Bitnomial Exchange: What It Is and Why It Matters in Crypto Trading

When you hear Bitnomial exchange, a regulated U.S.-based crypto derivatives platform that lets traders buy and sell crypto futures with leverage. Also known as Bitnomial, it’s one of the few crypto platforms that operates under actual financial oversight in the United States. Unlike most crypto exchanges that operate in legal gray zones, Bitnomial is registered with the CFTC and follows strict compliance rules. That means you’re not just trading tokens—you’re trading contracts backed by real regulatory frameworks.

This matters because most crypto platforms you hear about—like Buff Network or FREE2EX—are either untracked, unverified, or outright risky. Bitnomial, on the other hand, works like a traditional brokerage but for crypto derivatives. It’s designed for traders who want to hedge positions, speculate on price swings, or gain exposure without holding actual coins. It supports Bitcoin, Ethereum, and other major assets through futures contracts, not spot trading. That’s a big difference. You’re not buying Bitcoin—you’re betting on its future price with margin, just like trading oil or gold futures on a regulated exchange.

Bitnomial’s model is built for traders who care about security, transparency, and legal protection. It’s not for people looking to buy Solana or Dogecoin with a credit card. It’s for those who want to trade with clear rules, audited systems, and real customer support. This makes it a rare exception in a space full of sketchy platforms. Compare that to MaskEX or WhiteBIT—both are crypto exchanges, but neither is regulated like Bitnomial. WhiteBIT offers spot trading and low fees; Bitnomial offers futures and compliance. They serve different needs.

Why does this distinction matter? Because regulation isn’t just a buzzword—it’s a safety net. When a platform like Bitnomial is overseen by the CFTC, it must keep customer funds separate, report suspicious activity, and follow anti-money laundering rules. That’s something you won’t find on platforms based in Belarus, the UAE, or anywhere without clear oversight. If you’ve ever worried about withdrawal delays, fake trading volumes, or hidden fees, Bitnomial’s structure answers those fears.

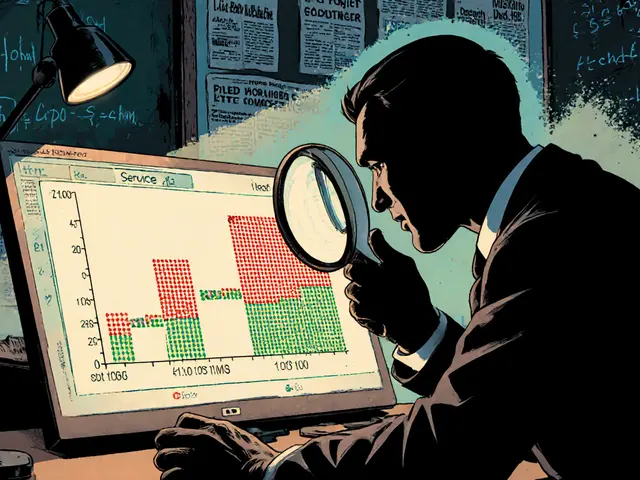

It’s not perfect. It doesn’t have the wide token selection of Binance or the user-friendly app of Coinbase. But if you’re serious about trading crypto derivatives legally and safely, Bitnomial is one of the few options that actually exists. The posts below dive into what this means in practice—how it compares to other platforms, what risks still exist even with regulation, and whether its features match up to what traders really need in 2025. You’ll find real reviews, fee breakdowns, and warnings about what to watch out for—even on regulated platforms. This isn’t hype. It’s the truth about where regulated crypto trading stands today.