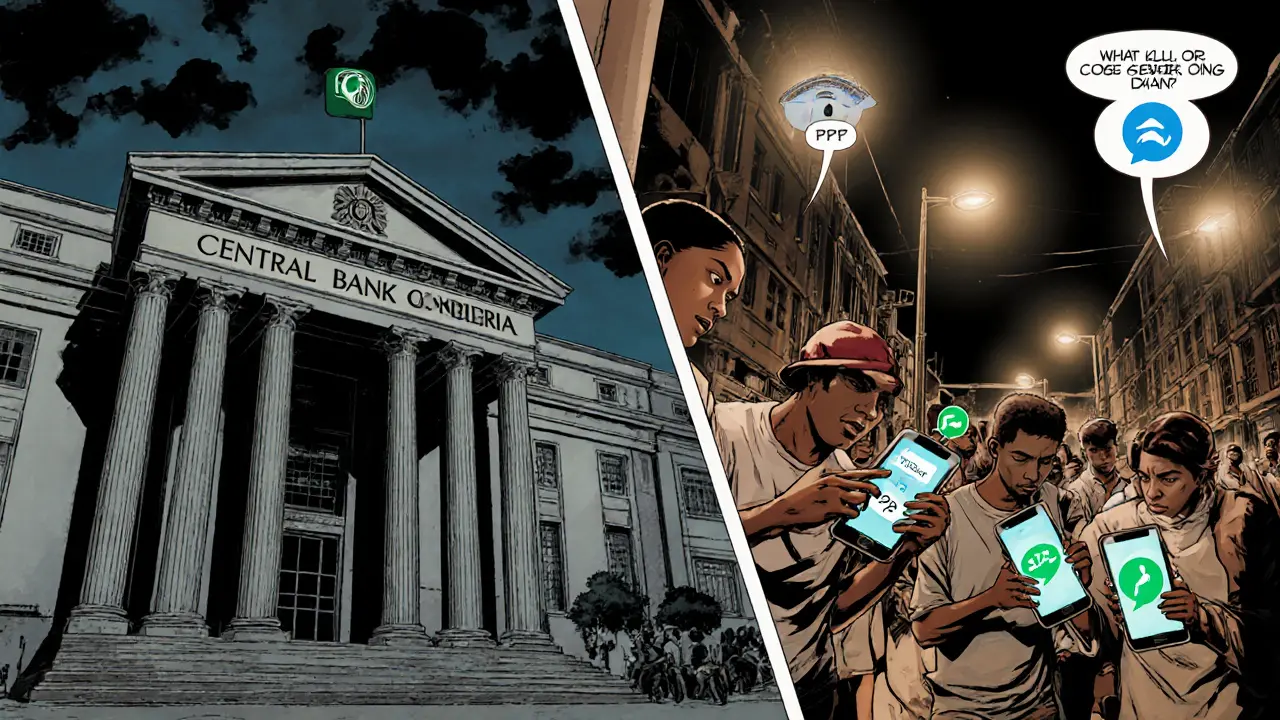

How Nigeria’s Underground Crypto Economy Thrived During the 2021‑2023 Ban

Explore how Nigeria's crypto ban sparked a billion‑dollar underground market, the P2P platforms that powered it, fraud risks, and its lasting impact on regulation.

Read MoreCrypto fraud Nigeria is a growing threat that’s hitting investors, traders, and everyday users of digital assets. When dealing with crypto fraud Nigeria, the surge of scams targeting Nigerians in the crypto space. Also known as Nigerian crypto scams, it blends social engineering, fake exchanges, and shady token launches. The problem isn’t just about losing money—it erodes trust in the whole ecosystem and fuels a cycle of illegal activity.

One of the biggest levers to curb these attacks is VASP licensing Nigeria, the regulatory framework that forces crypto service providers to register, maintain capital, and follow anti‑money‑laundering rules. Without a proper VASP licence, many platforms operate in a gray zone, making it easy for fraudsters to hide behind anonymous services. The licensing scheme also requires robust KYC procedures, which act as a first line of defense against phishing and Ponzi schemes.

Even when a platform is licensed, perpetrators can still try to launder the proceeds. That’s where crypto money laundering penalties, stiff criminal sentences and financial fines imposed on those who move illicit crypto funds come into play. Recent U.S. cases have shown sentences of up to 20 years for crypto‑related money laundering, sending a clear message that authorities are watching. These penalties influence the behavior of Nigerian operators, pushing them to adopt stronger monitoring tools and report suspicious activity.

The Nigeria crypto regulation, set by the Securities and Exchange Commission and the Central Bank, defines what tokens are allowed, bans certain activities, and outlines compliance expectations ties everything together. When the SEC declares a token illegal or demands a registration, it forces the market to self‑clean, reducing the pool of fraudulent projects. Together, licensing, penalties, and regulation create a three‑pillar system that aims to protect investors from scams.

Scammers use a handful of playbooks that keep evolving. Fake initial coin offerings (ICOs) promise massive returns, then disappear with the funds. Phishing attacks mimic legitimate wallets or exchanges, stealing private keys in minutes. Ponzi schemes lure participants with guaranteed yields, paying early investors with money from later ones until the bubble bursts. Even “gift‑card” scams have migrated to crypto, where fraudsters ask for payment in Bitcoin to “unlock” larger sums. Understanding these patterns helps you spot red flags before you click.

Protecting yourself starts with basic hygiene: verify a platform’s VASP licence, read the SEC’s public watchlist, and use two‑factor authentication. Look for transparent tokenomics, a verifiable development team, and community reviews on independent forums. If a deal sounds too good to be true, it probably is—run a quick Google search on the project’s name and check for any reported fraud alerts. Remember, the best defense is a mix of regulatory awareness and personal diligence.

Below you’ll find a curated collection of articles that dive deeper into each of these topics. From detailed breakdowns of Nigeria’s licensing process to real‑world case studies of crypto money‑laundering penalties, the posts are designed to give you actionable insights and keep you a step ahead of fraudsters.

Explore how Nigeria's crypto ban sparked a billion‑dollar underground market, the P2P platforms that powered it, fraud risks, and its lasting impact on regulation.

Read More