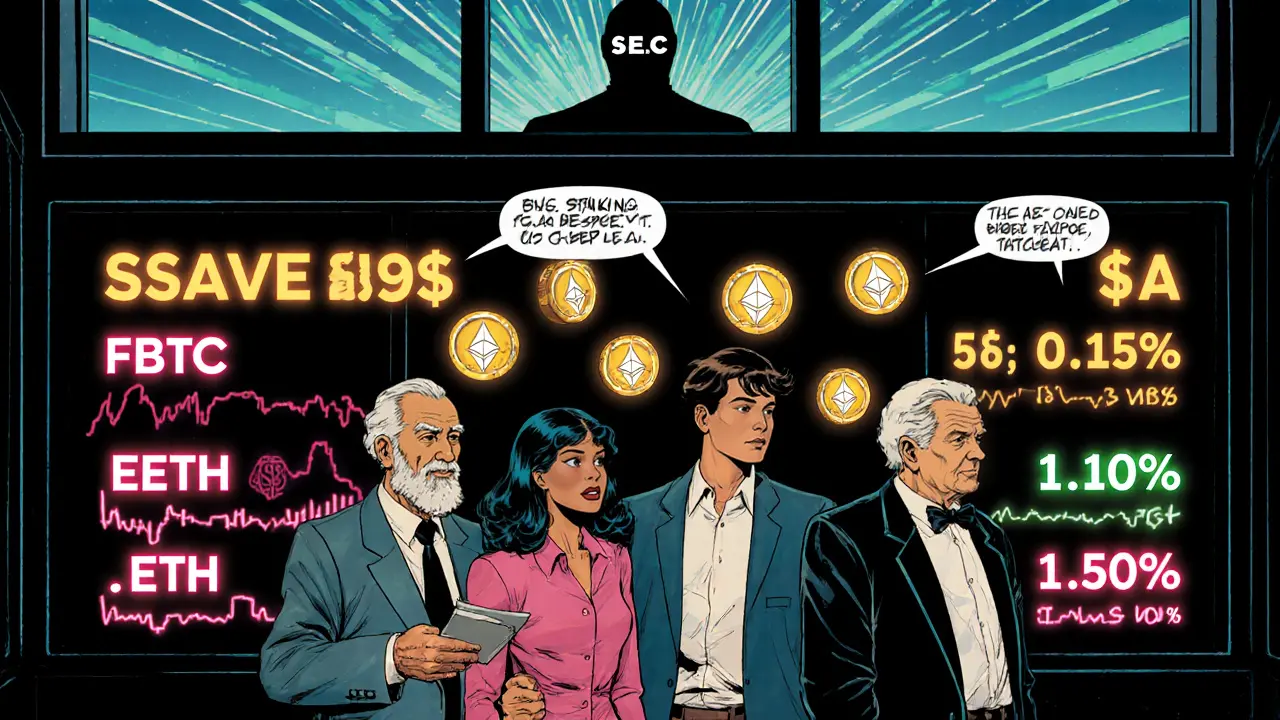

ETF Fee Impact Calculator

Calculate how ETF fees impact your long-term investment returns. The calculator shows the difference between your investment with a high-fee ETF versus a low-fee ETF.

Input Investment Parameters

Recommended ETFs

Low-Fee Option: Fidelity FBTC (0.00%) or VanEck EETH (0.15%)

High-Fee Option: Grayscale GBTC (0.90%) or ETHE (1.50%)

Ethereum-specific: 45.5% of Ethereum ETFs offer staking rewards

Note: Fees shown are typical examples. Actual fees vary by ETF provider and structure.

Results

After calculating, results will appear here...

For over a decade, investors waited for a simple way to buy Bitcoin and Ethereum through a traditional brokerage account. The SEC kept saying no-rejecting 13 Bitcoin ETF applications since 2013. Then, in January 2024, everything flipped. The first spot Bitcoin ETFs launched, and six months later, Ethereum ETFs followed. By October 2025, these aren’t just new products-they’ve reshaped how money moves between Wall Street and crypto markets.

Why the SEC Changed Its Mind

The turning point wasn’t a vote. It was a court ruling. In August 2023, the D.C. Circuit Court told the SEC it had been inconsistent. It approved ETFs for gold, oil, and even solar energy, but kept rejecting Bitcoin ETFs without clear reasoning. The court said: if you treat Bitcoin as a commodity for other purposes, you can’t call it a security just to block an ETF. That forced the SEC’s hand. By January 2024, six Bitcoin ETFs were approved, led by BlackRock’s IBIT, which hit $4.6 billion in assets within its first week. Then came Ethereum. On July 23, 2024, the SEC gave the green light to 11 Ethereum ETFs. This was bigger than Bitcoin. Ethereum isn’t just digital gold-it’s the backbone of smart contracts, DeFi, and NFTs. The SEC’s approval signaled they now see Ethereum as a legitimate asset class, not just a risky speculation.How These ETFs Work (And Why It Matters)

At first, these ETFs used a cash-only model. If you wanted to buy shares, you paid cash. If you wanted to sell, you got cash back. That meant ETF providers had to constantly buy and sell Bitcoin or Ethereum on the open market to match demand. It was messy. It created tax headaches. And it made it hard for big holders to move crypto into ETFs without selling their coins. That changed on July 29, 2025. The SEC approved in-kind creation and redemption. Now, authorized participants can swap actual Bitcoin or Ethereum for ETF shares-no cash needed. Think of it like trading gold bars for shares in GLD, the gold ETF. This is huge. It means:- Big holders can move their crypto into ETFs without triggering taxable events

- ETFs become more efficient, with lower tracking errors

- Operational costs drop by 0.15%-0.25% annually-saving the market up to $250 million a year

Bitcoin vs. Ethereum ETFs: Key Differences

They’re both ETFs. But they’re not the same. Bitcoin ETFs are simple. They hold Bitcoin. No staking. No rewards. Just buy, hold, and track the price. All 11 Bitcoin ETFs use the same structure. Fees range from 0.00% (Fidelity’s FBTC) to 0.90% (Grayscale’s GBTC). The average? 0.25%. Ethereum ETFs are more complex. Ethereum runs on proof-of-stake. That means the network pays rewards to validators who lock up ETH. Grayscale, Fidelity, and a few others decided to pass those rewards to ETF shareholders. As of September 2025, only 5 of the 11 Ethereum ETFs (45.5%) offer staking. Grayscale’s ETHE holds 3.1 million ETH and stakes 4.2% of it-generating $127 million in quarterly rewards. But here’s the catch: Ethereum ETFs cost more. Average fees? 0.35%. Grayscale’s ETHE charges 1.50%-nearly six times more than VanEck’s EETH at 0.15%. That premium comes from Grayscale’s history as a trust. Investors are paying for brand recognition, not just exposure.

Market Performance: Who’s Winning?

By September 2025, Bitcoin ETFs had $54.3 billion in assets under management. BlackRock’s IBIT alone held $16.9 billion-31.2% of the total. Ethereum ETFs hit $18.7 billion. Grayscale’s ETHE led with $5.1 billion (27.3% share). But trends are shifting. In Q3 2025, Bitcoin ETFs saw $1.2 billion in net outflows. Why? Rising interest rates made bonds and Treasuries more attractive. Meanwhile, Ethereum ETFs gained $478 million. Investors aren’t just betting on price-they’re betting on Ethereum’s utility. Staking rewards, DeFi access, and smart contract demand are pulling money in. Even more telling: Bitcoin ETFs trade at a 0.08% premium to their net asset value (NAV). Ethereum ETFs trade at 0.23%. That means people are willing to pay more for Ethereum ETFs than their actual holdings are worth. Strong demand. Limited supply.What This Means for Regular Investors

You don’t need a crypto wallet anymore. You don’t need to worry about private keys or exchange hacks. You can buy a Bitcoin or Ethereum ETF through your Fidelity, Schwab, or Robinhood account-just like Apple or Tesla stock. For people who held crypto before ETFs: in-kind conversions let you move your coins into ETFs without selling. That’s a tax win. For new investors: it’s the easiest, safest entry point into crypto. But watch the fees. Fidelity’s FBTC is free. Grayscale’s GBTC and ETHE aren’t. If you’re holding long-term, a 1.5% fee eats into your returns fast. VanEck’s EETH at 0.15% is a better deal for passive investors. Also, tax reporting got trickier. With in-kind conversions, you’re moving crypto into an ETF without a sale. But when you eventually sell the ETF, the IRS will want to know your original cost basis. You’ll need records of when and how much crypto you converted. Coinbase’s ETF integration has a 4.2/5 rating, but 28% of users say tax docs are confusing.

What’s Next?

The SEC’s October 2025 orders didn’t just open the door for Bitcoin and Ethereum. They said it applies to “a host of crypto asset ETPs.” That means Solana, Cardano, and even XRP could be next. The Hong Kong Stock Exchange launched its first spot Solana ETF on October 23, 2025-with a 0.99% fee. Singapore and the EU are expected to follow by mid-2026. In the UK, the FCA lifted its ban on crypto ETNs, letting firms like 21Shares and Bitwise offer physical Bitcoin and Ether ETPs in ISAs. Meanwhile, institutional adoption is accelerating. Evernorth announced a $1 billion deal to acquire XRP for yield strategies. Strategy, a major asset manager, added 168 more Bitcoin to its holdings, bringing its total to 640,418 BTC. These aren’t speculators. These are institutions building long-term exposure.Warnings and Risks

Not everyone’s cheering. John Coates, former SEC acting chairman and Harvard Law professor, warned in September 2025 that staking Ethereum ETFs could create systemic risk. Why? Because 68% of Ethereum’s network security comes from staked ETH. If ETFs start locking up too much ETH, they could weaken the network’s decentralization-or trigger a sell-off if investors panic. Also, the SEC hasn’t said all crypto assets qualify. Chairman Paul S. Atkins made it clear: “Not all crypto assets will qualify for ETP treatment.” That means Ripple, Dogecoin, or Shiba Inu won’t get approved just because Bitcoin and Ethereum did. Each case will be reviewed individually.Bottom Line: A New Era

The approval of Bitcoin and Ethereum ETFs isn’t just about access. It’s about legitimacy. For the first time, Wall Street has fully embraced crypto as an investable asset class. The SEC isn’t fighting it anymore. It’s building the rules. In-kind processing has made these ETFs more efficient, cheaper, and more attractive to big money. Ethereum’s staking rewards add a new income layer that Bitcoin can’t match. Fees vary wildly-choose wisely. And while the market is growing fast, regulatory risks remain. If you’re looking to invest, don’t just pick the biggest name. Compare fees, check if staking is included, and understand how in-kind conversions affect your taxes. The era of crypto as a fringe asset is over. Now, it’s part of your portfolio.Are Bitcoin and Ethereum ETFs safe?

They’re safer than holding crypto on an exchange, but not risk-free. ETFs are regulated, held by custodians like BlackRock or Fidelity, and subject to SEC oversight. But the underlying assets-Bitcoin and Ethereum-are still volatile. Prices can swing 10% in a day. You’re not protected from market drops, just from exchange hacks and custody failures.

Can I buy Ethereum ETFs on Robinhood or Fidelity?

Yes. Most major brokers now offer spot Bitcoin and Ethereum ETFs. Fidelity has FBTC and FETH. Schwab, Robinhood, and Charles Schwab all list the top ETFs. You don’t need a crypto wallet. Just search for the ticker-like IBIT for Bitcoin or FETH for Ethereum-and buy like any stock.

Why do some Ethereum ETFs pay staking rewards and others don’t?

It’s a business decision. Staking requires technical setup, compliance with Ethereum’s validator rules, and ongoing monitoring. ETF providers like Grayscale and Fidelity chose to do it because they believe investors want passive income. Others, like VanEck, skipped it to keep things simple and reduce costs. Check the fund’s prospectus before investing.

Is it better to buy Bitcoin ETFs or actual Bitcoin?

It depends. If you want custody control, easy trading, and tax simplicity, ETFs win. If you want full ownership, to use Bitcoin for payments, or to participate in Layer 2 networks like Lightning, then self-custody is better. Most investors use ETFs for core exposure and hold some Bitcoin directly for flexibility.

Will more crypto ETFs be approved soon?

Almost certainly. The SEC’s October 2025 order explicitly allows in-kind processing for “a host of crypto asset ETPs.” Solana’s ETF is already live in Hong Kong. XRP, Cardano, and Polygon are next in line. The SEC is no longer saying no-it’s saying, “Show us your custody, liquidity, and compliance plan.” The bar is higher, but the door is open.

How do I know which ETF to pick?

Compare three things: fees, whether staking is included (for Ethereum), and asset size. Avoid funds with fees over 0.5%. Prefer ones with over $1 billion in assets-they’re more liquid and stable. Check the issuer’s reputation. BlackRock, Fidelity, and VanEck are low-risk. Grayscale is trusted but expensive. And always read the prospectus.

There are 27 Comments

angela sastre

Finally! I’ve been waiting for this since 2017. No more juggling wallets and seed phrases. Just buy FETH on Robinhood like I buy TSLA. Game changer.

Also, staking rewards? Yes please. Passive income in crypto? That’s the dream.

Aniket Sable

thats awesome man! i been holdin eth since 2021 and now i can move it to etf without payin tax? sweet. no more exchange drama.

Patrick Rocillo

YESSSS!!! 🎉🔥 Finally Wall Street caught up. BlackRock’s IBIT hitting $16B? That’s not a trend-that’s a takeover. Ethereum staking ETFs? Bro, we’re living in the future.

Also, 1.5% fee on ETHE? That’s like paying for a VIP pass to the past. VanEck’s EETH at 0.15%? That’s the real MVP.

Santosh harnaval

ETFs are legit now. No more scams. Just buy and hold.

Jessica Smith

Don’t be fooled. This is just SEC-sanctioned gambling with a compliance stamp. They’re turning crypto into a Wall Street casino and calling it ‘investing.’

Staking rewards? More like debt traps wrapped in ETFs. You think you’re earning yield? You’re just funding the validators who’ll dump when the market turns.

Edwin Davis

Why are we letting foreign exchanges like Hong Kong lead this? The U.S. should’ve been first. Now we’re playing catch-up while China and India quietly build their own chains.

And don’t get me started on Ethereum. It’s not even American tech. Why are we betting our retirement on it?

Nisha Sharmal

Oh wow, a 0.15% fee? How quaint. Meanwhile, in India, we’re building real blockchain infrastructure-no ETFs needed. You’re paying for brand names, not innovation.

And staking rewards? Cute. You think Grayscale gives a damn about decentralization? They’re just another hedge fund with a crypto label.

Marianne Sivertsen

It’s funny how we treat crypto like a new thing, but it’s just the next phase of money. Gold had its ETFs. Bonds had theirs. Now it’s crypto’s turn.

What’s wild is how fast we normalized it. Five years ago, people thought you were crazy for owning Bitcoin. Now your cousin’s 70-year-old uncle has FETH in his 401(k).

And yet-we still don’t know if it’s money, tech, or speculation. Maybe it’s all three.

Will Atkinson

Man, I just love how this whole thing unfolded-court forces SEC’s hand, institutions rush in, and suddenly we’re all just buying crypto like it’s Apple stock.

It’s not perfect, but it’s progress. The fact that in-kind conversions are live? That’s huge. No more selling your coins just to get into an ETF. That’s respect for the OG holders.

And honestly? I’m glad someone finally figured out how to make this simple for normal people. No more cold wallets, no more phishing scams. Just click, buy, and chill.

Mike Kimberly

The approval of these ETFs isn’t just regulatory-it’s cultural. For over a decade, crypto was the wild west, the domain of tech bros, anarchists, and conspiracy theorists. Now? It’s in your 401(k).

The SEC didn’t change its mind because it suddenly loved Bitcoin. It changed because the market forced it. BlackRock didn’t ask permission-they built the product, the demand exploded, and the court said, ‘You can’t be this inconsistent.’

And Ethereum? Oh, this is bigger than Bitcoin. Bitcoin is digital gold. Ethereum is digital infrastructure. You don’t just buy Ethereum-you buy access to a global computer. That’s why the staking rewards matter. It’s not just price appreciation-it’s yield from utility.

But let’s not pretend this is risk-free. The underlying assets are still wildly volatile. The ETFs protect you from custody risk, not market risk. And those fees? They compound. A 1.5% fee on $100k is $1,500 a year. That’s a vacation. That’s a new laptop. That’s money you’ll never get back.

Also, tax basis tracking? Yeah, that’s a nightmare. If you moved ETH into an ETF in-kind, you need to document every single transaction from the day you bought it. Most people won’t. And when the IRS comes knocking? You’re screwed.

And don’t get me started on the systemic risk of staking. If 68% of ETH is staked, and ETFs start locking up 20% of that? What happens when a liquidity crunch hits? Do you think people will panic-sell their ETF shares? And if they do, who’s left to validate the network?

This isn’t the end of crypto’s evolution. It’s the beginning of its institutionalization. And that means more regulation, more oversight, more bureaucracy. The wild west is over. The bank vault is open.

emma bullivant

i think the real story here is how fast we accepted this… i mean, a decade ago people thought crypto was a bubble, now its in 401ks? weird. also, did anyone else notice the typo in the article? it says 'the sec' lowercase in one place. lol.

Laura Herrelop

They’re not approving ETFs because they believe in crypto.

They’re approving them because they know they can’t stop it.

Think about it-what if the SEC had kept saying no? Where would the money have gone? Into private trusts? Into offshore exchanges? Into Chinese wallets?

Now the government gets to tax it, regulate it, monitor it, and control the narrative.

This isn’t freedom. It’s assimilation.

And soon? They’ll start banning self-custody. They’ll say, ‘It’s too risky.’ They’ll say, ‘You need to use the approved ETFs.’

They’ve already started.

Peter Schwalm

Biggest takeaway for new investors: don’t chase the biggest name. IBIT and ETHE look impressive, but they’re not the best value.

FBTC at 0.00%? That’s a steal. EETH at 0.15%? Even better.

And if you’re holding ETH long-term? Go for the staking ones. That 4.2% yield isn’t free money-it’s the network paying you for helping secure it.

Just make sure you know your cost basis. Tax season’s gonna be messy for a lot of people.

Karla Alcantara

I’m so glad this happened. My mom just bought FETH last week. She didn’t even know what staking was, but she saw the yield and said, ‘If it’s on Fidelity, it’s safe.’

And you know what? She’s right. She doesn’t need to understand the tech. She just needs to know she’s not getting hacked.

Crypto finally became mainstream without losing its soul. That’s rare.

Nick Carey

So… I can just buy this like a stock? No wallet? No seed phrase? No drama?

Then why did I spend 3 years learning how to use MetaMask?

Welp. Guess I’m obsolete.

monica thomas

While the regulatory approval is significant, one must consider the potential for increased systemic risk due to the concentration of staked ETH within institutional ETFs. The decentralization of Ethereum’s consensus mechanism may be compromised if a significant portion of staked assets becomes subject to liquidity pressures from institutional redemption flows. Additionally, the tax implications of in-kind transfers remain ambiguously defined under current IRS guidance, which may lead to compliance challenges for retail investors. A thorough review of the fund’s prospectus and legal structure is strongly advised prior to investment.

Petrina Baldwin

Grayscale is overpriced. Just buy VanEck.

sundar M

Bro, this is the moment crypto became real. I’ve been holding since 2020. Saw the hate, the memes, the scams. Now my uncle in Mumbai is asking me how to buy ETHE on his phone.

And you know what? I’m proud. Not because it’s profitable-though it is-but because it’s finally normal. No more explaining to people why I’m not buying Bitcoin because ‘it’s fake money.’

It’s money now. And it’s here to stay.

Sonu Singh

in india we dont have etfs yet but i use binance… but i heard in-us they can now move eth to etf without tax? wow. thats big. i need to learn how to do this when i move there.

Shruti rana Rana

Finally! 🌟 I’ve been waiting for this since 2018. Now my parents can invest without worrying about private keys. And staking rewards? That’s like getting dividends from tech! 💸✨ I’m buying EETH today. 0.15% fee? Yes, please! 🙌

Alex Horville

Why are we letting a foreign court force the SEC’s hand? The U.S. government should have led this. Now we’re reacting to a judicial decision, not making policy.

And Ethereum? It’s not even American. Why are we betting trillions on a foreign blockchain? We should be building our own.

Michael Hagerman

THEY DIDN’T APPROVE XRP. THEY DIDN’T APPROVE SOLANA. THEY DIDN’T APPROVE DOGECOIN.

AND YET THEY APPROVED BITCOIN AND ETHEREUM?

THIS ISN’T REGULATION.

THIS IS A COVER-UP.

THEY KNOW WHAT’S COMING. THEY’RE SAVING THE BEST FOR LAST.

THEY’RE PREPARING THE MARKET.

THEY’RE GETTING US USED TO IT.

AND THEN-

WHEN THE NEXT CRYPTO CRASH COMES-

THEY’LL SAY ‘WE TOLD YOU SO.’

AND THEY’LL TAKE EVERYTHING.

Claymore girl Claymoreanime

Let me guess-you bought IBIT because it’s ‘BlackRock.’

Of course you did.

You think you’re investing? You’re just feeding the machine.

You didn’t believe in crypto-you believed in the brand.

You didn’t want decentralization-you wanted a brokerage account with a crypto label.

You’re not a crypto investor.

You’re a Wall Street rent-seeker with a crypto fetish.

And when the fees eat your returns and the SEC changes its mind again? You’ll cry.

But you’ll still blame the market.

Not yourself.

Ralph Nicolay

It is of paramount importance to note that the in-kind creation and redemption mechanism, while operationally efficient, introduces potential counterparty risk associated with authorized participants. Furthermore, the differential fee structures among Ethereum ETFs may constitute a material misalignment of incentives between fund sponsors and beneficiaries, particularly in the case of Grayscale’s ETHE, which levies a fee exceeding 1.5%. Investors are advised to conduct a comprehensive due diligence process prior to portfolio allocation.

angela sastre

Also, if you’re still using Coinbase for tax docs? Yikes. Their 4.2/5 rating says it all. I switched to Koinly. Saved me hours.

Peter Schwalm

And if you’re thinking of moving your crypto into an ETF-do it before Q1 2026. The IRS might start requiring Form 8949 for in-kind transfers. Right now, it’s a gray area. That won’t last.

Karla Alcantara

My mom just asked me if she can sell her ETHE and buy FBTC. I told her, ‘If you don’t care about staking, yes. But you’ll miss out on the yield.’ She said, ‘Then I’ll keep it.’

That’s the moment crypto stopped being a niche thing.

Write a comment

Your email address will not be published. Required fields are marked *