Regulated Crypto Futures: What They Are and Which Platforms Actually Follow the Rules

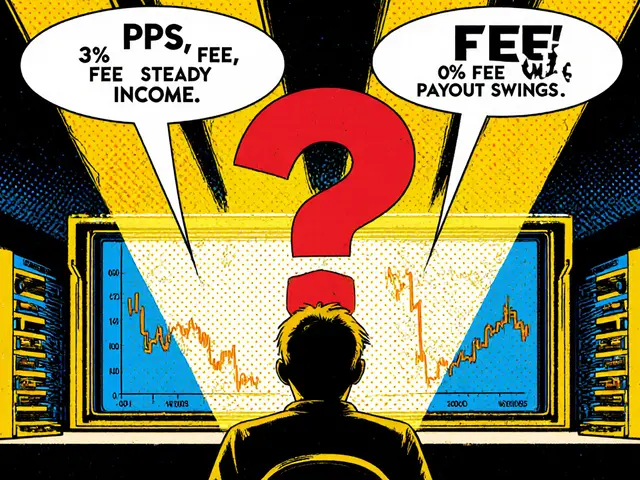

When you trade regulated crypto futures, derivatives contracts tied to cryptocurrency prices that are overseen by financial authorities like the CFTC or SEC. Also known as compliant crypto derivatives, they let you bet on price movements without owning the actual coin—while still being subject to rules that protect traders from fraud and manipulation. This isn’t just about legality—it’s about safety. Unregulated platforms can vanish overnight, freeze withdrawals, or manipulate prices. Regulated ones have to prove they hold client funds separately, run regular audits, and report suspicious activity. If you’re trading futures, skipping this check is like driving without a seatbelt.

Not all crypto futures are created equal. A crypto futures exchange, a platform that offers leveraged contracts on digital assets under government supervision like WhiteBIT or a U.S.-licensed broker must follow strict KYC and AML rules. That means verifying your identity, limiting leverage for retail users, and keeping capital reserves. Compare that to platforms like MaskEX or FREE2EX, which operate in legal gray zones, have no public audits, and show up on lists of untracked exchanges. The difference isn’t just paperwork—it’s whether your money is at risk from bad actors or systemic failure.

Regulation also affects what you can trade. In the U.S., only a few crypto futures are approved—mostly Bitcoin and Ethereum. Others, like obscure altcoins or meme tokens, are blocked because they lack clear market data or are too volatile. Meanwhile, in places like the EU or Canada, rules are looser but still require licensing. That’s why you’ll find posts here about crypto trading regulations, the legal frameworks that govern how digital asset derivatives are offered and traded across countries—from Kazakhstan’s mining bans to Bolivia’s trading penalties. These aren’t random rules; they’re responses to real crashes, pump-and-dumps, and platform failures.

What you’ll find below isn’t a list of every exchange. It’s a curated set of real reviews—platforms that either meet the standards or clearly don’t. You’ll see why WhiteBIT made the cut for European traders, why Buff Network is labeled untracked, and how even big names like MaskEX fail basic safety checks. There’s no hype here, just facts: trading fees, withdrawal histories, license status, and user complaints. If you’re serious about futures trading, you need to know which platforms are watching your back—and which are just waiting for you to click "Buy".