MaskEX Exchange: What It Is, How It Works, and What You Need to Know

When you hear MaskEX exchange, a decentralized crypto trading platform built for users who want direct access to tokens without relying on centralized middlemen. Also known as MaskEX DEX, it lets you swap assets, provide liquidity, and earn rewards—all from your own wallet. Unlike big-name exchanges that hold your coins, MaskEX puts control back in your hands. You don’t deposit funds. You connect your wallet and trade directly on-chain. That means no KYC, no account freezes, and no third-party custody. But it also means you’re fully responsible for your own security.

This places MaskEX exchange, a type of decentralized exchange (DEX) that operates on blockchain networks like Ethereum and BNB Smart Chain. Also known as non-custodial trading platform, it relies on smart contracts to match trades instead of order books run by a company. That’s the core difference from centralized exchanges like Binance or Coinbase. You’re not buying from a company—you’re swapping with other users via automated liquidity pools. The liquidity pool, a smart contract holding paired crypto assets that enable instant swaps. Also known as automated market maker (AMM), it is what makes trading possible without buyers and sellers finding each other directly. If a pool has enough funds, you can swap tokens instantly. If it’s thin, you’ll face slippage or high fees.

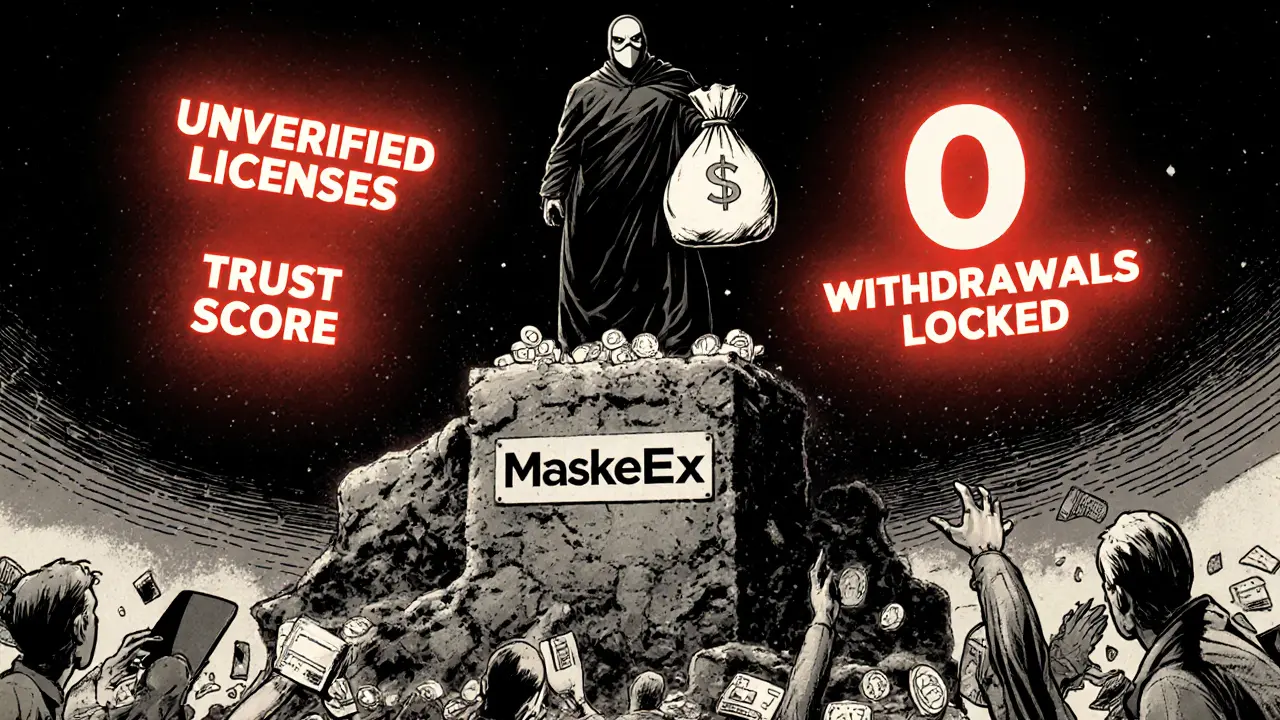

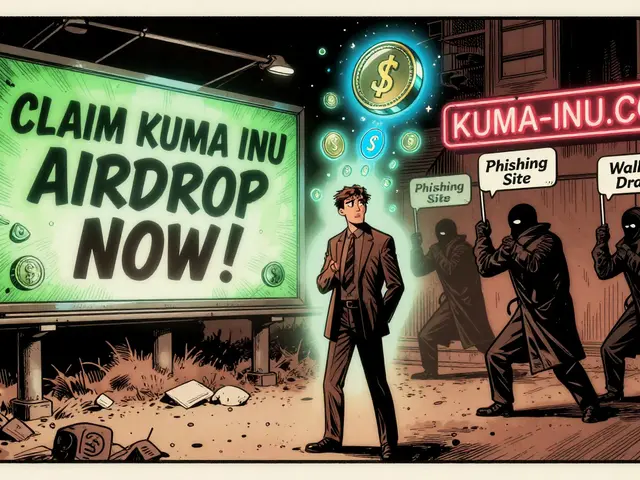

MaskEX isn’t the only DEX out there. It competes with Uniswap, PancakeSwap, and others. But what makes it stand out? Some users say its interface is cleaner for beginners. Others point to lower fees on certain chains. And a few highlight the tokenomics of its native token—used for governance and fee discounts. But here’s the catch: many of the tokens listed on MaskEX are new, low-volume, or high-risk. That’s true for most DEXs. The freedom to trade anything comes with the risk of trading something worthless.

If you’ve ever used a crypto exchange, you know the drill: find a token, check the price, click swap, confirm the transaction. MaskEX follows that flow. But because it’s decentralized, you need to understand gas fees, slippage tolerance, and approval limits. A bad setting can cost you money. A wrong token address? You lose it forever. That’s why the posts below cover real user experiences, security tips, and comparisons with other platforms. You’ll find guides on how to connect wallets, spot fake tokens, and avoid common traps. You’ll also see breakdowns of tokens that gained traction on MaskEX—and those that vanished overnight.

There’s no hype here. Just facts. What works. What doesn’t. And what you need to know before you click ‘Confirm’.