CFTC Crypto Exchange: What You Need to Know About Regulation and Safe Platforms

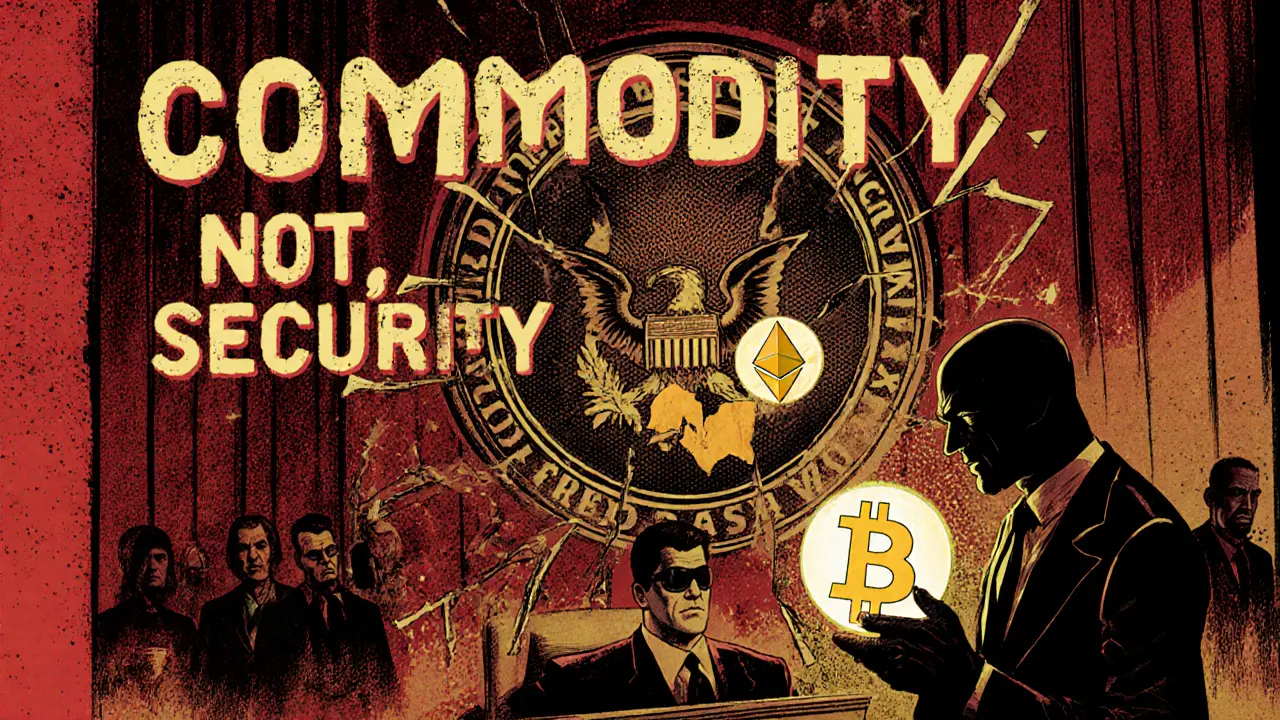

When you trade crypto on a platform in the U.S., you’re not just dealing with price charts—you’re dealing with CFTC crypto exchange, a regulated financial market entity overseen by the Commodity Futures Trading Commission. Also known as a futures-compliant crypto platform, it’s the only kind that’s legally allowed to offer derivatives like futures and options on digital assets without breaking federal law. The CFTC doesn’t approve every exchange, but it does draw the line on fraud, market manipulation, and unregistered trading. If a platform doesn’t answer to the CFTC, it’s not just risky—it’s potentially illegal.

That’s why you’ll see posts here about WhiteBIT, a Europe-focused exchange with strong compliance practices, and why others like Buff Network, an untracked platform with zero transparency, get flagged as dangerous. The CFTC doesn’t care if a site looks slick or promises high returns. It cares if it’s registered, audited, and accountable. Platforms like FREE2EX, based in Belarus, or MaskEX in the UAE, fly under the radar because they avoid U.S. jurisdiction—but that doesn’t make them safe. It just means you’re on your own if things go wrong.

The CFTC’s role isn’t just about stopping scams. It’s about making sure exchanges have real security, clear fee structures, and proper KYC. That’s why you’ll find reviews here on exchanges that actually follow rules, not just hype. If a site doesn’t mention CFTC compliance, it’s probably not built for long-term use. You don’t need to trade futures to care about this. Even if you’re just buying Bitcoin, you want your exchange to be held to standards—not left to the wild west.

What you’ll find in this collection aren’t guesses or opinions. These are real reviews of platforms that either passed scrutiny—or got exposed for skipping it. You’ll see how a crypto exchange’s location, licensing, and transparency directly affect your risk. You’ll learn why some platforms disappear overnight while others stick around because they play by the rules. And you’ll see how the CFTC’s actions—like cracking down on unregistered derivatives—ripple through the whole market.