How P2P Technology Evolved Within Blockchain Systems

Explore how peer-to-peer technology evolved from early file-sharing to modern blockchain networks, covering consensus, scaling solutions, and future trends in a clear, concise guide.

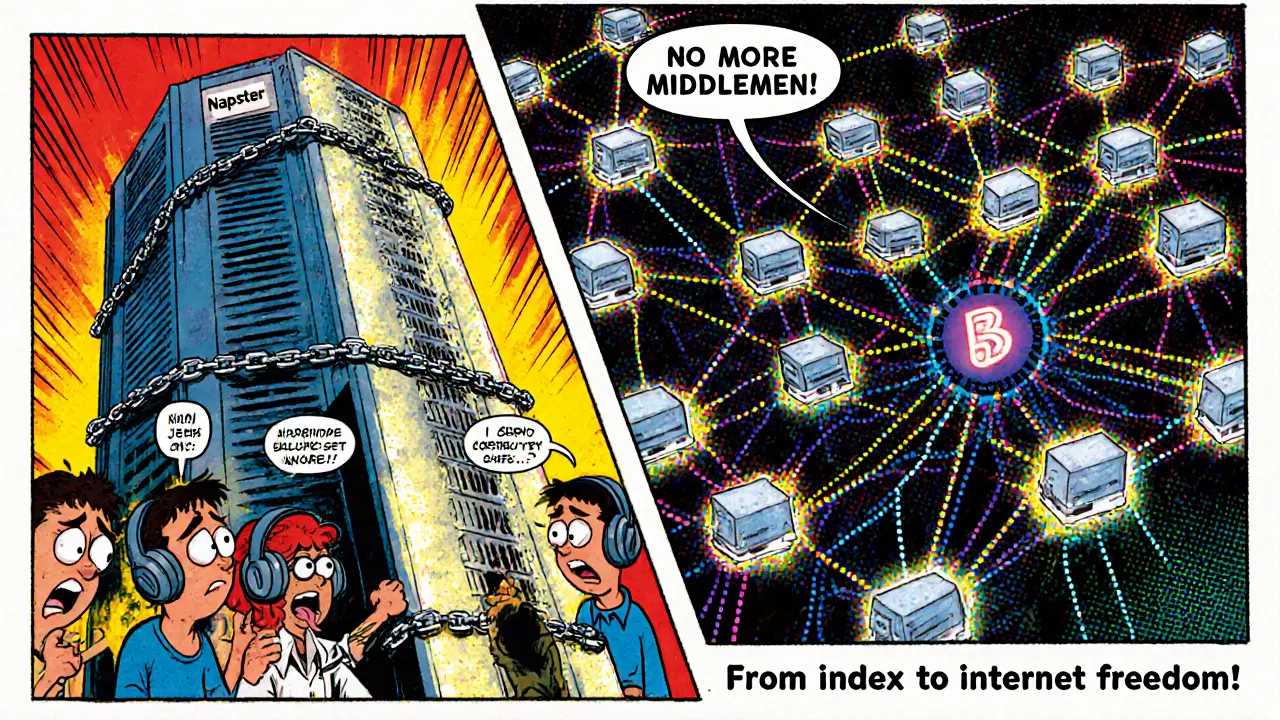

Read MoreWhen working with peer-to-peer evolution, the gradual shift toward direct, trust‑less exchanges in blockchain and finance. Also known as P2P development, it captures how users move assets, share resources, and bypass intermediaries. This movement isn’t just a buzzword; it’s the engine behind many of today’s hottest crypto products.

Decentralized Finance, a suite of financial services that run on blockchain without banks is a core pillar of the peer-to-peer evolution. DeFi protocols let you lend, borrow, and trade without a central ledger, turning every user into a mini‑exchange. The rise of Crypto ETF, an exchange‑traded fund that tracks a basket of crypto assets shows how institutional investors are tapping into this peer‑driven wave. By bundling many tokens into a single tradable product, ETFs lower the barrier for mainstream money to flow into the ecosystem, further accelerating peer‑to‑peer liquidity.

First, P2P trading platforms, online services that match buyers and sellers directly, often using escrow have become the go‑to way to acquire crypto in regions with strict regulations. Nigeria’s underground crypto economy, for example, grew into a billion‑dollar market after the government ban, largely thanks to Binance P2P and similar services. Second, modular blockchain projects like Celestia are redefining data availability, allowing rollups to focus on execution while the base layer handles consensus. This separation makes it easier for developers to launch new P2P applications without rebuilding the entire stack.

Third, the emergence of Decentralized Physical Infrastructure Networks (DePIN) blends real‑world assets with P2P coordination. Helium’s wireless network and Filecoin’s storage market let participants earn tokens by providing physical resources, demonstrating that peer‑to‑peer principles extend beyond pure digital tokens. Finally, regulatory milestones such as Canada’s spot Bitcoin ETF illustrate how trusted custody solutions can coexist with open‑source P2P markets, giving investors a regulated entry point while preserving the ethos of decentralization.

All these threads—DeFi, ETFs, P2P platforms, modular chains, and DePIN—interlock to form a single narrative: peer‑to‑peer evolution is reshaping how value moves, how risk is managed, and how anyone can participate in the global financial system. Below you’ll find a curated collection of guides, analyses, and case studies that dive deeper into each of these angles.

Explore how peer-to-peer technology evolved from early file-sharing to modern blockchain networks, covering consensus, scaling solutions, and future trends in a clear, concise guide.

Read More