiat money and crypto. When markets crash, traders flee into USDT to preserve value. When markets surge, they use USDT to quickly buy other coins.

It’s controversial. Critics say Tether isn’t fully backed by reserves. But the truth is, even with those concerns, no other stablecoin comes close in volume. USD Coin (USDC) is the only real competitor, but it’s still only half the size of Tether. Until something better comes along, Tether will remain the oil that keeps the crypto engine running.

The Rise of the New Players

Beyond the top four, a few other coins are carving out serious space.

- Hyperliquid (HYPE) has surged to a $15 billion market cap, up 86% in 2026. It’s a layer-1 blockchain built for high-frequency trading. Hedge funds are using it to execute complex strategies with sub-millisecond latency. HYPE’s capped supply of 1 billion coins and its low-fee structure make it attractive for professional traders.

- BNB is still going strong. With a $105 billion market cap and a 23% gain this year, it remains the go-to token for users of Binance, the world’s largest exchange. BNB isn’t just a coin-it’s a utility token that cuts trading fees, pays for cloud services, and powers Binance’s ecosystem.

- TRON (TRX) has hit $12 billion in market cap, up 33% in 2026. It’s focused on content and entertainment. From streaming platforms to gaming, TRON is becoming the blockchain of choice for creators who want to monetize directly.

These aren’t flash-in-the-pan projects. They have real users, real partnerships, and real revenue streams. Their growth isn’t based on hype-it’s based on adoption.

What’s Driving the Market in 2026?

The crypto market in 2026 is shaped by three big forces:

- Institutional adoption-ETFs, corporate treasuries, and even central bank experiments are bringing real capital into crypto.

- Regulatory clarity-Countries like the U.S., Japan, and Singapore have passed clear rules. That’s reducing uncertainty and encouraging investment.

- Real-world utility-Crypto is no longer just about trading. It’s about payments, identity, asset tokenization, and DeFi lending. Projects that solve actual problems are winning.

That’s why the top coins are holding their ground. They’ve moved beyond speculation. They’re becoming infrastructure.

Why Market Cap Matters More Than Price

Many beginners look at price and think, "Why is Bitcoin worth more than Dogecoin? It’s only $124,000 vs. $0.00008." That’s the wrong way to look at it.

Market cap = price × circulating supply. Bitcoin has a supply cap of 21 million coins. Dogecoin has over 145 billion. Even if Dogecoin hit $1, its market cap would still be less than 1% of Bitcoin’s.

Market cap tells you how much value the world has assigned to a project. It’s not about how expensive one coin is-it’s about how much trust and demand exist overall.

That’s why the top five coins-Bitcoin, Ethereum, XRP, Tether, and BNB-dominate. They’ve earned their market cap through years of use, adoption, and reliability.

What Comes Next?

The next big shift won’t come from a new coin. It’ll come from integration. We’re seeing banks start to offer crypto custody. Insurance companies are covering DeFi protocols. Governments are testing CBDCs that use blockchain tech.

The top cryptocurrencies aren’t going anywhere. They’re becoming part of the financial fabric. Whether you’re investing, trading, or just trying to understand the space, focus on the leaders. They’re not just the biggest-they’re the most trusted.

Which cryptocurrency has the highest market cap in 2026?

Bitcoin (BTC) has the highest market cap in 2026, at approximately $2.48 trillion. It accounts for nearly 58% of the total cryptocurrency market, making it by far the largest digital asset by value.

Why is Ethereum second in market cap?

Ethereum is second because it’s the most widely used blockchain for decentralized applications. Over 70% of DeFi, NFTs, and smart contracts run on Ethereum. Its network effects, ongoing upgrades, and institutional adoption have kept its market cap stable at around $550 billion despite competition from newer blockchains.

Is XRP really a cryptocurrency?

Yes, XRP is a cryptocurrency, though it operates differently than Bitcoin or Ethereum. The XRP Ledger is open-source and decentralized in its consensus mechanism. While Ripple Labs created the network, it doesn’t control the ledger. XRP is used by financial institutions for cross-border payments, and courts have ruled it is not a security under U.S. law, confirming its legitimacy as a digital asset.

Why does Tether have such a large market cap?

Tether (USDT) has a large market cap because it’s the most used stablecoin in crypto trading. Traders use it to move in and out of other cryptocurrencies quickly without converting to fiat. Its stability, liquidity, and widespread acceptance on exchanges make it essential for daily trading volume, even if its price stays near $1.

Can a new cryptocurrency overtake Bitcoin in market cap?

It’s extremely unlikely in the near term. Bitcoin has over a decade of network security, institutional trust, and regulatory recognition. No new cryptocurrency has come close to matching its adoption, liquidity, or user base. Even Ethereum, with its strong utility, only holds about 23% of Bitcoin’s market cap. For a new coin to overtake Bitcoin, it would need to solve a problem far more critical than Bitcoin does-and no project has shown that yet.