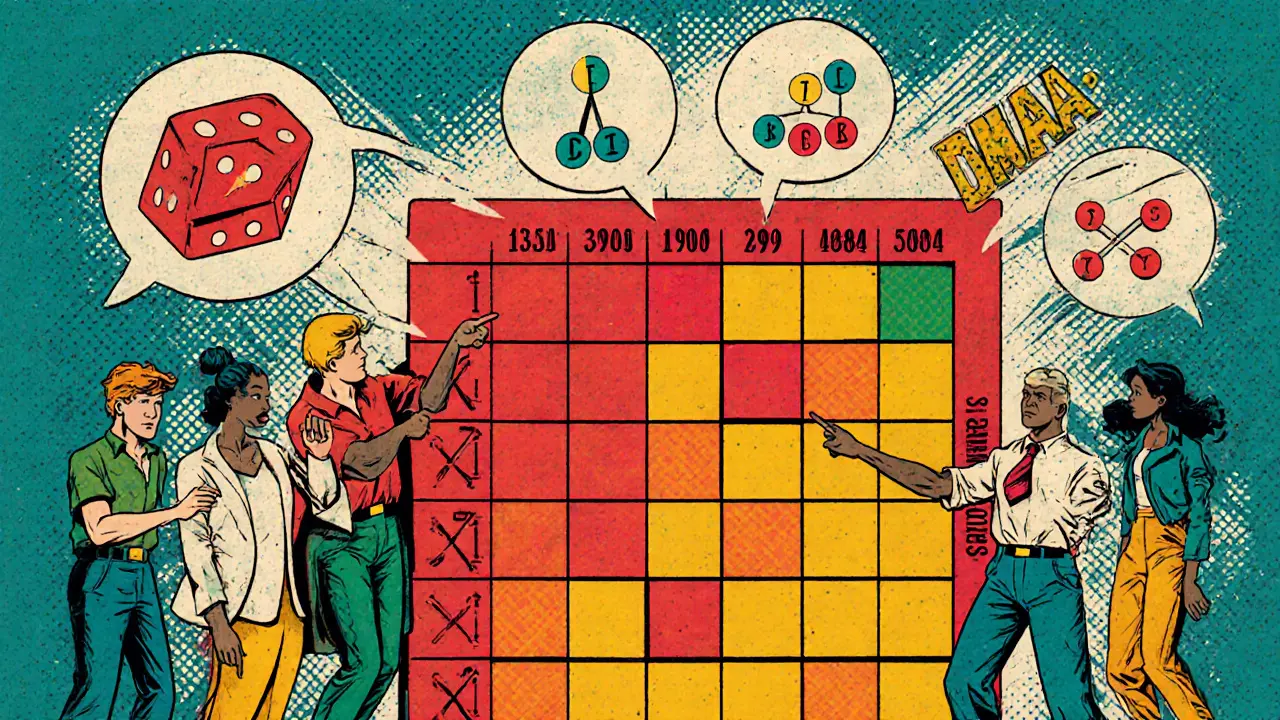

Risk Assessment Matrix Simulator

Understanding Risk Categories

Use this interactive matrix to explore how different combinations of likelihood and impact determine risk severity.

Impact Scale

Likelihood Scale

Interactive Risk Matrix

| Likelihood | Very Unlikely | Unlikely | Probable | Likely | Almost Certain |

|---|---|---|---|---|---|

| Very High | High | High | High | High | High |

| High | High | High | High | Medium | Medium |

| Medium | High | Medium | Medium | Medium | Low |

| Low | Medium | Medium | Low | Low | Low |

| Very Low | Medium | Low | Low | Low | Low |

Risk Response Recommendations

Click on any cell in the matrix above to see recommended actions for that risk level.

Systematic risk management is a comprehensive framework that helps organizations identify, assess, and control risks that can affect entire markets, economies, or business operations. Unlike traditional risk management, which often zeroes in on isolated threats, this approach treats risk as an interconnected ecosystem that requires coordinated processes, strategic oversight, and continuous adaptation.

Why a Systematic Approach Matters

Businesses that rely only on ad‑hoc risk checklists miss the bigger picture. When a supply‑chain disruption ripples through multiple regions, or a regulatory shift alters the competitive landscape, isolated defenses crumble. Studies from PwC’s Global Risk Survey show that firms with systematic risk programs are five times more likely to earn stakeholder confidence and twice as likely to achieve faster revenue growth. In short, a systematic mindset turns risk from a surprise‑visitor into a predictable element of strategic planning.

Core Components of the Framework

A systematic approach follows a repeatable loop: Identify → Analyze → Evaluate → Respond → Review. Each stage relies on specific tools and data sources.

- Risk Identification captures both internal (personnel, operational inefficiencies) and external (economic downturns, natural disasters) threats.

- Risk Analysis digs into root causes, likelihood, and potential impact using quantitative or qualitative techniques.

- Risk Evaluation ranks risks on a matrix of impact versus likelihood, spotlighting high‑impact/high‑likelihood items for immediate action.

- Risk Response crafts mitigation plans, contingency measures, or acceptance decisions based on cost‑benefit analysis.

- Risk Review ensures continuous monitoring, updates, and learning from post‑mortem analyses.

Quantitative vs. Qualitative Assessment Tools

Choosing the right toolset depends on data availability, time constraints, and the decision‑making culture.

| Aspect | Quantitative | Qualitative |

|---|---|---|

| Primary Method | Monte Carlo Simulation, probabilistic models | Expert judgment, risk matrix |

| Output | Numeric loss estimates, probability distributions | Risk categories (Low/Medium/High) |

| Data Needs | Historical loss data, statistical parameters | Stakeholder insights, scenario workshops |

| Typical Use‑Case | Financial portfolio stress testing | Project‑level quick scans |

| Tool Examples | Monte Carlo Simulation, @Risk | Risk Matrix, brainstorming sessions |

Advanced Analytical Techniques

When risks are complex, deeper analyses add clarity.

- Failure Mode and Effects Analysis (FMEA) dissects each process step to uncover potential failure modes and their consequences.

- Bowtie Analysis visualizes cause‑effect chains, linking preventive controls on the left side with recovery measures on the right.

- Scenario Planning builds narrative futures (e.g., regulatory crackdown, rapid technology adoption) and tests how existing controls hold up.

Technology Enablers: GRC Platforms

Manual spreadsheets can’t keep pace with today’s risk velocity. Integrated governance, risk, and compliance (GRC) platforms automate registers, workflows, and reporting.

- LogicGate Risk Cloud offers a centralized risk register, real‑time dashboards, and automated escalation rules.

- Other GRC suites (e.g., RSA Archer, MetricStream) provide similar capabilities but differ in configurability, pricing, and AI add‑ons.

Choosing a platform should hinge on three criteria: scalability to handle enterprise‑wide data, built‑in analytics for predictive insights, and ease of integration with existing ERP or BI tools.

Industry Applications and Real‑World Examples

Systematic risk management shines in sectors where market‑wide shocks happen often.

- Financial Services: Banks use systematic frameworks to gauge macro‑economic stress, complying with Basel III capital requirements.

- Energy & Utilities: Companies model regulatory changes and climate‑related disruptions to protect long‑term asset values.

- Technology Start‑ups: Rapid growth creates staffing and knowledge gaps; systematic risk identification prevents talent burn‑out.

In each case, the discipline helps organizations anticipate what diversification alone cannot-systemic shifts that affect the entire ecosystem.

Embedding a Continuous Risk Culture

Tools and processes fade without the right mindset. Harvard Business School professors Robert Simons and Eugene Soltes stress two cultural pillars:

- Transparency - risk registers and dashboards must be visible to all decision‑makers.

- Accountability - owners of high‑risk processes are tasked with mitigation plans and regular status updates.

Regular tabletop exercises, wargaming sessions, and post‑mortems turn lessons learned into actionable improvements.

Implementation Checklist

- Define scope: enterprise‑wide or functional (e.g., supply chain, IT).

- Assemble a cross‑functional risk team with finance, operations, and compliance reps.

- Choose assessment methods: quantitative for high‑value exposures, qualitative for emerging threats.

- Set up a GRC platform and migrate existing risk registers.

- Populate a risk matrix and prioritize top‑10 risks.

- Develop mitigation or contingency plans for each priority risk.

- Schedule monthly review meetings and quarterly board updates.

- Run a post‑mortem after any major incident to capture improvement ideas.

Frequently Asked Questions

How does systematic risk management differ from traditional risk management?

Traditional risk management usually targets specific, isolated threats (e.g., a single cyber‑attack). Systematic risk management looks at the whole risk ecosystem, covering interrelated market‑wide, regulatory, and operational uncertainties that can’t be mitigated by simple diversification.

When should an organization use quantitative methods like Monte Carlo simulation?

Quantitative methods are best when you have sufficient historical data and need precise loss estimates-common in financial stress testing, large capital projects, or supply‑chain capacity planning.

Can a small business benefit from a systematic risk management approach?

Yes. Even a modest firm can adopt the core loop (identify‑analyze‑evaluate‑respond‑review) using simple tools like a risk matrix and a cloud‑based GRC starter pack. The key is to treat risk as an ongoing conversation, not a one‑off checklist.

What role does technology play in keeping the risk loop continuous?

Technology provides real‑time data feeds, automated alerts, and analytics dashboards that surface emerging threats instantly. Integrated GRC platforms also enforce workflow approvals, ensuring that risk owners act on new findings without delay.

How often should the risk register be reviewed?

At a minimum quarterly, but high‑velocity environments (e.g., fintech, biotech) should update the register monthly or whenever a material change occurs in market conditions or regulatory policy.

There are 15 Comments

Jack Fans

When you start mapping risk across the entire enterprise, the first thing that popps up is data silos, and those can really mess up the matrix. I've seen teams pull together impact scores from finance, ops, and compliance, only to discover that the likelihood scales were defined in completely different ways! The trick is to set a common language up front-think of it like a shared dictionary for risk terms. Once everyone speaks the same jargon, the risk register starts to look less like a Frankenstein monster and more like a usable tool. Also, don’t forget to schedule a quick sync every two weeks; it keeps the momentum going and catches any drift early.

Adetoyese Oluyomi-Deji Olugunna

A veritable tour de force of risk theory.

Krithika Natarajan

Looking at the systematic loop, the identify‑analyze‑evaluate‑respond‑review cycle feels like a gentle habit‑forming practice. It nudges teams to revisit assumptions without shouting. The matrix itself is a visual reminder that probability and impact dance together. Keeping the language simple helps new hires feel included.

Rebecca Stowe

Even if you’re just starting out, the checklist approach can boost confidence. Small wins build a culture that actually cares about risk.

Aditya Raj Gontia

The reliance on Monte‑Carlo simulations feels overengineered for most mid‑size firms; you end up drowning in variance metrics that no exec can interpret. A leaner qualitative matrix would serve better, aligning with agile delivery cycles.

Kailey Shelton

Nice write‑up, but the GRC platform list could use a mention of open‑source alternatives.

Angela Yeager

One practical tip is to embed the risk register directly into your project management tool, such as Jira or Azure DevOps. That way, risk items surface alongside tasks, and owners get automatic reminders. It also democratizes visibility across departments, fostering a shared sense of responsibility.

vipin kumar

What most people don’t see is that the risk matrix is actually a front for hidden power structures; by defining “high risk” you subtly dictate which projects get funded and which get buried.

Lara Cocchetti

Indeed, the matrix can be weaponized, yet the same tool can also illuminate systemic blind spots that big players prefer to ignore. Transparency is the antidote to that hidden agenda.

Mark Briggs

Sure, schedule a sync every two weeks-because nothing screams efficiency like endless meetings that produce more spreadsheets.

mannu kumar rajpoot

While embedding risk into Jira sounds collaborative, it also creates a single point of failure; once the platform glitches, all your risk data disappears, and you’re left scrambling.

Tilly Fluf

It is worth noting that Monte‑Carlo techniques, when applied judiciously, can uncover tail‑risk scenarios that qualitative assessments simply miss. However, the cost‑benefit balance must be evaluated before committing resources.

Darren R.

Allow me to illuminate the profound absurdity of treating risk as a mere spreadsheet exercise; one must first recognize that risk, in its most elemental form, is an ontological reality that transcends corporate governance and seeps into the very fabric of human decision‑making.

Consequently, any framework that pretends to “manage” risk without confronting its existential dread is, at best, a superficial veneer.

The systematic approach you champion, with its tidy Identify‑Analyze‑Evaluate‑Respond‑Review loop, mirrors the ancient alchemical quest for transmutation-attempting to turn the base metal of uncertainty into the gold of predictability.

Yet, just as alchemists ignored the chaotic turbulence of the crucible, so too do many organizations dismiss the stochastic volatility that underpins market dynamics.

Take, for instance, the reliance on Monte‑Carlo simulations; these probabilistic models assume a world of normal distributions while reality gladly flouts Gaussian comfort zones in moments of crisis.

Moreover, the insistence on a universal risk matrix imposes a Cartesian grid upon phenomena that are inherently non‑linear, thereby obscuring emergent properties that only complex systems theory can reveal.

In practice, the “high‑risk” cell becomes a bureaucratic catch‑all, funneling resources into a few flashy mitigation projects while the subtle, slowly‑building threats-like regulatory drift or cyber‑erosion-slip quietly beneath the radar.

A truly systematic method must therefore embed continuous learning loops, leveraging real‑time data feeds, AI‑driven anomaly detection, and adaptive governance-not merely quarterly board reviews.

Only by integrating these dynamic capabilities can an organization hope to maintain resilience amidst the ever‑accelerating velocity of change.

Furthermore, cultural alignment is not a peripheral concern; it is the crucible in which risk perception is forged.

If leadership fails to model transparency and accountability, the risk register becomes a hollow artifact, revered in theory but ignored in practice.

Thus, the call to “embed the register in existing ERP tools” is a pragmatic step, yet it must be accompanied by incentives that reward proactive disclosure, lest the system devolve into a ritualistic checkbox exercise.

In sum, systematic risk management is not a static diagram but a living organism-requiring nourishment, vigilance, and the humility to accept that not all risk can be quantified.

Embrace this paradox, and the organization will transition from a reactive fire‑fighter to a strategic sentinel, poised to anticipate and shape its own destiny.

Hardik Kanzariya

That was an epic deep‑dive! You’ve captured the philosophical side while keeping it actionable-especially the point about embedding AI‑driven alerts. I’ll definitely bring this perspective into our next risk‑steering session.

Shanthan Jogavajjala

Appreciate the synthesis; integrating continuous learning loops aligns with the DevSecOps pipeline, where risk telemetry streams synergize with automated mitigation playbooks. Let’s pilot a KPI dashboard that surfaces variance metrics alongside MTTR for risk incidents.

Write a comment

Your email address will not be published. Required fields are marked *