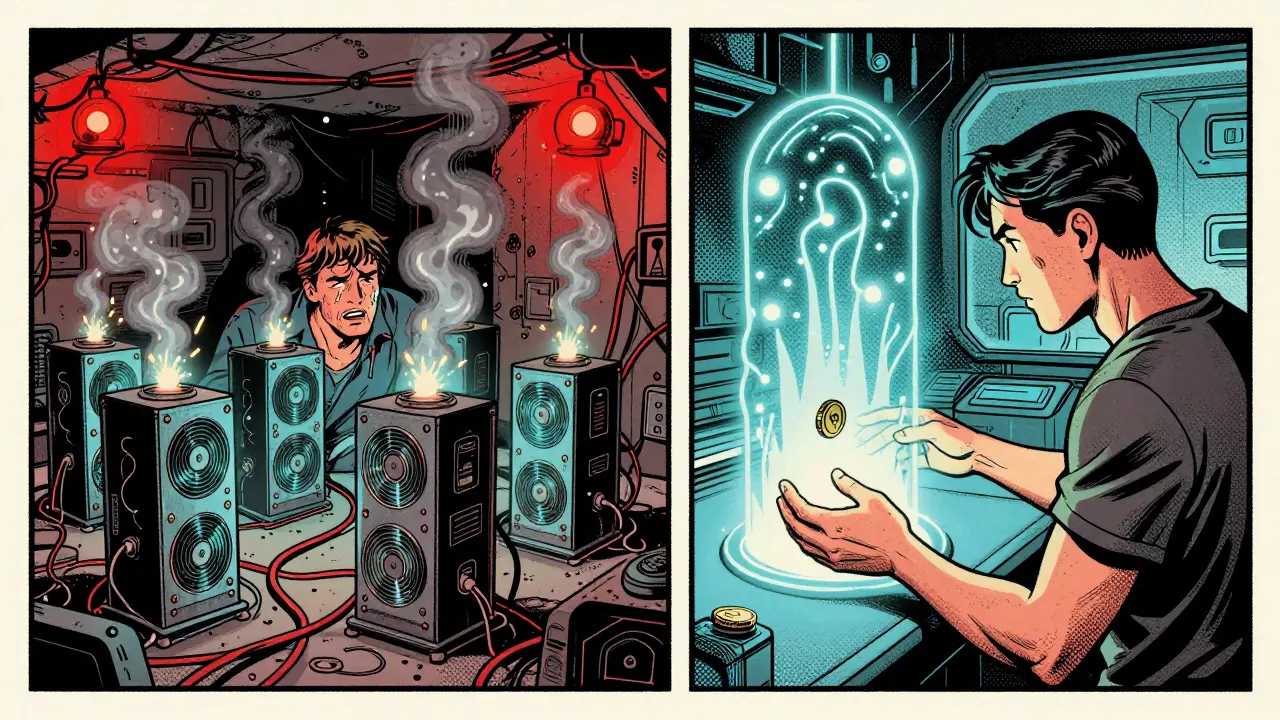

How Ethereum Moved from Mining to Staking - And Why It Matters

Ethereum switched from energy-heavy mining to eco-friendly staking in 2022. Learn how staking works, how much you need to start, and why it's better than mining for most users.

Read MoreWhen you stake crypto staking, the process of locking up cryptocurrency to help secure and validate transactions on a proof-of-stake blockchain. Also known as staking your coins, it’s how networks like Ethereum, Solana, and Cosmos keep running without miners. Instead of using electricity to solve math problems, you lock your tokens in a wallet or pool—and in return, you get paid. It’s like earning interest, but for helping the network stay safe and fast.

Proof-of-stake, the consensus mechanism that replaces mining and relies on token holders to verify transactions is the engine behind most modern blockchains. It’s faster, cheaper, and greener than Bitcoin’s old-school mining. But not all staking is the same. Some networks let you stake directly from your wallet. Others require you to join a staking pool, a group of users who combine their tokens to increase chances of earning rewards. Then there are validator rewards, the actual payments you receive for running a node and confirming blocks—which can vary based on how many people are staking, how long you lock your coins, and whether the network penalizes you for going offline.

Some people think staking is risk-free. It’s not. You can lose rewards if your validator gets slashed for misbehavior. Some platforms lock your tokens for weeks or months—you can’t sell them if the price crashes. And if you stake through an exchange, you’re trusting them with your keys. That’s why some posts here warn about shady tokens promising 100% APY—those aren’t staking, they’re scams. Real staking happens on transparent, live blockchains with clear rules.

What you’ll find below aren’t just generic staking guides. These are real breakdowns: how validator economics actually work on Ethereum and Solana, why some staking pools pay more than others, and what happens when a network changes its reward structure. You’ll see what went wrong with fake projects that pretended to offer staking, and how real ones like Cosmos or Polygon keep their users paid. There’s no fluff—just what you need to know before you lock up your coins.

Ethereum switched from energy-heavy mining to eco-friendly staking in 2022. Learn how staking works, how much you need to start, and why it's better than mining for most users.

Read More