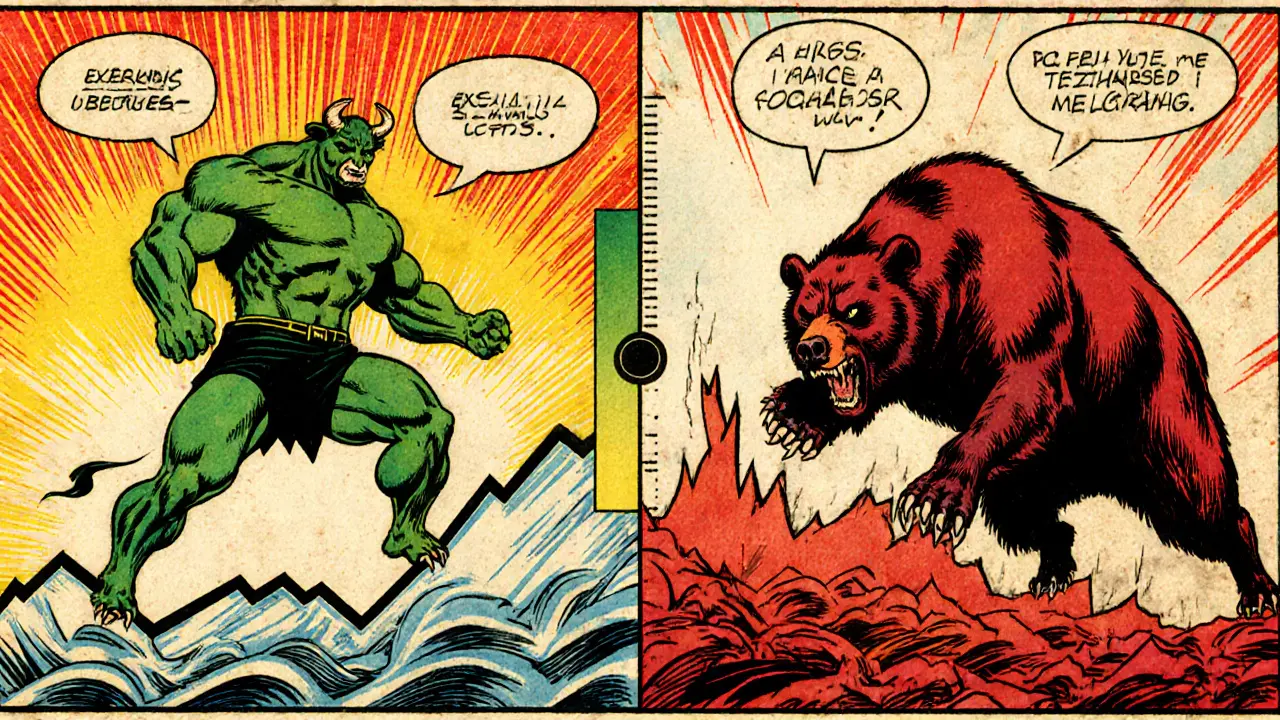

Understanding Volatility Patterns in Bull and Bear Markets

Explore how volatility differs in bull and bear markets, see historical patterns, key drivers, and practical steps to manage risk in each phase.

Read MoreWhen talking about volatility patterns, recurring price movements that signal market risk and opportunity, most people think of wild Bitcoin charts or meme‑coin rockets. In reality, volatility patterns are a blend of several forces: they encompass price spikes, sudden drops, and the rhythm of how assets bounce back. Understanding them starts with a few key building blocks. First, perpetual futures, derivative contracts that never expire and mirror spot price movements give traders a way to bet on direction without owning the asset. Second, funding rates, regular payments exchanged between long and short positions to keep futures prices aligned with spot prices act as a pressure gauge—high rates often push price corrections. Third, trading pairs, the two assets you exchange on an exchange, like BTC/USDT or ETH/BNB shape how liquidity flows, which in turn amplifies or dampens volatility. When you connect these pieces, you can see why a sudden surge in funding rates on a popular perpetual futures market can ignite a volatility pattern that ripples across multiple trading pairs and even fuels arbitrage hunts.

Volatility patterns are more than just chart decoration; they dictate risk management, entry timing, and profit potential. For example, a classic "spike‑and‑fade" pattern shows a sharp price jump followed by a rapid pullback. Traders who recognize that the jump coincided with an unusually high funding rate on a perpetual futures contract can anticipate a short‑term reversal and set tighter stop‑losses. Conversely, a "breakout" pattern—where price breaks a strong support or resistance—often aligns with a shift in funding rates from negative to positive, signaling bullish sentiment. Knowing these relationships lets you act before the market fully reacts. Moreover, trading pairs play a hidden role: a volatile BTC/USDT pair can cause knock‑on effects in BTC/EUR or BTC/BNB, creating cross‑pair arbitrage opportunities. If you spot a price discrepancy larger than the combined funding cost, you can lock in a risk‑adjusted profit. In short, each volatility pattern is a clue about underlying funding dynamics, futures contract pressures, and liquidity flows across pairs.

Another angle to consider is how market makers and bots use volatility patterns to set spreads. When funding rates surge, they widen spreads on the most active trading pairs to protect against rapid price swings. This means retail traders face higher transaction costs during high‑volatility windows. By tracking funding rate announcements and monitoring perpetual futures order books, you can predict when spreads will widen and avoid costly trades. Similarly, crypto‑specific events—like a network upgrade or a major airdrop—often trigger a volatility pattern that starts in the spot market and quickly spreads to futures and options markets. The ripple effect shows up as a temporary divergence between funding rates on different contracts, offering a short‑lived arbitrage window. Spotting these patterns early gives you a tactical edge, whether you’re a day trader, a swing trader, or a longer‑term holder looking to hedge exposure.

From a risk‑aware perspective, volatility patterns also inform portfolio allocation. If a particular asset shows a history of sharp, frequent spikes—often linked to elevated funding rates on its perpetual futures—you might allocate a smaller position size or use stop‑limit orders. Conversely, assets with smoother, lower‑amplitude patterns could tolerate larger positions. This approach aligns with the core principle that volatility is a measure of uncertainty; the more you understand its drivers—funding rates, futures contracts, and trading pair liquidity—the better you can size your bets. In practice, many successful traders keep a simple spreadsheet tracking daily funding rates for their favorite contracts, overlaying that data on price charts. When they see a pattern of funding spikes preceding price corrections, they adjust their exposure accordingly.

Finally, volatility patterns aren’t static; they evolve with market structure. As decentralized finance (DeFi) protocols launch new perpetual futures markets, funding rate mechanisms become more transparent, and cross‑chain trading pairs gain depth, the shape of volatility patterns shifts. Keeping an eye on emerging platforms—like modular blockchains that improve data availability for futures exchanges—helps you anticipate future pattern changes before they become mainstream. This forward‑looking mindset ensures you stay ahead of the curve, turning pattern recognition from a reactive habit into a proactive strategy.

Now that you’ve got a solid grasp on what drives volatility patterns—from funding rates and perpetual futures to the subtle influence of trading pairs and arbitrage—take a look at the articles below. They dive deeper into specific cases, show real‑world examples, and offer step‑by‑step tactics you can apply right away.

Explore how volatility differs in bull and bear markets, see historical patterns, key drivers, and practical steps to manage risk in each phase.

Read More