Wrapped Token Verification Tool

Verify Your Wrapped Token

Verification Results

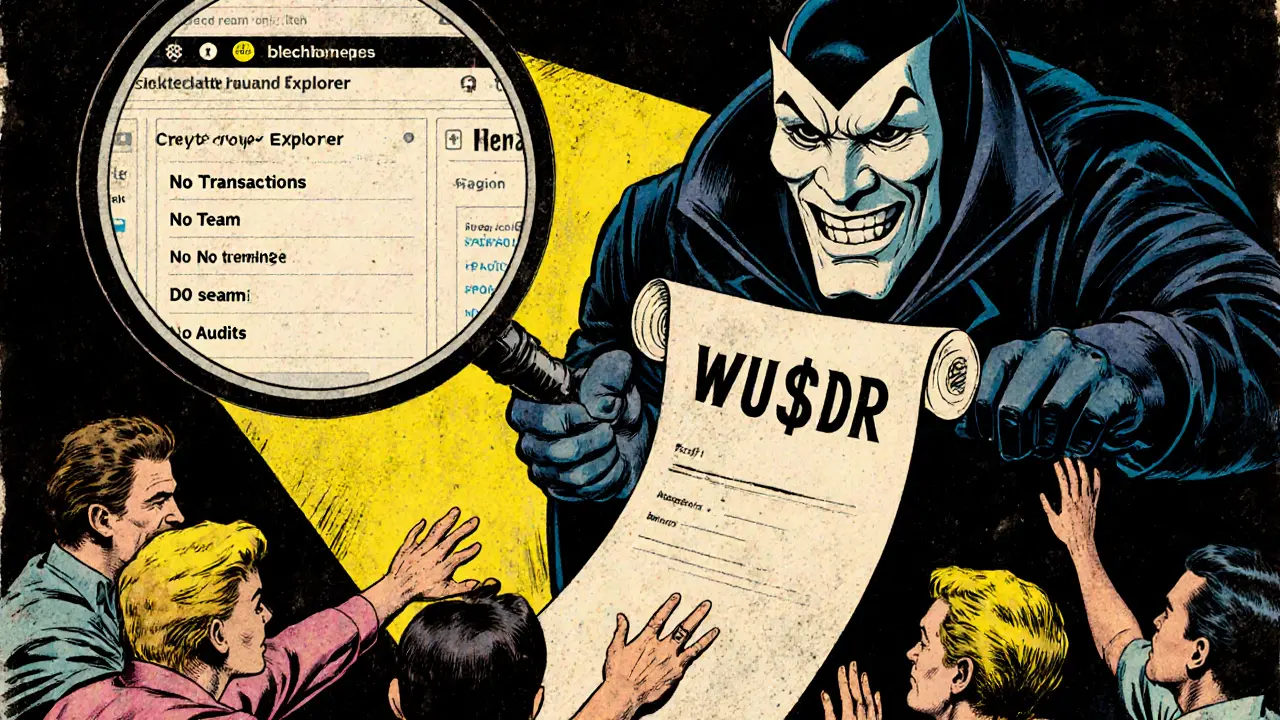

There is no such thing as Wrapped USDR (WUSDR) as a real cryptocurrency. If you’ve come across this name online, you’re likely seeing a scam, a mistake, or a fictional token being pushed by someone trying to cash in on confusion. No major exchange, wallet, or blockchain explorer lists WUSDR. Not CoinMarketCap. Not CoinGecko. Not Ethereum, Binance Smart Chain, or Solana. Not even a single verified smart contract address exists for it.

Let’s be clear: USDR itself isn’t a real stablecoin. The big, trusted stablecoins you can actually use are USDT, USDC, DAI, and BUSD. They’re backed by real assets, audited, and traded on every major platform. USDR? It doesn’t show up in any official documentation, whitepaper, or regulatory filing. So if WUSDR is supposed to be a wrapped version of USDR, you’re wrapping nothing.

What Are Wrapped Tokens, Really?

Wrapped tokens aren’t magic. They’re practical tools. Think of them like IOUs for crypto. If you want to use Bitcoin on the Ethereum network, you can’t just send BTC directly-Ethereum doesn’t understand it. So you lock your Bitcoin with a trusted custodian, and in return, you get Wrapped Bitcoin (WBTC). WBTC is an ERC-20 token that’s always worth exactly 1 BTC, backed by real Bitcoin sitting in cold storage.

This works for other coins too. Wrapped Ether (wETH) lets you use Ether in DeFi apps that only accept ERC-20 tokens. Wrapped Bitcoin (WBTC) has over $10 billion locked in DeFi protocols. Wrapped USDT (WUSDT) exists too, but only as a niche bridge between Ethereum and Tezos, created by a small team called Bender Labs. It’s not widely used. But at least it’s real.

Wrapped tokens solve a real problem: interoperability. They let assets move across blockchains. But they come with a catch. You’re trusting someone else to hold your original asset. If the custodian disappears, or the smart contract gets hacked, your wrapped token becomes worthless. That’s why WBTC is managed by a DAO with multiple trusted parties. That’s why you never see WBTC on shady websites.

Why WUSDR Doesn’t Exist (And Why It’s Dangerous)

There’s no team behind WUSDR. No GitHub repo. No Twitter account with updates. No audit reports. No liquidity pools on Uniswap or PancakeSwap. If you search for WUSDR on Etherscan or BscScan, you’ll find nothing. That’s not an oversight-it’s a red flag.

Scammers love to invent fake tokens with names that sound official. Wrapped USDR? It’s designed to look like WBTC or WUSDT. They’ll create a fake website with a sleek design, a fake whitepaper, and a “buy now” button. They might even list it on a tiny, unregulated exchange you’ve never heard of. Once you send them crypto, they vanish.

Real wrapped tokens are built on transparency. WBTC’s reserves are publicly verifiable. wETH’s contract is open-source. WUSDR has none of that. If you can’t find who’s behind it, you can’t trust it. And in crypto, if you can’t trust it, you shouldn’t touch it.

How to Spot a Fake Wrapped Token

Here’s how to check if a wrapped token is real or fake:

- Check CoinMarketCap or CoinGecko - If it’s not listed, it’s not real. Period.

- Search the token contract address - Paste it into Etherscan or Solana Explorer. If it’s empty or has zero transactions, it’s a ghost.

- Look for audits - Real projects get audited by firms like CertiK or SlowMist. If there’s no audit, walk away.

- Check the team - Who built this? Do they have LinkedIn profiles? Have they worked on other projects? Anonymous teams = high risk.

- Ask yourself: Why does this exist? - What’s the use case? If the answer is “to make money fast,” it’s a scam.

WUSDR fails every single one of these checks. That’s not a coincidence. It’s by design.

What You Should Use Instead

If you want to use a USD-pegged stablecoin across blockchains, stick with the real ones:

- USDC - Backed by Circle and Coinbase. Audited monthly. Available on Ethereum, Solana, Tron, and more.

- USDT - The oldest and most liquid. Wrapped versions (WUSDT) exist on Tezos, but USDT itself works on dozens of chains.

- DAI - Decentralized and overcollateralized. No single company controls it.

Need to move them between chains? Use trusted bridges like LayerZero, Across, or the official bridging tools from Circle (for USDC) or Tether (for USDT). Don’t use random “wrapped” tokens with no track record.

The Bigger Picture: Why Fake Tokens Like WUSDR Keep Showing Up

Crypto is still wild west territory. New people are joining every day. Scammers know that. They don’t need to fool everyone-just a few hundred people who don’t know how to check. A fake token like WUSDR doesn’t need to be profitable for the creator. It just needs to trick enough people to make a quick profit.

And the market rewards this behavior. Fake tokens get listed on low-quality exchanges. Influencers get paid to promote them. Reddit threads pop up with people asking, “Is WUSDR legit?”-and someone always says, “I bought it and made 5x!” (They’re lying, or they’re the scammer themselves.)

Real crypto grows slowly. It’s built on code, audits, and trust. Fake crypto grows fast. It’s built on hype, FOMO, and lies.

Final Advice: Don’t Guess. Verify.

Never invest in a crypto project you can’t verify. If you see a token like WUSDR, don’t ask Reddit. Don’t ask Telegram groups. Go straight to the source: blockchain explorers, official websites, and trusted marketplaces. If the information isn’t there, the token isn’t real.

There’s no hidden secret. No underground project. No future airdrop. WUSDR is a ghost. And ghosts don’t pay back.

If you’re new to crypto, stick to the basics: Bitcoin, Ethereum, USDC, and DAI. Learn how wallets, exchanges, and bridges work. Build your knowledge before chasing shiny new tokens. The best way to avoid losing money is to not buy what doesn’t exist.

Is Wrapped USDR (WUSDR) a real cryptocurrency?

No, Wrapped USDR (WUSDR) is not a real cryptocurrency. There is no verified token, smart contract, exchange listing, or development team behind it. Major platforms like CoinMarketCap and CoinGecko do not list WUSDR, and no blockchain explorer shows any activity for it. It is either a scam, a mistake, or a fictional concept.

What is USDR, and is it a stablecoin?

USDR is not a recognized stablecoin. The major, trusted USD-pegged stablecoins are USDT, USDC, DAI, and BUSD. USDR does not appear in any official documentation, audit reports, or regulatory filings. It has no backing, no issuer, and no market presence.

Can I buy WUSDR on Binance or Coinbase?

No, you cannot buy WUSDR on Binance, Coinbase, Kraken, or any other reputable exchange. These platforms only list verified, audited assets. If a site claims to sell WUSDR, it is not legitimate. Do not send funds to it.

Are wrapped tokens safe to use?

Wrapped tokens like WBTC and wETH are generally safe when they’re backed by trusted custodians and have public audits. But they introduce counterparty risk-you’re trusting someone else to hold your original asset. Always verify the issuer, check for audits, and avoid obscure wrapped tokens with no track record.

What should I use instead of WUSDR?

Use established stablecoins like USDC or USDT, which are available across multiple blockchains. For cross-chain transfers, use trusted bridges like LayerZero, Across, or the official bridges from Circle (USDC) and Tether (USDT). Avoid unverified wrapped tokens with no transparency or community support.

There are 21 Comments

Becca Robins

Pranjali Dattatraya Upadhye

andrew seeby

Kyung-Ran Koh

Leo Lanham

Whitney Fleras

Liam Workman

Louise Watson

Finn McGinty

Eric von Stackelberg

Michelle Sedita

Robin Hilton

Grace Huegel

Nitesh Bandgar

Jessica Arnold

Chloe Walsh

Stephanie Tolson

Anthony Allen

Megan Peeples

Sarah Scheerlinck

Hope Aubrey

Write a comment

Your email address will not be published. Required fields are marked *