Oasis Network Trading Comparison Calculator

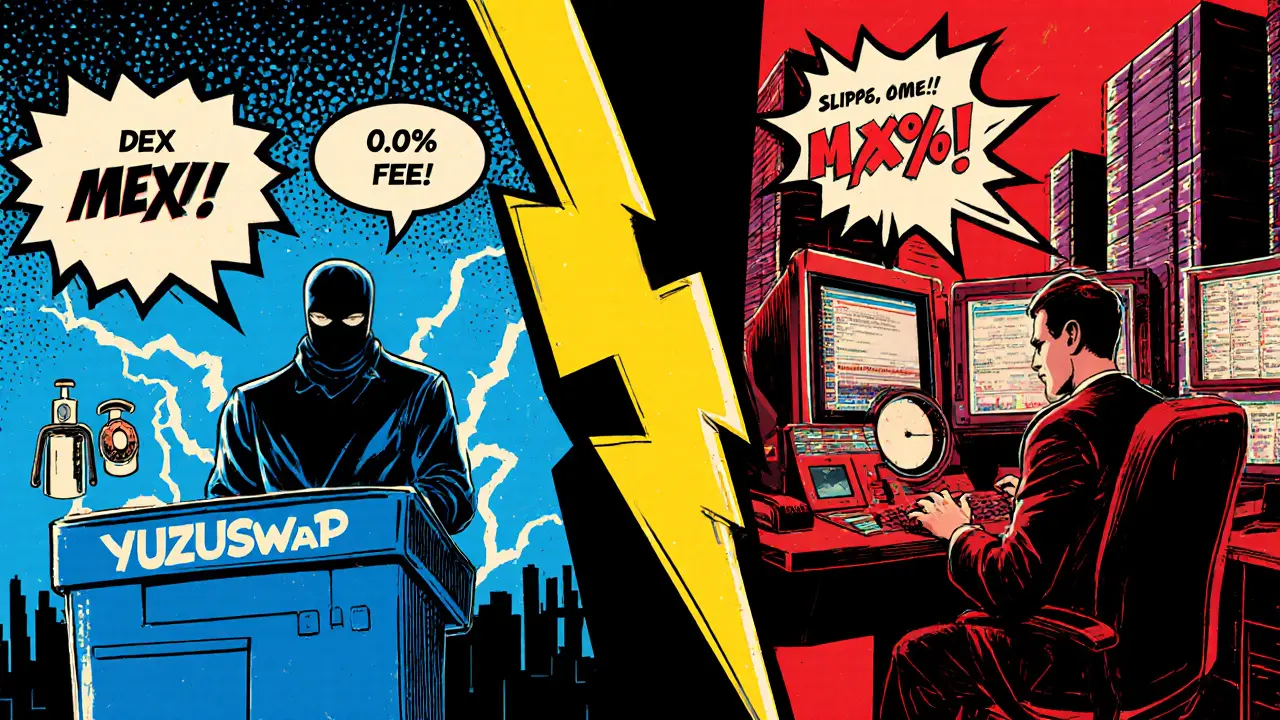

YuzuSwap DEX

Low fees, privacy, decentralized

Centralized Exchange (e.g. MEXC)

Deep liquidity, fast execution

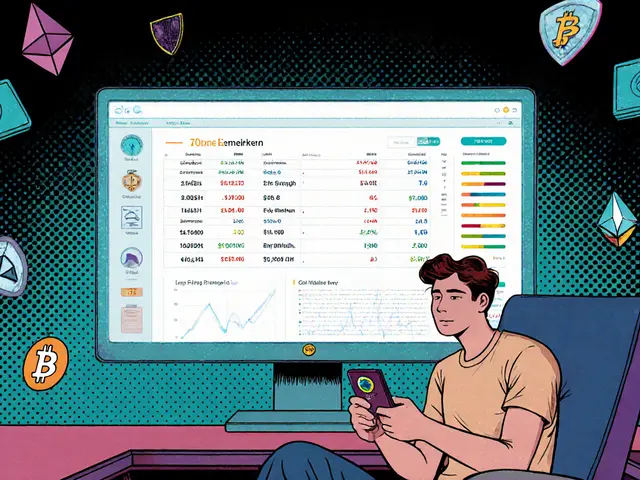

Trading Cost Comparison

Based on current rates as of October 2025:

YuzuSwap DEX Fees

- Swap Fee: 0.10% (paid in ROSE)

- Gas Cost: Under $0.001

- Slippage: ≈ 0.8%

- Total Estimated Cost: $0.00

Centralized Exchange (MEXC) Fees

- Maker/Taker Fee: 0.20% (paid in USDT)

- Slippage: ≈ 0.2%

- Total Estimated Cost: $0.00

Recommendation

Key Features Comparison

| Feature | Oasis Network (YuzuSwap) | Centralized Exchange (MEXC) |

|---|---|---|

| Privacy | Confidential transactions via ParaTime | No on-chain privacy |

| Finality | Sub-second finality | Off-chain processing |

| Liquidity Depth | Varies by pair | Deep order book |

| Transaction Speed | Instant settlement | Fast execution |

| Fee Structure | 0.10% swap + minimal gas | 0.20% maker/taker |

When you hear "Oasis" you might picture a sunny beach, but in crypto it’s a whole ecosystem built around privacy, speed, and modular design. This review breaks down what the Oasis Network actually offers for traders - from its native token ROSE to the YuzuSwap DEX, wallet options, and how it stacks up against more familiar exchanges.

Quick Takeaways

- Oasis is a Layer‑1 privacy‑first blockchain, not a traditional centralized exchange.

- YuzuSwap on the Emerald ParaTime provides a low‑fee DEX with instant finality.

- Staking ROSE secures the network and earns up to 15% APY for delegators.

- The Oasis Web Wallet and Ledger integration give non‑custodial control.

- Liquidity on ROSE is solid on MEXC, but depth on YuzuSwap can vary.

What Is the Oasis Network?

Oasis Network is a privacy‑first, proof‑of‑stake Layer 1 blockchain that separates consensus from compute. The Consensus Layer runs a scalable PoS validator set, while the ParaTime Layer hosts multiple parallel runtimes (ParaTimes) that process transactions independently. This dual‑layer design lets heavy workloads run on one ParaTime without slowing down simple token transfers on another.

Launched in 2020, Oasis caps its native coin - ROSE token - at 10billion, using it for fees, staking, and governance. By October2025 the market cap sits in the top‑tier of crypto assets, reflecting strong institutional and developer interest.

How Trading Works Inside Oasis

The network doesn’t host a centralized order‑book like Binance. Instead, trading lives on its first decentralized exchange, YuzuSwap, which runs on the Emerald ParaTime - an EVM‑compatible environment.

YuzuSwap offers standard DEX features: swapping between ERC‑20‑style tokens, creating liquidity pools, and earning the native YUZU token for pool participation. Transaction fees are paid in ROSE, and 20% of those fees funnel into a community treasury that token holders can vote on.

Because Emerald inherits Oasis’s high throughput and sub‑second finality, swaps settle almost instantly and gas fees stay under $0.001 for most trades. That’s a stark contrast to Ethereum’s volatile gas prices during peak demand.

Security and Privacy - The Core Differentiators

Oasis’s privacy model allows developers to create confidential smart contracts where inputs, outputs, and state changes stay hidden from the public ledger. This is achieved through a combination of secure enclaves and threshold cryptography on the ParaTime Layer. For traders, the benefit is twofold: your transaction amounts stay private, and you can interact with DeFi protocols without exposing data to front‑running bots.

Staking also adds a security layer. Validators must lock up ROSE, and if they act maliciously they lose a portion of their stake. Delegators - everyday token holders - can spread their stake across multiple validators to reduce risk while still earning rewards.

Wallet Options: Non‑Custodial Control

The Oasis Web Wallet is a browser‑based, non‑custodial solution. It lets you store, send, and stake ROSE without handing over private keys to a third party. The wallet integrates with Ledger hardware devices for offline signing, adding an extra shield against phishing attacks.

Ledger’s support means you can keep your ROSE on a hardware wallet, connect it to the Oasis Web Wallet, and sign transactions securely. The setup process takes under ten minutes, and the UI mirrors popular wallets, making the learning curve gentle for newcomers.

Liquidity Landscape: DEX vs Centralized Markets

While YuzuSwap offers low fees, its pool depth can be shallow for less‑traded pairs. For higher liquidity, many traders turn to centralized platforms like MEXC, which lists ROSE with tighter spreads and larger order books. MEXC’s UI is beginner‑friendly, and it provides spot, futures, and margin products for ROSE.

Below is a side‑by‑side look at key metrics for YuzuSwap and MEXC as of October2025:

| Metric | YuzuSwap (DEX) | MEXC (CEX) |

|---|---|---|

| Average Fee per Trade | 0.10% (paid in ROSE) | 0.20% (paid in USDT) |

| Typical Slippage (50K ROSE) | ≈0.8% | ≈0.2% |

| 24‑Hour Volume | $12M | $45M |

| Gas Cost per Swap | Under $0.001 | N/A (off‑chain) |

| Privacy Guarantees | Confidential swaps via ParaTime | No on‑chain privacy |

If you value privacy and ultra‑low fees, YuzuSwap wins. If you need deep order books and fast execution for large orders, a CEX like MEXC is still the go‑to.

Use Cases Beyond Simple Swaps

Oasis’s architecture opens doors for more than token trading. The network’s Tokenized Data product lets users stake their personal data and earn ROSE rewards, creating a nascent data economy. In healthcare, providers have piloted confidential patient‑record analytics on Oasis, leveraging the privacy layer to comply with regulations while still extracting insights.

DeFi platforms on Oasis also experiment with under‑collateralized loans, where borrowers’ creditworthiness is proven via zero‑knowledge proofs rather than massive asset locks. These innovations hint at a future where financial services can be both private and capital‑efficient.

Pros, Cons, and Bottom Line

Pros

- Privacy‑first design protects transaction data.

- Dual‑layer architecture delivers high throughput and low latency.

- Staking ROSE offers competitive APY while securing the network.

- Non‑custodial wallet and Ledger support give full control.

- YuzuSwap’s fees are among the cheapest in the DeFi space.

Cons

- Liquidity on YuzuSwap can be thin for niche pairs.

- Ecosystem is still growing; tooling isn’t as mature as Ethereum’s.

- Learning curve for ParaTime concepts may intimidate beginners.

Overall, Oasis isn’t a traditional “crypto exchange” you can log into and place market orders. It’s an ecosystem where the exchange experience lives on a privacy‑optimized DEX, backed by strong staking incentives and a growing suite of data‑centric applications. If you prioritize privacy, low fees, and are comfortable navigating a DEX, Oasis offers a compelling alternative to mainstream platforms.

Frequently Asked Questions

Is Oasis Network a centralized exchange?

No. Oasis is a Layer‑1 blockchain. Trading happens on its DEX, YuzuSwap, which is fully decentralized.

How do I buy ROSE?

You can purchase ROSE on major CEXs like MEXC or Binance, then transfer it to your Oasis Web Wallet for staking or DEX trading.

What are the fees on YuzuSwap?

Swaps charge a flat 0.10% fee payable in ROSE, plus a negligible gas cost (<$0.001) on the Emerald ParaTime.

Can I stake ROSE without a hardware wallet?

Yes. The Oasis Web Wallet lets you delegate stake directly from your browser. Using a Ledger adds extra security but isn’t required.

Is my transaction data truly private?

When you trade on YuzuSwap’s confidential ParaTimes, transaction amounts and participant identities are hidden from the public ledger, thanks to secure enclave technology.

There are 15 Comments

Peter Johansson

Reading about Oasis really makes you think about where finance is heading – privacy, speed, and community all wrapped in one. It’s like a gym for your crypto muscles, you just have to learn the right form. Keep experimenting and you’ll find the sweet spot. 😊

Cindy Hernandez

The dual‑layer design is a game‑changer. By separating consensus from compute, Oasis can keep transaction finality sub‑second while still offering heavy‑duty smart contracts on ParaTimes. For anyone worried about gas spikes, YuzuSwap’s under‑a‑penny gas is a breath of fresh air. Just remember to move your ROSE to a non‑custodial wallet for full control.

Karl Livingston

What really struck me is the way Oasis treats data as a first‑class citizen. Imagine staking your personal info and getting ROSE in return – that’s a whole new economy. The confidential swaps feel like a whisper in a crowded room, hidden from prying eyes. And the fact that you can earn up to 15% APY while securing the network? That’s music to any investor’s ears. Just watch the pool depth; niche pairs can get thin fast.

Kyle Hidding

Let’s cut the fluff: Oasis is basically a glorified sandbox with a fancy privacy veneer. The fee model looks cheap until you scale up and the slippage eats your profit. Their “confidential contracts” are just another layer of obfuscation for regulators to dodge. Bottom line – it’s hype with a thin liquidity pool.

Andrea Tan

I’ve been using the Oasis Web Wallet for a month now and it feels solid. The Ledger integration adds that extra peace of mind we all need. If you’re new, just follow the setup guide – it’s pretty straightforward.

Gaurav Gautam

Anyone feeling hesitant about DEX liquidity can start small on YuzuSwap and watch the pools grow. The community treasury funded by swap fees means the ecosystem can reinvest in depth over time. Keep your expectations realistic and you’ll enjoy the privacy benefits without the stress of empty order books. Let’s keep the conversation constructive and help each other navigate.

Cody Harrington

The sub‑second finality is impressive; I’ve seen trades settle instantly on YuzuSwap. However, the UI still feels a bit raw compared to Binance. It’s a trade‑off between privacy and polish.

Chris Hayes

While the architecture is innovative, the real‑world experience suffers from thin order books on many pairs. For high‑volume traders, the centralized route still wins on speed and spread. Consider splitting your strategy: use YuzuSwap for small privacy‑focused swaps and MEXC for larger moves.

victor white

One must wonder if the “privacy” promise is just a smokescreen for the inevitable centralization of power behind the ParaTimes. The oracle mechanisms could be subtly steering the network toward a single point of failure. Keep your eyes peeled.

mark gray

Both sides have merit – the DEX offers unmatched privacy, while the CEX gives you depth. It really depends on your risk tolerance and trade size. Diversify accordingly.

Alie Thompson

It is incumbent upon every participant in the blockchain ecosystem to recognize that the allure of privacy should never eclipse the fundamental principles of transparency and accountability, for without them the very notion of trust disintegrates into a fragile veneer of false security; moreover, the promise of high yields must be weighed against the moral responsibility to avoid reckless speculation that can destabilize entire markets, lest we repeat the errors of past financial bubbles that left countless individuals impoverished and disillusioned; furthermore, the integration of confidential smart contracts, while technically impressive, raises ethical questions about the potential for illicit activities to flourish unchecked, a concern that cannot be dismissed lightly; in addition, the community treasury funded by swap fees should be governed with utmost scrutiny to prevent the concentration of power in the hands of a few insiders; nevertheless, the opportunity for a data‑centric economy, where personal information is valued and remunerated, heralds a progressive shift toward user empowerment, provided it is implemented with robust safeguards; simultaneously, the staking incentives must be structured in a manner that discourages predatory behavior and promotes long‑term network stability; it is also essential that educational resources be disseminated widely so that newcomers are not lured by glossy marketing into risky positions; the on‑chain privacy mechanisms, while innovative, should complement rather than replace existing regulatory frameworks designed to protect consumers; ultimately, the decision to engage with Oasis should be guided by a balanced appraisal of its technological merits and the broader societal implications; those who champion its adoption must do so with a consciousness of the potential for both positive transformation and inadvertent harm; as custodians of this emerging technology, we bear a collective duty to foster an environment where transparency, security, and ethical conduct coexist harmoniously; only then can the promise of a truly decentralized, privacy‑preserving financial system be realized; in conclusion, proceed with cautious optimism, informed by both technical insight and moral consideration.

Samuel Wilson

Thank you for the thorough overview; the clarity of your explanation aids many newcomers. The formal tone underscores the seriousness of privacy considerations. I appreciate the balanced perspective between DEX benefits and CEX practicality. Looking forward to deeper discussions.

Rae Harris

Honestly, I think the whole privacy hype is just a buzzword to distract from the fact that most users still need liquidity, and YuzuSwap can’t deliver that at scale. The gas‑free narrative is nice, but you’ll still pay hidden costs in slippage. If you’re not into the “secret club” vibe, stick with the mainstream exchanges.

Danny Locher

Sounds good.

Emily Pelton

Listen up, everyone,-the Oasis ecosystem is a perfect storm of innovation, privacy, and community‑driven growth, and you’d be foolish to ignore it,; the low fees, sub‑second finality, and staking rewards combine to create a compelling value proposition,; but remember, every advantage comes with a responsibility to stay informed, stay vigilant, and stay engaged-let’s make the most of this opportunity!

Write a comment

Your email address will not be published. Required fields are marked *