Inter Stable Token (IST) isn’t another stablecoin that just tries to mimic the US dollar. It’s a crypto-backed stablecoin built from the ground up to power the Agoric blockchain and connect decentralized finance across the Cosmos ecosystem. Unlike USDC or USDT, which rely on bank reserves, IST stays pegged to $1 through over-collateralized crypto assets and smart contract rules. But here’s the catch: it’s not trading at $1 right now. It’s hovering around 98 cents. Why? And should you care?

How IST Actually Works

IST doesn’t hold dollars in a vault. Instead, it’s backed by crypto assets locked in smart contracts. If you want to create IST, you have three options:- Deposit USDC or another approved stablecoin into a smart contract and get IST back at a 1:1 ratio

- Lock up ATOM, stATOM, or other approved assets in a Vault and borrow IST against them

- Stake BLD (Agoric’s native token) to mint IST - and here’s the twist: you can’t unstake BLD until you pay back the IST debt

Each method has different collateral requirements. For example, ATOM might need to be worth 175% of the IST you mint. If the value of your collateral drops below that threshold, your position gets liquidated. But BLD staking is different - because you earn stacking rewards over time, you can repay your IST debt with those rewards, avoiding liquidation. That makes BLD staking a unique, long-term play.

Behind the scenes, IST uses the Zoe framework and ERTP - advanced JavaScript-based tools built into Agoric’s blockchain. These aren’t just buzzwords. They allow for precise, secure control over who owns what and when. Think of it like a digital ledger that doesn’t just track balances, but enforces rules automatically.

Why IST Exists: More Than Just a Stablecoin

IST isn’t meant to be a store of value like Bitcoin or a speculative asset like Solana. It’s the gas of the Agoric network. Every time you interact with a smart contract on Agoric - whether you’re swapping tokens, lending, or staking - you pay fees in IST. That means demand for IST isn’t just about traders wanting to buy it. It’s about users needing it to operate on the platform.This is a big deal. Most stablecoins survive because people use them for trading or remittances. IST survives because it’s required. No IST? No transactions. That built-in utility gives it a structural advantage over algorithmic stablecoins like Terra’s UST, which collapsed because they had no real demand driver.

IST also connects to other blockchains. Thanks to the Inter-Blockchain Communication (IBC) protocol, IST can move between Cosmos chains like Osmosis, Juno, and Crescent. It’s not stuck on one chain. That’s why developers building cross-chain DeFi apps see IST as a useful tool - it’s the only stablecoin native to Cosmos that’s designed to flow between chains without bridges or wrappers.

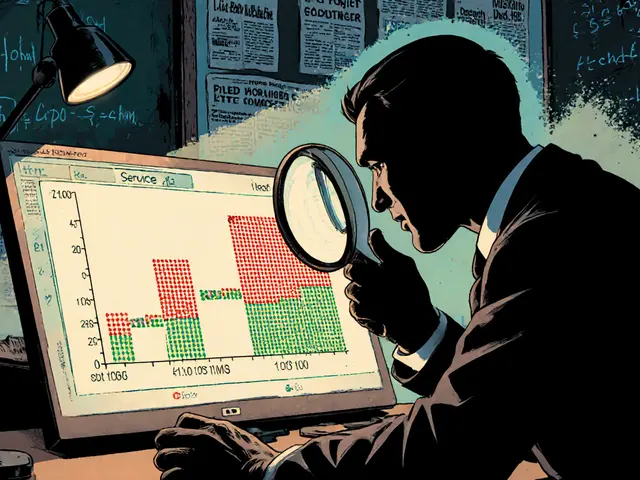

Market Reality: Why IST Trades Below $1

Despite its design, IST isn’t trading at $1. As of January 2026, it’s been stuck between 89 cents and 98 cents for months. Why?- Liquidity is thin. The IST/USDC pair on Osmosis has a 24-hour volume of just $618. That’s less than what a single large trade can move on major exchanges.

- Slippage is real. One trader reported a 3.2% slippage swapping 5,000 IST - meaning they lost $160 on a $5,000 trade just because there weren’t enough buyers or sellers.

- Impermanent loss hits liquidity providers. People who put IST and USDC into liquidity pools on Osmosis lost up to 8% during market swings in late 2023 because IST kept drifting from $1.

These aren’t theoretical problems. They’re daily frustrations for users. The Parity Stability Module (PSM) is supposed to help - it lets users swap IST for USDC at 1:1, up to a limit set by governance. But if no one is using it, or if the limit is too low, it doesn’t help much.

Market cap? IST is ranked #5542 on CoinMarketCap. Fully diluted, it’s worth under $600,000. Compare that to DAI, which has a $1.2 billion market cap. IST is tiny. But size isn’t everything. It’s about utility.

Who’s Using IST - And Why

You won’t find IST on Coinbase or Binance. It lives on decentralized exchanges like Osmosis, Shade Protocol, and Astrovault. That means only crypto-native users are interacting with it - and they’re not casual traders.Developers on Agoric’s Discord say using IST as gas cuts their transaction costs compared to paying in BLD. Why? Because IST is cheaper to mint than buying BLD outright. For someone running a dApp with hundreds of daily interactions, that adds up.

Stakers who lock BLD to mint IST are betting on the long-term growth of Agoric. They’re not trying to flip IST for a quick profit. They’re locking capital in exchange for stacking rewards, hoping the value of BLD and the ecosystem grows faster than the IST debt they carry.

On Twitter, Cosmos-focused analysts argue IST’s real value isn’t in its price today - it’s in its role as the backbone of Agoric’s economy. If Agoric becomes a major hub for DeFi in Cosmos, IST will become essential. That’s the bet.

What’s Next for IST?

The Agoric community isn’t sitting still. In December 2023, governance lowered the collateralization ratio for stATOM from 175% to 165%. That made it easier and cheaper to mint IST using staked ATOM - a move designed to boost adoption.Future plans include:

- Adding more collateral types (like ETH or SOL via bridges)

- Expanding IBC integrations to more Cosmos chains

- Improving the PSM to handle larger swap volumes

- Building better tools for users to monitor collateral ratios and avoid liquidation

Delphi Digital reports the Cosmos ecosystem grew 285% in TVL in 2023. If that growth continues, IST has a real shot at becoming the default stablecoin for Cosmos DeFi. But it’s not guaranteed. The competition is fierce. Other chains are launching their own stablecoins. Agoric needs to deliver real user growth - not just technical specs.

Should You Use IST?

If you’re a casual crypto user who just wants a stable asset to hold or trade - skip IST. It’s too volatile, too illiquid, and too complicated.If you’re a DeFi builder, a BLD staker, or someone deeply involved in the Cosmos ecosystem - IST is worth learning. It’s the only stablecoin designed to work natively across multiple Cosmos chains. It’s the fuel for Agoric’s smart contracts. And if Agoric takes off, IST could become the most important token you never traded.

Here’s what you need to know before getting involved:

- Use Keplr wallet - it’s the standard for Agoric and Cosmos

- Understand collateral ratios - if your position drops below 150-175%, you risk liquidation (except for BLD staking)

- Don’t expect IST to stay at $1 - it’s been below $1 for months

- Only use IST if you’re interacting with Agoric-based dApps - otherwise, stick with USDC or DAI

- Monitor Agoric’s governance proposals - changes to fees, limits, and collateral rules happen often

IST isn’t a get-rich-quick coin. It’s a tool. And like any tool, its value depends on how you use it - and whether the ecosystem around it grows.

Frequently Asked Questions

Is IST backed by US dollars?

No. IST is backed by cryptocurrency assets like ATOM, stATOM, and BLD, locked in smart contracts. It’s not tied to bank reserves like USDC or USDT. Its stability comes from over-collateralization and governance-controlled mechanisms, not fiat.

Can I buy IST on Coinbase or Binance?

No. IST is only available on decentralized exchanges in the Cosmos ecosystem, primarily Osmosis, Shade Protocol, and Astrovault. You need a Cosmos-compatible wallet like Keplr to trade it.

Why is IST trading below $1?

IST trades below $1 due to low liquidity, limited trading volume, and market skepticism about its long-term peg stability. While the protocol has tools like the PSM to maintain the peg, they’re not being used enough yet to fully offset supply-demand imbalances.

Is IST safe to use?

IST is as safe as the smart contracts it runs on. Agoric’s code has been audited and uses the Zoe framework, which is designed for security. However, like all DeFi, you risk liquidation if your collateral value drops. BLD staking is safer because it avoids liquidation, but you can’t access your staked BLD until you repay your IST debt.

How do I mint IST?

You can mint IST in three ways: deposit USDC into a smart contract, lock ATOM or stATOM in a Vault with sufficient collateral, or stake BLD to borrow IST. Each method has different rules and risks. Agoric’s official documentation and Discord support channel offer step-by-step guides.

What happens if IST’s price drops further?

If IST’s price drops further, users with Vaults may face liquidation if their collateral falls below the required ratio. Liquidity providers in IST/USDC pools could suffer more impermanent loss. However, the governance system can respond by adjusting collateral requirements, minting fees, or expanding the PSM limits to restore confidence.

There are 11 Comments

Barbara Rousseau-Osborn

Arnaud Landry

Athena Mantle

carol johnson

Paru Somashekar

Steve Fennell

Heather Crane

Catherine Hays

Chidimma Catherine

Melissa Contreras López

Mike Stay

Write a comment

Your email address will not be published. Required fields are marked *