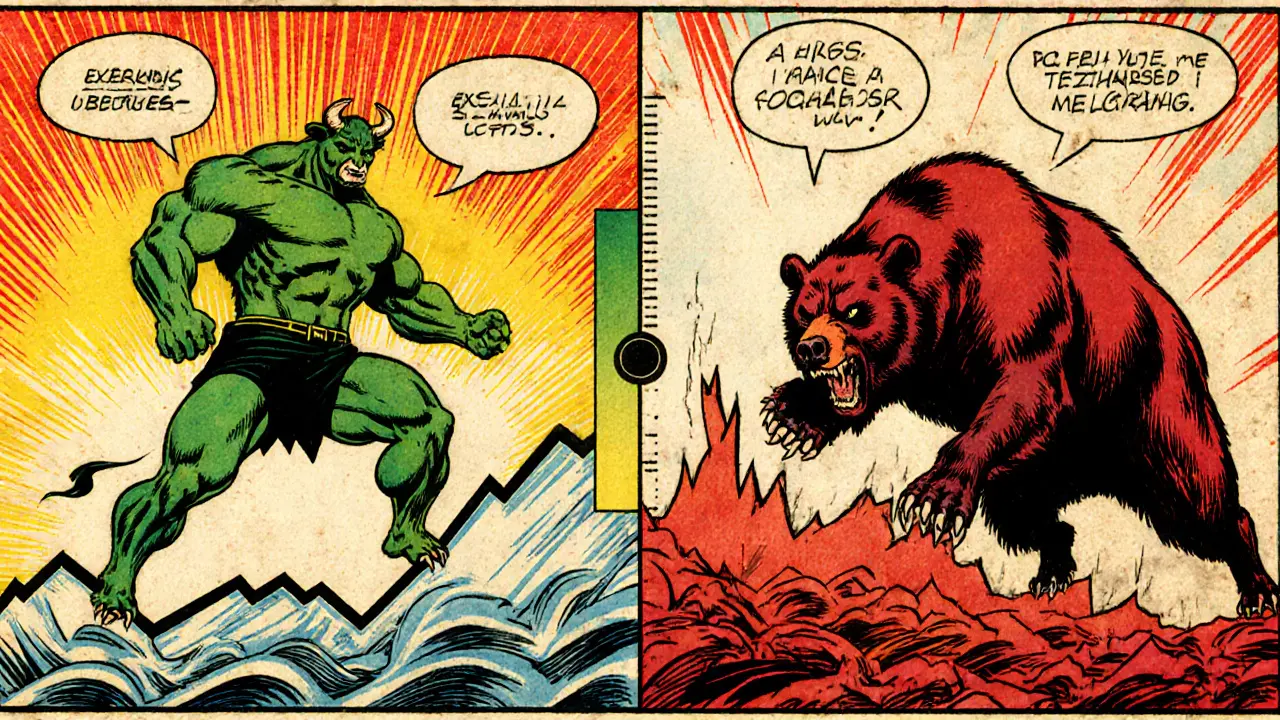

Understanding Volatility Patterns in Bull and Bear Markets

Explore how volatility differs in bull and bear markets, see historical patterns, key drivers, and practical steps to manage risk in each phase.

Read MoreWhen navigating bear market volatility, the rapid and often unpredictable price swings that occur during prolonged downtrends in crypto markets. Also known as down‑trend turbulence, it challenges anyone with exposure to digital assets.

One key to surviving these swings is understanding crypto market cycles, the repeating phases of expansion, peak, contraction and trough that drive price momentum. When a cycle enters the contraction phase, volatility tends to spike, feeding the bear market vibe. Another crucial piece is the volatility index, a statistical measure (like CVI for crypto) that quantifies how wildly prices are moving. A high index signals that price swings are widening, prompting traders to tighten stop‑losses or shift to safer assets.

Managing this turbulence requires solid risk management, the set of techniques—position sizing, stop‑loss placement, diversification—that limit potential loss. For example, funding rates on perpetual futures can turn volatile spikes into profit opportunities if you know how to hedge correctly. Hedging itself is a distinct hedging strategy, the practice of taking offsetting positions (like options or inverse ETFs) to protect a portfolio from adverse moves. Combining these tools lets you stay in the market without getting knocked out by sudden drops.

The articles below dive deep into the concepts introduced here. You’ll find practical guides on funding rates, slashing protection for validators, and how modular blockchains like Celestia can affect market dynamics. There are also case studies on regional crypto bans, airdrop opportunities, and real‑world examples of volatility‑driven arbitrage. Together they give you a toolbox to navigate bear‑market chaos, spot hidden upside, and keep your capital safe.

Ready to turn bear market volatility from a nightmare into an advantage? Browse the curated posts for actionable tactics, data‑driven analysis, and step‑by‑step instructions that match every skill level.

Explore how volatility differs in bull and bear markets, see historical patterns, key drivers, and practical steps to manage risk in each phase.

Read More