Crypto Market: Trends, Tools, and Strategies

When you step into the crypto market, the global arena where digital assets are bought, sold, and priced. Also known as digital asset market, it connects traders, developers, and regulators in a constantly shifting landscape. Understanding its moving parts helps you spot opportunities and avoid common pitfalls.

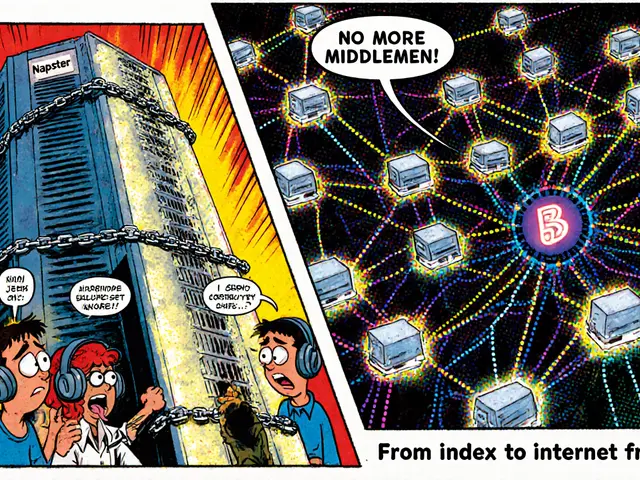

One of the biggest shifts comes from modular blockchain, a design that separates consensus, data availability, and execution layers. This architecture lets rollup projects scale without overloading the base chain, and it relies on data availability sampling to keep security tight. The crypto market now rewards projects that adopt modular setups because they can deliver faster transaction speeds and lower fees.

At the same time, perpetual futures, derivative contracts that let traders hold positions forever as long as funding fees are paid are reshaping trader behavior. Funding rates act like a hidden interest rate, pulling prices toward spot markets. When funding is positive, long positions pay shorts, and the opposite happens when it’s negative. This mechanism creates arbitrage loops that keep the market efficient, but it also adds a layer of risk that savvy participants must manage.

Another driver of price swings is crypto airdrop, a distribution method where projects give free tokens to eligible users. Airdrops can instantly boost a token’s circulation and generate buzz, but they also dilute existing holdings. Knowing the eligibility criteria, claim process, and tax implications lets you turn a free token into a real return, while protecting you from scams that mimic legitimate drops.

Meanwhile, blockchain fork, a split in a blockchain’s protocol that creates a new chain or updates the existing one can flip market sentiment in minutes. Hard forks introduce new features and sometimes new tokens, while soft forks are backward‑compatible upgrades. Traders watch fork announcements closely because price can surge on optimism or crash on uncertainty. Understanding the technical reasons behind a fork helps you gauge whether it’s a genuine upgrade or a contentious split.

These forces don’t act in isolation. The crypto market encompasses modular blockchain innovations, and modular designs require robust data availability sampling. Perpetual futures influence trader positioning, which in turn affects how airdrop news moves sentiment. Fork events can rewrite the supply dynamics that airdrops rely on, creating a feedback loop that drives volatility. Recognizing these interconnections gives you a clearer view of why price moves the way it does.

Beyond the headline topics, you’ll also see coverage of volatility patterns in bull versus bear phases, slashing protection for validators, and the latest regulatory updates across Africa and Australia. Whether you’re a beginner curious about how a wrapped token like WBTC works, or an experienced trader looking for funding‑rate arbitrage tips, the collection below offers practical guides that cut through the hype.

Ready to dig deeper? Below you’ll find a curated set of articles that break down each of these concepts, showcase real‑world examples, and equip you with actionable steps to navigate the crypto market with confidence.