How P2P Technology Evolved Within Blockchain Systems

Explore how peer-to-peer technology evolved from early file-sharing to modern blockchain networks, covering consensus, scaling solutions, and future trends in a clear, concise guide.

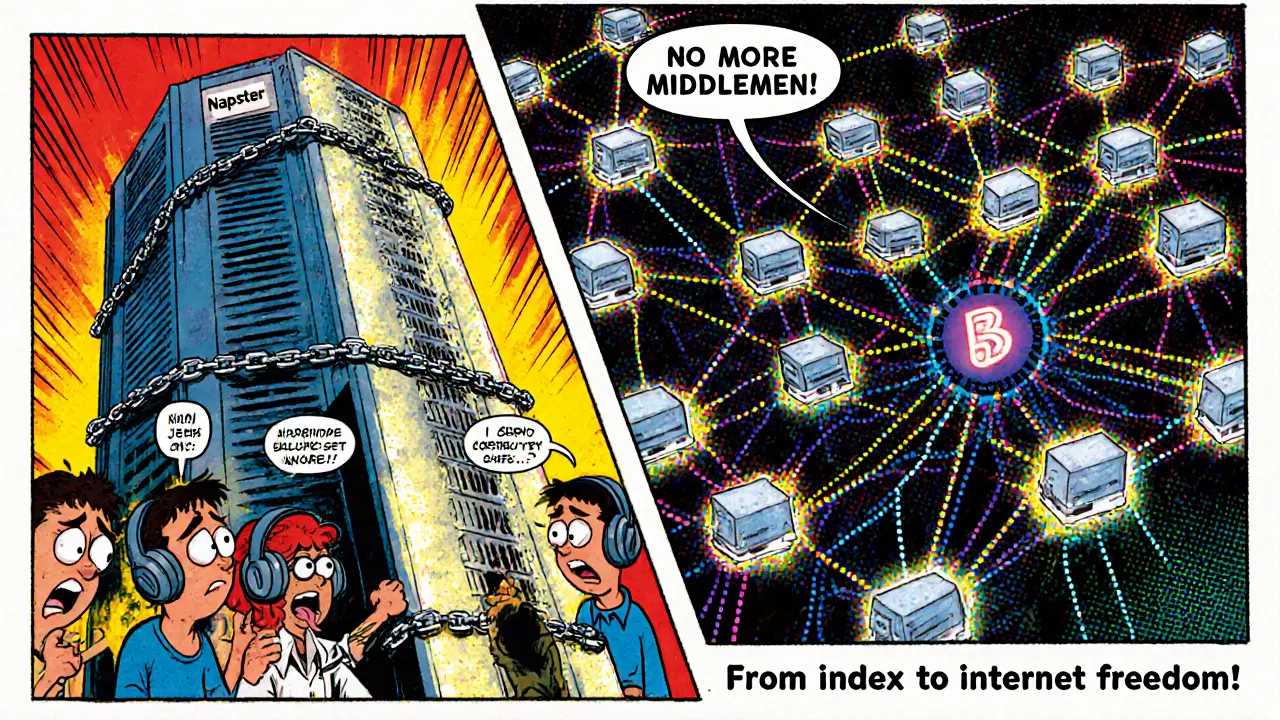

Read MoreWhen talking about P2P technology, a system that lets two parties trade directly without a central intermediary, often using blockchain to secure the swap. Also known as peer‑to‑peer tech, it powers many of today's crypto marketplaces. P2P technology enables instant, borderless trades while cutting fees.

One major player built on this idea is Binance P2P, a platform that matches buyers and sellers directly, using escrow to protect each side. It shows how a peer-to-peer crypto exchange works in practice: users set their own prices, choose payment methods, and the system only steps in to release funds when conditions are met. This model reduces reliance on traditional order books and gives users more control over liquidity.

The underground crypto economy, a hidden market that flourishes when official channels are restricted, often relies on P2P platforms for daily transactions illustrates a powerful semantic triple: P2P technology fuels the underground economy, and the underground economy pushes innovation in P2P tools. Nigeria’s 2021‑2023 crypto ban turned millions of users toward P2P apps, creating a billion‑dollar parallel market. The ban forced traders to adopt peer‑to‑peer solutions, highlighting how regulation can accelerate the adoption of decentralised methods.

But with great freedom comes risk. Crypto fraud, scams that exploit trust gaps in peer‑to‑peer trades, such as fake payment confirmations or phishing sites is a direct challenge for P2P users. Understanding the fraud landscape is essential: a typical scam chain starts with a fake seller, moves to a compromised escrow, and ends with the victim losing funds. Recognising these patterns helps traders protect themselves while still benefiting from the low‑cost, high‑speed nature of P2P deals.

Beyond individual trades, P2P technology underpins broader decentralized finance, the ecosystem of financial services built on blockchain without central banks or intermediaries. DeFi protocols often integrate P2P lending, borrowing, and swapping, creating a seamless bridge between personal trades and protocol‑level liquidity pools. This relationship can be captured in another semantic triple: P2P technology bridges personal crypto exchange and DeFi’s automated markets, expanding access for everyday users.

In practice, anyone interested in P2P can start by choosing a reputable platform, verifying escrow mechanisms, and using strong KYC practices where required. Combining these steps with awareness of local regulations—like Nigeria’s VASP licensing—helps avoid legal snags while enjoying the benefits of direct trade. The next section of articles dives deeper into real‑world case studies, risk mitigation tactics, and the latest platform updates, giving you the tools to navigate the P2P landscape confidently.

Explore how peer-to-peer technology evolved from early file-sharing to modern blockchain networks, covering consensus, scaling solutions, and future trends in a clear, concise guide.

Read More