Token Risk Assessment Tool

Assess Your Token's Risk

This tool helps identify red flags in cryptocurrency projects based on the same factors that led to the failure of Matrix SmartChain (MSC). Enter key metrics to calculate the risk level.

Input Key Metrics

Risk Assessment Results

When you hear the name Matrix SmartChain, you might picture a next‑gen blockchain that’s shaking up DeFi. In reality, MSC is a token that tried to launch on the BNB Smart Chain in 2024, promised low fees and fast proof‑of‑stake (PoS) transactions, but has since faded into near‑zero value. This article breaks down what MSC actually is, how its ecosystem was supposed to work, why the market turned against it, and what red flags investors should look for in similar projects.

Defining Matrix SmartChain and the MSC Token

Matrix SmartChain is a blockchain‑focused cryptocurrency project that launched with three advertised pillars: the Matrix chain, the Matrix digital wallet, and the Matrix decentralized exchange (DEX). The native asset, identified by the ticker MSC, was marketed as a utility token for DeFi services on the BNB Smart Chain network.

Technical Blueprint: How the Project Said It Would Operate

The developers claimed the Matrix chain would run a PoS consensus, aiming for energy efficiency and sub‑second block times. In theory, the PoS model lets token holders stake MSC to secure the network while earning rewards. The promised Matrix digital wallet was meant to be a self‑custody app for storing MSC and other BEP‑20 tokens, and the Matrix DEX would let users swap assets without a central intermediary.

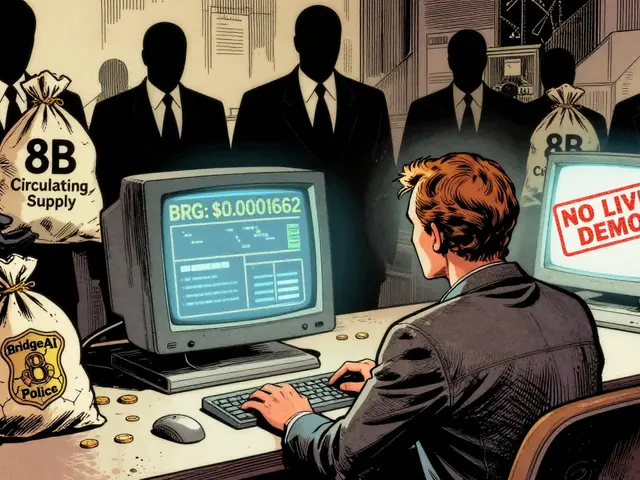

Tokenomics on Paper vs. Reality

On paper, MSC had a fixed supply of 120million tokens, a design meant to create scarcity. However, tracking sites reported a circulating supply of 0 MSC, meaning no tokens were actively tradeable. The discrepancy between a static total supply and a nonexistent circulating supply raised immediate questions about liquidity and whether the token ever left its smart contract.

| Metric | Value |

|---|---|

| Total Supply | 120,000,000 MSC |

| Circulating Supply | 0 MSC |

| All‑Time High Price | $2.01 (Sept272024) |

| Current Price | ≈ $0.0000000000 (Coinbase) |

| Market Cap | ≈ $0 (multiple trackers) |

| 24‑Hour Volume | $0 |

| Rank | #8,372 (CoinMarketCap) |

Where MSC Was Listed and Why It’s Hard to Trade

Despite its low activity, MSC appeared on several exchange interfaces:

- Binance listed the token on its Web3 Wallet page, suggesting spot trading could be done via a decentralized gateway.

- Coinbase displayed MSC with a price of essentially zero, reflecting a lack of liquidity.

- Bitget also featured MSC, promoting “Learn2Earn” and “Assist2Earn” programs that promised rewards for holding the token.

Community Presence - The Silent Warning Sign

One of the strongest indicators of a project’s health is its community. Searches of Reddit, Discord, and Twitter turn up almost nothing for MSC. There are no active subreddits, no official Discord server with members, and no recent social media posts from the development team. This vacuum suggests the project never built a user base, and it also makes it hard to verify claims or get support.

Risk Assessment: Why MSC Is Considered a Red Flag

Investors should treat MSC as a textbook example of high‑risk crypto exposure. The main red flags include:

- Zero circulating supply despite a fixed total supply.

- Complete price collapse from $2.01 to effectively $0 within a year.

- No verifiable development updates or roadmap progress since launch.

- Lack of any community or social media engagement.

- Conflicting price data across tracking platforms, indicating poor market transparency.

These factors align with patterns seen in abandoned or fraudulent tokens, where the initial hype is followed by a swift disappearance of value.

Comparing MSC to More Established PoS Networks

While MSC advertised PoS benefits, established PoS blockchains such as Ethereum, Cardano, and the native BNB Smart Chain itself deliver similar or better scalability with active developer ecosystems. Below is a quick side‑by‑side glimpse:

| Feature | MSC | BNB Smart Chain | Ethereum (PoS) |

|---|---|---|---|

| Launch Year | 2024 | 2020 | 2022 (PoS) |

| Total Supply (native token) | 120M MSC | Uncapped BNB | Uncapped ETH |

| Active Validators | 0 (no data) | ≈ 1,200 | ≈ 600 |

| Daily Tx Volume | $0 | ≈ $1B | ≈ $25B |

| Community Size | None | Millions | Millions |

The contrast is stark: MSC offers none of the network effects or active participation that give established PoS chains real utility.

Future Outlook - Is There Anything Left to Hope For?

As of October2025, there are no announced roadmaps, no code commits on public repositories, and no official statements from the founding team. Some price‑prediction sites still post optimistic numbers (e.g., $0.49-$0.52 by 2032), but those forecasts ignore the fundamental absence of circulating tokens and market activity. Until a clear development plan and token release emerge, MSC remains effectively dead.

Key Takeaways for Investors

- Always verify circulating supply before buying; a token with zero supply cannot be traded.

- Check for active community channels-no members usually means no support or updates.

- Cross‑reference price data on multiple reputable platforms; large discrepancies are warning signs.

- Be skeptical of projects that promise a full ecosystem (chain, wallet, DEX) but have no working demos.

- Prioritize tokens that are listed on exchanges with genuine liquidity and transparent on‑chain metrics.

Frequently Asked Questions

What does MSC stand for?

MSC is the ticker symbol for the Matrix SmartChain token, the native cryptocurrency of the Matrix SmartChain project.

Is MSC still tradable on major exchanges?

No. All major price trackers show a 24‑hour volume of $0 and a circulating supply of 0, meaning there are effectively no tradable MSC tokens on Binance, Coinbase, or Bitget.

Why did MSC’s price drop to zero?

The drop stems from a combination of zero circulating supply, lack of liquidity, and an apparent abandonment of the project. Without tokens in users’ wallets, markets cannot trade, driving the price to effectively zero.

Can I stake MSC to earn rewards?

Staking was advertised, but because no MSC tokens are circulating, there are no staking contracts to interact with, so earning rewards is not possible at this time.

Is MSC a scam?

While we cannot label any project without legal proof, MSC exhibits classic red flags of a potentially fraudulent or abandoned token: zero supply, no community, no active development, and a total loss of value for early investors.

There are 15 Comments

Brandon Salemi

MSC is a textbook case of hype without substance.

Leynda Jeane Erwin

Reading through this breakdown, one cannot help but notice the stark contrast between the project's lofty promises and its stark realities. The author does a solid job highlighting the red flags, especially the zero circulating supply, which should alarm any prudent investor. While the technical ambitions sounded impressive on paper, the lack of demonstrable progress undermines credibility. In short, if you’re eyeing MSC, treat it with the same caution you’d reserve for any dubious pump-and-dump scheme.

Siddharth Murugesan

Ok i guess the whole thing was a joke, zero supply and all. No dev updates, no community-just dead air. Looks like a classic rug pull to me.

Hanna Regehr

The risk assessment tool you included is actually pretty handy for quick sanity checks. Spotting a zero circulating supply early can save you from sinking funds into a phantom token. I also appreciate the side‑by‑side comparison with established PoS chains; it drives the point home. For anyone still curious about MSC, think of this article as a cautionary checklist rather than a recommendation.

Orlando Lucas

When we dissect projects like Matrix SmartChain, the first thing that jumps out is the mismatch between their marketing hype and the on‑chain data. The article correctly points out the zero circulating supply, which is a fundamental red flag-no tokens in users’ wallets means no real market activity. Moreover, the promised ecosystem of a chain, wallet, and DEX never materialized into any usable product, which suggests either severe mismanagement or outright deception. The listed price on Coinbase being effectively zero further underscores the lack of liquidity; you can’t trade what isn’t there. Community silence is another glaring warning sign-no Discord, no Reddit chatter, and social media accounts that have gone ghost. A healthy project thrives on community engagement, so the vacuum here is telling. Development activity is similarly nonexistent; without code commits or roadmap updates, there’s no evidence of ongoing work. Comparing MSC to established PoS networks like BNB Smart Chain or Ethereum highlights the disparity in active validators, transaction volume, and user base. Those networks benefit from network effects, whereas MSC offers none. The tokenomics claim of a fixed 120 million supply is meaningless when the circulating supply stays at zero, effectively removing any scarcity dynamics. Investors should also be wary of the “Learn2Earn” and “Assist2Earn” programs touted by exchanges, which often serve as marketing fluff without substance. In short, MSC ticks every box of a high‑risk, potentially fraudulent token: zero supply, no community, absent development, and a collapsed price. The article’s risk‑assessment framework is solid, but the underlying data tells a clear story-stay far away unless you’re looking to study a cautionary tale. Finally, the absence of any official statements from the founding team as of late 2025 cements the consensus that MSC is essentially dead, and any optimistic price predictions are purely speculative fiction.

Jade Hibbert

Wow, that was a marathon-thanks for the deep dive, but honestly, who even cares about a dead token?

Leo McCloskey

From a technical standpoint, the absence of validators renders MSC a non‑entity within the PoS paradigm; without staking, you have no consensus. Consequently, the token fails to meet basic decentralization criteria. The article's juxtaposition with legitimate chains is a welcome reality check.

Anjali Govind

That comparison really hits home. While MSC sounds impressive on a press release, the lack of community engagement is a glaring omission. In crypto, a silent Discord often means silent wallets-no one is using it, and no one is buying it. It’d be interesting to see if any developers ever pushed a testnet, but the article suggests otherwise. Overall, it’s a solid reminder to dig beyond the hype.

Ben Parker

🤔 MSC looks like a ghost token-nothing to see here! 🚫💸

Lena Vega

Zero supply, zero volume, zero hope.

Mureil Stueber

The risk tool you shared is simple yet effective; quick checks like these can save a lot of trouble. Thanks for the clear layout.

Emily Kondrk

Honestly, I think there’s a covert agenda behind promoting dead tokens like MSC-maybe a siphoning scheme? The whole ecosystem feels like a meme, yet the colors and branding are too polished to be random. It’s as if someone wanted to create a perfect case study for a future “how not to invest” lecture. The absence of any community chatter is suspiciously engineered, like a staged quiet before a storm that never arrives. Keep an eye out for hidden wallets moving funds under the radar.

Annie McCullough

People love to dump hype on MSC like it’s the next Bitcoin while ignoring the fundamental metrics-supply, liquidity, and community. Such tokenomics are quintessentially speculative.

Daron Stenvold

While your contrarian stance on MSC is noted, the analytical framework you employ remains solid. The paucity of verifiable data justifies a cautious posture. Nonetheless, the dramatic narrative surrounding any token should be tempered with empirical scrutiny. In essence, the evidence aligns with a high‑risk classification.

hrishchika Kumar

From a cultural perspective, projects that vanish without a trace erode trust in the broader crypto space. It’s a lesson in how community building is as crucial as tech development. Let’s hope future initiatives learn from MSC’s missteps.

Write a comment

Your email address will not be published. Required fields are marked *