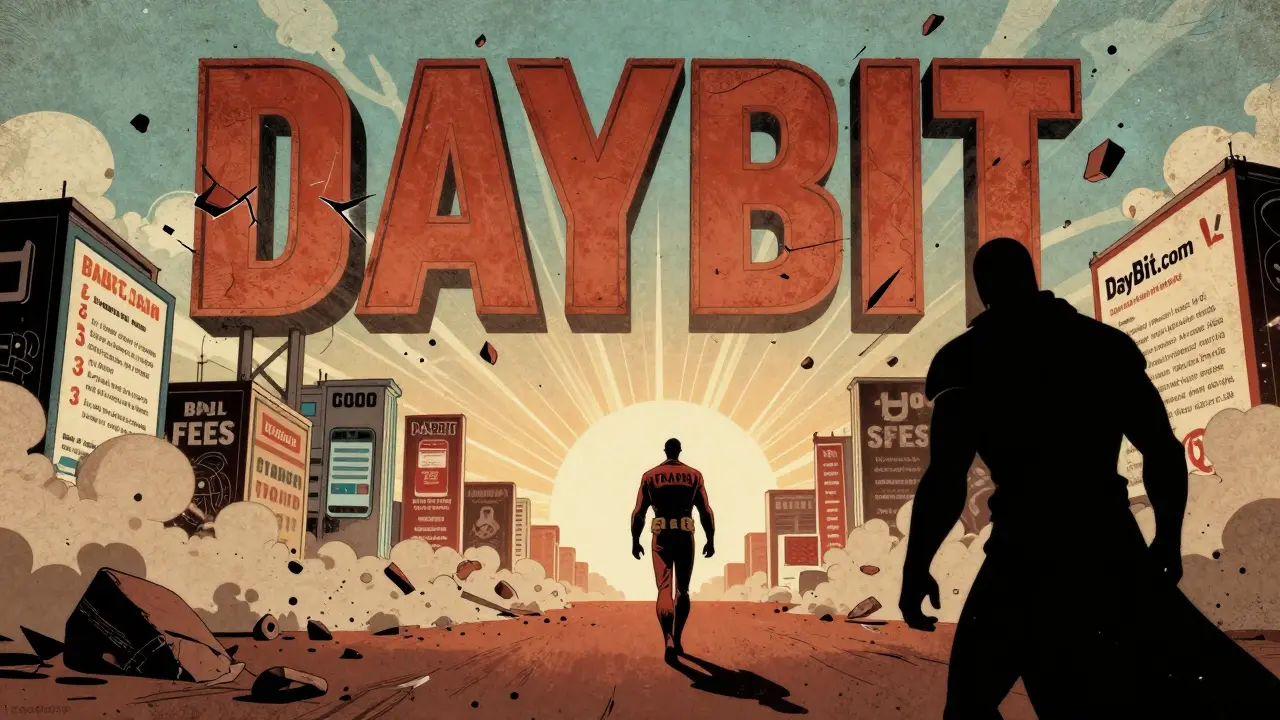

When you're looking for a crypto exchange in 2026, you want something that works - fast deposits, low fees, clear support, and real trading volume. But what do you do when you stumble across a platform like Daybit Exchange and can't find any solid answers? It’s not just quiet - it’s nearly invisible.

Daybit Exchange: A Ghost in the Crypto Market

Daybit Exchange doesn’t show up on CoinMarketCap as a tracked platform. It’s labeled as an "Untracked Listing," which means no one is monitoring its trades, no volume data exists, and no reserve balances are reported. That’s not normal. Even small exchanges like Kucoin or MEXC are tracked because they have users and activity. Daybit? Nothing. Zero. Not even a whisper. This isn’t a case of being new. Many exchanges launch quietly and grow. But Daybit has been around long enough that if it had traction, someone would’ve noticed. No Reddit threads. No Trustpilot reviews. No YouTube tutorials. No user complaints. That silence speaks louder than any marketing page.Fees Are High - And That’s the Least of Your Problems

According to Cryptowisser, Daybit’s trading fees are "a bit on the high end." That’s a polite way of saying they’re worse than most. The industry average in 2026 is around 0.10% per trade. Binance charges 0.08%. Bybit? 0.03%. Kucoin runs promotions with zero spot fees. Daybit? No public fee schedule, but user reports suggest it’s closer to 0.15% or higher. High fees matter when you’re trading regularly. But here’s the real issue: you can’t even fund your account easily.Only Korean Won? No Credit Cards. No Flexibility.

Daybit Exchange accepts only Korean Won (KRW). That’s it. No USD, no EUR, no GBP. If you don’t have access to a Korean bank account or a way to send KRW, you’re locked out. Most new crypto users rely on credit cards to buy their first Bitcoin or Ethereum. Daybit doesn’t allow credit card deposits. No PayPal. No bank wire from outside Korea. No crypto on-ramps. Compare that to exchanges like Bitpanda or Crypto.com, which let you buy crypto with a card in over 40 countries. Or even regional players like VALR in South Africa - they support ZAR, local bank transfers, and have customer service in English. Daybit offers none of that.

No Features. No Tools. No Future.

Top exchanges in 2026 don’t just let you buy and sell. They offer:- Futures and perpetual contracts

- Staking with 5-10% APY

- NFT marketplaces

- Copy trading

- API access for bots

- Mobile apps with push notifications

Confusion with DayBit.com

There’s another site: DayBit.com. It’s not the same thing. This site acts like a crypto review blog - it lists "trusted exchanges," promotes crypto casinos, and pushes "provably fair games" and bonuses. It’s not a trading platform. It’s a content site. Many people search for "Daybit Exchange" and end up on DayBit.com by accident. The names are too similar. This confusion makes it even harder to find real information about the actual exchange. If you’re trying to research Daybit, you’re likely hitting dead ends or misleading affiliate content.

Why No One Talks About It

Major crypto reviewers - CryptoBureau, CoinDesk, Forbes Adviser, CryptoAdventure - don’t mention Daybit. Not once. Not in 2025. Not in 2026. Meanwhile, exchanges like Bybit and Kucoin are featured in top 10 lists every month. Why? Because they have users, data, and transparency. Daybit has none of that. No volume. No support. No updates. No press releases. No roadmap. No team page. No LinkedIn. No Twitter. No GitHub. It’s not just small - it’s absent from the digital world.Who Is Daybit Even For?

The only plausible answer: Korean retail traders who can’t use global exchanges due to local restrictions. But even then, Korea has strong, regulated platforms like Upbit and Bithumb. Both have deep liquidity, English interfaces, mobile apps, and customer service. Why would someone choose a platform with higher fees, no features, and zero support over those? Unless you’re in Korea, have KRW, and have no other options - Daybit doesn’t offer a reason to exist.The Bottom Line: Avoid It

In 2026, the crypto exchange market is crowded, competitive, and transparent. You have hundreds of options with better fees, better tools, and real user support. Daybit Exchange offers none of that. It’s not just underperforming - it’s non-functional as a real trading platform. If you’re looking to trade crypto, skip Daybit. There are dozens of better alternatives that actually work.Is Daybit Exchange a scam?

There’s no proof Daybit Exchange is a scam - but there’s also no proof it’s legitimate. It doesn’t publish regulatory licenses, doesn’t disclose its company structure, and has no public leadership team. Most regulated exchanges clearly state their legal status. Daybit doesn’t. That lack of transparency is a major red flag. If it were operating legally, it would be listed on CoinMarketCap with verified volume. It isn’t.

Can I deposit USD or EUR into Daybit Exchange?

No. Daybit Exchange only accepts Korean Won (KRW). There are no options for USD, EUR, GBP, or any other fiat currency. This makes it unusable for anyone outside Korea who doesn’t already have KRW in a Korean bank account - which most people don’t.

Does Daybit Exchange have a mobile app?

There is no official mobile app for Daybit Exchange. No app exists on the Apple App Store or Google Play Store. Users report accessing the platform only through a mobile browser, which is unreliable and lacks features like push notifications or biometric login - standard on every major exchange today.

Why is Daybit not listed on CoinMarketCap as a tracked exchange?

CoinMarketCap only lists exchanges that provide verified trading volume and liquidity data. Daybit Exchange does not share this data, so it’s marked as "Untracked." This means its trading activity is either too low to measure, artificially inflated, or non-existent. Untracked exchanges are generally avoided by serious traders because there’s no way to know if prices are real or manipulated.

Are there any alternatives to Daybit Exchange for Korean users?

Yes. Upbit and Bithumb are the two largest and most trusted crypto exchanges in South Korea. Both are regulated, offer KRW deposits, have mobile apps, support hundreds of cryptocurrencies, and provide customer support in Korean and English. They also offer staking, futures trading, and NFT marketplaces - all features Daybit lacks.