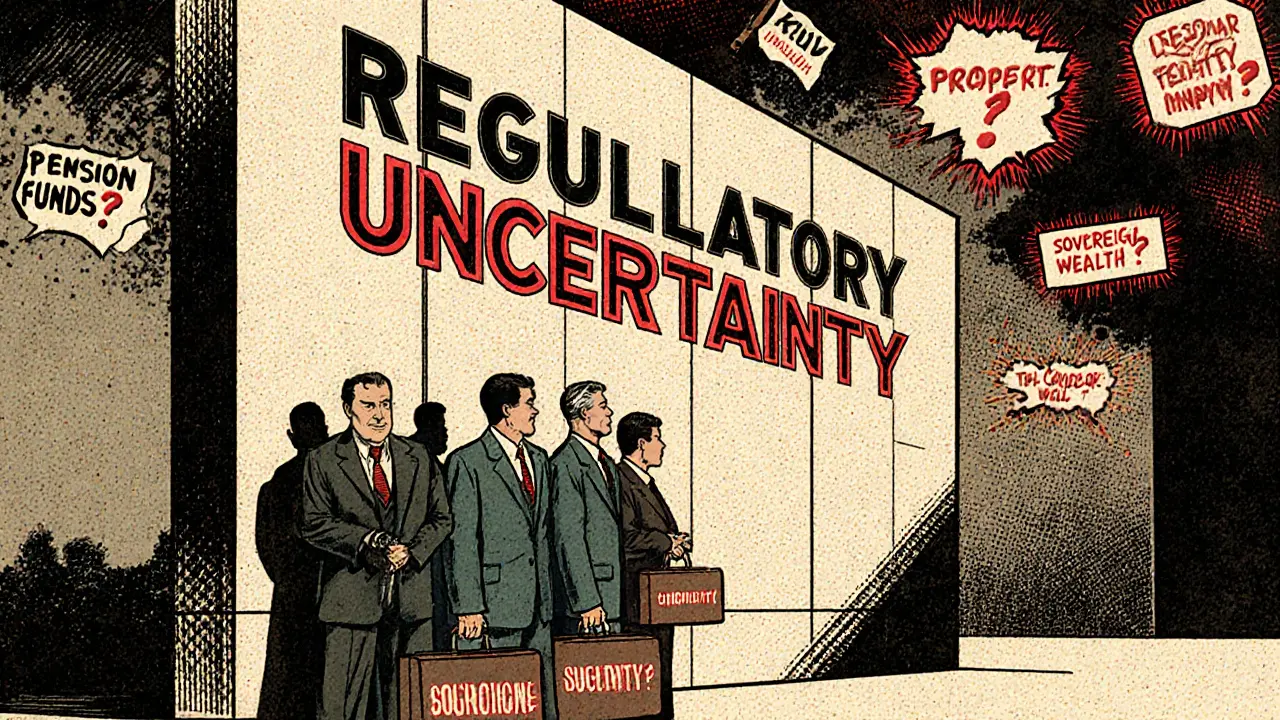

Regulatory Hurdles in Crypto: What’s Blocking Adoption and How It Affects You

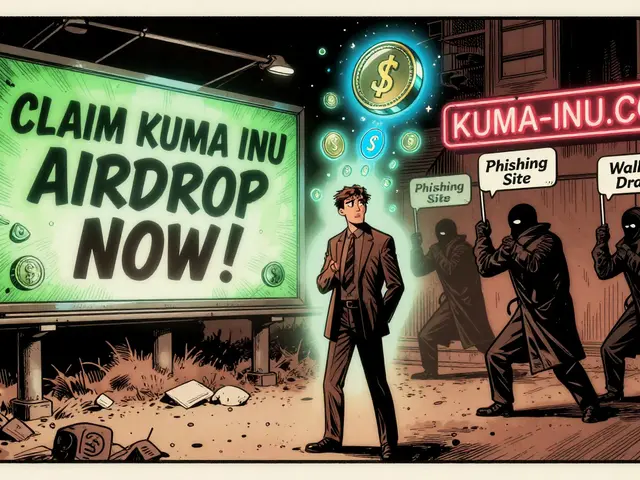

When you hear regulatory hurdles, the legal and bureaucratic obstacles that restrict or control how cryptocurrencies are used, traded, or developed. Also known as crypto compliance barriers, these are the unseen forces that shut down exchanges, freeze wallets, and kill tokens before they even launch. This isn’t theory—it’s happening right now. Countries like Kazakhstan banned mining because their power grid couldn’t handle it. Bolivia slapped fines on traders. The U.S. approved Bitcoin ETFs but still treats meme coins like gambling chips. CBDC, a government-issued digital currency that replaces cash and gives central banks total control over money flow is being pushed as the future, but it’s designed to replace decentralized crypto, not work alongside it.

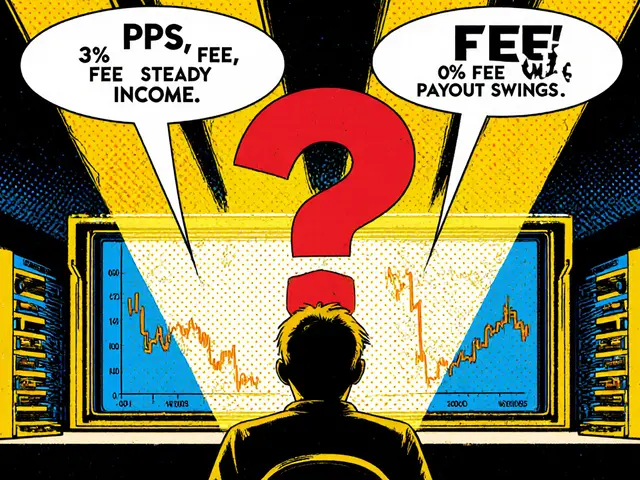

Regulatory hurdles don’t just target big players—they crush small ones too. Exchanges like Buff Network and MaskEX vanished because they couldn’t prove they were licensed. FREE2EX and Coinzo operate in legal gray zones, forcing users to choose between low fees and total risk. Even legitimate platforms like Bitnomial had to fight for years to get CFTC approval just to offer futures. And then there’s crypto penalties, fines, jail time, or asset seizures handed out to individuals or companies violating local crypto laws. In Bolivia, trading crypto could mean legal trouble. In some places, simply holding a token without reporting it is enough to trigger an audit. These aren’t edge cases—they’re the new normal.

What’s behind all this? It’s not about protecting users—it’s about control. Governments want to track every dollar, stop tax evasion, and prevent capital flight. That’s why they push crypto exchange compliance, the strict rules exchanges must follow to operate legally, including KYC, AML checks, and licensing. But compliance isn’t free. It costs millions. That’s why smaller exchanges die, and only big ones with deep pockets survive. Meanwhile, tokens like Wrapped USDR don’t exist because no regulator would ever approve a fake stablecoin. And projects like Wiener AI? They’re not just risky—they’re legally dangerous, built on hype, not compliance.

What you’ll find below isn’t just a list of articles. It’s a map of the battlefield. You’ll see how real exchanges got crushed or cleared by regulators, how CBDCs are being rolled out to replace crypto, how penalties are applied in real countries, and why some tokens vanish overnight—not because they failed, but because they broke the rules before anyone even noticed. This isn’t about speculation. It’s about survival.