BitSwap v3 isn’t another big-name crypto exchange like Binance or Coinbase. It doesn’t have millions in daily volume, flashy marketing, or a team of celebrities endorsing it. But if you’re trading within the BounceBit ecosystem, it might be one of the only places you can actually do it.

Launched in 2024, BitSwap v3 is a niche decentralized exchange built specifically for the BounceBit network. It’s not trying to be everything to everyone. It’s trying to be the go-to spot for BBTC and WBB tokens. That’s it. And for some traders, that’s enough.

What You Can Actually Trade on BitSwap v3

Right now, BitSwap v3 supports just three coins and three trading pairs. The most active one? BBTC/WBB. That’s not a typo. This exchange is built around the BounceBit token ecosystem. BBTC is the native token, and WBB is its wrapped version-designed to work across different chains. If you’re holding either of these, you’ll need BitSwap v3 to trade them.

There’s no ETH, no SOL, no DOGE here. If you’re looking to swap Bitcoin for Ethereum, you’re on the wrong platform. But if you’re deep into BounceBit’s layer-2 staking or bridging mechanics, this exchange is your only real option. It’s like a specialty coffee shop that only sells one roast-but if that’s your favorite, you’ll drive across town for it.

Trading Volume and Liquidity: Small, But Not Dead

On January 1, 2026, BitSwap v3’s 24-hour trading volume sat at $59,250.71. That’s down 17.5% from the day before. That kind of drop might sound alarming, but context matters.

Compare that to top exchanges: Binance handles over $10 billion daily. Even smaller DEXs like Uniswap V3 trade over $100 million. BitSwap v3’s volume is tiny. But here’s the thing-it’s not supposed to compete with them. It’s designed for a small, focused community. The fact that it’s still moving $50k+ daily after just over a year suggests there’s real, consistent demand inside the BounceBit ecosystem.

Liquidity is thin. The average bid-ask spread is 0.606%. That’s higher than what you’d see on major exchanges (often under 0.1%), but normal for a small DEX. If you’re trading small amounts-under $500-it won’t kill you. But if you’re trying to move $10,000 in a single order, you’ll feel the slippage. This isn’t a platform for large traders.

No Margin, No Market Makers, No Frills

BitSwap v3 doesn’t offer margin trading. No leverage. No shorting. No futures. If you’re looking to amplify your gains-or losses-you’ll need another platform.

There are also no market-making fees. That means no incentives for bots to provide liquidity. The platform relies on organic user trading. That’s risky. If the community shrinks, liquidity dries up fast. But it also means no hidden fees or complex incentive structures. What you see is what you get: simple swaps, no tricks.

This simplicity is both a strength and a weakness. It’s easy to use. No confusing tabs. No confusing fee tiers. But it also means there’s no safety net if things go sideways. No automated liquidity pools backed by big funds. Just users trading with each other.

Security and Trust: Limited Data, But Some Legitimacy

Here’s the biggest question: Is BitSwap v3 safe?

We don’t know who built it. No team page. No LinkedIn profiles. No whitepaper with detailed audits. That’s a red flag for many. But here’s what we do know: it’s listed on CoinGecko. That’s not a guarantee of safety, but it’s a sign that someone outside the project is monitoring it. CoinGecko doesn’t just add any random site-they check for basic data integrity, volume consistency, and API access.

It’s also indexed by FxVerify, a financial review platform. Again, not a seal of approval, but it means someone’s trying to track it. No major hacks reported. No user complaints flooding Reddit or Twitter. That’s not proof of security, but it’s not a warning sign either.

For now, treat it like a small, private bank. It’s not FDIC-insured. It’s not regulated. But if you trust the team behind BounceBit-and you’re only putting in what you can afford to lose-it might be fine. Never store large amounts here. Use it as a bridge, not a vault.

Who Is This Exchange For?

BitSwap v3 isn’t for beginners. It’s not for people who want to buy Bitcoin with a credit card. It’s not for investors looking for the next big moonshot.

It’s for three types of people:

- Those who hold BBTC or WBB and need to trade them.

- Stakers in the BounceBit ecosystem who want to rebalance their positions without leaving the network.

- Early adopters who believe in BounceBit’s long-term vision and want to support the protocol by using its native tools.

If you fall into one of those groups, BitSwap v3 is worth trying. If you’re just browsing for the best exchange to trade altcoins? Keep looking.

The Bottom Line: Niche, Not General

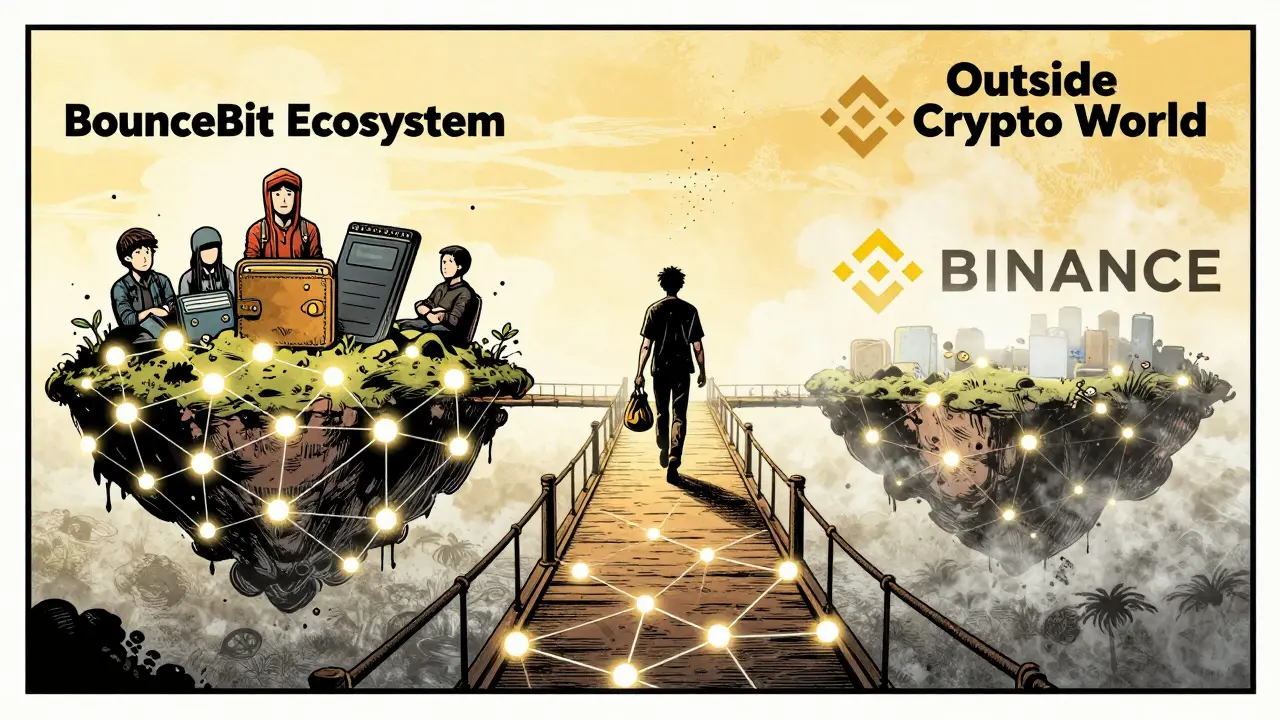

BitSwap v3 is not a competitor to Coinbase or Kraken. It doesn’t need to be. It’s a specialized tool for a specific community. Its low volume, thin liquidity, and lack of features aren’t flaws-they’re by design.

It’s like a single-lane bridge connecting two islands. It won’t handle traffic from a highway, but if you’re one of the few people who need to cross, it gets the job done.

Right now, BitSwap v3 is a quiet, unassuming exchange. No hype. No ads. Just a simple interface and one real use case. If the BounceBit ecosystem grows, so will this exchange. If it fades, so will BitSwap v3.

For now, it’s a tool for insiders. Not a place for outsiders.

Is BitSwap v3 a scam?

There’s no evidence BitSwap v3 is a scam. It’s listed on CoinGecko, has consistent trading data, and no major security incidents have been reported. But it’s also not transparent about its team or audits. Treat it like any small DeFi platform: only use what you can afford to lose, and never store large amounts long-term.

Can I trade Bitcoin or Ethereum on BitSwap v3?

No. BitSwap v3 only supports three coins: BBTC, WBB, and one other token tied to the BounceBit network. If you want to trade Bitcoin, Ethereum, or any major cryptocurrency, you’ll need to use a different exchange like Uniswap, KuCoin, or Binance.

Does BitSwap v3 have a mobile app?

As of January 2026, BitSwap v3 does not have a dedicated mobile app. You can access it through your browser on a phone, but there’s no official iOS or Android application. Always use a secure wallet like MetaMask and avoid public Wi-Fi when trading.

Is BitSwap v3 available in my country?

There’s no official list of supported countries. Since it’s a decentralized exchange with no KYC, it’s technically accessible from anywhere. But if you’re in a heavily regulated region like the U.S., EU, or Australia, you should check local laws around using non-KYC DeFi platforms. Some jurisdictions treat them as unlicensed financial services.

What are the fees on BitSwap v3?

BitSwap v3 doesn’t charge market-making fees or trading fees beyond standard blockchain gas costs. That means you pay only the network fee (like Ethereum or BSC gas) to execute your trade. There are no hidden platform fees. But because liquidity is low, you may experience higher slippage, which effectively increases your cost.

How does BitSwap v3 compare to Uniswap?

Uniswap supports thousands of tokens, has billions in daily volume, and deep liquidity pools. BitSwap v3 supports three tokens, has under $60k daily volume, and thin liquidity. Uniswap is a general-purpose DEX. BitSwap v3 is a niche tool. If you’re trading BBTC, BitSwap v3 is your only option. For everything else, Uniswap is far superior.

If you’re already invested in the BounceBit ecosystem, BitSwap v3 is your natural next step. If you’re just exploring crypto, skip it. There are better, safer, and more liquid options out there. But if you’re deep in the BounceBit world? This exchange might be the quiet engine keeping it alive.

There are 26 Comments

Shawn Roberts

Abhisekh Chakraborty

dina amanda

Emily L

Gavin Hill

SUMIT RAI

Andrea Stewart

Josh Seeto

surendra meena

Kevin Gilchrist

Khaitlynn Ashworth

NIKHIL CHHOKAR

Mike Pontillo

Joydeep Malati Das

rachael deal

Elisabeth Rigo Andrews

Adam Hull

Johnny Delirious

Bianca Martins

alvin mislang

Monty Burn

Kenneth Mclaren

Alexandra Wright

Jack and Christine Smith

Prateek Chitransh

Shawn Roberts

Write a comment

Your email address will not be published. Required fields are marked *