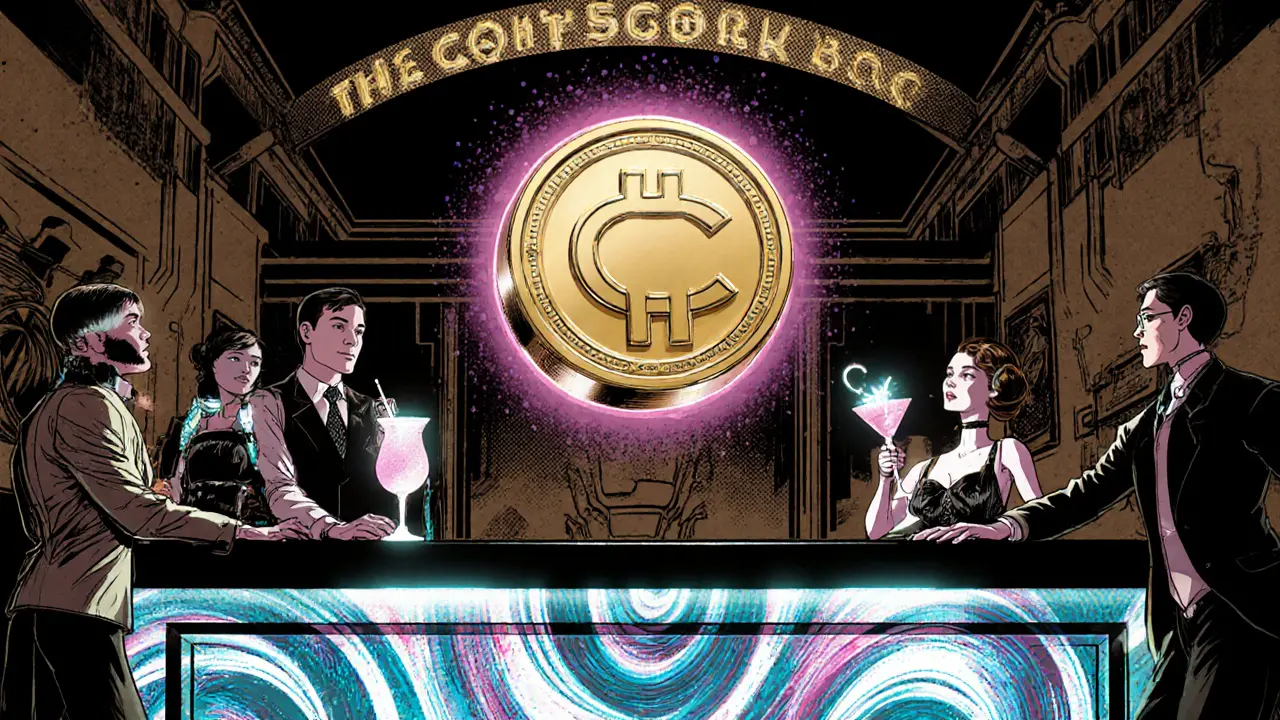

The CocktailBar (COC) Crypto Coin Explained - Token Details, Market Data & Risks

A plain‑English guide to The CocktailBar (COC) crypto coin: token basics, market data, utility, governance, risks and FAQs.

Read MoreWhen working with CocktailBar COC token, a community‑driven DeFi asset built on the Binance Smart Chain that powers the CocktailBar ecosystem. Also known as COC, it enables holders to vote on platform upgrades, earn staking rewards, and access exclusive liquidity pools. The token combines governance, yield, and brand identity in one package, making it a solid entry point for both newcomers and seasoned traders.

COC token, the underlying utility token behind CocktailBar requires staking to unlock its full benefit suite. Stakers receive a share of transaction fees, which translates into a steady passive income stream. This staking mechanism creates a direct link between token demand and network security, a core principle of most DeFi tokens. Meanwhile, the airdrop, a free distribution event for early community members introduces liquidity and broadens the user base, allowing the token to gain traction quickly. Together, these elements form a cycle: airdrop fuels adoption, adoption boosts staking, and staking reinforces token value.

The CocktailBar COC token encompasses governance rights, letting holders submit proposals and vote on protocol changes. This governance layer ties directly to the DeFi token, any digital asset used for decentralized finance activities such as lending, borrowing, or liquidity provision. By holding COC, users can participate in liquidity mining programs that feed into decentralized exchanges, enhancing market depth and reducing slippage. Additionally, the token supports cross‑chain bridges, enabling seamless movement of assets between BSC and other chains—an essential feature for users seeking arbitrage opportunities.

From a technical standpoint, the COC token follows the BEP‑20 standard, which ensures compatibility with most wallets and DEXs. Its tokenomics allocate 40% to community rewards, 30% to liquidity, 20% to development, and 10% to the founding team, a split designed to balance growth and sustainability. The tokenomics, the economic design governing supply, distribution, and incentives are transparent and audited, reducing the risk of hidden minting. This transparency influences investor confidence, a factor that often determines a token’s long‑term success.

Looking ahead, the CocktailBar team plans to roll out a NFT marketplace where COC will serve as the primary payment method. This future integration illustrates how a DeFi token can evolve into a broader ecosystem utility, linking finance, gaming, and social experiences. As the ecosystem expands, the airdrop alumni will likely become early adopters of new features, reinforcing the token’s network effect.

Below you’ll find a curated collection of articles that dive deeper into each of these topics—from detailed tokenomics breakdowns and staking strategies to step‑by‑step airdrop claim guides. Use them to sharpen your understanding, plan your participation, and stay ahead of the latest CocktailBar developments.

A plain‑English guide to The CocktailBar (COC) crypto coin: token basics, market data, utility, governance, risks and FAQs.

Read More