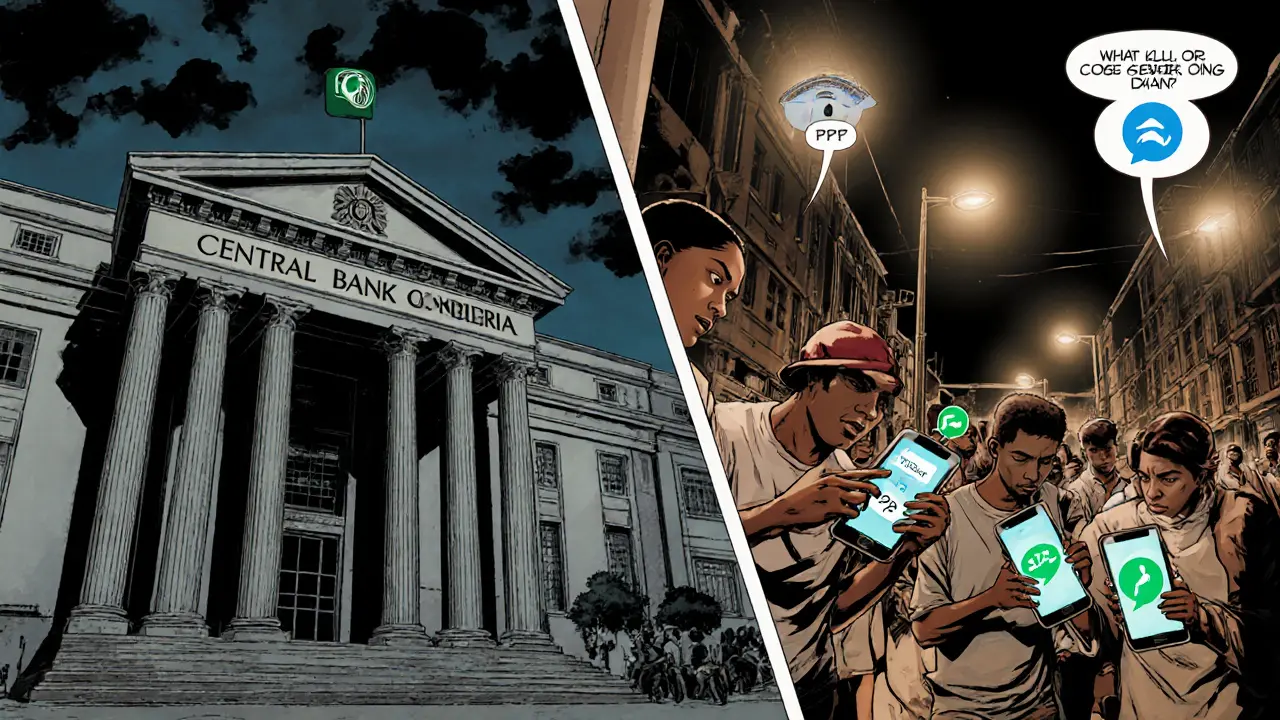

How Nigeria’s Underground Crypto Economy Thrived During the 2021‑2023 Ban

Explore how Nigeria's crypto ban sparked a billion‑dollar underground market, the P2P platforms that powered it, fraud risks, and its lasting impact on regulation.

Read MoreWhen working with Nigeria crypto ban, the 2024 government prohibition on buying, selling, and holding cryptocurrencies within Nigeria's borders. Also known as Nigeria's crypto restriction, it signals a major shift in the country's digital asset policy and forces every stakeholder to rethink how they engage with crypto.

One of the first things you’ll notice is that the ban is tightly linked to VASP licensing Nigeria, the regulatory framework that requires crypto service providers to obtain a Virtual Asset Service Provider licence from the SEC. This licensing regime is meant to bring transparency, AML/KYC compliance, and capital safeguards to the market. In practice, it means that exchanges, wallet providers, and even airdrop platforms must prove they can track users and report suspicious activity before they can operate legally.

Another crucial piece of the puzzle is the broader crypto money laundering penalties, the harsh punishments—including up to 20 years in prison—imposed for illicit crypto transactions under Nigerian law. These penalties raise the stakes for anyone attempting to skirt the ban, and they push compliance teams to adopt robust monitoring tools, real‑time transaction analytics, and thorough customer due‑diligence procedures.

While Nigeria’s crackdown sounds severe, it mirrors trends seen in other African jurisdictions. For example, Algeria moved from vague restrictions in 2018 to a full prohibition in 2025, creating a similar compliance landscape for local traders. Comparing the two helps illustrate how regulators balance the desire to curb illicit activity with the need to foster innovation. Understanding these parallels can guide businesses in crafting cross‑border strategies that respect each country's rules.

First, keep an eye on the SEC’s ARIP fast‑track program. It speeds up VASP licensing for firms that meet capital and security standards, offering a lifeline for legitimate players eager to stay in the market. Second, monitor the enforcement arm of the Central Bank of Nigeria (CBN). Their recent raids on unlicensed exchanges show that the ban isn’t just a paper rule—it’s actively policed. Third, track the emergence of compliant DeFi solutions that use on‑chain identity verification to satisfy KYC demands without sacrificing user privacy. These projects could become the next wave of legal crypto activity in Nigeria.

For investors, the ban reshapes portfolio decisions. Holding crypto on a foreign exchange may reduce exposure to local enforcement, but it also introduces custodial risk and potential tax complications. Meanwhile, Nigerian startups are pivoting to offer services like fiat‑to‑stablecoin gateways that comply with VASP standards, creating new avenues for market participation. Nigeria crypto ban has turned compliance into a competitive advantage: firms that can prove they meet licensing, AML, and reporting requirements will attract the trust of both users and regulators.

Below you’ll find a curated collection of articles that break down the ban’s legal nuances, walk through the VASP licensing steps, compare Nigeria’s approach with other African regimes, and share practical tips on staying compliant while still tapping into crypto’s potential.

Explore how Nigeria's crypto ban sparked a billion‑dollar underground market, the P2P platforms that powered it, fraud risks, and its lasting impact on regulation.

Read More