Consensus Mechanism Comparison Tool

Compare Blockchain Consensus Mechanisms

Explore the trade-offs between different consensus algorithms used in blockchain technology

Consensus Mechanisms

| Proof of Work (PoW) | Proof of Stake (PoS) | Proof of Authority (PoA) | Delegated Proof of Stake (DPoS) | |

|---|---|---|---|---|

| Security | High | High | Medium | Medium |

| Energy Efficiency | Low (121+ TWh/year) | Very High (99.95% reduction) | Medium | High |

| Throughput (TPS) | ~7 | ~30 (pre-sharding) | High (varies) | ~1,000-3,000 |

How It Works

When people hear “peer‑to‑peer,” they often picture file‑sharing apps from the early 2000s. Yet the real game‑changer came when that model married the cryptographic backbone of blockchain, creating a trust‑less network where strangers can exchange value directly. This article traces the journey from the first academic papers to today’s multi‑layered ecosystems, highlighting the technical leaps, scaling hacks, and what the next decade might look like.

Key Takeaways

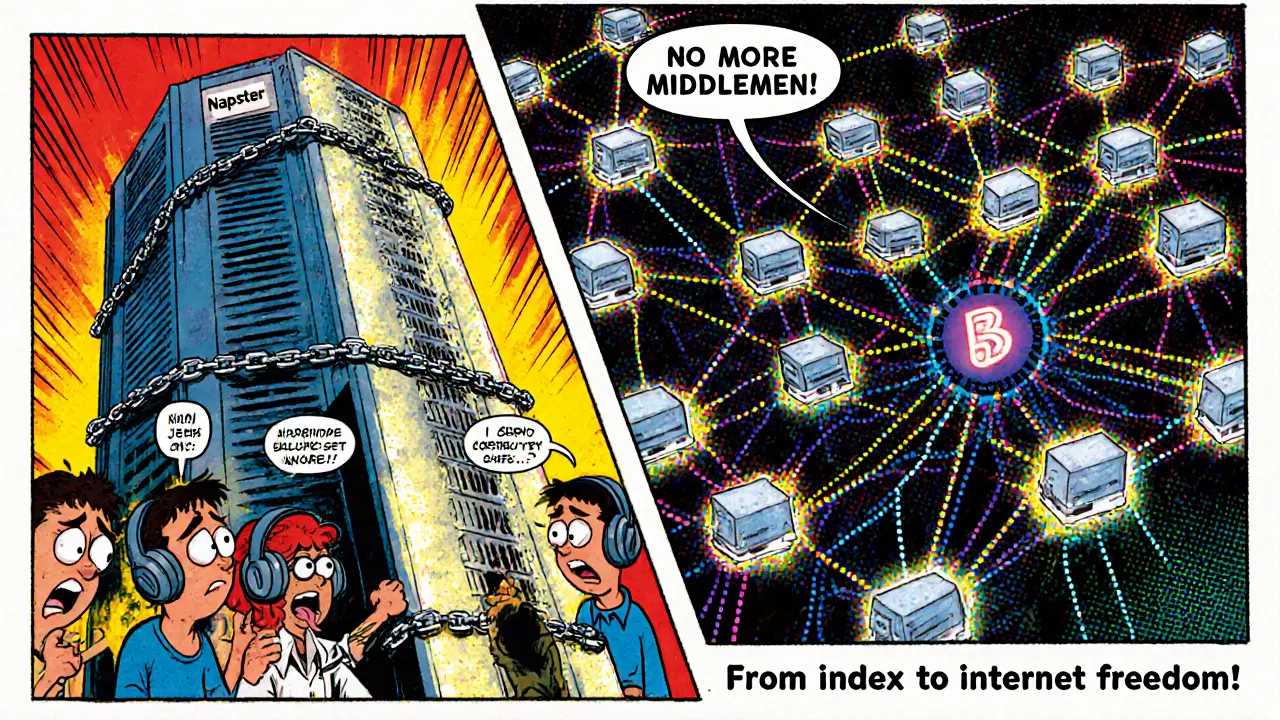

- Early P2P ideas (Napster, BitTorrent) introduced distributed concepts but still relied on central indexes.

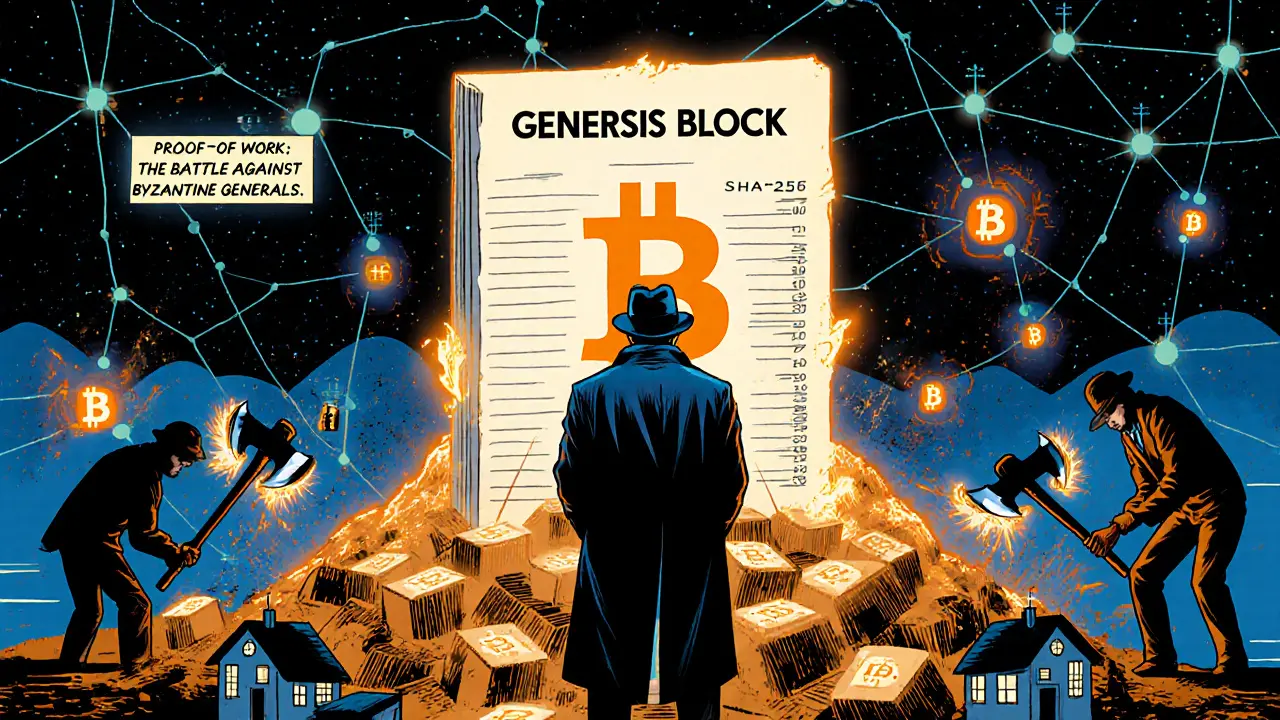

- Satoshi Nakamoto’s 2008 whitepaper turned P2P into a fully trust‑less ledger by solving the Byzantine Generals problem with proof‑of‑work.

- Consensus mechanisms have diversified: PoW, PoS, PoA, and hybrid models each address security, speed, or energy use.

- Scaling solutions-Lightning Network, sharding, and cross‑chain bridges-are extending transaction throughput beyond Bitcoin’s ~7 TPS.

- Future growth hinges on interoperability (Cosmos IBC, Polkadot XCM) and regulatory clarity worldwide.

Peer-to-Peer (P2P) technology in blockchain is a decentralized networking model that enables direct data or value exchange between participants without a central authority. It builds on the classic P2P concepts of the 1990s and layers cryptographic verification, consensus rules, and immutable ledgers to create a trust‑less environment.

From Academic Roots to Early File‑Sharing Networks

The story begins with David Chaum’s 1982 dissertation, which proposed a system where mutually suspicious groups could maintain a shared record. A decade later, Haber and Stornetta introduced a cryptographically chained series of timestamps, and the 1992 addition of Merkle trees made it practical to verify large batches of data with a single hash.

Napster (1999) popularized the idea of millions of computers working together, but its central server for indexing made it vulnerable to legal shutdowns. BitTorrent (2001) pushed the model further, eliminating the index by using distributed hash tables (DHTs). Both proved that massive, resilient networks could be built from ordinary PCs, setting the cultural stage for a truly decentralized vision.

The Bitcoin Breakthrough: Full Decentralization

In 2008, an unknown figure named Satoshi Nakamoto released the Bitcoin whitepaper. By embedding a proof‑of‑work (PoW) puzzle and a difficulty adjustment, Bitcoin solved the Byzantine Generals problem without any trusted third party. The first block-known as the genesis block-was mined on 3 January 2009, and the inaugural transaction (10 BTC to Hal Finney) demonstrated that peer‑to‑peer value transfer could happen securely at scale.

Bitcoin’s network grew to roughly 15,000 public nodes by 2023, each storing a copy of the ledger. The system’s security hinges on SHA‑256 hashing, PoW mining, and the transparent, append‑only chain that makes retroactive tampering virtually impossible.

Beyond Bitcoin: Diversifying Consensus

While PoW proved secure, its energy appetite-over 121 TWh in 2022, comparable to Norway’s consumption-sparked a search for greener alternatives. Ethereum’s 2022 move from PoW to proof‑of‑stake (PoS) slashed energy use by about 99.95 % while preserving security through staked ETH as collateral.

Other consensus flavors have emerged:

- Proof‑of‑Authority (PoA): trusted validators sign blocks, ideal for private consortiums.

- Hybrid models: combine PoW for checkpointing with PoS for day‑to‑day finality (e.g., Decred).

- Delegated Proof‑of‑Stake (DPoS): token holders elect a small set of block producers, boosting throughput (e.g., EOS).

Each approach tweaks the classic P2P model-nodes still talk directly, but the rules that decide which node adds the next block differ.

Scaling the P2P Ledger: From Lightning to Sharding

Bitcoin’s ~7 transactions per second (TPS) starkly contrasts with Visa’s 24,000 TPS. To bridge that gap, developers built off‑chain layers like the Lightning Network, which creates payment channels between parties and settles the net result on‑chain. Users experience near‑instant transfers with fees that drop to fractions of a cent.

Ethereum tackled scalability with sharding-a method that splits the state into multiple “shards,” each processing its own transactions in parallel. The roadmap foresees a multi‑shard mainnet delivering tens of thousands of TPS once fully implemented.

Other ecosystems introduced rollups (Optimistic and ZK‑Rollups) that batch many transactions into a single proof, drastically reducing data stored on the base chain.

Comparative Landscape: Classic P2P vs Blockchain P2P

| Feature | Napster (1999) | BitTorrent (2001) | Bitcoin (2009) | Ethereum (2022 PoS) |

|---|---|---|---|---|

| Indexing | Central server | DHT (decentralized) | Distributed ledger | Distributed ledger |

| Consensus | None | None | Proof‑of‑Work | Proof‑of‑Stake |

| Security model | Vulnerable to server shutdown | Resilient to single point failure | Cryptographic hash + PoW | Staked tokens + PoS |

| Typical throughput | ~200 KB/s (file sharing) | ~5 MB/s (peer upload) | ~7 TPS | ~30 TPS (pre‑sharding) |

| Energy usage | Low | Low | High (PoW) | Very low (PoS) |

The table illustrates how blockchain P2P added a consensus layer, cryptographic guarantees, and a native token economy-features absent from classic file‑sharing networks.

Real‑World Use Cases and Pain Points

Cross‑border remittances showcase blockchain’s strength: a user can send $500 from the U.S. to Nigeria in 15 minutes for $2.50, compared with a $35 fee and three‑day wait from traditional banks. Supply‑chain verification also benefits from immutable records, letting stakeholders trace a product’s journey in seconds.

However, the technology isn’t a silver bullet. During network congestion, Bitcoin users have reported paying $50 in fees for a $20 transaction-an unacceptable cost for everyday commerce. Scaling solutions are still maturing, and regulatory uncertainty (e.g., the EU’s MiCA framework) adds compliance hurdles for businesses.

Future Directions: Interoperability and Governance

Next‑generation P2P platforms aim to talk to each other. Protocols like Cosmos IBC enable token transfers across heterogeneous chains, while Polkadot’s XCM (Cross‑Consensus Message) format lets parachains share data securely.

Governance models are also evolving. On‑chain voting, quadratic voting, and DAO structures give token holders direct influence over protocol upgrades-essentially turning the P2P network into a self‑governing entity.

Analysts at Gartner predict that by 2026, 10 % of global government interactions will occur via blockchain‑based P2P systems, up from 0.5 % in 2023. If scalability hurdles are solved, the technology could hold up to 10 % of global assets by 2030, according to ARK Invest.

Quick Checklist for Builders

- Choose the right consensus: PoW for maximal security, PoS for energy efficiency, or a hybrid for specific use cases.

- Plan storage: a full Bitcoin node now needs >500 GB SSD and weeks to sync.

- Implement fee‑optimisation: use fee‑estimation APIs or batch transactions via rollups.

- Secure key management: hierarchical deterministic wallets reduce loss risk.

- Stay compliant: monitor regional regulations like MiCA or the U.S. FinCEN guidance.

Frequently Asked Questions

How does P2P differ from traditional client‑server models?

In a client‑server setup, a central server handles all requests, creating a single point of failure and control. P2P spreads the workload across all participants, so each node can act as both client and server, removing the need for a trusted intermediary.

Why is proof‑of‑stake considered greener than proof‑of‑work?

PoS replaces energy‑intensive mining calculations with a staking process where validators lock up tokens as collateral. The network only needs to randomly select a validator, cutting electricity use by over 99 % while still providing economic security.

Can I use Bitcoin’s Lightning Network for everyday purchases?

Yes, many wallets now support Lightning, allowing instant, low‑fee payments. Adoption is still growing, and both sender and receiver need Lightning‑compatible wallets, but the user experience is approaching that of traditional card payments.

What are the biggest regulatory challenges for blockchain P2P?

Regulators grapple with anti‑money‑laundering (AML) rules, consumer protection, and taxation. The EU’s MiCA requires a 90‑day notification for new services, while the U.S. still debates clear guidance on token classification.

Is it realistic for blockchain to handle global transaction volumes?

Currently, most public blockchains are far from Visa‑scale. However, layered solutions-rollups, sidechains, and cross‑chain bridges-are rapidly closing the gap. Full global adoption will likely rely on a mix of layer‑1 scalability and layer‑2 off‑chain processing.

Whether you’re a developer building the next DeFi app or a business evaluating blockchain for payments, understanding how P2P technology has matured helps you pick the right tools, anticipate roadblocks, and plan for the future.

There are 24 Comments

Jon Miller

Wow, this deep‑dive just blew my mind! 😲

mike ballard

The evolution of P2P overlays in blockchain stacks is a classic case of network topology refinement :) The shift from naive DHTs to gossip‑based propagation dramatically lowers consensus latency 🚀

Moreover, the integration of BFT‑style finality gadgets adds cryptographic robustness without sacrificing throughput.

Johanna Hegewald

If you’re just starting, run a full node on a SSD and keep an eye on disk usage – the chain keeps growing.

Mike Cristobal

We must not lose sight of the moral duty to design systems that protect users from exploitation – the tech shouldn’t become a playground for greed. 😉

Tom Glynn

Think of the blockchain as a living organism; each node is a cell that learns from its peers. 🌱 By coaching validators to adopt adaptive slashing, we can foster resilience and still keep the network friendly.

Molly van der Schee

Your analogy resonates deeply. A supportive ecosystem nurtures growth, and when nodes collaborate, the whole protocol thrives.

Prerna Sahrawat

The trajectory of peer‑to‑peer paradigms, when examined through the lens of sociotechnical theory, reveals an intricate tapestry of intent, adaptation, and power dynamics that extend far beyond mere technical specifications. Early attempts such as Napster, while superficially revolutionary, were constrained by central indexing mechanisms that rendered them vulnerable to both legal and economic coercion. BitTorrent’s introduction of distributed hash tables marked a decisive departure, enabling a more robust content‑addressable network, yet it remained confined within the domain of file exchange without an intrinsic value transfer protocol. The advent of Bitcoin in 2008 reframed P2P as a trustless monetary ledger, embedding cryptographic proof‑of‑work as a deterrent against Sybil attacks and thereby democratizing the notion of digital scarcity. Subsequent evolutions, including Ethereum’s shift to proof‑of‑stake, illustrate a conscious rebalancing of security, energy consumption, and decentralization, underscoring the community’s capacity for self‑governance. Scaling solutions such as Lightning and sharding are not merely performance tweaks; they constitute fundamental restructurings of the underlying graph topology, redistributing transaction verification across numerous parallel channels. Interoperability protocols like Cosmos IBC and Polkadot XCM further dissolve silos, suggesting an emergent multichain federation akin to the early days of the internet’s TCP/IP standard. However, these advancements are tempered by regulatory headwinds, where divergent jurisdictional frameworks threaten to fragment the nascent ecosystem, coaxing developers toward compliance‑driven design choices. In this complex milieu, the future of P2P blockchain technology hinges upon reconciling the competing imperatives of scalability, security, and sovereign legitimacy, a triad that will define the next decade of decentralized innovation.

Ryan Comers

All this techno‑babble sounds great, but let’s face it – the real world still runs on national currencies, and any crypto that can’t dominate its own borders is just a hobby for Silicon Valley.

Joy Garcia

Sure, if you believe the deep‑state isn’t already planting backdoors in every ledger, then comfort yourself with those shiny roll‑ups. The truth is far more unsettling.

Patrick Day

Yo, the whole thing is a massive experiment the elites run to see who can break the system first. Keep your eyes open.

Erik Shear

Let’s stay calm and evaluate the technical merits without jumping to conspiracies.

Andrew Smith

Exactly! With a collaborative mindset we can turn these challenges into opportunities for everyone.

PRIYA KUMARI

This article glosses over the fact that most of these so‑called "solutions" are just buzzwords dreamed up by overpaid consultants.

Jessica Pence

i think it’s actually pretty helpfull, even tho i typo a lot lol. you just need to look at the basics and u’ll get it.

johnny garcia

While the casual tone is noted, the underlying technical concepts merit a more rigorous treatment. 📘

Scott McCalman

Everybody knows the real issue is that these networks are just a fad. 😉

Benjamin Debrick

Indeed, the author fails to address the critical bottleneck, namely, the lack of cross‑chain atomicity; consequently, the argument remains incomplete; furthermore, empirical data is notably absent, thereby weakening the overall thesis.

del allen

i totally get what u’re sayin – the cross‑chain stuff is kinda confusing, but it’s defo cool!!

Jon Miller

Hah, love the enthusiasm! Keep digging, the community’s got tons of resources.

Evan Holmes

This is all just hype, nothing really changes.

Isabelle Filion

Oh, how original: “just hype.” One might suggest a deeper reading before dismissing an entire field.

Jenna Em

It’s simple: if the tech works, people will use it. If not, it disappears.

Stephen Rees

Well, that’s one perspective. I tend to think the hidden forces are more subtle.

Katheline Coleman

Given the current regulatory landscape, it would be prudent for developers to incorporate compliance‑by‑design mechanisms, thereby ensuring that future deployments can seamlessly adapt to evolving legal frameworks.

Write a comment

Your email address will not be published. Required fields are marked *