iUSD Collateral Ratio Calculator

How the iUSD Collateral Ratio Works

iUSD requires 150% over-collateralization with ADA. For every $1 of iUSD, you must lock at least $1.50 worth of ADA as collateral. This ensures stability even during price fluctuations.

Minimum Collateral Ratio: 150% (1.5x)

Current iUSD Supply: ~3.1M tokens

ADA Price Reference: $0.75 (example value, update as needed)

Your Collateral Requirements

Ever wondered what sits behind the ticker IUSD and why Cardano fans keep talking about it? The answer is Indigo Protocol, a synthetic‑asset platform that brings a stablecoin to the Cardano ecosystem. If you’re curious about how it works, what makes it different from the likes of DAI or TerraUST, and whether it’s worth your ADA, keep reading.

What is Indigo Protocol?

Indigo Protocol is a decentralized synthetic‑assets protocol built on the Cardano blockchain that lets users mint and trade tokenized representations of real‑world assets. Launched in 2023, the protocol aims to fill the gap of synthetic assets within Cardano, offering low‑fee, fast settlement and native integration with Cardano’s staking model.

Introducing iUSD - the flagship stablecoin

iUSD (ticker IUSD) is the primary stablecoin issued by Indigo Protocol. It is pegged 1:1 to the US dollar and lives as a native Cardano asset at address f66d78b4a3cb3d37afa0ec36461e51ecbde00f26c8f0a68f94b6988069555344.

Unlike algorithmic coins that rely on market dynamics, iUSD is over‑collateralized: users lock ADA or liquid‑staked ADA (LSD) in a Collateralized Debt Position (CDP) and receive iUSD tokens. The minimum collateralization ratio is 150%, meaning for every $1 of iUSD you must provide at least $1.50 worth of ADA.

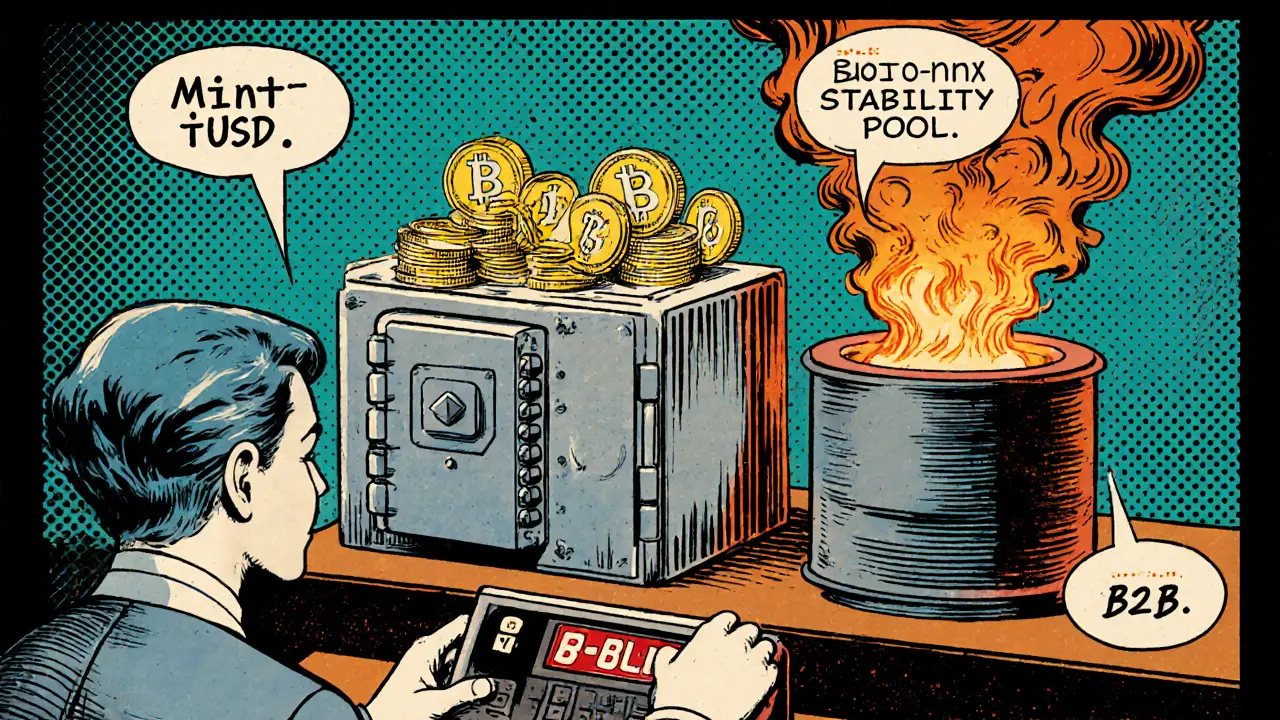

How iUSD works - minting, stability and the Buy‑to‑Burn mechanism

- Minting: Connect a Cardano wallet (Nami, Eternl or Flint), deposit the required ADA, open a CDP and click “Mint iUSD”. The protocol automatically issues iUSD tokens proportional to your locked collateral.

- Stability Pools: If a CDP’s collateral falls below the safety threshold, the position is liquidated. The debt is covered by the Stability Pool, which also rewards providers in INDY tokens and protocol fees.

- Buy‑to‑Burn (B2B): Introduced in version2, B2B lets users swap ADA for iUSD directly inside the UI while simultaneously reducing the overall debt of the system. Approximately 94% of protocol revenue is funneled into this mechanism, helping keep the peg stable.

Tokenomics - iUSD and the governance token INDY

iUSD itself has a circulating supply of about 3.1million tokens and trades around $1.02, giving it a market cap of roughly $3.14million (October2023 data). The second native token, INDY, serves as the governance token. Holders vote on protocol upgrades, fee distribution and liquidity mining programs. INDY’s total supply is capped at 1billion tokens.

How iUSD stacks up against other stablecoins

| Stablecoin | Base Chain | Collateral Type | Market Cap (2023) | Avg Tx Fee |

|---|---|---|---|---|

| iUSD | Cardano | ADA (150% over‑collateralized) | $3.14M | $0.02 |

| DAI | Ethereum | Crypto collateral (multi‑collateral) | $5.1B | $1.75 |

| sUSD | Ethereum | Crypto collateral | $85M | $1.20 |

| Djed | Cardano | Algorithmic reserve (Ada‑backed) | $480M | $0.03 |

From the table you can see iUSD shines on fee‑efficiency and settlement speed (≈20seconds), but its market depth lags far behind DAI. For traders who need cheap, fast swaps inside Cardano’s DeFi hubs, iUSD is a solid choice; for large‑scale arbitrage, deeper liquidity pools on Ethereum may still be preferable.

Pros and cons - a quick rundown

- Pros

- Transaction fees as low as $0.02, far cheaper than Ethereum.

- Native Cardano integration lets you earn staking rewards while your ADA sits as collateral.

- Buy‑to‑Burn reduces systemic debt and supports price stability.

- Clear governance via INDY, with regular DAO votes.

- Cons

- Liquidity is limited - only a handful of trading pairs on Cardano DEXs.

- Cross‑chain support is still in development; you can’t move iUSD directly to Ethereum yet.

- Managing CDP collateral ratios can be tricky for newcomers.

- Market cap is small, which can amplify price swings during high demand.

Step‑by‑step: How to start using iUSD

- Install a Cardano wallet that supports native assets - Nami, Eternl or Flint are the most common.

- Fund the wallet with ADA. You’ll need at least 1.5× the amount of iUSD you plan to mint.

- Visit Indigo Protocol’s web interface (https://app.indigoprotocol.io). Connect your wallet.

- Choose “Create CDP”, set the collateral amount, and confirm the transaction. The UI will show the estimated iUSD you’ll receive.

- After minting, you can move iUSD to a Cardano DEX (SundaeSwap, Minswap) via the “Dexter” aggregator to trade, provide liquidity, or earn INDY rewards.

- Monitor your collateral ratio regularly. If the ratio approaches 150%, consider adding more ADA or using the “Buy‑to‑Burn” feature to reduce debt.

Most first‑time users spend 2-3hours on the whole process, including wallet setup and a quick test mint.

Risks, security and regulatory outlook

Security‑wise, Indigo’s smart contracts are written in Plutus and have been audited by InputOutputGlobal (IOG). The audit found no critical flaws, though it warned about edge‑case liquidation cascades during extreme market drops. Users should keep an eye on ADA price volatility - a 15% dip can trigger liquidation if you’re close to the minimum ratio.

Regulation is another factor. The EU’s MiCA framework, effective 2024, treats stablecoins with stricter reserve requirements. Because iUSD is over‑collateralized with ADA, it sidesteps many of the reserve‑audit demands, but future cross‑border rules could still affect its adoption.

Future roadmap - what’s next for iUSD?

Indigo DAO has approved a liquidity‑mining program that will distribute 5million INDY tokens to farmers providing iUSD pairs on Cardano DEXs, slated for November2023. A cross‑chain bridge to Ethereum via CCIP is slated for Q12024, which could boost iUSD’s TVL by up to 300% according to internal forecasts.

Long‑term projections vary: IOG’s research suggests iUSD could capture 5‑7% of Cardano’s stablecoin market by 2025 (a $50‑70M market cap), while conservative analysts warn that without major liquidity partners the upside may stay modest.

Key takeaways

- iUSD offers a low‑fee, fast stablecoin native to Cardano, backed by over‑collateralized ADA.

- The protocol’s Buy‑to‑Burn mechanism and Stability Pools help keep the peg stable.

- Liquidity and cross‑chain capabilities are still growing pains; early adopters should monitor CDP health.

- Future bridge and mining incentives could dramatically expand its ecosystem.

Frequently Asked Questions

How is iUSD different from DAI?

iUSD runs on Cardano and is over‑collateralized with ADA, while DAI lives on Ethereum and accepts a basket of crypto assets. iUSD’s transaction fees are under a cent, compared with roughly $1.75 for an Ethereum swap.

Can I use iUSD on other blockchains?

Not yet. Indigo’s roadmap includes a cross‑chain bridge to Ethereum in early 2024, but until then iUSD is confined to the Cardano network.

What happens if the price of ADA drops below my collateral ratio?

The CDP will be liquidated and the debt covered by the Stability Pool. You’ll lose the ADA used as collateral, but the protocol’s design aims to keep iUSD’s peg intact.

Do I need to hold INDY to mint iUSD?

No. INDY is only for governance and rewards. Minting iUSD only requires ADA as collateral.

Is there a mobile app for Indigo Protocol?

Currently the UI is web‑based and works in mobile browsers that support Cardano wallets. A native mobile app is in the community backlog.

There are 24 Comments

Schuyler Whetstone

i dont get why everyone is hypeing iUSD its just another over‑collateralized token dont be fooled its got the same risks as any other stablecoin and the fees are still there

Kaitlyn Zimmerman

i think it’s cool that iUSD brings cheap swaps to cardano it can help new users get into defi without paying eth gas fees also the buy‑to‑burn model is an interesting way to keep the peg stable

Devi Jaga

yeah sure, another synthetic token leveraging ada as collateral while pretending to be revolutionary – the same old over‑collateralization spiel with a dash of “buy‑to‑burn” hype that probably won’t survive a market dip

Hailey M.

😏 wow, iUSD finally gives us cheap trades on cardano 🙄 – can’t wait to see the peg hold while i’m sipping coffee ☕️

Carolyn Pritchett

iusd’s low fees are nice but the liquidity is embarrassingly shallow – you’ll see massive slippage on any decent trade unless they bring big market makers on board

Jason Zila

Minting iUSD is literally a few clicks.

Cecilia Cecilia

The protocol’s audit by iog found no critical vulnerabilities, which is reassuring for early adopters.

lida norman

i love seeing cheap swaps 🎉 but i’m a bit nervous about the liquidation risk 😬

Miguel Terán

i’ve been poking around the indigo docs for a while now and there are a few points worth highlighting that many newcomers tend to overlook

first, the 150% collateralization ratio is not just a safety net but a design choice that directly influences the stability pool’s dynamics

second, because ada’s price can be volatile, users need to monitor their CDPs more closely than they would on eth‑based collaterals

third, the buy‑to‑burn mechanism actually reduces overall system debt, which can help the peg during periods of high demand

fourth, the governance token indy gives holders a say in fee distribution, which can incentivize more active participation in the ecosystem

fifth, the protocol’s fees are routed largely into the B2B pool, meaning that every transaction you make indirectly helps support the peg

sixth, the liquidity‑mining program slated for november will distribute millions of indy to farmers, potentially boosting iusd pools on sundae‑swap and minswa p

seventh, the upcoming ccip bridge to eth could dramatically increase tvl, but it also introduces cross‑chain risk that the community will need to manage carefully

eighth, iusd’s market cap is still tiny compared to dai, so price swings can be outsized when large trades hit the pool

ninth, the stability pool rewards are paid in indy, which means you’re simultaneously earning governance tokens while providing safety

tenth, the protocol’s smart contracts are written in plutus and have undergone a thorough iog audit, yet edge‑case liquidation cascades remain a theoretical concern

finally, for anyone considering minting, remember to keep a buffer above the minimum ratio to avoid unexpected liquidations during sudden ada dips

Shivani Chauhan

The over‑collateralisation model ensures that each iUSD is backed by at least 1.5 × its fiat value in ADA, which provides a solid cushion against price volatility while keeping the peg stable.

Bobby Lind

Exactly! The low‑fee environment means even small traders can experiment without burning their wallets!!!

Katharine Sipio

In summary, iUSD presents a cost‑effective stablecoin solution for Cardano, though its future growth will depend on liquidity incentives and cross‑chain integration.

Shikhar Shukla

While the analysis is thorough, one must also consider the regulatory environment, particularly EU MiCA, which could impose additional compliance burdens on over‑collateralised assets.

Deepak Kumar

Hey folks, if you’re looking to get started, remember to keep an eye on your collateral ratio after each market move – the stability pool will save the peg but you’ll lose the locked ADA if you’re too close to the threshold.

Matthew Theuma

🤔 the philosophical angle here is fascinating – iUSD tries to balance decentralised trust with algorithmic stability, a modern take on the age‑old problem of “what backs money?”

Deborah de Beurs

Look, if you think iUSD is going to dominate, you’re being naive – the whole thing hinges on a few devs and a tiny community. Still, if you love hype, go for it.

Chris Morano

Optimistic outlook aside, the reality is that the protocol needs more robust liquidity to survive long‑term market pressures.

Ikenna Okonkwo

True, and the upcoming bridge could be a game‑changer if executed well, opening doors for cross‑chain arbitrage.

Jessica Cadis

Don’t listen to the naysayers – iUSD is a proud american‑style innovation on cardano and should be supported by every true crypto patriot.

David Moss

Everyone’s talking about iUSD like it’s harmless, but have you considered who’s really pulling the strings? the hidden agenda behind the “buy‑to‑burn” could be a covert token‑price‑manipulation scheme…; i’m just saying…

Pierce O'Donnell

i guess it’s fine, i mean it does what it says, but honestly the market cap is tiny so don’t get your hopes too high.

Vinoth Raja

Yo, the whole iusd thing is just another synthetic on cardano, using ada collateral – it’s cool but watch out for those liquidation cascades, they’re a real pain.

DeAnna Brown

Look, as an american we should proudly back iusd – it’s a step towards financial sovereignty and we need to champion it!

Sara Stewart

Totally agree, the iusd ecosystem is growing fast, and the liquidity mining incentives are a solid reason to add it to your portfolio.

Write a comment

Your email address will not be published. Required fields are marked *