Bitcoin DeFi: How Bitcoin Powers Decentralized Finance

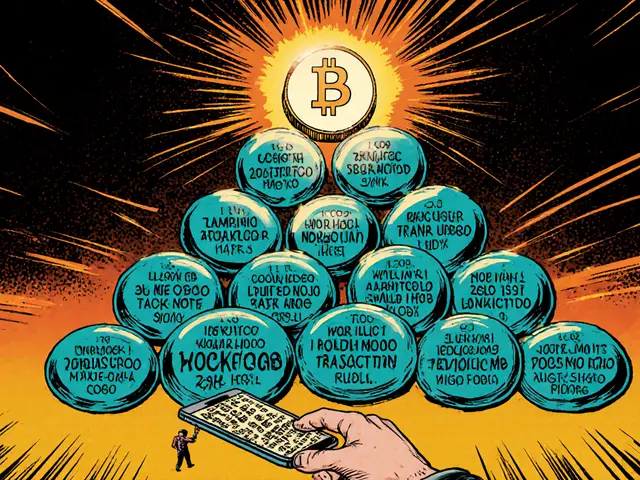

When you think of Bitcoin DeFi, the use of Bitcoin in decentralized finance protocols that allow lending, borrowing, and earning without banks. Also known as DeFi on Bitcoin, it’s the quiet revolution happening beneath the surface of Bitcoin’s price charts. For years, Bitcoin was seen as digital gold—something to hold, not to use. But that’s changing. Now, people are using Bitcoin to earn interest, trade assets, and access loans—all without giving up control of their coins. This isn’t Ethereum-style DeFi. It’s Bitcoin, but smarter, safer, and built on top of its network.

Bitcoin Layer 2, networks built on top of Bitcoin that enable faster, cheaper transactions and smart contract functionality. Also known as Bitcoin scaling solutions, it’s what makes this possible. Projects like Lightning Network and Rootstock (RSK) let developers build apps that interact with Bitcoin without overloading the main chain. These aren’t sidechains—they’re extensions that keep Bitcoin’s security while adding new features. You can now lock your BTC in a smart contract on a Layer 2 and get a loan in stablecoins, or trade BTC for other assets with near-instant settlement. No centralized exchange needed. No KYC. Just your private key and a protocol.

And it’s not just about trading. Bitcoin wallets, software or hardware tools that let you store, send, and manage Bitcoin and interact with DeFi protocols. Also known as non-custodial Bitcoin wallets, it’s the gateway to this new world. You don’t need to move your BTC off-chain to participate. Modern wallets like Phoenix, BlueWallet, and Ledger Live now connect directly to Bitcoin DeFi apps. You sign transactions with your key. You control everything. And if you’re careful, you avoid the scams and rug pulls that plague other crypto spaces.

Some still say Bitcoin can’t do DeFi. They’re wrong. It’s slower to build, yes. But it’s more secure. More predictable. More resistant to collapse. The DeFi happening on Bitcoin isn’t flashy. It doesn’t have meme coins or 1000x returns. But it’s real. It’s growing. And it’s built to last.

Below, you’ll find clear breakdowns of the tools, tokens, and protocols making Bitcoin DeFi work today—from Layer 2 networks that handle millions in value, to wallets that let you earn interest on your BTC, to tokens that give you exposure to Bitcoin without moving it. Some are well-known. Others are quiet giants. All of them are worth understanding if you want to use Bitcoin as more than just a savings account.