XDB CHAIN Token Price Tracker

Current Price

24h Volume

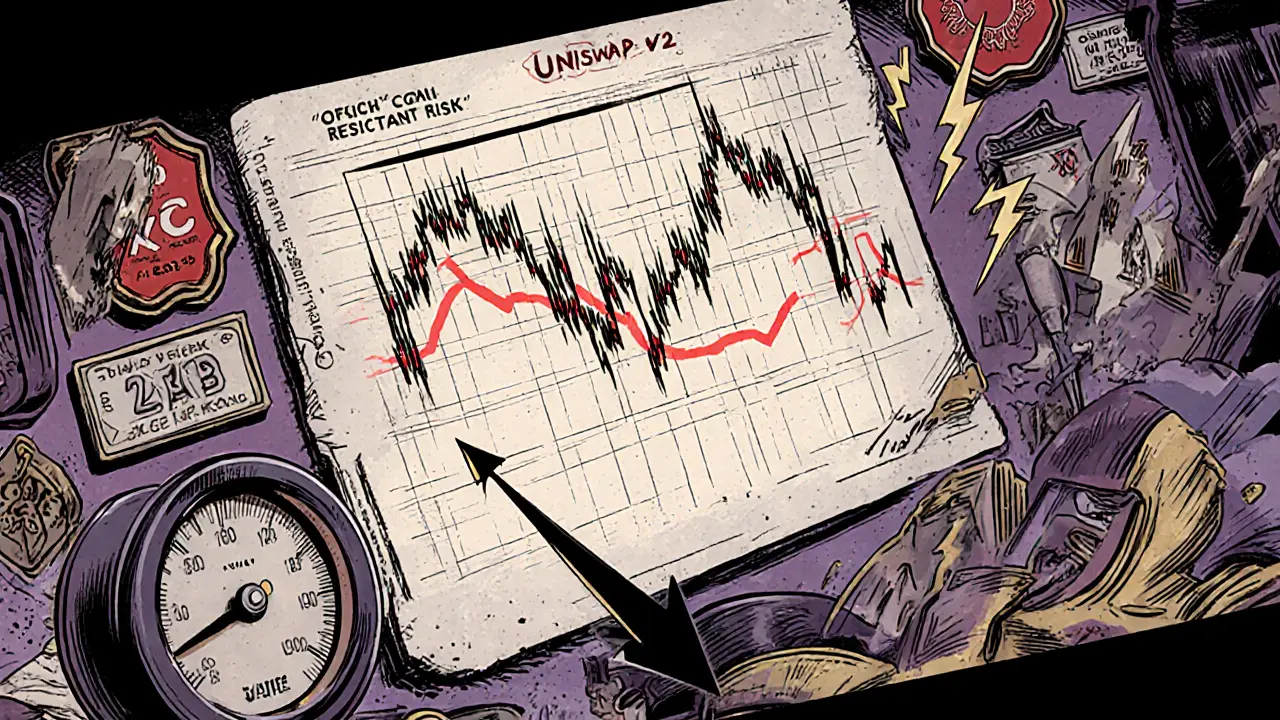

XDB is currently trading between $0.000485 and $0.000555. All EMA lines are flashing "Sell," indicating bearish momentum.

XDB is available for trading on the following exchanges:

Most liquid pairs: XDB/USDT

Current Status: Bearish momentum indicated by technical indicators.

Recommendation: Short-term caution advised. Long-term potential depends on adoption of point-economy assets.

When people ask, XDB CHAIN is a third‑generation blockchain platform built to let brands and everyday users create and move digital money quickly and cheaply. Its native coin, XDB, acts as both a transaction token and a Real World Asset (RWA) wrapper for things like branded currencies, NFTs, stablecoins and payment tokens.

Quick Facts

- Native token: XDB

- Built on a fork of the Stellar network (v19)

- Focus: branded coins, point‑economy assets, Web3 payments

- Current price (Oct2025): ≈$0.000507 USD

- 24‑hour volume: about $1.58million USD

Where XDB CHAIN Comes From

The codebase started as a fork of Stellar network version19. By keeping Stellar’s fast consensus and low‑fee model, XDB CHAIN can settle transactions in seconds without burning gas like some older blockchains.

Core Pieces of the Platform

Three technical building blocks make the system work:

- Token certification service - lets anyone register a new digital asset on‑chain and have it officially verified.

- Decentralized Exchange (DEX) - a built‑in market where users trade assets without leaving the network.

- Real World Asset (RWA) token layer - bridges traditional finance items (like fiat‑backed stablecoins) to the blockchain.

What You Can Build on XDB CHAIN

The platform markets itself as a playground for “Branded Coins (BCO).” In practice that means a coffee shop, a sports club or a gaming studio can launch its own token that works exactly like cash inside its app. The same infrastructure also supports:

- NFTs for collectibles or digital tickets.

- Stablecoins pegged to fiat or commodities.

- Web3 payment integration that lets merchants accept crypto alongside credit cards.

How the XDB Token Is Used

XDB functions in three ways:

- Fee payment - every operation on the chain (issuing a new brand coin, swapping on the DEX, etc.) costs a tiny amount of XDB.

- Liquidity provider - holders can stake XDB into the DEX pools and earn a share of transaction fees.

- RWA wrapper - projects can lock value in XDB to represent real‑world assets, making them tradable on the blockchain.

Market Data (October2025)

| Metric | Value |

|---|---|

| Current price (USD) | $0.000507 |

| 24‑hour volume | $1,576,150 |

| Exchange presence | MXC, Gate.io, Uniswapv2 |

| EMA(10) | $0.000528 (Sell) |

| EMA(200) | $0.000550 (Sell) |

| Resistance levels | $0.000555, $0.000638, $0.000753 |

Technical charts show XDB hovering between $0.000485 and $0.000555, with the Simple Moving Average at $0.000567. All EMA lines are flashing “Sell,” so momentum leans bearish for now.

Community & Ecosystem

According to the project, more than 100000 people follow XDB on social platforms. One platform alone claims 150000 members, while others range from 10000 to 30000. The open‑source code lives on GitHub under the DigitalBitsOrg organization, and developers can run a XDB CHAIN core node to help secure the network.

Pros and Cons

Pros

- Fast, low‑fee transactions thanks to Stellar‑derived consensus.

- Built‑in DEX makes token swaps seamless.

- Special focus on point‑economy assets, which are still a niche but growing market.

- Open‑source and relatively easy for developers to integrate.

Cons

- Price is very low, which can make it feel speculative.

- Technical indicators are bearish, indicating short‑term weakness.

- Project road‑map is vague; investors may want clearer milestones.

- Competes with other branded‑coin platforms that already have larger partner networks.

How to Get Started with XDB

- Set up a wallet that supports Stellar‑based assets (e.g., Claw or Solar Wallet).

- Buy XDB on an exchange that lists the pair XDB/USDT - MXC, Gate.io, or Uniswapv2 are the most liquid.

- Transfer the tokens to your personal wallet - remember to keep a small XDB balance for fees.

- If you want to create a branded coin, follow the token‑certification guide on the official site and pay the required XDB fee.

- Consider staking XDB in the built‑in DEX pools to earn a share of transaction fees.

Frequently Asked Questions

What is the main purpose of XDB CHAIN?

XDB CHAIN aims to make it easy for brands and everyday users to create, trade and use digital tokens that behave like cash, loyalty points or NFTs, all on a fast, low‑cost blockchain.

How does XDB differ from Stellar?

XDB CHAIN is a fork of Stellarv19, so it inherits Stellar’s consensus and fee model, but adds a token‑certification service, a built‑in DEX and dedicated layers for branded coins and Real World Asset tokens.

Where can I buy XDB?

The most liquid markets are MXC, Gate.io and Uniswapv2 (XDB/USDT pair). Create an account, deposit USDT, and trade for XDB.

Is XDB a good investment right now?

Technical analysis shows bearish momentum across all EMA timeframes, and the price is near recent lows. If you believe in the long‑term point‑economy vision, you might hold; otherwise, treat it as high‑risk speculative.

Can I create my own branded coin on XDB?

Yes. After setting up a wallet, use the token‑certification service on the XDB CHAIN website, pay the XDB fee, and your custom token will be live on the blockchain.

There are 19 Comments

Alie Thompson

It is reprehensible, and frankly immoral, that so many people are lured by the glitter of XDB CHAIN, a coin whose price dances on the edge of the abyss, all while ignoring the profound ethical implications of fueling speculative bubbles. The very architecture of XDB, built upon a fork of Stellar, may appear innovative, yet it is merely a veneer that masks the predatory nature of tokenization of everyday life. When brands transform loyalty points into tradable assets, they blur the line between genuine value and manufactured hype, coercing consumers into a perpetual state of financial anxiety. The relentless promotion of "branded coins" and point‑economy assets encourages a culture of dependence on digital tokens, eroding the dignity of honest labor. Moreover, the low‑fee, high‑speed promises of the network are nothing more than a sugar‑coated invitation to waste time and resources on a platform that has yet to prove any substantive utility beyond speculation. It is a betrayal of public trust when developers tout "Real World Asset" wrappers while the underlying assets remain opaque, unregulated, and subject to the whims of market manipulators. The bearish signals-EMA lines flashing "Sell"-should serve as a stark warning, yet many still chase the mirage of quick gains, demonstrating a collective moral failing. In the grand tapestry of financial innovation, we must ask whether we are advancing human prosperity or merely feeding the voracious appetites of a crypto‑centric elite that profits from our naiveté. Let us not be complicit in this grand charade; let us demand transparency, accountability, and a steadfast commitment to the commons rather than the whims of a token‑obsessed minority.

Samuel Wilson

While the concerns raised about speculative excess are certainly valid, it is also important to recognize the technical merits that XDB CHAIN brings to the blockchain ecosystem. Its Stellar‑derived consensus offers fast finality and low transaction costs, which can be advantageous for micro‑transactions and point‑based economies. Developers seeking to launch branded tokens now have a ready‑made infrastructure, potentially lowering barriers to entry for innovative use‑cases. Nonetheless, prudent investors should conduct thorough due diligence, weighing the project's roadmap against market dynamics before allocating capital.

Rae Harris

Honestly, XDB feels like the latest hype‑pump in the sea of DeFi junk, packed with buzzwords but lacking real traction. The whole "branded coin" narrative is just a fancy way to repack loyalty points as a "crypto" and then sell them to unsuspecting retail users. You’ve got the usual token‑certification service, a DEX that probably has negligible volume, and a thin veneer of RWA support – all the ingredients for a classic shitcoin that will burn out once the hype fades.

Danny Locher

Yeah, there’s definitely a lot of hype around XDB, but it also has some practical features that could be useful for small businesses wanting cheap, quick payments. If you’re looking at it just for a quick flip, that’s risky, but as a tech layer for point‑economy apps it might actually solve a niche problem.

Emily Pelton

Look, I get the excitement, but let’s cut the fluff-XDB’s price is at rock‑bottom, the EMA signals are screaming “Sell”, and the community hype is nothing more than a marketing echo chamber, ! If you’re not prepared to watch a potential further dip, you might as well stay away, ! The technical fundamentals simply don’t justify the speculative frenzy, !

sandi khardani

From an analytical standpoint, XDB CHAIN exhibits all the classic hallmarks of a low‑utility token masquerading as a financial instrument. Its market depth is minuscule, with a 24‑hour volume that barely scratches the surface of meaningful liquidity, indicating that any sizable order will cause slippage beyond acceptable levels. The EMA(10) and EMA(200) both sit on the sell side, confirming a bearish momentum that has persisted for weeks, if not months. Moreover, the token’s distribution appears heavily concentrated among a handful of wallets, suggesting potential pump‑and‑dump schemes orchestrated by early insiders. The token‑certification service, while technically sound, is rarely used in practice, rendering the supposed utility of branded coins more speculative than operational. On top of that, the governance model lacks transparency; there is no clear roadmap or milestone tracking, which raises concerns about the project's long‑term viability. In sum, the confluence of low liquidity, concentrated ownership, bearish technical indicators, and vague governance makes XDB a high‑risk asset that should be approached with extreme caution, if at all.

Donald Barrett

XDB is a waste of time.

Christina Norberto

One must contemplate the underlying ontological framework that governs the emergence of tokens such as XDB within the broader matrix of global financial hegemony. The ostensible decentralization is, in reality, a façade engineered by an invisible cabal of technocratic elites who manipulate token standards to retain sovereign control over monetary flows. Every "real‑world asset" wrapper is but a conduit for funneling fiduciary power into opaque smart contracts, effectively disenfranchising the proletariat while enriching a select few. The cryptic token‑certification process, cloaked in technical jargon, serves to legitimize a system that is fundamentally antithetical to genuine economic emancipation. Hence, any participation in XDB not only perpetuates this clandestine agenda but also implicates the participant in the perpetuation of a digital feudalism that masquerades as innovation.

Fiona Chow

Ah, the classic “elite secret society” narrative-because every time a blockchain project launches, there’s automatically a shadow government pulling the strings. Sure, it sounds dramatic, but the reality is that most of these tokens are just trying to find a market niche, not orchestrating a world domination plot.

Cindy Hernandez

If you’re interested in dipping your toes into XDB, the first step is to set up a wallet that supports Stellar‑based assets, such as Claw or Solar Wallet. Once your wallet is ready, head over to one of the listed exchanges-MXC, Gate.io, or Uniswap v2-deposit USDT, and trade for XDB. Remember to keep a small amount of XDB in your wallet to cover transaction fees, as every operation on the chain requires a tiny XDB payment. After acquiring XDB, you can explore the token‑certification service if you want to launch your own branded coin, or you can stake your tokens in the built‑in DEX pools to start earning a share of the fees generated by the network.

Karl Livingston

Great rundown! I’d add that the community on the official Discord is pretty active, and you can get real‑time help with setting up nodes or troubleshooting wallet issues. When I first started, I was confused about the fee‑payment mechanism, but the community helped me understand that a handful of XDB tokens is all you need to keep things moving smoothly.

Kyle Hidding

While the community may be nice, the underlying tokenomics are still riddled with inefficiencies. The liquidity pools on the DEX suffer from shallow depth, leading to massive slippage for any non‑trivial trade. Additionally, the fee‑burn model is a gimmick that does nothing to sustain long‑term value; it merely reduces the circulating supply in a way that is uneconomical for real‑world adoption.

Andrea Tan

I hear the concerns, but let’s not forget that many early‑stage projects face liquidity challenges. Patience and community support can sometimes turn things around, especially if the developers deliver on their roadmap.

Gaurav Gautam

Hey everyone! If you’re still on the fence, think of XDB as a sandbox to experiment with tokenizing everyday assets. Whether it’s a loyalty program for your local coffee shop or a small NFT collection, the platform gives you a low‑cost entry point to test ideas without huge upfront fees.

Robert Eliason

maybe its not all doom n gloom, but idk if its really worth the risk rn.

Cody Harrington

I appreciate the optimism, but I think we should all stay grounded and evaluate the data before making any commitments.

Chris Hayes

From a balanced perspective, XDB presents both an interesting technical proposition and significant market risk. Investors should allocate only a small portion of their portfolio and monitor the EMA trends closely.

victor white

It’s fascinating how the financial elite subtly embed their influence within ostensibly decentralized protocols, quietly steering token economies to serve their clandestine objectives while the masses remain oblivious.

mark gray

Let’s keep the conversation respectful and focus on the facts without jumping to conclusions.

Write a comment

Your email address will not be published. Required fields are marked *