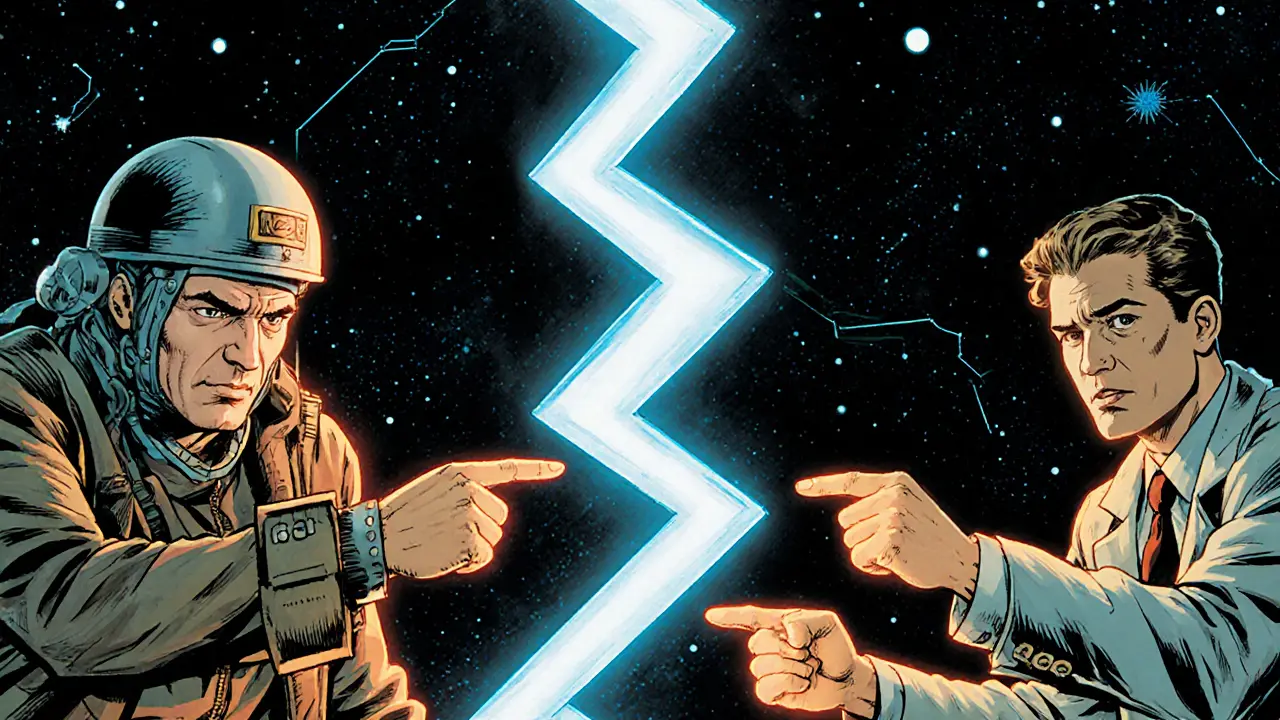

Blockchain Forks Explained: Types, Causes, and Real‑World Impact

Learn what blockchain forks are, why they happen, and how soft and hard forks impact cryptocurrencies, markets, and future blockchain governance.

Read MoreWhen working with soft fork, a backward‑compatible blockchain upgrade that lets older nodes stay on the network while new rules apply. Also known as compatible fork, it enables developers to add functionality without splitting the chain.

Another common upgrade path is a hard fork, a non‑compatible change that creates a separate chain when nodes don’t adopt the new rules. Hard forks and soft forks both stem from changes in the consensus mechanism, the set of rules that nodes follow to validate blocks and reach agreement. When a community decides to tweak those rules, the choice between a hard or soft fork hinges on how much disruption is acceptable. For example, many upgrades on Ethereum, the second‑largest blockchain by market cap, use soft forks to roll out features like EIP‑1559 or Shanghai without forcing every wallet to update immediately.

Why do developers prefer soft forks? First, they protect network value by keeping a single chain, which avoids the market confusion that can follow a hard fork. Second, they let miners, validators, or stakers adopt the new rules at their own pace, reducing the risk of a split. Third, a well‑designed soft fork can improve security or scalability—think of how adding a new transaction type can curb spam while preserving existing transaction processing.

Every soft fork starts with a clear definition of the new rule set. The change must be a subset of the original protocol so that old nodes still see the blocks as valid. This property is called backward compatibility. Developers write the upgrade as a set of consensus‑layer tweaks, often bundled into an EIP (Ethereum Improvement Proposal) or a BIP (Bitcoin Improvement Proposal). Once the proposal gains community support, the upgrade is scheduled at a specific block height or timestamp.

Implementation details matter. Validators need to upgrade their software before the activation point; otherwise, they might reject valid blocks and get slashed (in proof‑of‑stake systems). Tools like CubeSigner or Geth provide built-in support for flagging upcoming soft forks, giving operators time to test in a testnet environment. Monitoring the network during the activation window is crucial—if a significant portion of the network fails to upgrade, the fork could stall or unintentionally become a hard fork.

Another aspect is economic incentive. Some soft forks introduce new fee structures or tokenomics that affect miner or validator revenue. The EIP‑1559 upgrade on Ethereum, for instance, burned a portion of transaction fees, changing the supply dynamics. Understanding how a soft fork reshapes incentives helps users anticipate price movements or changes in staking returns.

Our collection of articles dives deep into real‑world examples. You’ll find a breakdown of how modular blockchains like Celestia use soft‑fork‑friendly designs to improve data availability, a guide to slashing protection for validators during upgrades, and a look at funding rates in perpetual futures that can shift after a protocol change. Together, they illustrate the breadth of scenarios where a soft fork can either smooth a transition or introduce subtle risks.

Ready to see how these concepts play out across different blockchain ecosystems? Below you’ll discover detailed guides, case studies, and actionable tips that walk you through everything from planning a soft fork on Ethereum to assessing its impact on token economics. Whether you’re a developer, validator, or just a curious trader, the articles ahead give you the practical insight you need to navigate blockchain upgrades confidently.

Learn what blockchain forks are, why they happen, and how soft and hard forks impact cryptocurrencies, markets, and future blockchain governance.

Read More