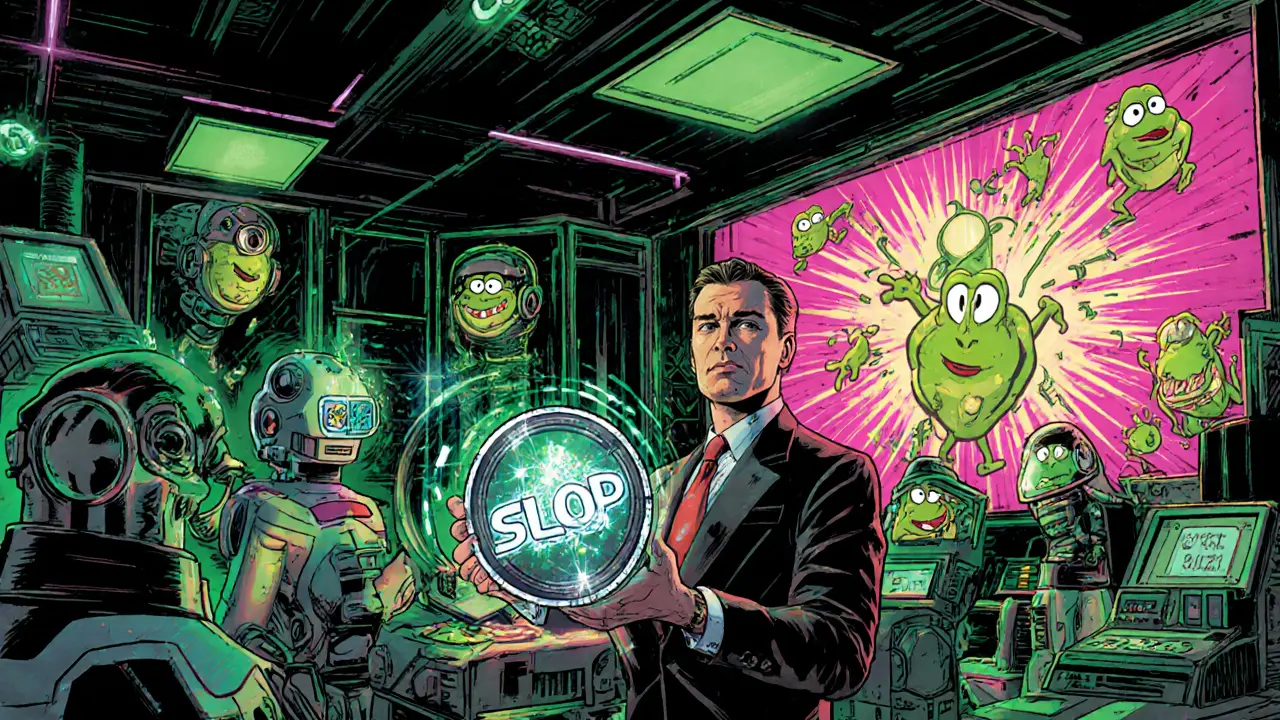

What Is Slop (SLOP) Crypto Coin? A Deep Dive into the AI‑Powered Meme Token

Explore Slop (SLOP) crypto, the AI‑powered meme token on Solana. Learn its origin, how it works, buying steps, volatility, risks, and expert outlook.

Read MoreWhen exploring SLOP token, a DeFi utility token on Ethereum that distributes protocol fees and grants voting power to its holders. Also known as SLOP, it fuels liquidity mining, the process of providing assets to a pool to earn token rewards and participates in governance, the on‑chain voting system that lets token holders influence protocol upgrades. The token’s tokenomics, its supply schedule, fee‑distribution model and reward rates are built to align incentives across users, developers and investors.

The SLOP token lives inside the broader DeFi, a suite of financial services that run on blockchain without intermediaries ecosystem. Because DeFi relies on smart contracts, SLOP’s functionality is encoded in immutable code that automatically splits collected fees among stakers, liquidity providers and the treasury. This means the token’s price isn’t just speculation; it reacts to real usage metrics like total value locked (TVL) and transaction volume. In practice, higher TVL leads to larger fee pools, which then boost the rewards distributed to SLOP holders.

First, the supply model is capped at 100 million tokens, but a portion is released each week through a controlled inflation schedule. That schedule ties directly to the amount of liquidity supplied: the more assets you lock, the higher the weekly emission you earn. Second, fee distribution follows a three‑tier split – 40 % to liquidity miners, 30 % to stakers, and 30 % to the protocol reserve for future development. Third, governance proposals are submitted via a simple on‑chain form; any holder with at least 1 % of the circulating supply can trigger a vote, while proposals that reach a quorum of 10 % are executed automatically.

These three pieces—supply, fee split, and voting—create a feedback loop. SLOP token encompasses tokenomics (first triple). SLOP token requires smart contracts (second triple). Liquidity influences SLOP token price (third triple). The loop encourages users to add more capital, which raises fees, which then increase payouts, making the token more attractive. That cycle can also attract speculative traders, so it’s essential to monitor the inflation rate and TVL growth to gauge long‑term sustainability.

Staking is straightforward: connect a Web3 wallet, select the amount of SLOP you want to lock, and confirm the transaction. Once staked, you’ll see your share of the fee pool reflected in daily reward statements. Unstaking incurs a 48‑hour cooldown to protect the protocol from flash‑loan attacks. For liquidity mining, you provide an equal‑value pair (e.g., SLOP/ETH) to an approved pool, and the pool’s smart contract automatically distributes SLOP rewards based on your proportion of the total pool.

Governance participation is optional but highly encouraged. Proposals can cover anything from adjusting the fee split to adding new reward tiers or even upgrading the underlying smart‑contract code. Each proposal includes a rationale, expected impact, and a voting deadline. Community discussion usually happens in the protocol’s Discord or forum, where you can gauge sentiment before casting your vote.

Risk‑aware users should keep an eye on three main factors: contract audits, market volatility, and regulatory shifts. The SLOP code has been audited by reputable firms, but no code is immune to bugs. Market swings can quickly erode the value of earned rewards, especially if SLOP’s price drops sharply. Finally, because SLOP operates in the DeFi space, it may be subject to evolving regulations around token classification and securities law.

Below you’ll find a curated collection of articles that dig deeper into each of these topics—real‑world examples of fee‑distribution math, step‑by‑step staking guides, governance case studies, and risk‑management tips. Whether you’re just curious about what SLOP token does or you’re ready to start earning, the posts ahead will give you the practical insights you need.

Explore Slop (SLOP) crypto, the AI‑powered meme token on Solana. Learn its origin, how it works, buying steps, volatility, risks, and expert outlook.

Read More