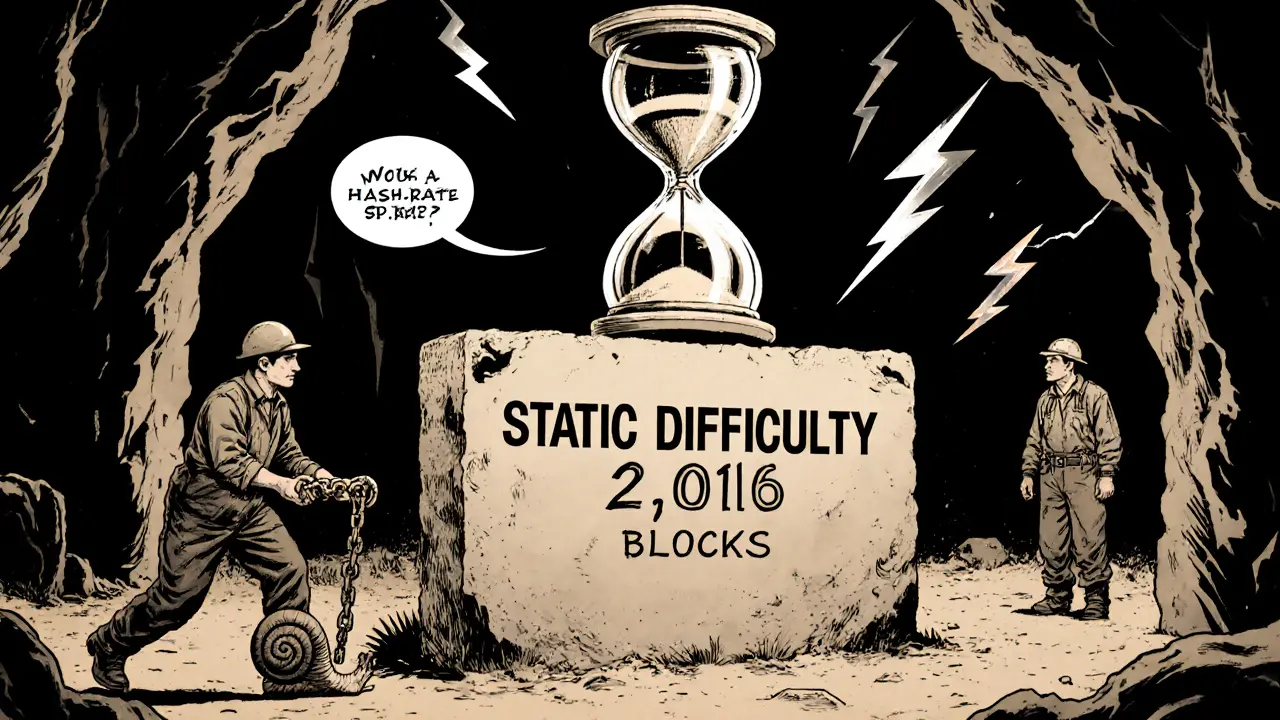

How Hash Rate Impacts Bitcoin Mining Difficulty - A Complete Guide

Explore how Bitcoin's hash rate drives mining difficulty adjustments, the math behind it, and what it means for miners, security, and future network changes.

Read MoreWhen talking about cryptocurrency mining, the process of securing a blockchain by solving complex math puzzles and adding new blocks to the ledger. Also known as crypto mining, it powers networks like Bitcoin and Ethereum (while they were on proof‑of‑work). The backbone of modern crypto mining is the ASIC miner, a specialized chip built to hash at high speed with low power draw, which replaced generic GPUs for most profitable operations. Proof‑of‑Work, the consensus algorithm that requires miners to perform computational work to validate transactions defines the security model, while a mining pool, a group of miners who combine hash power and share rewards proportionally lets smaller operators earn steadier payouts. Together these elements shape the ecosystem you’ll see in the articles below.

Choosing the right hardware is the first decision most miners face. In 2025 the market is dominated by models like the Antminer S21e and the newer hydro‑cooled rigs that push efficiency beyond 140 J/TH. Hydro cooling not only trims electricity bills but also extends hardware lifespan, a fact highlighted in our "Top Bitcoin Mining Hardware Picks for 2025" guide. When you plug these numbers into a profit calculator, you’ll see that energy cost is the single biggest variable – a 10 % change in kilowatt‑hour price can flip a profitable run into a loss. That’s why many operators now locate farms in regions with cheap renewable power or natural cooling, turning the energy‑consumption‑profitability triangle into a strategic advantage.

Beyond the machines, how you connect to the blockchain matters. Mining pools like Slush Pool or F2Pool aggregate hash power, smooth out variance, and often provide fee discounts for high‑volume contributors. However, pool fees and payout structures differ, so you’ll want to compare fee percentages, minimum payout thresholds, and the pool’s track record for uptime. For solo miners, the alternative is higher variance but full reward ownership – a path best suited for those with massive hash power or who enjoy the thrill of hunting for a block on their own.

Finally, regulatory and environmental factors are hard to ignore. Countries such as Algeria and Nigeria have imposed bans or strict licensing rules that affect where you can set up a farm. On the flip side, regions offering tax incentives for renewable‑energy‑backed mining are booming. Understanding these dynamics helps you avoid costly shutdowns and positions you to benefit from government‑backed sustainability programs.

All this context sets the stage for the deep‑dive articles you’ll find below. Whether you’re sizing up the latest ASIC, figuring out how to slash energy use, or navigating pool selection, the collection gives you practical steps and real‑world examples to make your cryptocurrency mining venture more informed and profitable.

Explore how Bitcoin's hash rate drives mining difficulty adjustments, the math behind it, and what it means for miners, security, and future network changes.

Read More

Explore how adaptive mining difficulty will reshape blockchain security, energy use, and miner profitability. Learn the tech, benefits, challenges, and adoption timeline for this next‑gen consensus tool.

Read More