How Ethereum Moved from Mining to Staking - And Why It Matters

Ethereum switched from energy-heavy mining to eco-friendly staking in 2022. Learn how staking works, how much you need to start, and why it's better than mining for most users.

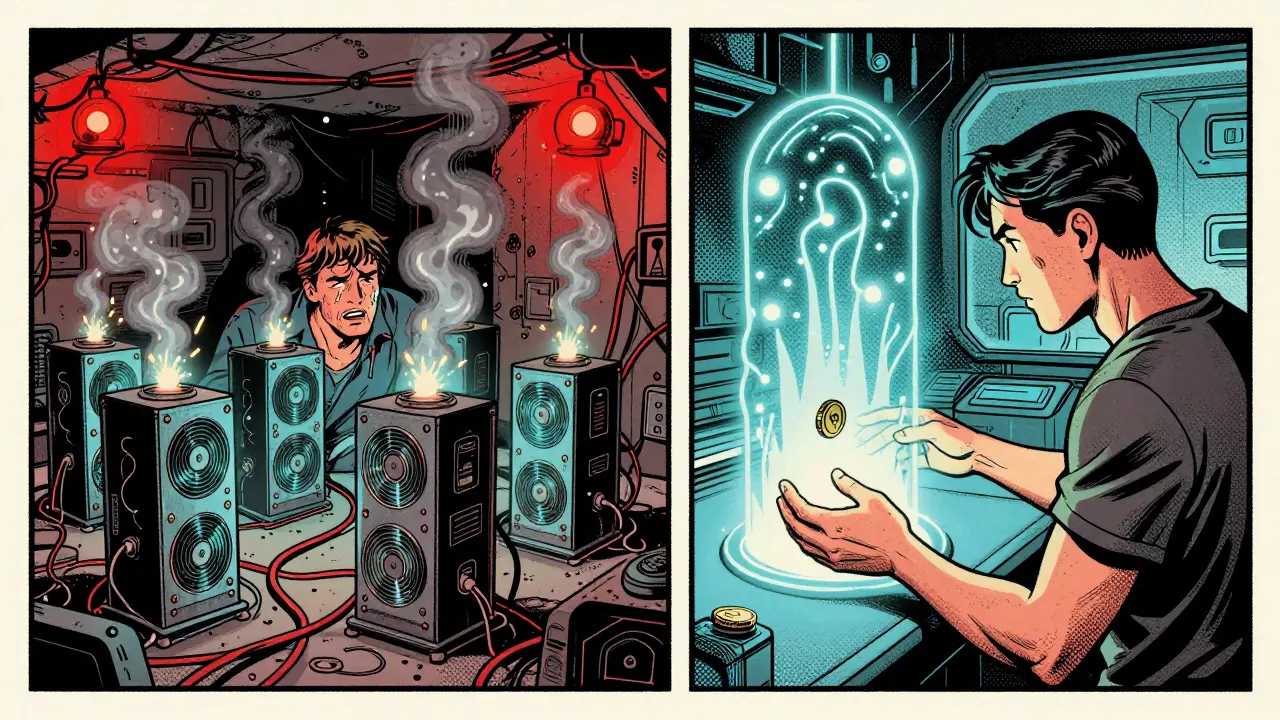

Read MoreWhen The Merge, the historic upgrade that switched Ethereum from proof-of-work to proof-of-stake. Also known as Ethereum 2.0, it didn’t just tweak the network—it rewrote the rules of how blockchains operate. Before The Merge, Ethereum relied on miners using massive amounts of electricity to secure the chain. After The Merge, it runs on validators who stake ETH to do the same job, using 99.95% less energy. This wasn’t a marketing buzzword. It was the largest infrastructure overhaul in crypto history, and its effects still ripple through every wallet, exchange, and DeFi app today.

The Merge didn’t happen in a vacuum. It required proof-of-stake, a consensus mechanism where users lock up cryptocurrency to validate transactions instead of solving complex math puzzles. This shift made Ethereum far more scalable and environmentally sustainable. It also changed how people earn from the network. Instead of buying expensive mining rigs, anyone with 32 ETH could become a validator, a participant who helps secure the Ethereum network by staking their coins and earning rewards. For smaller holders, staking pools became the go-to way to earn passive income without technical setup. Validator rewards, once unpredictable and tied to mining hardware, became a steady stream of ETH payouts—governed by clear rules, not luck or hardware luck. This change made Ethereum more accessible, more secure, and more aligned with real-world financial systems. Governments and institutions took notice. The same year The Merge went live, regulators started treating Ethereum differently than Bitcoin—not as a mining-based commodity, but as a programmable network with clear economic incentives.

The Merge also exposed what really matters in crypto: not hype, not speculation, but infrastructure. Projects that depended on Ethereum’s old mining model scrambled. New ones built on its new efficiency. Today, you see the results everywhere—in DeFi protocols with lower fees, in wallets that process transactions faster, in airdrops that reward users for staking instead of mining. Even the way we talk about crypto changed. No one says "mining ETH" anymore. They say "staking ETH." That shift isn’t just semantic—it’s structural. The Merge didn’t just upgrade a blockchain. It redefined what a blockchain could be.

Below, you’ll find real-world breakdowns of what happened after The Merge—from how validator economics work today, to how it influenced global crypto regulations, to the tokens and platforms that rose because of it. These aren’t theory pieces. They’re reports from the front lines of a network that changed overnight—and never looked back.

Ethereum switched from energy-heavy mining to eco-friendly staking in 2022. Learn how staking works, how much you need to start, and why it's better than mining for most users.

Read More