Fiat-Backed Stablecoin Checker

When you trade crypto, you probably reach for a token that stays close to $1. That reliability comes from fiat-backed stablecoins, a system that mixes old‑school banking with blockchain transparency.

TL;DR

- Fiat‑backed stablecoins are 1:1 linked to a fiat currency, usually the USDollar.

- Issuers keep exact reserves in regulated banks and prove it with regular third‑party audits.

- Arbitrage between market price and redemption value forces the price back to $1.

- USDT and USDC dominate the market; USDT holds about 70% share, USDC about 20%.

- Risks include centralization, regulatory changes, and bank‑run scenarios.

What Is a Fiat‑Backed Stablecoin?

Fiat‑backed stablecoin is a digital token that promises a one‑to‑one value with a traditional fiat currency, most often the USDollar, by holding an equivalent amount of cash or cash‑like assets in a regulated bank. The idea is simple: every token you see on the blockchain is backed by a real dollar sitting somewhere in a bank vault.

How Issuance and Redemption Work

When you want to buy a stablecoin, you send dollars to the issuer. The issuer immediately deposits that amount into a regulated bank a licensed financial institution that is subject to government oversight and regular examinations. At the same time, a smart contract code on the blockchain that creates, tracks, and destroys tokens automatically mints the corresponding number of tokens and sends them to your wallet.

Want to cash out? You send the tokens back to the issuer. The smart contract “burns” (destroys) the tokens, and the custodian releases the exact amount of fiat from the bank account to your bank. This two‑way flow keeps the total number of tokens perfectly aligned with the amount of cash held.

The Three Pillars That Keep the Peg

Three mechanisms work together to keep the price glued to $1.

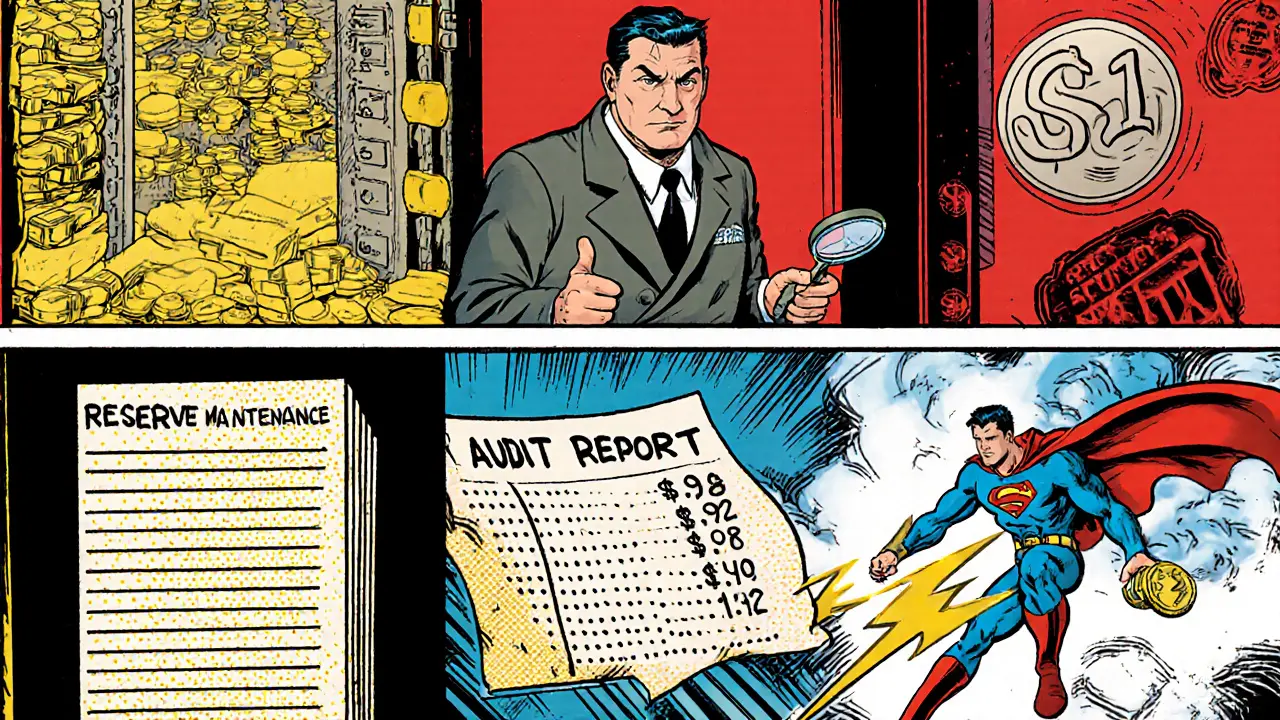

1. Reserve Maintenance

Issuers must hold reserve assets cash equivalents such as Treasury bills, money‑market funds, or short‑term commercial paper that can be quickly turned into cash equal to the circulating token supply. If 10million USDT are out there, the issuer should have $10million in reserve.

2. Transparent Auditing

Every few weeks, a third‑party auditor an independent accounting firm that verifies the issuer’s reserve holdings and publishes an attestation report checks the bank statements. The audit report is posted publicly, letting users see that the backing really exists.

3. Market Arbitrage

Because tokens can be redeemed for real dollars, traders can profit from price gaps. If the token trades at $0.98, a trader buys the cheap token, redeems it for $1, and pockets $0.02. That buying pressure shrinks supply and nudges the price up. If the token trades at $1.02, a trader mints fresh tokens, sells them for $1.02, and the extra supply pushes the price back down. This self‑correcting loop is the cheapest and most powerful stabilizer.

Real‑World Players: USDT vs. USDC

Two names dominate the space: Tether (USDT) the first and largest fiat‑backed stablecoin, originally launched in 2014, now representing roughly 70% of the stablecoin market and USD Coin (USDC) a stablecoin issued by Circle, known for frequent audits and strong regulatory compliance, holding about 20% market share. While both claim a $1 peg, they differ in transparency, audit cadence, and regulatory posture.

| Attribute | USDT | USDC |

|---|---|---|

| Issuer | Tether Ltd. | Circle (in partnership with Coinbase) |

| Reserve Transparency | Monthly attestations, historically criticized for opacity | Monthly attestation reports, real‑time reserve dashboard (since Sep2024) |

| Market Share (Oct2024) | ≈70% | ≈20% |

| Audit Frequency | Quarterly (in‑depth), monthly snapshots | Monthly independent audit |

| Regulatory Status | Operating under US and global banking licences, under US Treasury scrutiny | US‑registered money‑services business, compliant with NYDFS and upcoming MiCA rules |

Risks and Challenges

Even with solid reserves, fiat‑backed stablecoins face three big headwinds.

Centralization

Because only a few entities control the reserves, users must trust the issuer, the custodian bank, and the auditor. This runs counter to the decentralization ethos of crypto and creates single points of failure.

Regulatory Exposure

Governments are drafting stablecoin‑specific rules (e.g., the EU’s MiCA, the U.S. Treasury’s stablecoin framework). A change in law could force an issuer to freeze assets, alter reserve composition, or even shut down operations.

Bank‑Run Scenarios

If a major custodian bank shows signs of distress, holders may rush to redeem tokens, draining reserves faster than the issuer can replenish them. The Silicon Valley Bank episode in March2023 briefly de‑pegged USDC before Circle diversified its reserves and secured emergency liquidity.

Future Outlook

Two forces will shape the next chapter for fiat‑backed stablecoins.

Central Bank Digital Currencies (CBDCs)

National digital currencies could compete directly with private stablecoins by offering a government‑backed digital dollar. Issuers will need to prove added value-like faster cross‑border transfers, programmable money, or lower fees-to stay relevant.

Regulatory Clarity and Transparency

As regulators tighten the net, issuers that invest in real‑time reserve dashboards, frequent audits, and diversified banking relationships will likely win institutional trust. The trend toward monthly attestation reports, as pioneered by Circle, sets a new industry baseline.

Key Takeaways

- The peg stays stable because every token is backed by a dollar in a regulated bank and can be redeemed at any time.

- Arbitrage by traders constantly forces price deviations back to $1.

- Transparency via third‑party auditor reports is the main trust builder.

- USDT dominates the market, but USDC often wins on compliance and audit frequency.

- Future health depends on regulatory acceptance, reserve diversification, and competition from CBDCs.

Frequently Asked Questions

How can I verify that a stablecoin is fully backed?

Look for the issuer’s most recent audit or attestation report. Reputable projects publish a link to a third‑party accountant’s statement that shows the exact dollar amount held in reserve and the date of verification.

What happens if the reserve bank fails?

If the primary custodian can’t meet redemption requests, the issuer must scramble to move funds to a backup bank or liquidate other reserve assets. In extreme cases, the token could lose its peg temporarily until liquidity is restored.

Are fiat‑backed stablecoins considered securities?

Regulators differ by jurisdiction. In the U.S., the SEC has hinted that some stablecoins could fall under securities law if they’re deemed investment contracts, while others are treated as money‑service businesses. Always check local guidance before large‑scale use.

Can I earn interest on my stablecoin holdings?

Yes, many DeFi platforms and centralized exchanges offer yield on USDC or USDT by lending them out. However, those yields come with smart‑contract risk and counter‑party exposure beyond the basic peg mechanism.

How do fiat‑backed stablecoins differ from algorithmic ones?

Algorithmic stablecoins try to keep the peg using code‑only mechanisms-like expanding supply when price falls-without any actual cash reserves. That model proved fragile during the 2022 Terra collapse, whereas fiat‑backed coins rely on real dollars, making them far more reliable.

There are 24 Comments

Shanthan Jogavajjala

When you look at the reserve ratio, the math tells the whole story: a 1.05x coverage means arbitrage bots have enough collateral to squeeze any deviation back to $1. The on‑chain proof‑of‑reserve snapshots act like a pressure gauge, and when the gauge spikes, liquidity providers instantly step in. This creates a self‑reinforcing loop that most people don’t even realize is happening under the hood. In short, the system’s stability is baked into its incentive architecture.

Ayaz Mudarris

Fundamentally, the peg persists because the contractual obligation to redeem at par integrates legal enforceability with market forces. The fiduciary responsibility of the custodian bank, coupled with periodic attestations, establishes a credibility buffer that is essential for widespread adoption. Moreover, the arbitrage mechanism operates as a continuous price‑discovery process, ensuring that any divergence is promptly corrected. This synthesis of law, economics, and cryptographic transparency is what sustains confidence in fiat‑backed stablecoins.

Irene Tien MD MSc

Ah, the grand illusion of “full backing” – it’s like trusting a magician not to pull a rabbit out of a hat, except the rabbit is your savings and the hat is a bank that could vanish at any moment. The audit reports are polished PDFs that look impressive until you read the fine print, where the “sufficient reserves” claim is qualified with “subject to market conditions and regulator goodwill.” And let’s not forget the countless times issuers have slipped a little‑known commercial paper into the mix, which, as we all know, is as stable as a house of cards in a hurricane. So while the peg looks pristine on the surface, beneath the glitter lies a precarious calculus of trust and timing.

kishan kumar

Indeed, the elegance of the redemption model is often overstated. While the code promises instantaneous burn‑and‑mint, the real bottleneck lies in the custodial banking layer, which must process fiat transfers within traditional settlement windows. A delay there can cause a temporary supply‑demand mismatch, leading to modest price drift. Nevertheless, the market’s arbitrageurs act as a corrective force, arbitraging away such inefficiencies, albeit at the cost of additional transaction fees. :)

Anthony R

The peg works because redemption is always possible.

Cindy Hernandez

For anyone new to stablecoins, the key takeaway is that the $1 peg isn’t magic – it’s the result of three pillars: real‑world reserves, regular audits, and market arbitrage. If any of those pillars wobble, the price can drift, but arbitrageurs quickly step in to restore balance. The difference between USDT and USDC largely comes down to transparency: USDC publishes a real‑time dashboard, while USDT relies on monthly attestations that have been criticized for opacity. In practice, both remain largely stable, but you should always check the latest reserve report before moving large sums.

Karl Livingston

I’d add that newcomers often overlook the importance of diversified banking relationships. Circle, for example, spread its USDC reserves across several top‑tier banks after the SVB incident, which adds a layer of resilience that many smaller issuers lack. So when you’re assessing risk, look beyond the headline % reserve ratio and ask where those dollars actually sit.

Robert Eliason

Sure, diversification sounds nice, but it’s still just a piece of paper in a bank that could be bailed out tomorrow. The whole system is fragile; one regulatory crack and the whole peg could wobble, regardless of how many banks you spread the cash across.

mark gray

Reserve ratio math is simple: if it’s above 1, you’re covered.

Alie Thompson

While the arithmetic may be straightforward, the ethical dimension is far more complex. Relying on private entities to safeguard a public monetary promise brings about a responsibility that extends beyond mere compliance. When a company can issue tokens backed by a fraction of a million dollars yet still claim a dollar‑for‑dollar guarantee, it raises profound questions about accountability and the moral obligations owed to end users. Moreover, the concentration of power in the hands of a few custodians creates a systemic risk that the broader financial ecosystem must reckon with. Should regulators step in to enforce stricter transparency, or does that stifle innovation? In any case, users should remain vigilant and demand full disclosure, lest we repeat the mistakes of past financial crises.

Samuel Wilson

The stability of fiat‑backed stablecoins is fundamentally a legal and economic construct, not a purely technological one. Without legal enforceability, the on‑chain mechanisms alone cannot guarantee redemption. Therefore, robust regulatory frameworks are essential to ensure that issuers maintain adequate reserves and that auditors remain independent.

Rae Harris

Regulation is just a fence that could be knocked down tomorrow; the real safety lies in code and community vigilance, not in a handful of legal clauses.

Danny Locher

Looking at the market share numbers, it’s clear why USDT dominates: it has been around longer and has deeper liquidity pools across most exchanges.

Emily Pelton

Dominance doesn’t equal trust; it just means more eyes are watching, which can be a double‑edged sword when any slip‑up happens.

Donald Barrett

The whole market is a sham-USDT is propped up by shady accounting while USDC pretends to be the “good guy” but both are just fiat proxies for the same old financial elite.

Kailey Shelton

Stablecoins are useful for quick transfers, but you should always keep an eye on the latest audit reports.

Angela Yeager

Exactly, staying informed is key. The monthly attestation from Circle is a good benchmark for USDC, while Tether’s reports are less frequent, so adjust your exposure accordingly.

vipin kumar

Don’t trust any of these reports-most of the reserves are probably parked in offshore shell banks that are invisible to the public.

Lara Cocchetti

Even if the audits are clean, the underlying fiat system is still vulnerable to sovereign debt crises, which could cascade into stablecoin failures.

mannu kumar rajpoot

True, but the market’s arbitrage bots will simply shift to the next stablecoin if one loses its peg, preserving overall crypto liquidity.

Tilly Fluf

From a regulatory perspective, the upcoming MiCA framework in the EU will likely set a new gold standard for reserve transparency, which could force issuers worldwide to adopt similar practices.

Darren R.

Ah, the “gold standard”-a phrase that makes you feel safe while the reality is a maze of compliance paperwork that only the biggest players can afford.

Hardik Kanzariya

Compliance is a moving target, but the more jurisdictions that align, the less room there is for regulatory arbitrage, which ultimately benefits users.

Millsaps Delaine

When you dive deep into the mechanics of fiat‑backed stablecoins, you quickly realize that the surface narrative of a simple 1:1 backing is a carefully curated myth. First, the reserve composition often includes not just cash but a mélange of treasury bills, short‑term commercial paper, and occasionally more opaque assets that are only loosely correlated with the dollar. Second, the audit cadence, while publicly advertised as “monthly,” frequently relies on attestations rather than full‑scale examinations, leaving room for interpretation and, frankly, creative bookkeeping. Third, the redemption process, which most users assume is instantaneous, actually hinges on the underlying banking settlement cycles that can be subject to delays, especially under stress. Fourth, the arbitrage loop that keeps the price tethered to $1 is powered by a sophisticated network of bots that profit from any deviation, yet this same network can amplify market volatility when many participants act simultaneously. Fifth, regulatory oversight differs wildly across jurisdictions-what passes as compliance in one country might be deemed insufficient in another, creating a patchwork of legal exposure for issuers. Sixth, the concentration of reserves in a handful of major banks introduces systemic risk; a single bank failure could trigger a cascade of redemption requests that the issuer cannot meet promptly. Seventh, the market share dominance of USDT, despite its opacity, illustrates that liquidity and network effects can outweigh transparency in user decision‑making. Eighth, USDC’s real‑time dashboard is a commendable step forward, but it still abstracts away the granular details of where each dollar sits, which matters when stress events occur. Ninth, the emerging Central Bank Digital Currency (CBDC) initiatives pose a long‑term existential question: will private stablecoins remain relevant if sovereign digital currencies can offer comparable stability with direct legal backing? Tenth, as the regulatory landscape evolves-particularly with EU’s MiCA and the U.S. Treasury’s stablecoin framework-issuers may be forced to redesign their reserve structures, potentially impacting the peg’s resilience. Eleventh, historical precedents like the Silicon Valley Bank debacle underscore how external banking shocks can temporarily unpeg even the most robust stablecoins. Twelfth, the interplay between on‑chain governance and off‑chain legal obligations creates a hybrid risk model that is difficult to quantify. Thirteenth, user education remains a critical missing piece; many participants treat stablecoins as “risk‑free” without grasping the underlying complexities. Fourteenth, the future may see hybrid models that blend fiat reserves with algorithmic mechanisms to improve capital efficiency while retaining price stability. Finally, while the current system has proven relatively stable, it is a delicate balance of trust, legal enforceability, and market incentives-a balance that could tip under enough pressure, reminding us that no financial instrument is truly immune to risk.

Write a comment

Your email address will not be published. Required fields are marked *